Attractive Valuations And Potential To Outperform Peers Are Highlights Of American Electric Power

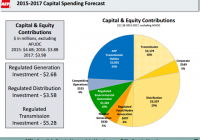

Summary Stock should trade at a 5%-10% premium to its peers’ average forward P/E. Company’s business fundamentals remain strong and efforts to strengthen regulated operations will bode well for stock price. As AEP increases regulated operations, its cash flows will become more certain, which will support dividend growth. American Electric Power (NYSE: AEP ) has strong business fundamentals and its future financial performance is expected to be solid. The stock stays an attractive investment prospect for income-seeking investors, as it offers a solid yield of 3.9% . Moreover, the company’s future growth is expected to stay strong, which will be mainly driven by its capital spending, directed at strengthening and expanding its regulated business operations. The company’s focus on regulated business operations is gaining significant traction, and it expects to achieve long-term growth of 4%-6%. Moreover, an important decision American Electric has to make in the next 3-6 months is regarding the faith of its merchant assets; either the company will sell the assets or continue to operate them. Furthermore, the stock’s current valuations are attractive. Strong Performance and Growth Catalysts American Electric has been delivering a strong financial performance, which is expected to continue in future, mainly driven by its increased focus on regulated operations. The company reported EPS of $0.88 for 2Q2015, beating consensus of $0.81. Also, rate increases and cost control initiatives positively affected American Electric’s performance for the quarter. In 2Q2015, the company secured a $123.5 million annual revenue increase and ROE of 9.75% in West Virginia, along with a $45.4 million annual revenue increase and ROE of 10.25% in Kentucky. Given the strong performance in the first half of 2015, the company increased its mid-point of 2015 EPS guidance by 2%; increased 2015 EPS guidance from $3.4-$3.6 to $3.5-$3.65 . In recent times, the company increased its focus on regulated operations, as the performance of unregulated/merchant operations has stayed weak and volatile because of low forward power prices. The company has a robust capital spending outlook, which will fuel its revenues and earnings growth in future years; American Electric plans to incur capital spending of $12.3 billion from 2015-2017. As the company has increased its focus on strengthening its regulated operations, 96% of the planned capital spending will be allocated to regulated business. Also, the company increased its 2015 capital spending guidance from $4.4 billion to $4.6 billion ; as the company continues to make progress with its cost control measures under its continuous improvement program, it freed up an additional $200 million for capital investment for 2015. The following chart shows the breakdown of the company’s planned capital spending. (click to enlarge) Source: Investors Presentation As forward power prices remain weak and volatile, utility companies in the U.S. are taking initiatives to reduce their merchant power operations. American Electric is also considering different strategic options for its 7,900MW of competitive fleet. I think that in the next 3-6 months, the company will make a decision regarding the future of its merchant assets, as currently it waits for the PJM auction results and for the pending Ohio PPA proposal. I think the best option for the company is to sell its merchant assets, as it will allow it to completely focus on regulated operations, which will improve its revenues and cash flow stability, and will augur well for the stock valuation. Moreover, I believe the company’s merchant assets sale value could range from $2 billion to $3.2 billion, depending on the outcome of the PJM auction prices, which are expected to settle by mid-August. Also, if the company chose to sell its merchant assets, it can direct the sale proceeds to increase its planned capital spending for future years, which will have a positive impact on the stock price. Other than the robust capital spending profile, the company has been making consistent efforts to improve its credit outlook. The company has successfully managed to reduce its total debt to total capitalization ratio from 57% in 2010 to 54.3% in 2Q2015. Also, the company’s qualified pension funding stands at 101% in 2Q2015, up from 96% in 1Q2015 and 97% in 2014, as displayed below in the figures. (click to enlarge) Source: Investors Presentation Valuation and Summation The stock’s current valuation stays attractive, as it is trading at a forward P/E of 15.08x , in contrast to its peers’ average forward P/E of 15.5x. Given, the company’s solid financial performance and robust capital spending profile, which will fuel its future growth, I think the stock should trade at a 5%-10% premium to its peers’ average forward P/E. Also, the company’s business fundamentals remain strong and the company’s efforts to strengthen its regulated operation will bode well for the stock price. And if the company chose to sell its merchant assets, its business risk profile will improve, as revenues and earnings will become more stable. Moreover, as the company is increasing its regulated operations, its cash flows will become more certain, which will support its dividend growth. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.