Scalper1 News

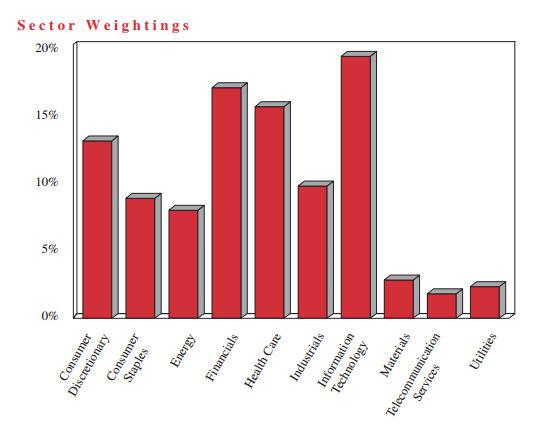

Recently renamed ADX turned in a good first half. Health care and consumer saw new additions. Overall, new management is proving solid so far. Adams Diversified Equity Fund (NYSE: ADX ), formerly known as Adams Express, is one of the oldest closed-end funds, or CEFs, around. That said, a management change in early 2013 meant the potential for big shifts at the fund — and a risk that performance might falter. So far, however, investors should be reasonably pleased with how CEO Mark Stoeckle has been running things. And the first half of 2015 bears that out. Things change… Adams changed its management at the start of 2013, which meant that 2013 was a transition year. Notably, portfolio turnover that year basically doubled compared to historical levels. That said, 2014 saw that number come back down to more-normal levels and that trend has continued so far in 2015. Performance-wise, the fund’s total return in 2013 wasn’t great on a relative basis. Based on net asset value, or NAV, and including reinvested distributions, the fund trailed that S&P by around 3.5 percentage points that year. That said, the fund’s return was 28% in 2013, which is a hard number to complain about. The next year, 2014, wasn’t as good on an absolute basis, but the fund closed the gap with the S&P, with ADX lagging the index by roughly half a percentage point. That’s a much better relative showing. And according to the fund, through the first six months of this year ADX’s return of 2.7% compared favorably to the S&P’s gain of 1.2%. Is this a harbinger of outperformance to come? Maybe, maybe not. As we all know, past returns don’t predict future results. But what it shows is that under new management, ADX hasn’t fallen off a cliff. That said, Stoeckle has only been operating Adams in a generally up market, so he still needs to be tested by a downturn. But investors should be reasonably pleased with the fund’s showing over the last two and half years or so that he’s been running things. New holdings With a fund like ADX, things aren’t usually all that exciting at the portfolio level. This is why the portfolio restructuring in 2013 that doubled the turnover rate was so notable. But with things back to normal, change at the fund is more incremental. For example , Stoeckle noted in the fund’s quarterly report that he added to the fund’s positions in Facebook and Comcast, and added new positions in Valeant and Edwards Lifesciences in health care and Kroger and Spectrum Brands in the consumer space. These aren’t huge shifts or changes, and keep with broader themes already present in the fund. Comcast, around 2.2% of assets at the midpoint of the year, is a top-10 holding, the others are not. That said, while the fund is fairly well diversified, there is one concerning holding — Apple. That stock, the fund’s largest holding, accounted for over 5% of assets at the end of June. That’s a fairly hefty exposure to one company and as the recent Apple sell-off attests, is worth keeping in the back of your mind. Still, at 5% of assets, an Apple sell-off would hurt the fund but alone shouldn’t be enough to cause major damage. The fund sold a number of holding in the period, too. The list includes Abbvie, General Mills, Hershey, Micron Technology, and Unilever. Several positions were trimmed, as well, including Aetna, Coca-Cola, Gilead Sciences, Intel, and Disney. Bouncing those names against the additions, you can see the big picture didn’t alter all that much. Looking at the fund from that greater distance, technology, finance, and health care were the three largest sectors at the end of June, making up roughly half the fund. The consumer sector was number four. Utilities, telecom, and basic materials pulled up the rear, representing the fund’s smallest sector weightings. Dividends and more So the first half was relatively uneventful for the fund. It performed well and aside from Apple, which has long been a large holding, there really weren’t any red flags. Moreover, the portfolio changes were largely shifting within the bigger picture. So mostly good news here. Adams also announced another dividend, of $0.05 a share. That’s relatively small, but keeps with the trend of three small quarterly payments and one larger one at the end of the year. The fund’s goal is to distribute 6% of assets on an annual basis. That’s a number that should interest income-oriented investors. There’s no expected change to that, according to Stoeckle. The way in which distributions are paid out, however, isn’t exactly desirable if you are trying to live off of your investment income. So you’ll have to take that into consideration here if you are buying for the distributions. Note, too, that annual distributions will go up and down based on performance since they are a set as a percentage of NAV, not a hard dollar figure. In addition, the fund bought 765,000 of its own shares in the first half at an average discount of just under 14%. That’s roughly where the discount sits today and in line with its average over the past three years. I’d say that’s a reasonable use of cash and helps to support the fund’s NAV over the long term. Remember, that the fund has been in existence since the Great Depression, so this is far from a fly-by-night operation. And as a stand-alone company, there’s no sponsor manipulating things. What you see is what you get at ADX and it’s looking to stay in business for years to come. So while stock buybacks are interesting, they should be seen in light of a longer-term picture — not necessarily as a way to shift market perceptions today. All of that said, ADX often gets chided for being a closet S&P index clone, which isn’t too far off the mark. However, for investors seeking income, the 6% yield target is much better than the yield on the S&P. True, the expense ratio of 0.65% is high relative to an S&P index, but some investors might be willing to make that trade-off. (Note that actual reported expenses this year will be higher because of one-time items related to the termination of a defined benefit retirement plan, which is likely a net positive for the company and its shareholders.) So, in the end, the first half was a good one for Adams. And while it isn’t a perfect investment, it’s a pretty good one if you are looking to outsource some of your investment load. It’s been around for a long, long time and looks like it will continue to be around for a long, long time to come. