Scalper1 News

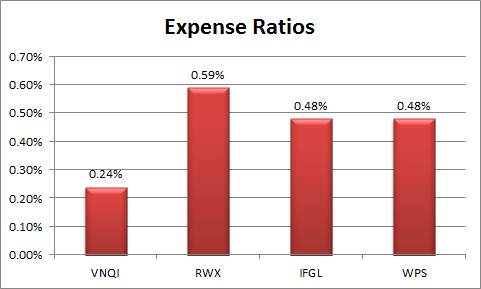

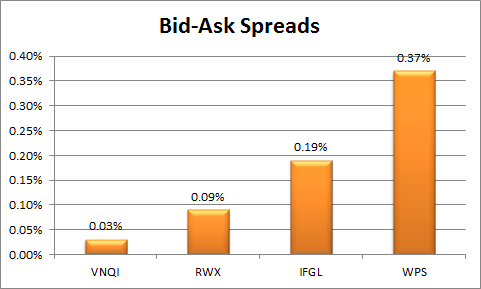

Summary I’m comparing VNQI, RWX, IFGL and WPS to find the best international real estate ETF. The results are split as no ETF won on all 3 metrics. Out of the 4, my favorite is VNQI, but I am concerned about the exposure to the Chinese market. The Vanguard Global ex-U.S. Real Estate Index Fund ETF (NASDAQ: VNQI ) is one of the best investments in international REITs. Unfortunately, it is also one of the only ones. This is an area of the market where the volume of competition is not particularly high and lower levels of competition can lead to lower levels of returns as companies are not battling to attract the consumer with the best value. I thought it would be worthwhile to compare VNQI with a few of the other options that are available to investors. For instance, investors may also be considering the SPDR® Dow Jones International Real Estate ETF (NYSEARCA: RWX ), the iShares International Developed Real Estate ETF (NASDAQ: IFGL ), or the iShares International Developed Property ETF (NYSEARCA: WPS ). Expense Ratios Due to a lack of competition, expense ratios in this space may be higher than in other areas. That’s unfortunate for investors and may give some investors good reason to look for other types of international exposure that have lower expense ratios. For instance, buying into ETFs that are investing in international companies rather than focused on REITs will result in reaching a market with more competition and lower expense ratios. I charted the expense ratios for the four ETFs below. The expense ratio drains money away from the investor each year and results in a lower CAGR (compound annual growth rate). Therefore, I see lower expense ratios as very favorable. I would prefer to see an expense ratio below .24%, but there are not many options to choose from. Bid-Ask Spreads Liquidity is a very real cost. When investors are going to buy an ETF, they will face the challenge of covering the bid-ask spread. It is true that they may use a limit order to avoid the bid-ask spread, but then the investor still faces execution uncertainty as their order might not trigger. If the order doesn’t trigger and the investor missed the opportunity to buy, they have missed out on the opportunity. When the bid-ask spread is smaller and liquidity is higher, it is more likely that the order will trigger (assuming it is set near the normal spread) and the investor will have a completed transaction. Therefore, I see a smaller spread as being advantageous. All else equal, I would be more inclined to buy into an ETF where the spread was smaller. While researching for this article I checked the spreads on each security. Keep in mind these are spreads at one point in time so they may fluctuate meaningfully from their average level. To make the spreads more indicative of the value lost due to a wider spread, I’m using spreads as a percentage of the share price rather than using the amount of cents in the spread. If an investor buys and sells frequently, a larger spread becomes more important than a larger expense ratio on the ETF. Holdings in China I’m bearish on the Chinese market because I believe the market has become too frothy as investors are able to access margins and bid up prices with money they don’t have. If the losses start and the domestic investors lose money, they may lose the purchasing power necessary to support the domestic companies. As a result, I would prefer international ETFs with a smaller allocation to China. I’m treating investments in Hong Kong as being separate, though I wouldn’t be surprised to see a strong correlation between the two and I would be happy to see lower levels of investment in Hong Kong. While the Vanguard Global ex-U.S. Real Estate ETF is offering investors the lowest expense ratios and best liquidity, it also offers the most exposure to China. Over 8% of the equity value is coming from China for VNQI, which is higher than any of the other ETFs. The other ETFs have all kept China out of their portfolio. In my opinion, the ideal investment in international REITs would more closely resemble VNQI on the first two metrics without having China as a meaningful weight in the portfolio. Since I’m concerned about a correlation between Hong Kong and the main Chinese market, I want to recognize the exposure to that market as well. VNQI performs the best on this metric with less than 11% in Hong Kong while RWX comes in right behind it with about 11.5%. For IFGL the exposure on Hong Kong is 17% and for WPS it is 15%. Conclusion I have to give the nod on portfolio holdings to RWX while crowning VNQI as the champ on the other metrics. IFGL and WPS both offer too much exposure to Hong Kong, too little liquidity, and too high of expense ratios. If an investor really wants to play with IFGL and WPS, it may be best to become very knowledgeable about them and use limit orders to prevent crossing the bid-ask spread. Disclosure: I am/we are long