Scalper1 News

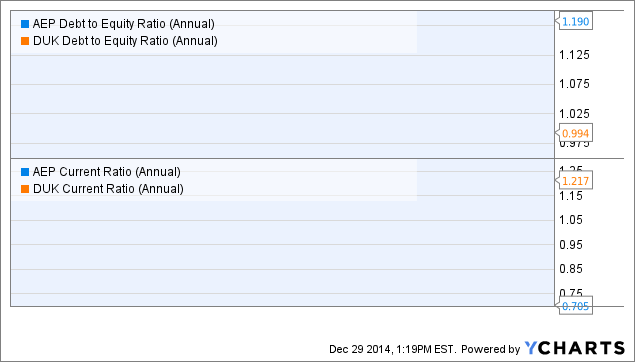

Summary American Electric’s fundamentals and valuation are favorable. American Electric is employing a number of strategies to improve its operational efficiency, and is also expected to invest aggressively in infrastructure projects. American Electric is expected to grow at a faster rate than the industry average. Electric utility company American Electric Power (NYSE: AEP ) has turned out to be a profitable investment so far this year. The company’s stock has done better than the S&P 500 index, gaining 28% so far. But, the god thing is that American Electric still remains a good investment due to its strong fundamental position and sound strategies that will help it improve further. Fundamentals are strong Trading at 16.33 times last year’s earnings, American Electric is cheaper than other players in the industry. Moreover, in the future, it is expected that the company will see better growth in its bottom line. In the previous five years, American Electric has clocked an annual earnings growth rate of 4.81%, and in the next five years, the growth rate is expected to improve to 5.2%. In comparison, the broader industry’s earnings are expected to improve at a rate of just 1.23%. Hence, American Electric is expected to grow at a faster rate than its peers. In addition, American Electric’s cash flow and dividend are appealing. The company carries a yield of 3.60% at a payout ratio of 55%. Now, since its bottom line growth is expected to be strong, it should be able to sustain the dividend. Moreover, American Electric has generated impressive cash flow numbers in the past twelve months. Its operating cash flow stands at $4.8 billion, while levered free cash flow is $287 million. As such, American Electric is in a fundamentally strong position considering the above argument. Strategies are sound Going forward, the company’s strategies should ensure that it continues to get better. American Electric Power is executing on its plan of expanding the transmission business model, and it is allocating an extra $100 million of incremental capital in 2014 for the model. Looking ahead, American Electric has approximately $2 billion of incremental transmission projects that will be executed in the coming four years. Also, to make operations more efficient, American Electric has deployed trucks at the Cardinal Plant for loading the entire welding materials at one place, and thus saving much of the time to transport and get inventory for parts. The time saved can be utilized in attending to tube leaks and alternate areas to get back the generation quickly. At the South Ben storage yard, it is simplifying and organizing storerooms and toolkits for improving the work times. The creation of new documents by the engineering group will also allow for accelerated response for projects to its customers for enhancing the customer experience. In addition, the Cook Nuclear plant is undergoing a first of its kind LEAN activity, and American Electric has already reduced the duration for targeted re-fueling, along with the costs related to it. Hence, the company is focused on reviewing several processes to eradicate redundant activities, along with the ones that fail to add value. Also, American Electric has evaluated a barge unloading system at the Amos Plant, which has resulted in an estimated investment of $6 million. It is estimated that this move will reduce coal costs by $10 million per year. Moreover, the company has decided to wash the flagging vests in the APCo Charleston area, thus saving $6,000 per year for a single employee, amounting to a total of $120 million of savings for 20,000 employees of the company. Risks to consider However, there are certain risks that investors will be taking on if they invest in American Electric. First, the company has a very weak financial position. Its cash position is weak at $299 million as compared to the total debt of $19.34 billion. In addition, a current ratio of 0.70 indicates weak short-term liquidity. A look at the graphic below indicates American Electric’s financial position as compared to industry peer Duke Energy (NYSE: DUK ). AEP Debt to Equity Ratio (Annual) data by YCharts Hence, American Electric has a pretty high debt-to-equity ratio as compared to Duke, while the current ratio is also lower than Duke. As such, American Electric will need to continue growing its earnings and cash flow at a good pace in order to improve its financial position. But, the good thing is that American Electric is well-positioned to improve its earnings, as analysts expect its bottom line at a rate of 5.2% for the next five years as compared to the industry average of 1.3%. Conclusion Hence, there are a number of reasons for investors to remain invested in American Electric. The company’s fundamentals are sound, it is focused on delivering more efficiency, and it has lined up investments to make the business better. As a result, though the stock has performed impressively this year, it is likely that it can deliver more gains going forward. Scalper1 News

