Scalper1 News

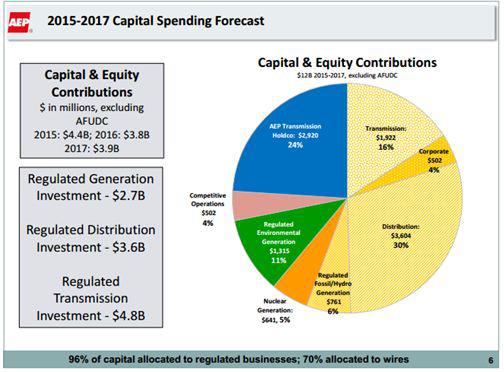

Summary DUK and AEP are set to deliver healthy performances in the coming year. Efforts to increase regulated operations will fuel future growths of both companies. DUK and AEP offer safe dividend yields. Utility stocks have been an admired investment choice for dividend-seeking investors, as they offer high dividend yields. In 2014, the utility sector delivered healthy results and performed better than the S&P 500. The healthy performance of the utility sector can be mainly attributed to a low treasury yield environment. Going forward, I believe utilities will perform well in 2015 due to the prevalent low treasury yield environment, the measures taken by utility companies to improve operational productivity, and continuous efforts by utilities to reduce competitive power operations. As I believe utility sector will deliver a healthy performance next year, I recommend investors to buy two utility stocks, namely American Electric Power (NYSE: AEP ) and Duke Energy (NYSE: DUK ), in 2015. AEP and DUK are positioned well in the industry to deliver a healthy performance in 2015. Also, both stocks offer attractive and safe dividend yields. The following graph shows the declining trend for 10-Year Treasury Yield. Source: Bloomberg.com 2 Stocks for 2015 The utility sector has performed better than the S&P 500 in 2014. And as we head into 2015, I believe the utility sector will deliver a healthy performance next year as well. The low treasury rate environment, efforts to improve operational efficiencies, and lower competitive power operations across the industry will support the utility sector’s performance in 2015. The following table shows the performance of the S&P 500, the utility sector, DUK, and AEP in 2014 year-to-date. S&P 500 Utility Sector ETF (NYSEARCA: XLU ) DUK AEP 2014 – Year-to-date Performance 13% 29% 26% 34.5% Source: Bloomberg.com As the competitive business operations of U.S. utility companies have remained challenging, due to weak capacity revenues and commodity prices, companies have been making efforts to lower their competitive operations. Efforts to lower competitive operations will portend well for companies’ bottom-line numbers and cash flows in future. Many utility companies, including AEP, DUK, PPL Corp. (NYSE: PPL ), Exelon (NYSE: EXC ), have been making efforts to lower their competitive operations. DUK will benefit in the coming year from an increase in its capital expenditures. Also, the company has been addressing the challenges in competitive business operations by selling its unregulated assets. The company, in 4Q’14, sold its competitive power assets in the Midwest for $2.8 billion. The transaction will positively affect the bottom-line numbers of the company in future, as the Midwest assets were posting weak results and were weighing on the company’s total EPS. The company intends to use the cash from the assets sale to expand its regulated operations. The company plans to make capital expenditures of $18 billion (midpoint) from 2014-2018, which includes $7 billion (midpoint) for new generation facilities. The capital expenditures that DUK has planned will help it expand its regulated operations and fuel its top and bottom-line growth. Analysts are anticipating a healthy next five-year growth rate of 4.8% for DUK. Along with healthy growth prospects, the stock offers a high dividend yield of 3.90% . DUK has consistently increased dividends over the years, and the healthy future growth prospects promises further increases in dividends. Also, the dividends offered by DUK are backed by its cash flows, evident from its healthy dividend coverage ratio. Moreover, the company has been successfully increasing its ROE in recent years. The following table shows the increase in dividends per share and ROE over the years, the dividend payout ratio, and the dividend coverage ratio for DUK. (Note * Dividend coverage ratio = operating cash flow/annual dividends, and 2014 figures below are based on estimates). Dividend Per Share ($) Dividend Payout Ratio Dividend Coverage* ROE 2012 $3.03 70% 3x 9.5% 2013 3.12 71% 2.9x 10.7% 2014 * 3.15 70% 3.1x 11.5% Source: Company Reports and Calculations AEP is among the leading utility companies in the U.S. As the competitive business operations remain challenging, AEP has been making efforts to decrease its competitive operations and expand regulated operations. The increase in regulated operations will