Scalper1 News

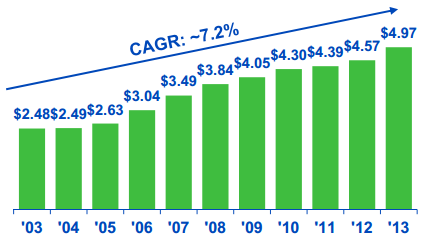

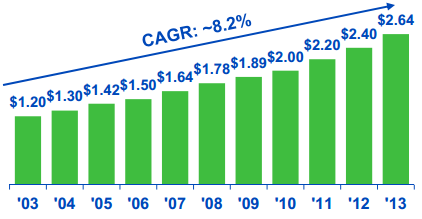

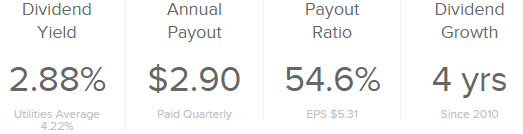

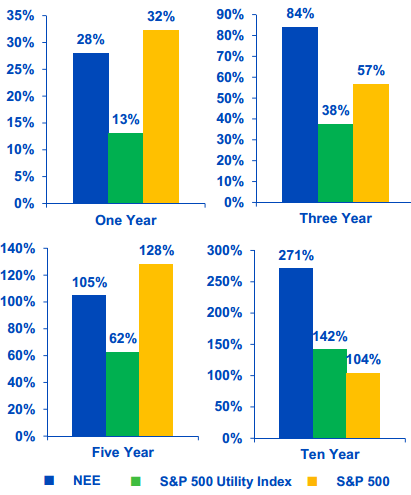

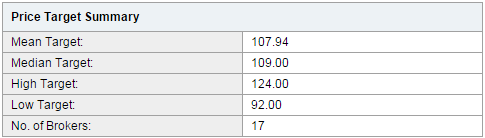

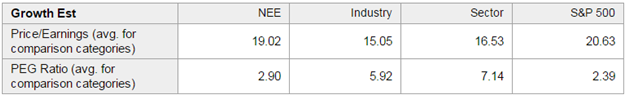

Summary NEE is a leading energy producer that owns a great portfolio of energy assets. NextEra Energy is a proactive company that is creating value for its investors and shareholders. NEE has announced that it would merge with Hawaiian Electric Industries to lever its expertise, and financial resources to realize their aim of creating more efficient renewable energy resources. NEE is a good long-term investment that is well positioned to create value for its shareholders. NextEra Energy (NYSE: NEE ) is a leading producer of green energy and it owns a great portfolio of energy assets. Through its subsidies, NextEra Energy serves a large population in the US and has an interest in the largest renewable energy generation infrastructures including wind and solar power in North America. NextEra Energy has Taken a Step towards Realizing its Aim NextEra Energy is a dynamic company that strives to create value for its customers and shareholders. NextEra Energy is working on its ambitious target to increase renewables to 65%, increasing solar energy generation three-fold and decreasing customers’ bills by 20% by 2030. NextEra Energy has taken another step forward to realize this target. NextEra Energy and Hawaiian Electric Industries, Inc. (NYSE: HE ) have agreed to combine their resources in order to lever their strengths, expertise and financial resources and move towards the achievement of their common aim of becoming highly efficient renewable energy producers. This move will allow NextEra Energy to generate value and healthy returns for its investors. NextEra Energy’s subsidiary Florida Power and Light [FPL] is one of the largest and most efficient US electric utility companies that caters to the energy needs of 4.7 million customer accounts. FPL has developed and operated one of the most advanced and reliable grid networks. FPL’s operational excellence has lower customer bills compared to the national average. Recently FPL received the Reliability One™ Award for its outstanding technology and innovation and reliability performance. FPL is a strong investment that is well positioned to produce returns for NextEra Energy in the coming years. Another great investment is Next Era Energy Resources LLP which is a leading renewable energy producer. With a capacity of 18,671 MW, Next Era Energy Resources owns assets in over 25 states and areas in Canada. NextEra Energy Resources is a strong renewable energy player that is well positioned to capitalize on the advancement in the renewable energy technology and innovation market. Strong Financial Performance and Shareholder Return NextEra Energy enjoys healthy growth prospects fueled by its investments in its transmission and distribution portfolio and its strategic focus on renewable energy. NextEra Energy is a well-run company that has reported healthy financial performances and generated returns for its investors. In the last decade, NextEra Energy managed to increase EPS at