Scalper1 News

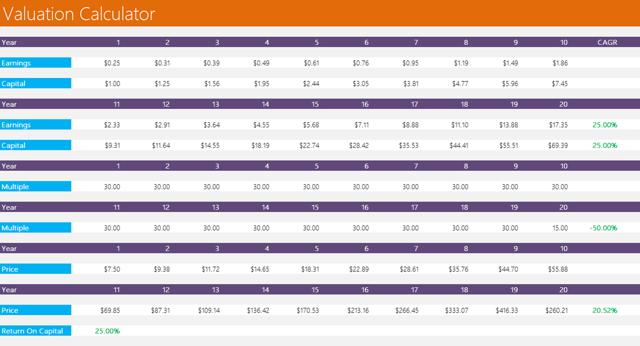

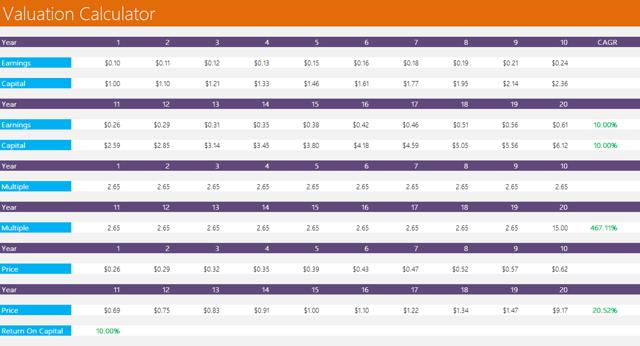

Summary As investors, our investment philosophy is closely aligned with our personality. My personality is that I like quality. Buying a basket of cheap stocks and selling them when they reach intrinsic value works. It just doesn’t work for me. Over 20 years, the stock price went from $7.50 to $260.21. That’s an annualized return of 20.52% and a cumulative return of 3370%! I’m a pretty cheap guy. But I think you have to pay up to enjoy the finer things in life. It’s nice to find great bargains. If you can buy a dollar for 50 cents, then why not? I’m a big fan of Ben Graham and the traditional value investing approach. I bought some stocks with this approach and did pretty well. However, this doesn’t exactly align with my personality. Investment Philosophy and Personality As investors, our investment philosophy is closely aligned with our personality. My personality is that I like quality. I like to buy great assets similar to how I like to collect rare video games. I know that you have to pay a little bit for quality. Sometimes you get good quality at a great price, but sometimes you get good quality at a reasonable price, which is okay too. I don’t like the idea of owning a company and hoping for the PE or book value to go up. The company is not doing so well, it’s not growing, nor creating any shareholder wealth. But it’s dirt cheap! And I hope that at some point the market will reappraise the business, it’s going to be bought out, management will do something to create value, etc. I’m a patient guy, but I don’t like the thought of depending on the kindness of others. You’re basically trying to find a higher price buyer for the same asset. A Company That Creates Wealth I like the idea of partnering with someone that’s really building a company. I’m attracted to the prospect that a company’s earnings will increase 500% over say 10 years. The fact that you made a good investment because the company has done very well is something that makes sense to me. I just have a different personality than the traditional value investor. I enjoy reading shareholder letters where management discusses the company’s many accomplishments and goals. You can read previous letters and track the progress. It’s really amazing to see a business creating wealth over time simply by reading the letters. Buying a basket of cheap stocks and selling them when they reach intrinsic value works. It just doesn’t work for me. I discovered that I like it better when I find a company I can own for 10 years and I do well not because the market does some kind of reappraisal of the business, but because the business has created wealth. But you know, that’s me. And I know the danger of paying too much for a great business so I try to be cautious on that too. With that said, let’s see how much we should pay up for quality. Time For Some Math My background is in engineering. I designed solar panels for a tech start-up a while back, thought I was going to change the world, but came up just a bit short. Coming from an engineering background, I like seeing numbers to support any valid reasoning. There’s a saying, “In the short term the stock market is a voting machine, and it’s a weighing machine long