provide EPS strength for the company. Also, the capital expenditure that AEP has been making will help it fuel its top and bottom-line numbers growth through rate case hikes. The company, in efforts to increase its regulated business, is expected to make capital expenditures of $12 billion from 2015-2017. Also, AEP is focusing on increasing its regulated transmission business in the coming years, and as a result, its transmission segment’s EPS is expected to grow to $0.67 in 2017, up from $0.30 in 2014. Capital expenditures by AEP to expand regulated operations will fuel its future growth. Due to the company’s healthy growth efforts, analysts are anticipating a healthy next five-year earnings growth rate of 4.95% for AEP. The following chart shows the capital expenditure forecast for AEP from 2015-2017. Source: Company Reports Other than attractive growth opportunities, the company offers a safe dividend yield of 3.6% . Dividends offered by the company have increased consistently over the years, and have been backed by its strong cash flows. In the future, dividends are expected to grow consistently due to the company’s growth efforts. The following table shows the increase in dividends per share over the years, dividend payout ratio and dividend coverage ratio for AEP. (Note * Dividend coverage ratio = operating cash flow/annual dividends, and 2014 figures below are based on estimates). Dividend Per Share ($) Dividend Payout Ratio Dividend Coverage* 2012 1.88 60% 4.1x 2013 1.95 60% 4.5x 2014 * 2.02 55% 4x Source: Company Reports and Calculations Conclusion I believe the utility sector will continue to perform well in 2015. I recommend investors to buy DUK and AEP for 2015, as both stocks are set to deliver healthy performances in the coming year. Both companies are expected to enjoy healthy growth in the next five years, and efforts to increase regulated operations will fuel future growths. Also, DUK and AEP offer safe dividend yields, which make both stocks attractive investment options for dividend-seeking investors. The following table shows the dividend yields and next five-year growth rates for DUK and AEP. Dividend Yield Next 5 Year Growth Rate DUK 3.9% 4.8% AEP 3.6% 4.95% Source: Yahoo Finance and nasdaq.com Scalper1 News

Summary DUK and AEP are set to deliver healthy performances in the coming year. Efforts to increase regulated operations will fuel future growths of both companies. DUK and AEP offer safe dividend yields. Utility stocks have been an admired investment choice for dividend-seeking investors, as they offer high dividend yields. In 2014, the utility sector delivered healthy results and performed better than the S&P 500. The healthy performance of the utility sector can be mainly attributed to a low treasury yield environment. Going forward, I believe utilities will perform well in 2015 due to the prevalent low treasury yield environment, the measures taken by utility companies to improve operational productivity, and continuous efforts by utilities to reduce competitive power operations. As I believe utility sector will deliver a healthy performance next year, I recommend investors to buy two utility stocks, namely American Electric Power (NYSE: AEP ) and Duke Energy (NYSE: DUK ), in 2015. AEP and DUK are positioned well in the industry to deliver a healthy performance in 2015. Also, both stocks offer attractive and safe dividend yields. The following graph shows the declining trend for 10-Year Treasury Yield. Source: Bloomberg.com 2 Stocks for 2015 The utility sector has performed better than the S&P 500 in 2014. And as we head into 2015, I believe the utility sector will deliver a healthy performance next year as well. The low treasury rate environment, efforts to improve operational efficiencies, and lower competitive power operations across the industry will support the utility sector’s performance in 2015. The following table shows the performance of the S&P 500, the utility sector, DUK, and AEP in 2014 year-to-date. S&P 500 Utility Sector ETF (NYSEARCA: XLU ) DUK AEP 2014 – Year-to-date Performance 13% 29% 26% 34.5% Source: Bloomberg.com As the competitive business operations of U.S. utility companies have remained challenging, due to weak capacity revenues and commodity prices, companies have been making efforts to lower their competitive operations. Efforts to lower competitive operations will portend well for companies’ bottom-line numbers and cash flows in future. Many utility