a healthy CAGR of 7.2%. The consensus EPS growth for the current financial year and next financial year is 7% each. Going forward, NextEra Energy is expected to use the strong cash flow to invest in growth projects. NextEra Energy’s strength and expertise will allow it to report healthy financial performances and generate returns for its shareholders. Adjusted Earnings Per Share NextEra Energy shared its success with its shareholders through growing dividends. NextEra Energy increased the dividend per share in the past decade at a CAGR of 8.2%. Dividend Per Share NextEra Energy’s current dividend yield of 2.88% is lower compared to the utilities industry average of 4.22%. However, NextEra Energy is investing about half of its profits in its growth projects with a focus on renewable energy. This strategy is expected to help the company report healthy growth and create value for its shareholders and NextEra Energy will be able to sustain the dividend growth in the coming years. Source: Dividend.com If we compare the total return of NextEra Energy with the S&P 500 Utility Index and broader S&P 500 index, we see that NextEra Energy has produced a healthy growth for its investors. Using investment horizons of one year, three years, five years, and ten years, we can see that NextEra Energy managed to outperform the S&P 500 Utility Index at all given instances and managed to outperform in the three-year and ten-year investment horizons. With low risk and growth potential NextEra Energy is an attractive long-term investment. Total Shareholder Return The Target Price Reveals Attractive Upside NextEra Energy is a great power generation company that enjoys healthy growth prospects and attracts attractive valuations by analysts. The consensus target price reveals attractive upside at its current price of $100.66. The mean target price of $107.94 presents an upside of 7% and the median target price of $109 presents an upside of 8% based on the current price. The most optimistic target price of $124, if realized, presents an upside of 23%. The most conservative analyst estimate of $92 has a downside of -9%. Investors who wish to GAIN exposure in efficient energy companies that are investing in their renewable energy portfolio should consider investing in NextEra Energy at its current price. Source: Yahoo Finance The Relative Valuation NextEra Energy’s price to earnings ratio of 19.02 shows that it is undervalued compared to the S&P 500 but overvalued compared to the industry and sector. After incorporating forecasted growth into the price to earnings multiple, THE RESULTANT PEG ratio shows that NextEra Energy is undervalued compared to the industry and sector but overvalued compared to the S&P 500. Relative valuation indicates that NextEra Energy’s current share price is appropriate for long-term investment. Source: Yahoo Finance Conclusion NextEra Energy is a proactive energy company with great energy assets. NextEra Energy’s merger with Hawaiian Electric Industry will allow both companies to create synergies by levering each others’ strengths. NextEra Energy is well positioned to create value for its customers and shareholders and therefore a good investment opportunity. Scalper1 News

