Scalper1 News

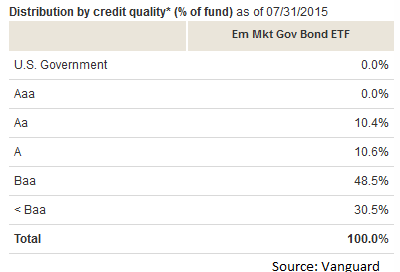

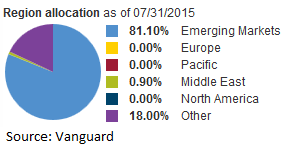

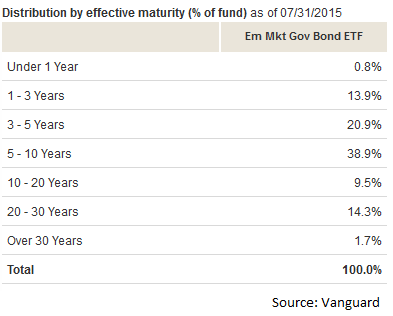

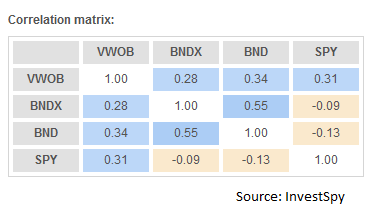

Summary VWOB offers investors exposure to the bond market for government debt in emerging markets. The portfolio has some substantial credit risk, but the yields and duration are solid. When the ETF is combined with other investments in a diversified portfolio, the low correlation is very attractive. I see this as a very solid holding for 3% to 5% of the portfolio. The Vanguard Emerging Markets Government Bond Index ETF (NASDAQ: VWOB ) is a very interesting bond fund. As I’ve been searching for appealing bond funds, I’ve found some of my favorites are from Vanguard. Given my distaste for high expense ratios, it should be no surprise that the Vanguard products would be appealing. After looking through the portfolio, I think the holdings are fairly reasonable for an investor wanting to regularly keep part of their portfolio in a bond fund. However, using only VWOB for bond exposure in a portfolio would be a very unwise decision. VWOB is designed to be an incredible supporting bond fund within a portfolio that already contains other bond investments. Quick Introduction The Vanguard Emerging Markets Government Bond Index ETF is showing a yield to maturity of 5.5% and an average duration of 5.7 years. Given the short duration on the portfolio and the very attractive yield on the bonds, it should be no surprise that the portfolio is carrying a substantial amount of credit risk. The emerging market governments don’t carry stellar credit ratings and there is definitely a material amount of risk in using the bond ETF as an investment. Credit Quality The following chart breaks down the credit quality of the issues being held in the portfolio. Clearly, a substantial portion of the holdings has fairly notable defects in their credit rating; however, the portfolio still offers investors diversification for their portfolio that can be very difficult to acquire in other ways. Emerging Markets and Other The holdings are primarily labeled as Emerging Markets; however, there is also a substantial allocation to a category labeled simply as “Other.” Investors should recognize that areas like Europe have zero allocation in the portfolio. See the chart below: The reason the allocations are so important is this exposure suggests that the portfolio’s correlation with other international bond funds might not be as high. That means even if the ETF is fairly volatile by itself, there could be some very substantial benefits to using it within a highly diversified portfolio that includes equity securities and bond funds allocated to different sectors, regions, and durations. Maturities I grabbed another chart to show the effective maturity on the securities: The maturity profile for the Vanguard Emerging Markets Government Bond Index ETF is fairly reasonable for an investor trying to get a solid diversification across the yield curve. There is a notable amount of exposure to the long-term bonds and the 5- to 10-year range. On the other hand, there is very little exposure to the shortest part of the yield curve. For optimal diversification, an investor may want to include other funds that target the shorter rate part of the yield curve. Risk Measuring returns and statistics since June of 2013 indicates that the portfolio is fairly stable for being invested in emerging markets. The annualized volatility of returns was 5.9%. For comparison, the annualized volatility on the S&P 500 for that period was 11.3% and the annualized volatility for the Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ) was 18.3%. Correlation The fund really starts to shine when we consider the correlation in returns between VWOB and other bond funds that the investor might use for a larger portion of their exposure. Look at the correlation matrix below for a comparison: The Vanguard Total International Bond ETF (NASDAQ: BNDX ) is significantly less volatile than VWOB, but the correlation to BNDX is only 28%. BNDX, unlike VWOB, carries a heavy emphasis on Europe, which is entirely absent from the VWOB portfolio. In my opinion, these two ETFs held together in a portfolio are significantly better than either one alone due to the low correlation. Conclusion As far as bond ETFs go, the Vanguard Emerging Markets Government Bond Index ETF is a fairly solid option. An investor that failed to diversify into multiple funds would be taking more risk than necessary to realize returns, but when VWOB is used to enhance the diversification of the portfolio, it is an exceptional ETF. There are only two weaknesses in the entire ETF. One is that the expense ratio of .34% is higher than I want to pay and the other is that the ETF isn’t on the free-to-trade list for Schwab accounts. For investors that have free trading on VWOB through their brokerage and are willing to rebalance their portfolios to take advantage of the low correlations, it would seem that VWOB should be a natural choice for a small portion of the portfolio. My estimate is that the ETF would be a great holding at around 3% to 5% of the total portfolio value. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary VWOB offers investors exposure to the bond market for government debt in emerging markets. The portfolio has some substantial credit risk, but the yields and duration are solid. When the ETF is combined with other investments in a diversified portfolio, the low correlation is very attractive. I see this as a very solid holding for 3% to 5% of the portfolio. The Vanguard Emerging Markets Government Bond Index ETF (NASDAQ: VWOB ) is a very interesting bond fund. As I’ve been searching for appealing bond funds, I’ve found some of my favorites are from Vanguard. Given my distaste for high expense ratios, it should be no surprise that the Vanguard products would be appealing. After looking through the portfolio, I think the holdings are fairly reasonable for an investor wanting to regularly keep part of their portfolio in a bond fund. However, using only VWOB for bond exposure in a portfolio would be a very unwise decision. VWOB is designed to be an incredible supporting bond fund within a portfolio that already contains other bond investments. Quick Introduction The Vanguard Emerging Markets Government Bond Index ETF is showing a yield to maturity of 5.5% and an average duration of 5.7 years. Given the short duration on the portfolio and the very attractive yield on the bonds, it should be no surprise that the portfolio is carrying a substantial amount of credit risk. The emerging market governments don’t carry stellar credit ratings and there is definitely a material amount of risk in using the bond ETF as an investment. Credit Quality The following chart breaks down the credit quality of the issues being held in the portfolio. Clearly, a substantial portion of the holdings has fairly notable defects in their credit rating; however, the portfolio still offers investors diversification for their portfolio that can be very difficult to acquire in other ways. Emerging Markets and Other The holdings are primarily labeled as Emerging Markets; however, there is also a substantial allocation to a category labeled simply as “Other.” Investors should recognize that areas like Europe have zero allocation in the portfolio. See the chart below: The reason the allocations are so important is this exposure suggests that the portfolio’s correlation with other international bond funds might not be as high. That means even if the ETF is fairly volatile by itself, there could be some very substantial benefits to using it within a highly diversified portfolio that includes equity securities and bond funds allocated to different sectors, regions, and durations. Maturities I grabbed another chart to show the effective maturity on the securities: The maturity profile for the Vanguard Emerging Markets Government Bond Index ETF is fairly reasonable for an investor trying to get a solid diversification across the yield curve. There is a notable amount of exposure to the long-term bonds and the 5- to 10-year range. On the other hand, there is very little exposure to the shortest part of the yield curve. For optimal diversification, an investor may want to include other funds that target the shorter rate part of the yield curve. Risk Measuring returns and statistics since June of 2013 indicates that the portfolio is fairly stable for being invested in emerging markets. The annualized volatility of returns was 5.9%. For comparison, the annualized volatility on the S&P 500 for that period was 11.3% and the annualized volatility for the Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ) was 18.3%. Correlation The fund really starts to shine when we consider the correlation in returns between VWOB and other bond funds that the investor might use for a larger portion of their exposure. Look at the correlation matrix below for a comparison: The Vanguard Total International Bond ETF (NASDAQ: BNDX ) is significantly less volatile than VWOB, but the correlation to BNDX is only 28%. BNDX, unlike VWOB, carries a heavy emphasis on Europe, which is entirely absent from the VWOB portfolio. In my opinion, these two ETFs held together in a portfolio are significantly better than either one alone due to the low correlation. Conclusion As far as bond ETFs go, the Vanguard Emerging Markets Government Bond Index ETF is a fairly solid option. An investor that failed to diversify into multiple funds would be taking more risk than necessary to realize returns, but when VWOB is used to enhance the diversification of the portfolio, it is an exceptional ETF. There are only two weaknesses in the entire ETF. One is that the expense ratio of .34% is higher than I want to pay and the other is that the ETF isn’t on the free-to-trade list for Schwab accounts. For investors that have free trading on VWOB through their brokerage and are willing to rebalance their portfolios to take advantage of the low correlations, it would seem that VWOB should be a natural choice for a small portion of the portfolio. My estimate is that the ETF would be a great holding at around 3% to 5% of the total portfolio value. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News