Scalper1 News

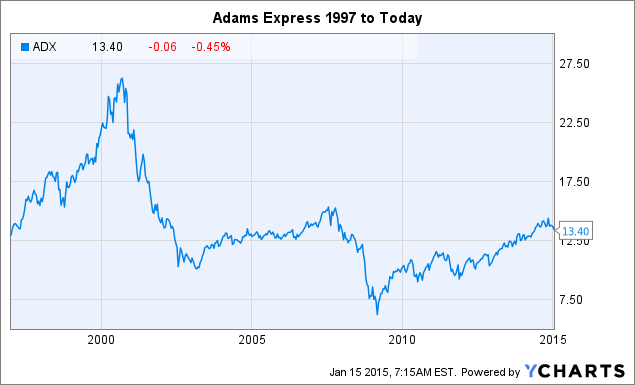

Closed-end fund ADX has been around since 1929. It’s paid dividends continuously since 1935. Since 1997, it’s paid $18 out in distributions—more than $5 more than it’s share price on 1/1/97. Adams Express Company (NYSE: ADX ) is something of an outlier in the closed-end fund, or CEF, world. It was founded in 1929 and, unlike most of its peers, is a stand alone company without a parent. What’s most impressive, however, is that Adams Express has long paid large dividends to shareholders and lived to tell about it. Proof that closed-end funds can pay worthwhile dividends and not self liquidate. A buyout that started it all Adams traces its current form back to World War I. It had been in the business of moving parcels, but was essentially shut out of the local mail angle of that by the government and the United Postal Service. Then, during the War, its business moving parcels by rail was taken over by the government. While it received nothing when the Post Office put it out of business delivering mail, in return for its rail express business it received shares in a company called American Railway Express Company. After the war those shares would be sold to the major railroads, leaving Adams with a lot of cash and, well, no business. That was when Adams Express shifted gears and became a closed-end fund. Oddly enough, that change took place pretty much right before the 1929 market crash and start of the Great Depression. At that point, the CEF had around $73 million. Today , the fund’s value is in the area of $1.5 billion. It started paying dividends, meanwhile, in 1935 and has done so continuously ever since-including through the depths of the 2007 to 2009 “great recession.” One important difference between Adams Express and most other closed-end funds is that it really is a separate company. In fact, the CEO is also the fellow who heads up its research and investing efforts. Most closed-end funds don’t have this type of independence, with a sponsor company like Eaton Vance (NYSE: EV ) calling all the shots and being paid to manage the fund. The fund’s day to day managers, meanwhile, usually work for the sponsor or another asset manager hired by the sponsor. Apples and Oranges? So, in some ways, it isn’t fair to make a direct comparison between Adams Express and other closed-end funds. Although that comparison isn’t exactly apples and oranges, it could easily be like comparing a Red Delicious to a Granny Smith. They are both apples, for sure, but they are vastly different other than that. That said, one thing that Adams proves is that dividends and closed-end funds can go very well together over long, long periods of time. In fact, more than 75 years . And the numbers are pretty amazing when you do some simple math. ADX data by YCharts Between 1997 and 2014 , Adams Express paid out $18 a share in distributions. The CEF traded hands for around $13 a share on January 1, 1997. And while the price has gone through its share of ups and downs over that 18-year span, that’s $5 more in distributions per share than what you would have paid to buy a share at the start of the period. Recently, the shares have been trading hands at around $13.50. That’s a pretty impressive feat. How did it do that? The thing about Adams Express’ dividend that helps make this possible is that it’s variable. Over that 18-year period the distribution was as high as $1.85 (2000) and as low as $0.45 (2009). So there should be no expectation of a steady payout here. In fact, the relatively new policy of paying out 6% of net assets a year in distributions means the payment will vary with performance. Many closed-end funds today use a managed or level distribution policy that ensures a high yield. Investors seeking income like this and often jump aboard for the income without much consideration for anything else. However, overly high payouts can lead to a slow bleed of net assets to shareholders. A quicker bleed in bad years. For long-term investors that could be a problem and means distribution policy is one of the most important things to consider. While a variable policy can leave you short of cash in weak markets, it can also ensure your investments keep paying you down the road. Another thing about Adams that is unique is a very low expense ratio . At around 0.6%, it’s similar to some of the more exotic, perhaps esoteric, exchange traded funds. That’s pretty cheap and helps to boost performance over long periods. Expenses are another important issue to keep an eye on for long-term investors. Not a recommendation, but… This isn’t meant to be a recommendation of Adams Express (I’ll write a more formal review shortly). It is more to hold up an example of a closed-end fund that has paid shareholders well via distributions and hasn’t slowly liquidated itself. That slow bleed is one of the concerns I read about most frequently in comments to CEF articles. And while most CEFs aren’t made of the same stuff as Adams Express, this quirky old bird still proves an important point about closed-end funds and dividends. Scalper1 News

