Scalper1 News

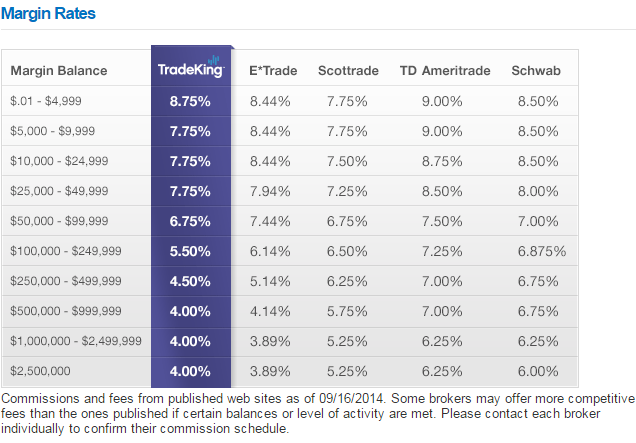

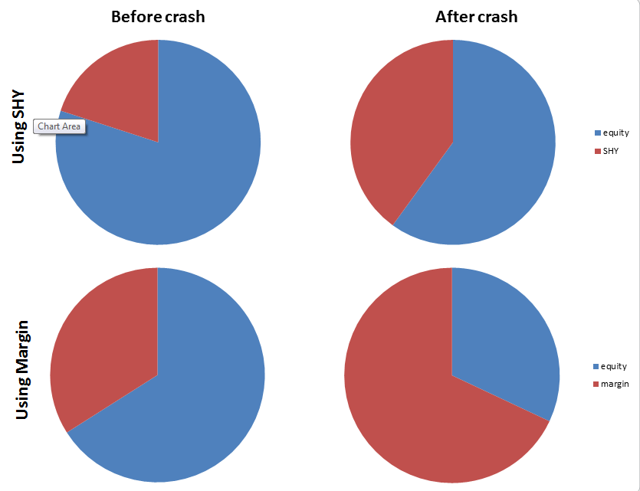

Summary Margin interest rates at major brokers are several percent. One could instead short SHY at the cost of one half a percent. Tail-risk could make this dangerous. ETF Description SHY is the short-duration treasury ETF managed by iShares. It holds treasuries with a duration between 1 and 3 years. It currently yields 0.46%. It effectively mirrors the behavior of the two year yield. SHY data by YCharts Thesis Below is a table taken from Tradeking of current margin rates at major brokers: One could save substantially by instead shorting SHY. For a hypothetical portfolio which has two dollars of equity for each dollar of margin the current interest charge might be 8%. By lowering that to 0.5% by shorting $1 of SHY for each two dollars of equity, our hypothetical portfolio would perform 3.75% better (on equity). Maintaining this level of out-performance would result in having twice as much money over twenty years! One may also benefit from capital gains because short term yields seem, on balance, more likely to rise than fall over the next ten years or so. Investment Risks Is this a free lunch? I’m honestly not quite certain. On May 6th, 2010 the Dow Jones Industrial average dropped 9% and recovered over the course of minutes. Some stocks, like Procter & Gamble, traded down to a penny. If for some reason there was a flash spike in the value of SHY and your broker forced liquidation, you could be wiped out. It’s hard to quantify the likelihood of such a situation. This is in general a problem of using margin, as a flash crash could wipe you out if your broker forced you to sell at pennies. One might be inclined to think that the risk could be decreased by using multiple short-duration treasury ETFs. This is not the case. It simply adds more danger, because any one of them could theoretically trade at an insane level. The fact that each ETF would represent a smaller amount of money doesn’t help, because it only takes one share trading for $100,000 (as some stocks did during the flash crash) to wipe you out. An important question to ask your broker is what they would do in such a situation. Second, if short-term yields declined further the value of SHY could increase. Suppose that short term interest rates went to negative 3% overnight. If the average duration is roughly two years so if the ETF reflects net asset value the value should increase to something like 6% above par. This would translate to a 6% increase in the ETF’s value. This might be scary if it happens overnight but isn’t much larger than you might have paid for interest over the course of the year. Much larger negative interest rates could cause more significant losses. If we saw short term interest rates go to negative 30% the Net Asset Value of the fund would double. If your broker forces you to sell at that point your losses could be substantial. Third, a deflationary environment might cause a similar problem. The value of short term treasuries might spike. To get a substantial loss (eg. 50%) we’d still need to see something like 17% deflation or 17% negative interest rates. Fourth, if your stock portfolio drops in value you might be forced to sell some positions at depressed values to cover your short position. This is more likely than when using margin! Take the time to calculate how much margin or short SHY you should use under different scenarios. You should at least assume that at some point the US stock market will fall 50%. If it does what will happen to your portfolio? If you are using one dollar of margin per dollar of equity then you are wiped out. Similarly, if you are short one dollar of SHY per dollar of equity you are also wiped out. You might be inclined at this point to say, well alright, I’ll just make sure that my margin/SHY is 49% of the value of my stocks. If this happens, your broker is still likely to force a sale at depressed levels, which could leave you with as little as 2% of your original portfolio value. You need to check what the maintenance requirement for margin is with your broker. For example, at Tradeking the maintenance requirement for stocks above $6 is 30% of the current value. After the drawdown you need to end up with at least 30% equity in your account. This means that you could only have started with a ratio of $2 of equity against $1 of margin to avoid a margin call. Any more margin than this is very risky and over long periods will likely wipe you out. If we handle this instead by shorting SHY the calculation is a little different. The amount of equity can’t (in the case of Tradeking) go below 140% of the market value of SHY. This means that we can only use $1 of shorted SHY for every $4 of equity. Even if you don’t intend to own stocks on margin, but instead use the shorted SHY for something else, you still need to pay attention to this rule. (click to enlarge) I don’t own any stocks on margin, but I am shorting a small amount of SHY to take advantage of a 3% interest rate on a checking account. The maximum amount that I feel comfortable using is 20% of the total stock value of the account. Scalper1 News