Summary NEE is a leading energy producer that owns a great portfolio of energy assets. NextEra Energy is a proactive company that is creating value for its investors and shareholders. NEE has announced that it would merge with Hawaiian Electric Industries to lever its expertise, and financial resources to realize their aim of creating more efficient renewable energy resources. NEE is a good long-term investment that is well positioned to create value for its shareholders. NextEra Energy (NYSE: NEE ) is a leading producer of green energy and it owns a great portfolio of energy assets. Through its subsidies, NextEra Energy serves a large population in the US and has an interest in the largest renewable energy generation infrastructures including wind and solar power in North America. NextEra Energy has Taken a Step towards Realizing its Aim NextEra Energy is a dynamic company that strives to create value for its customers and shareholders. NextEra Energy is working on its ambitious target to increase renewables to 65%, increasing solar energy generation three-fold and decreasing customers’ bills by 20% by 2030. NextEra Energy has taken another step forward to realize this target. NextEra Energy and Hawaiian Electric Industries, Inc. (NYSE: HE ) have agreed to combine their resources in order to lever their strengths, expertise and financial resources and move towards the achievement of their common aim of becoming highly efficient renewable energy producers. This move will allow NextEra Energy to generate value and healthy returns for its investors. NextEra Energy’s subsidiary Florida Power and Light [FPL] is one of the largest and most efficient US electric utility companies that caters to the energy needs of 4.7 million customer accounts. FPL has developed and operated one of the most advanced and reliable grid networks. FPL’s operational excellence has lower customer bills compared to the national average. Recently FPL received the Reliability One™ Award for its outstanding technology and innovation and reliability performance. FPL is a strong investment that is well positioned to produce returns for NextEra Energy in the coming years. Another great investment is Next Era Energy Resources LLP which is a leading renewable energy producer. With a capacity of 18,671 MW, Next Era Energy Resources owns assets in over 25 states and areas in Canada. NextEra Energy Resources is a strong renewable energy player that is well positioned to capitalize on the advancement in the renewable energy technology and innovation market. Strong Financial Performance and Shareholder Return NextEra Energy enjoys healthy growth prospects fueled by its investments in its transmission and distribution portfolio and its strategic focus on renewable energy. NextEra Energy is a well-run company that has reported healthy financial performances and generated returns for its investors. In the last decade, NextEra Energy managed to increase EPS at a healthy CAGR of 7.2%. The consensus EPS growth for the current financial year and next financial year is 7% each. Going forward, NextEra Energy is expected to use the strong cash flow to invest in growth projects. NextEra Energy’s strength and expertise will allow it to report healthy financial performances and generate returns for its shareholders. Adjusted Earnings Per Share NextEra Energy shared its success with its shareholders through growing dividends. NextEra Energy increased the dividend per share in the past decade at a CAGR of 8.2%. Dividend Per Share NextEra Energy’s current dividend yield of 2.88% is lower compared to the utilities industry average of 4.22%. However, NextEra Energy is investing about half of its profits in its growth projects with a focus on renewable energy. This strategy is expected to help the company report healthy growth and create value for its shareholders and NextEra Energy will be able to sustain the dividend growth in the coming years. Source: Dividend.com If we compare the total return of NextEra Energy with the S&P 500 Utility Index and broader S&P 500 index, we see that NextEra Energy has produced a healthy growth for its investors. Using investment horizons of one year, three years, five years, and ten years, we can see that NextEra Energy managed to outperform the S&P 500 Utility Index at all given instances and managed to outperform in the three-year and ten-year investment horizons. With low risk and growth potential NextEra Energy is an attractive long-term investment. Total Shareholder Return The Target Price Reveals Attractive Upside NextEra Energy is a great power generation company that enjoys healthy growth prospects and attracts attractive valuations by analysts. The consensus target price reveals attractive upside at its current price of $100.66. The mean target price of $107.94 presents an upside of 7% and the median target price of $109 presents an upside of 8% based on the current price. The most optimistic target price of $124, if realized, presents an upside of 23%. The most conservative analyst estimate of $92 has a downside of -9%. Investors who wish to GAIN exposure in efficient energy companies that are investing in their renewable energy portfolio should consider investing in NextEra Energy at its current price. Source: Yahoo Finance The Relative Valuation NextEra Energy’s price to earnings ratio of 19.02 shows that it is undervalued compared to the S&P 500 but overvalued compared to the industry and sector. After incorporating forecasted growth into the price to earnings multiple, THE RESULTANT PEG ratio shows that NextEra Energy is undervalued compared to the industry and sector but overvalued compared to the S&P 500. Relative valuation indicates that NextEra Energy’s current share price is appropriate for long-term investment. Source: Yahoo Finance Conclusion NextEra Energy is a proactive energy company with great energy assets. NextEra Energy’s merger with Hawaiian Electric Industry will allow both companies to create synergies by levering each others’ strengths. NextEra Energy is well positioned to create value for its customers and shareholders and therefore a good investment opportunity. Scalper1 News

Scalper1 News