Closed-end fund ADX has been around since 1929. It’s paid dividends continuously since 1935. Since 1997, it’s paid $18 out in distributions—more than $5 more than it’s share price on 1/1/97. Adams Express Company (NYSE: ADX ) is something of an outlier in the closed-end fund, or CEF, world. It was founded in 1929 and, unlike most of its peers, is a stand alone company without a parent. What’s most impressive, however, is that Adams Express has long paid large dividends to shareholders and lived to tell about it. Proof that closed-end funds can pay worthwhile dividends and not self liquidate. A buyout that started it all Adams traces its current form back to World War I. It had been in the business of moving parcels, but was essentially shut out of the local mail angle of that by the government and the United Postal Service. Then, during the War, its business moving parcels by rail was taken over by the government. While it received nothing when the Post Office put it out of business delivering mail, in return for its rail express business it received shares in a company called American Railway Express Company. After the war those shares would be sold to the major railroads, leaving Adams with a lot of cash and, well, no business. That was when Adams Express shifted gears and became a closed-end fund. Oddly enough, that change took place pretty much right before the 1929 market crash and start of the Great Depression. At that point, the CEF had around $73 million. Today , the fund’s value is in the area of $1.5 billion. It started paying dividends, meanwhile, in 1935 and has done so continuously ever since-including through the depths of the 2007 to 2009 “great recession.” One important difference between Adams Express and most other closed-end funds is that it really is a separate company. In fact, the CEO is also the fellow who heads up its research and investing efforts. Most closed-end funds don’t have this type of independence, with a sponsor company like Eaton Vance (NYSE: EV ) calling all the shots and being paid to manage the fund. The fund’s day to day managers, meanwhile, usually work for the sponsor or another asset manager hired by the sponsor. Apples and Oranges? So, in some ways, it isn’t fair to make a direct comparison between Adams Express and other closed-end funds. Although that comparison isn’t exactly apples and oranges, it could easily be like comparing a Red Delicious to a Granny Smith. They are both apples, for sure, but they are vastly different other than that. That said, one thing that Adams proves is that dividends and closed-end funds can go very well together over long, long periods of time. In fact, more than 75 years . And the numbers are pretty amazing when you do some simple math. ADX data by YCharts Between 1997 and 2014 , Adams Express paid out $18 a share in distributions. The CEF traded hands for around $13 a share on January 1, 1997. And while the price has gone through its share of ups and downs over that 18-year span, that’s $5 more in distributions per share than what you would have paid to buy a share at the start of the period. Recently, the shares have been trading hands at around $13.50. That’s a pretty impressive feat. How did it do that? The thing about Adams Express’ dividend that helps make this possible is that it’s variable. Over that 18-year period the distribution was as high as $1.85 (2000) and as low as $0.45 (2009). So there should be no expectation of a steady payout here. In fact, the relatively new policy of paying out 6% of net assets a year in distributions means the payment will vary with performance. Many closed-end funds today use a managed or level distribution policy that ensures a high yield. Investors seeking income like this and often jump aboard for the income without much consideration for anything else. However, overly high payouts can lead to a slow bleed of net assets to shareholders. A quicker bleed in bad years. For long-term investors that could be a problem and means distribution policy is one of the most important things to consider. While a variable policy can leave you short of cash in weak markets, it can also ensure your investments keep paying you down the road. Another thing about Adams that is unique is a very low expense ratio . At around 0.6%, it’s similar to some of the more exotic, perhaps esoteric, exchange traded funds. That’s pretty cheap and helps to boost performance over long periods. Expenses are another important issue to keep an eye on for long-term investors. Not a recommendation, but… This isn’t meant to be a recommendation of Adams Express (I’ll write a more formal review shortly). It is more to hold up an example of a closed-end fund that has paid shareholders well via distributions and hasn’t slowly liquidated itself. That slow bleed is one of the concerns I read about most frequently in comments to CEF articles. And while most CEFs aren’t made of the same stuff as Adams Express, this quirky old bird still proves an important point about closed-end funds and dividends. Scalper1 News

Scalper1 News