Summary American Electric’s fundamentals and valuation are favorable. American Electric is employing a number of strategies to improve its operational efficiency, and is also expected to invest aggressively in infrastructure projects. American Electric is expected to grow at a faster rate than the industry average. Electric utility company American Electric Power (NYSE: AEP ) has turned out to be a profitable investment so far this year. The company’s stock has done better than the S&P 500 index, gaining 28% so far. But, the god thing is that American Electric still remains a good investment due to its strong fundamental position and sound strategies that will help it improve further. Fundamentals are strong Trading at 16.33 times last year’s earnings, American Electric is cheaper than other players in the industry. Moreover, in the future, it is expected that the company will see better growth in its bottom line. In the previous five years, American Electric has clocked an annual earnings growth rate of 4.81%, and in the next five years, the growth rate is expected to improve to 5.2%. In comparison, the broader industry’s earnings are expected to improve at a rate of just 1.23%. Hence, American Electric is expected to grow at a faster rate than its peers. In addition, American Electric’s cash flow and dividend are appealing. The company carries a yield of 3.60% at a payout ratio of 55%. Now, since its bottom line growth is expected to be strong, it should be able to sustain the dividend. Moreover, American Electric has generated impressive cash flow numbers in the past twelve months. Its operating cash flow stands at $4.8 billion, while levered free cash flow is $287 million. As such, American Electric is in a fundamentally strong position considering the above argument. Strategies are sound Going forward, the company’s strategies should ensure that it continues to get better. American Electric Power is executing on its plan of expanding the transmission business model, and it is allocating an extra $100 million of incremental capital in 2014 for the model. Looking ahead, American Electric has approximately $2 billion of incremental transmission projects that will be executed in the coming four years. Also, to make operations more efficient, American Electric has deployed trucks at the Cardinal Plant for loading the entire welding materials at one place, and thus saving much of the time to transport and get inventory for parts. The time saved can be utilized in attending to tube leaks and alternate areas to get back the generation quickly. At the South Ben storage yard, it is simplifying and organizing storerooms and toolkits for improving the work times. The creation of new documents by the engineering group will also allow for accelerated response for projects to its customers for enhancing the customer experience. In addition, the Cook Nuclear plant is undergoing a first of its kind LEAN activity, and American Electric has already reduced the duration for targeted re-fueling, along with the costs related to it. Hence, the company is focused on reviewing several processes to eradicate redundant activities, along with the ones that fail to add value. Also, American Electric has evaluated a barge unloading system at the Amos Plant, which has resulted in an estimated investment of $6 million. It is estimated that this move will reduce coal costs by $10 million per year. Moreover, the company has decided to wash the flagging vests in the APCo Charleston area, thus saving $6,000 per year for a single employee, amounting to a total of $120 million of savings for 20,000 employees of the company. Risks to consider However, there are certain risks that investors will be taking on if they invest in American Electric. First, the company has a very weak financial position. Its cash position is weak at $299 million as compared to the total debt of $19.34 billion. In addition, a current ratio of 0.70 indicates weak short-term liquidity. A look at the graphic below indicates American Electric’s financial position as compared to industry peer Duke Energy (NYSE: DUK ). AEP Debt to Equity Ratio (Annual) data by YCharts Hence, American Electric has a pretty high debt-to-equity ratio as compared to Duke, while the current ratio is also lower than Duke. As such, American Electric will need to continue growing its earnings and cash flow at a good pace in order to improve its financial position. But, the good thing is that American Electric is well-positioned to improve its earnings, as analysts expect its bottom line at a rate of 5.2% for the next five years as compared to the industry average of 1.3%. Conclusion Hence, there are a number of reasons for investors to remain invested in American Electric. The company’s fundamentals are sound, it is focused on delivering more efficiency, and it has lined up investments to make the business better. As a result, though the stock has performed impressively this year, it is likely that it can deliver more gains going forward. Scalper1 News

Scalper1 News