VNQI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary I’m comparing VNQI, RWX, IFGL and WPS to find the best international real estate ETF. The results are split as no ETF won on all 3 metrics. Out of the 4, my favorite is VNQI, but I am concerned about the exposure to the Chinese market. The Vanguard Global ex-U.S. Real Estate Index Fund ETF (NASDAQ: VNQI ) is one of the best investments in international REITs. Unfortunately, it is also one of the only ones. This is an area of the market where the volume of competition is not particularly high and lower levels of competition can lead to lower levels of returns as companies are not battling to attract the consumer with the best value. I thought it would be worthwhile to compare VNQI with a few of the other options that are available to investors. For instance, investors may also be considering the SPDR® Dow Jones International Real Estate ETF (NYSEARCA: RWX ), the iShares International Developed Real Estate ETF (NASDAQ: IFGL ), or the iShares International Developed Property ETF (NYSEARCA: WPS ). Expense Ratios Due to a lack of competition, expense ratios in this space may be higher than in other areas. That’s unfortunate for investors and may give some investors good reason to look for other types of international exposure that have lower expense ratios. For instance, buying into ETFs that are investing in international companies rather than focused on REITs will result in reaching a market with more competition and lower expense ratios. I charted the expense ratios for the four ETFs below. The expense ratio drains money away from the investor each year and results in a lower CAGR (compound annual growth rate). Therefore, I see lower expense ratios as very favorable. I would prefer to see an expense ratio below .24%, but there are not many options to choose from. Bid-Ask Spreads Liquidity is a very real cost. When investors are going to buy an ETF, they will face the challenge of covering the bid-ask spread. It is true that they may use a limit order to avoid the bid-ask spread, but then the investor still faces execution uncertainty as their order might not trigger. If the order doesn’t trigger and the investor missed the opportunity to buy, they have missed out on the opportunity. When the bid-ask spread is smaller and liquidity is higher, it is more likely that the order will trigger (assuming it is set near the normal spread) and the investor will have a completed transaction. Therefore, I see a smaller spread as being advantageous. All else equal, I would be more inclined to buy into an ETF where the spread was smaller. While researching for this article I checked the spreads on each security. Keep in mind these are spreads at one point in time so they may fluctuate meaningfully from their average level. To make the spreads more indicative of the value lost due to a wider spread, I’m using spreads as a percentage of the share price rather than using the amount of cents in the spread. If an investor buys and sells frequently, a larger spread becomes more important than a larger expense ratio on the ETF. Holdings in China I’m bearish on the Chinese market because I believe the market has become too frothy as investors are able to access margins and bid up prices with money they don’t have. If the losses start and the domestic investors lose money, they may lose the purchasing power necessary to support the domestic companies. As a result, I would prefer international ETFs with a smaller allocation to China. I’m treating investments in Hong Kong as being separate, though I wouldn’t be surprised to see a strong correlation between the two and I would be happy to see lower levels of investment in Hong Kong. While the Vanguard Global ex-U.S. Real Estate ETF is offering investors the lowest expense ratios and best liquidity, it also offers the most exposure to China. Over 8% of the equity value is coming from China for VNQI, which is higher than any of the other ETFs. The other ETFs have all kept China out of their portfolio. In my opinion, the ideal investment in international REITs would more closely resemble VNQI on the first two metrics without having China as a meaningful weight in the portfolio. Since I’m concerned about a correlation between Hong Kong and the main Chinese market, I want to recognize the exposure to that market as well. VNQI performs the best on this metric with less than 11% in Hong Kong while RWX comes in right behind it with about 11.5%. For IFGL the exposure on Hong Kong is 17% and for WPS it is 15%. Conclusion I have to give the nod on portfolio holdings to RWX while crowning VNQI as the champ on the other metrics. IFGL and WPS both offer too much exposure to Hong Kong, too little liquidity, and too high of expense ratios. If an investor really wants to play with IFGL and WPS, it may be best to become very knowledgeable about them and use limit orders to prevent crossing the bid-ask spread. Disclosure: I am/we are long VNQI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News