term.” I believe that’s true. It’s hard for a stock to earn a much better return that the business which underlies it earns. A lot of folks are concerned about the price they paid for an investment. The price paid for an investment starts to diminish if a company can generate an attractive return on capital (ROC) and management does a good job of capital allocation. I know I know… enough about this return on capital stuff. But I think it’s really important. You can read my previous posts about ROC here and here . Let’s say we’re going to invest in two companies and hold them for 20 years. All earnings will be reinvested back into the business every year. After 20 years, both companies will trade at 15x earnings. Okay, the first business earns 25% ROC. We paid 30x earnings on day one. In 20 years, it’ll be trading at 15x earnings, that’s a multiple contraction of 50% over time. What earnings multiple of current earnings would we need to pay for a business earning 10% ROC to end up with an identical return? 10% ROC is roughly the average for most businesses, but I might be somewhat generous there. Think about it for a minute. I was like what the f$*% when I did the calculations. I think is might be the reason why Warren Buffett likes to buy and hold forever. Here are calculations for the first business earning 30% ROC. (click to enlarge) The first business earned $0.25 on $1.00 of capital. We’re paying 30x the $0.25 in earnings, or $7.50 per share. As you can see, the impact of compounding takes effect in a big way! In the 20th year, the first business earns $17.35, or 25%, on $69.39 per share in capital. At a multiple of 15x, the stock would be trading at $260.21 per share. Over 20 years, the stock price went from $7.50 to $260.21. That’s an annualized return of 20.52% and a cumulative return of 3370%! Not too shabby… Now let’s run the numbers for the second business earning 10% ROC. (click to enlarge) The second business earned $0.10 on $1.00 of capital. Assuming the stock trades at 15x for the $0.61 earnings in the 20th year, the market would pay $9.17 for this business. On day one, we would needed to pay $0.26 per share or about 2.65x earnings to match the returns generated by the first business, which we paid 30x earnings for. The multiple needed to expand from 2.65x to 15x, which is an increase of 467%. Conclusion It looks like paying up for quality isn’t such a bad thing after all. 30x earnings might seem like a high price at first, but as you can see the returns are pretty good over the long term. It all depends on how high your hurdle rate is. Mine is 15% annually. I try to achieve this by buying truly outstanding businesses at reasonable prices. A reasonable price for me is around 15-20x earnings, lower is always better of course. Luckily there aren’t many great businesses out there, which makes tracking them somewhat easier. I think I own some fantastic businesses. And there are more great businesses I’d love to own at the right price. So I watch them here and there. I guess the take away from all this is there’s serious money to be made by holding onto a truly outstanding business year after year after year. You just have to be patient. Would you pay up for quality? Click here to download the valuation calculator. Thanks for reading! Scalper1 News