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Recently renamed ADX turned in a good first half. Health care and consumer saw new additions. Overall, new management is proving solid so far. Adams Diversified Equity Fund (NYSE: ADX ), formerly known as Adams Express, is one of the oldest closed-end funds, or CEFs, around. That said, a management change in early 2013 meant the potential for big shifts at the fund — and a risk that performance might falter. So far, however, investors should be reasonably pleased with how CEO Mark Stoeckle has been running things. And the first half of 2015 bears that out. Things change… Adams changed its management at the start of 2013, which meant that 2013 was a transition year. Notably, portfolio turnover that year basically doubled compared to historical levels. That said, 2014 saw that number come back down to more-normal levels and that trend has continued so far in 2015. Performance-wise, the fund’s total return in 2013 wasn’t great on a relative basis. Based on net asset value, or NAV, and including reinvested distributions, the fund trailed that S&P by around 3.5 percentage points that year. That said, the fund’s return was 28% in 2013, which is a hard number to complain about. The next year, 2014, wasn’t as good on an absolute basis, but the fund closed the gap with the S&P, with ADX lagging the index by roughly half a percentage point. That’s a much better relative showing. And according to the fund, through the first six months of this year ADX’s return of 2.7% compared favorably to the S&P’s gain of 1.2%. Is this a harbinger of outperformance to come? Maybe, maybe not. As we all know, past returns don’t predict future results. But what it shows is that under new management, ADX hasn’t fallen off a cliff. That said, Stoeckle has only been operating Adams in a generally up market, so he still needs to be tested by a downturn. But investors should be reasonably pleased with the fund’s showing over the last two and half years or so that he’s been running things. New holdings With a fund like ADX, things aren’t usually all that exciting at the portfolio level. This is why the portfolio restructuring in 2013 that doubled the turnover rate was so notable. But with things back to normal, change at the fund is more incremental. For example , Stoeckle noted in the fund’s quarterly report that he added to the fund’s positions in Facebook and Comcast, and added new positions in Valeant and Edwards Lifesciences in health care and Kroger and Spectrum Brands in the consumer space. These aren’t huge shifts or changes, and keep with broader themes already present in the fund. Comcast, around 2.2% of assets at the midpoint of the year, is a top-10 holding, the others are not. That said, while the fund is fairly well diversified, there is one concerning holding — Apple. That stock, the fund’s largest holding, accounted for over 5% of assets at the end of June. That’s a fairly hefty exposure to one company and as the recent Apple sell-off attests, is worth keeping in the back of your mind. Still, at 5% of assets, an Apple sell-off would hurt the fund but alone shouldn’t be enough to cause major damage. The fund sold a number of holding in the period, too. The list includes Abbvie, General Mills, Hershey, Micron Technology, and Unilever. Several positions were trimmed, as well, including Aetna, Coca-Cola, Gilead Sciences, Intel, and Disney. Bouncing those names against the additions, you can see the big picture didn’t alter all that much. Looking at the fund from that greater distance, technology, finance, and health care were the three largest sectors at the end of June, making up roughly half the fund. The consumer sector was number four. Utilities, telecom, and basic materials pulled up the rear, representing the fund’s smallest sector weightings. Dividends and more So the first half was relatively uneventful for the fund. It performed well and aside from Apple, which has long been a large holding, there really weren’t any red flags. Moreover, the portfolio changes were largely shifting within the bigger picture. So mostly good news here. Adams also announced another dividend, of $0.05 a share. That’s relatively small, but keeps with the trend of three small quarterly payments and one larger one at the end of the year. The fund’s goal is to distribute 6% of assets on an annual basis. That’s a number that should interest income-oriented investors. There’s no expected change to that, according to Stoeckle. The way in which distributions are paid out, however, isn’t exactly desirable if you are trying to live off of your investment income. So you’ll have to take that into consideration here if you are buying for the distributions. Note, too, that annual distributions will go up and down based on performance since they are a set as a percentage of NAV, not a hard dollar figure. In addition, the fund bought 765,000 of its own shares in the first half at an average discount of just under 14%. That’s roughly where the discount sits today and in line with its average over the past three years. I’d say that’s a reasonable use of cash and helps to support the fund’s NAV over the long term. Remember, that the fund has been in existence since the Great Depression, so this is far from a fly-by-night operation. And as a stand-alone company, there’s no sponsor manipulating things. What you see is what you get at ADX and it’s looking to stay in business for years to come. So while stock buybacks are interesting, they should be seen in light of a longer-term picture — not necessarily as a way to shift market perceptions today. All of that said, ADX often gets chided for being a closet S&P index clone, which isn’t too far off the mark. However, for investors seeking income, the 6% yield target is much better than the yield on the S&P. True, the expense ratio of 0.65% is high relative to an S&P index, but some investors might be willing to make that trade-off. (Note that actual reported expenses this year will be higher because of one-time items related to the termination of a defined benefit retirement plan, which is likely a net positive for the company and its shareholders.) So, in the end, the first half was a good one for Adams. And while it isn’t a perfect investment, it’s a pretty good one if you are looking to outsource some of your investment load. It’s been around for a long, long time and looks like it will continue to be around for a long, long time to come. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News