companies, including AEP, DUK, PPL Corp. (NYSE: PPL ), Exelon (NYSE: EXC ), have been making efforts to lower their competitive operations. DUK will benefit in the coming year from an increase in its capital expenditures. Also, the company has been addressing the challenges in competitive business operations by selling its unregulated assets. The company, in 4Q’14, sold its competitive power assets in the Midwest for $2.8 billion. The transaction will positively affect the bottom-line numbers of the company in future, as the Midwest assets were posting weak results and were weighing on the company’s total EPS. The company intends to use the cash from the assets sale to expand its regulated operations. The company plans to make capital expenditures of $18 billion (midpoint) from 2014-2018, which includes $7 billion (midpoint) for new generation facilities. The capital expenditures that DUK has planned will help it expand its regulated operations and fuel its top and bottom-line growth. Analysts are anticipating a healthy next five-year growth rate of 4.8% for DUK. Along with healthy growth prospects, the stock offers a high dividend yield of 3.90% . DUK has consistently increased dividends over the years, and the healthy future growth prospects promises further increases in dividends. Also, the dividends offered by DUK are backed by its cash flows, evident from its healthy dividend coverage ratio. Moreover, the company has been successfully increasing its ROE in recent years. The following table shows the increase in dividends per share and ROE over the years, the dividend payout ratio, and the dividend coverage ratio for DUK. (Note * Dividend coverage ratio = operating cash flow/annual dividends, and 2014 figures below are based on estimates). Dividend Per Share ($) Dividend Payout Ratio Dividend Coverage* ROE 2012 $3.03 70% 3x 9.5% 2013 3.12 71% 2.9x 10.7% 2014 * 3.15 70% 3.1x 11.5% Source: Company Reports and Calculations AEP is among the leading utility companies in the U.S. As the competitive business operations remain challenging, AEP has been making efforts to decrease its competitive operations and expand regulated operations. The increase in regulated operations will provide EPS strength for the company. Also, the capital expenditure that AEP has been making will help it fuel its top and bottom-line numbers growth through rate case hikes. The company, in efforts to increase its regulated business, is expected to make capital expenditures of $12 billion from 2015-2017. Also, AEP is focusing on increasing its regulated transmission business in the coming years, and as a result, its transmission segment’s EPS is expected to grow to $0.67 in 2017, up from $0.30 in 2014. Capital expenditures by AEP to expand regulated operations will fuel its future growth. Due to the company’s healthy growth efforts, analysts are anticipating a healthy next five-year earnings growth rate of 4.95% for AEP. The following chart shows the capital expenditure forecast for AEP from 2015-2017. Source: Company Reports Other than attractive growth opportunities, the company offers a safe dividend yield of 3.6% . Dividends offered by the company have increased consistently over the years, and have been backed by its strong cash flows. In the future, dividends are expected to grow consistently due to the company’s growth efforts. The following table shows the increase in dividends per share over the years, dividend payout ratio and dividend coverage ratio for AEP. (Note * Dividend coverage ratio = operating cash flow/annual dividends, and 2014 figures below are based on estimates). Dividend Per Share ($) Dividend Payout Ratio Dividend Coverage* 2012 1.88 60% 4.1x 2013 1.95 60% 4.5x 2014 * 2.02 55% 4x Source: Company Reports and Calculations Conclusion I believe the utility sector will continue to perform well in 2015. I recommend investors to buy DUK and AEP for 2015, as both stocks are set to deliver healthy performances in the coming year. Both companies are expected to enjoy healthy growth in the next five years, and efforts to increase regulated operations will fuel future growths. Also, DUK and AEP offer safe dividend yields, which make both stocks attractive investment options for dividend-seeking investors. The following table shows the dividend yields and next five-year growth rates for DUK and AEP. Dividend Yield Next 5 Year Growth Rate DUK 3.9% 4.8% AEP 3.6% 4.95% Source: Yahoo Finance and nasdaq.com Scalper1 News

Scalper1 News