Summary As investors, our investment philosophy is closely aligned with our personality. My personality is that I like quality. Buying a basket of cheap stocks and selling them when they reach intrinsic value works. It just doesn’t work for me. Over 20 years, the stock price went from $7.50 to $260.21. That’s an annualized return of 20.52% and a cumulative return of 3370%! I’m a pretty cheap guy. But I think you have to pay up to enjoy the finer things in life. It’s nice to find great bargains. If you can buy a dollar for 50 cents, then why not? I’m a big fan of Ben Graham and the traditional value investing approach. I bought some stocks with this approach and did pretty well. However, this doesn’t exactly align with my personality. Investment Philosophy and Personality As investors, our investment philosophy is closely aligned with our personality. My personality is that I like quality. I like to buy great assets similar to how I like to collect rare video games. I know that you have to pay a little bit for quality. Sometimes you get good quality at a great price, but sometimes you get good quality at a reasonable price, which is okay too. I don’t like the idea of owning a company and hoping for the PE or book value to go up. The company is not doing so well, it’s not growing, nor creating any shareholder wealth. But it’s dirt cheap! And I hope that at some point the market will reappraise the business, it’s going to be bought out, management will do something to create value, etc. I’m a patient guy, but I don’t like the thought of depending on the kindness of others. You’re basically trying to find a higher price buyer for the same asset. A Company That Creates Wealth I like the idea of partnering with someone that’s really building a company. I’m attracted to the prospect that a company’s earnings will increase 500% over say 10 years. The fact that you made a good investment because the company has done very well is something that makes sense to me. I just have a different personality than the traditional value investor. I enjoy reading shareholder letters where management discusses the company’s many accomplishments and goals. You can read previous letters and track the progress. It’s really amazing to see a business creating wealth over time simply by reading the letters. Buying a basket of cheap stocks and selling them when they reach intrinsic value works. It just doesn’t work for me. I discovered that I like it better when I find a company I can own for 10 years and I do well not because the market does some kind of reappraisal of the business, but because the business has created wealth. But you know, that’s me. And I know the danger of paying too much for a great business so I try to be cautious on that too. With that said, let’s see how much we should pay up for quality. Time For Some Math My background is in engineering. I designed solar panels for a tech start-up a while back, thought I was going to change the world, but came up just a bit short. Coming from an engineering background, I like seeing numbers to support any valid reasoning. There’s a saying, “In the short term the stock market is a voting machine, and it’s a weighing machine long term.” I believe that’s true. It’s hard for a stock to earn a much better return that the business which underlies it earns. A lot of folks are concerned about the price they paid for an investment. The price paid for an investment starts to diminish if a company can generate an attractive return on capital (ROC) and management does a good job of capital allocation. I know I know… enough about this return on capital stuff. But I think it’s really important. You can read my previous posts about ROC here and here . Let’s say we’re going to invest in two companies and hold them for 20 years. All earnings will be reinvested back into the business every year. After 20 years, both companies will trade at 15x earnings. Okay, the first business earns 25% ROC. We paid 30x earnings on day one. In 20 years, it’ll be trading at 15x earnings, that’s a multiple contraction of 50% over time. What earnings multiple of current earnings would we need to pay for a business earning 10% ROC to end up with an identical return? 10% ROC is roughly the average for most businesses, but I might be somewhat generous there. Think about it for a minute. I was like what the f$*% when I did the calculations. I think is might be the reason why Warren Buffett likes to buy and hold forever. Here are calculations for the first business earning 30% ROC. (click to enlarge) The first business earned $0.25 on $1.00 of capital. We’re paying 30x the $0.25 in earnings, or $7.50 per share. As you can see, the impact of compounding takes effect in a big way! In the 20th year, the first business earns $17.35, or 25%, on $69.39 per share in capital. At a multiple of 15x, the stock would be trading at $260.21 per share. Over 20 years, the stock price went from $7.50 to $260.21. That’s an annualized return of 20.52% and a cumulative return of 3370%! Not too shabby… Now let’s run the numbers for the second business earning 10% ROC. (click to enlarge) The second business earned $0.10 on $1.00 of capital. Assuming the stock trades at 15x for the $0.61 earnings in the 20th year, the market would pay $9.17 for this business. On day one, we would needed to pay $0.26 per share or about 2.65x earnings to match the returns generated by the first business, which we paid 30x earnings for. The multiple needed to expand from 2.65x to 15x, which is an increase of 467%. Conclusion It looks like paying up for quality isn’t such a bad thing after all. 30x earnings might seem like a high price at first, but as you can see the returns are pretty good over the long term. It all depends on how high your hurdle rate is. Mine is 15% annually. I try to achieve this by buying truly outstanding businesses at reasonable prices. A reasonable price for me is around 15-20x earnings, lower is always better of course. Luckily there aren’t many great businesses out there, which makes tracking them somewhat easier. I think I own some fantastic businesses. And there are more great businesses I’d love to own at the right price. So I watch them here and there. I guess the take away from all this is there’s serious money to be made by holding onto a truly outstanding business year after year after year. You just have to be patient. Would you pay up for quality? Click here to download the valuation calculator. Thanks for reading! Scalper1 News

Scalper1 News