Summary Margin interest rates at major brokers are several percent. One could instead short SHY at the cost of one half a percent. Tail-risk could make this dangerous. ETF Description SHY is the short-duration treasury ETF managed by iShares. It holds treasuries with a duration between 1 and 3 years. It currently yields 0.46%. It effectively mirrors the behavior of the two year yield. SHY data by YCharts Thesis Below is a table taken from Tradeking of current margin rates at major brokers: One could save substantially by instead shorting SHY. For a hypothetical portfolio which has two dollars of equity for each dollar of margin the current interest charge might be 8%. By lowering that to 0.5% by shorting $1 of SHY for each two dollars of equity, our hypothetical portfolio would perform 3.75% better (on equity). Maintaining this level of out-performance would result in having twice as much money over twenty years! One may also benefit from capital gains because short term yields seem, on balance, more likely to rise than fall over the next ten years or so. Investment Risks Is this a free lunch? I’m honestly not quite certain. On May 6th, 2010 the Dow Jones Industrial average dropped 9% and recovered over the course of minutes. Some stocks, like Procter & Gamble, traded down to a penny. If for some reason there was a flash spike in the value of SHY and your broker forced liquidation, you could be wiped out. It’s hard to quantify the likelihood of such a situation. This is in general a problem of using margin, as a flash crash could wipe you out if your broker forced you to sell at pennies. One might be inclined to think that the risk could be decreased by using multiple short-duration treasury ETFs. This is not the case. It simply adds more danger, because any one of them could theoretically trade at an insane level. The fact that each ETF would represent a smaller amount of money doesn’t help, because it only takes one share trading for $100,000 (as some stocks did during the flash crash) to wipe you out. An important question to ask your broker is what they would do in such a situation. Second, if short-term yields declined further the value of SHY could increase. Suppose that short term interest rates went to negative 3% overnight. If the average duration is roughly two years so if the ETF reflects net asset value the value should increase to something like 6% above par. This would translate to a 6% increase in the ETF’s value. This might be scary if it happens overnight but isn’t much larger than you might have paid for interest over the course of the year. Much larger negative interest rates could cause more significant losses. If we saw short term interest rates go to negative 30% the Net Asset Value of the fund would double. If your broker forces you to sell at that point your losses could be substantial. Third, a deflationary environment might cause a similar problem. The value of short term treasuries might spike. To get a substantial loss (eg. 50%) we’d still need to see something like 17% deflation or 17% negative interest rates. Fourth, if your stock portfolio drops in value you might be forced to sell some positions at depressed values to cover your short position. This is more likely than when using margin! Take the time to calculate how much margin or short SHY you should use under different scenarios. You should at least assume that at some point the US stock market will fall 50%. If it does what will happen to your portfolio? If you are using one dollar of margin per dollar of equity then you are wiped out. Similarly, if you are short one dollar of SHY per dollar of equity you are also wiped out. You might be inclined at this point to say, well alright, I’ll just make sure that my margin/SHY is 49% of the value of my stocks. If this happens, your broker is still likely to force a sale at depressed levels, which could leave you with as little as 2% of your original portfolio value. You need to check what the maintenance requirement for margin is with your broker. For example, at Tradeking the maintenance requirement for stocks above $6 is 30% of the current value. After the drawdown you need to end up with at least 30% equity in your account. This means that you could only have started with a ratio of $2 of equity against $1 of margin to avoid a margin call. Any more margin than this is very risky and over long periods will likely wipe you out. If we handle this instead by shorting SHY the calculation is a little different. The amount of equity can’t (in the case of Tradeking) go below 140% of the market value of SHY. This means that we can only use $1 of shorted SHY for every $4 of equity. Even if you don’t intend to own stocks on margin, but instead use the shorted SHY for something else, you still need to pay attention to this rule. (click to enlarge) I don’t own any stocks on margin, but I am shorting a small amount of SHY to take advantage of a 3% interest rate on a checking account. The maximum amount that I feel comfortable using is 20% of the total stock value of the account. Scalper1 News

Scalper1 News