Scalper1 News

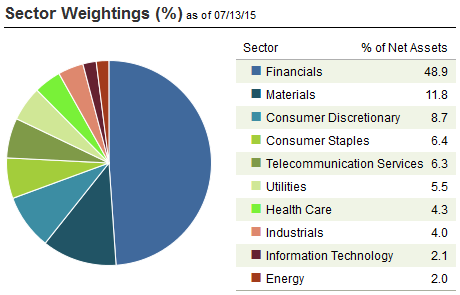

Summary Popular economic moat ETF strategy goes international. Highlight the new market Vectors Morningstar International Moat ETF. A closer look at the economic moat strategy. The popular Market Vectors Wide Moat ETF (NYSEARCA: MOAT ) got an international equivalent today with the debut of the Market Vectors Morningstar International Moat ETF (NYSEARCA: MOTI ). MOTI tracks the Global ex-US Moat Focus Index (MGEUMFUN), “a rules-based, equal-weighted index intended to offer exposure to 50 attractively priced companies outside the U.S. with sustainable competitive advantages according to Morningstar’s equity research team,” according to Market Vectors . Like its U.S.-focused counterpart, MOTI uses Morningstar’s proprietary methodology to identify companies with long-term advantages, which allows companies to earn sustainable excess economic profits , as measured by the return on invested capital relative to the company’s cost of capital. The new ETF features exposure to 16 countries, including four emerging markets. However, MOTI’s geographic lineup is heavily tilted toward developed markets. India, China, Mexico and Chile – MOTI’s four emerging markets exposure – combine for just over a quarter of the new ETF’s weight. Conversely, Australia alone is 21.1% of MOTI’s weight. Home to 51 stocks, MOTI’s lineup is roughly two and a half times the size of MOAT’s. However, MOTI applies the same equal-weight methodology. MOAT’s 21 holdings have weights ranging from 4.64% to 6%, whereas MOTI’s holdings range in size from 1.15% to 2.32%. Four of MOTI’s top 10 holdings are Indian stocks, making the country the most represented among MOTI’s top 10 lineup. ” MOAT resonated with investors and with much of the world’s investable opportunities outside the United States, we’re launching MOTI as a means to capture moat-based opportunities abroad,” said Brandon Rakszawski, product manager at Van Eck Global, in a statement. “Morningstar is a leader in equity research and we look forward to offering investors the ability to access its analysts’ best ideas through an investible ETF.” At the sector level, MOTI is heavily allocated to financial services names with that sector commanding nearly 49% of the ETF’s weight. Materials at almost 12% is the only other sector to garner a double-digit allocation. Consumer discretionary and staples names combine for just over 15% of MOTI’s weight, according to Market Vectors data. Familiar individual names in MOTI’s lineup include State Bank of India, Unilever (NYSE: UN ), America Movil (NYSE: AMX ), Westpac Banking (NYSE: WBK ), Nestle ( OTCPK:NSRGY ), Potash Corp. (NYSE: POT ), HSBC (NYSE: HSBC ) and all of Canada’s major banks. MOAT’s methodology has clearly been embraced by investors. The ETF has swelled to nearly $881 million in assets under management in just over three years of trading. MOTI’s annual expense ratio is 0.56%. MOTI Sector Weights Chart Courtesy: Market Vectors Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Popular economic moat ETF strategy goes international. Highlight the new market Vectors Morningstar International Moat ETF. A closer look at the economic moat strategy. The popular Market Vectors Wide Moat ETF (NYSEARCA: MOAT ) got an international equivalent today with the debut of the Market Vectors Morningstar International Moat ETF (NYSEARCA: MOTI ). MOTI tracks the Global ex-US Moat Focus Index (MGEUMFUN), “a rules-based, equal-weighted index intended to offer exposure to 50 attractively priced companies outside the U.S. with sustainable competitive advantages according to Morningstar’s equity research team,” according to Market Vectors . Like its U.S.-focused counterpart, MOTI uses Morningstar’s proprietary methodology to identify companies with long-term advantages, which allows companies to earn sustainable excess economic profits , as measured by the return on invested capital relative to the company’s cost of capital. The new ETF features exposure to 16 countries, including four emerging markets. However, MOTI’s geographic lineup is heavily tilted toward developed markets. India, China, Mexico and Chile – MOTI’s four emerging markets exposure – combine for just over a quarter of the new ETF’s weight. Conversely, Australia alone is 21.1% of MOTI’s weight. Home to 51 stocks, MOTI’s lineup is roughly two and a half times the size of MOAT’s. However, MOTI applies the same equal-weight methodology. MOAT’s 21 holdings have weights ranging from 4.64% to 6%, whereas MOTI’s holdings range in size from 1.15% to 2.32%. Four of MOTI’s top 10 holdings are Indian stocks, making the country the most represented among MOTI’s top 10 lineup. ” MOAT resonated with investors and with much of the world’s investable opportunities outside the United States, we’re launching MOTI as a means to capture moat-based opportunities abroad,” said Brandon Rakszawski, product manager at Van Eck Global, in a statement. “Morningstar is a leader in equity research and we look forward to offering investors the ability to access its analysts’ best ideas through an investible ETF.” At the sector level, MOTI is heavily allocated to financial services names with that sector commanding nearly 49% of the ETF’s weight. Materials at almost 12% is the only other sector to garner a double-digit allocation. Consumer discretionary and staples names combine for just over 15% of MOTI’s weight, according to Market Vectors data. Familiar individual names in MOTI’s lineup include State Bank of India, Unilever (NYSE: UN ), America Movil (NYSE: AMX ), Westpac Banking (NYSE: WBK ), Nestle ( OTCPK:NSRGY ), Potash Corp. (NYSE: POT ), HSBC (NYSE: HSBC ) and all of Canada’s major banks. MOAT’s methodology has clearly been embraced by investors. The ETF has swelled to nearly $881 million in assets under management in just over three years of trading. MOTI’s annual expense ratio is 0.56%. MOTI Sector Weights Chart Courtesy: Market Vectors Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News