Scalper1 News

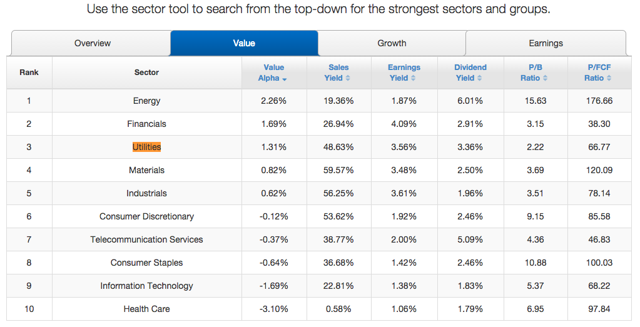

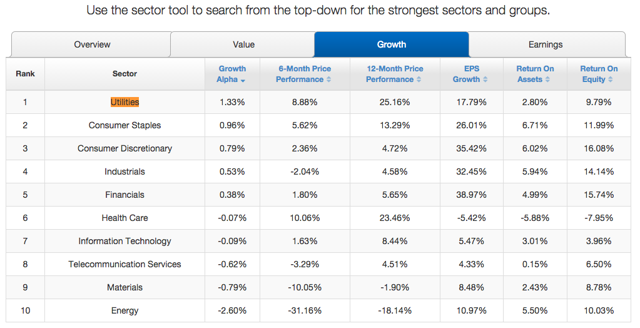

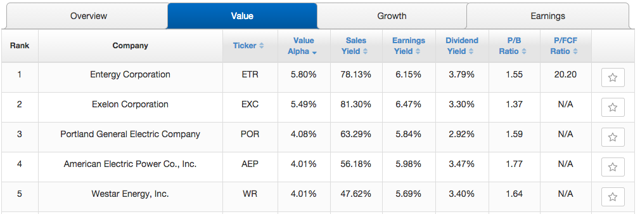

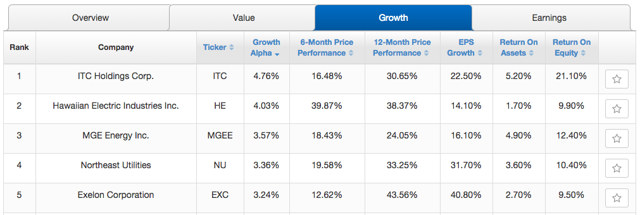

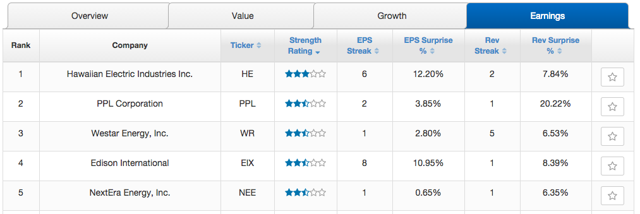

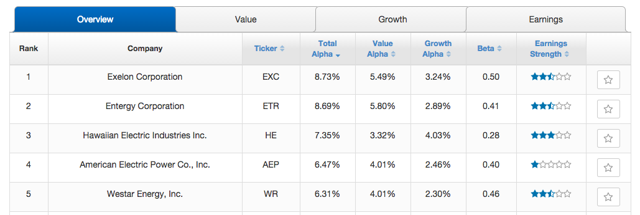

The strong rally in utilities will continue into 2015, despite statements to the contrary from analysts, as the sector is still strongly undervalued relative to the market. Exelon combines an attractive valuation with strong price momentum and EPS growth. We expect the stock to outperform the market by 8.7% over the next 12 months. Entergy Corporation, Hawaiian Electric, and Westar Energy are other electric utilities that look poised to outperform the market in 2015. A) Introduction The Utilities sector surprised many by posting the best price performance in the market in 2014. Electric utility companies were a particularly strong subset of the sector, posting an average gain of 31% during the course of the year. At this point, many investors are questioning whether the current rally will continue, especially with rising interest rates on the horizon (high interest rates hurt utilities). On Wednesday, Michael Purves, the head of equity derivatives research at Weeden & Co, advised investors to “start to take profits given the run is getting long in the teeth.” Contrary to common sentiment, we feel the sector’s momentum and growth should serve a signal of further outperformance, as the sector is still strongly undervalued relative to the overall market. Investors unfamiliar to our style of analysis should know that we solely look at metrics that have a long historical track record of predicting stock returns. We’ll first analyze how the overall Utility sector stacks up to the other nine sectors in ten metrics that have been academically shown to predict returns. Then, we’ll look into which stocks within the Electrical Utility industry group look poised to lead the group, again looking at value, momentum, and earnings. B) Top-Down Analysis of the Utility Sector In deciding whether to invest in certain utility stocks, it is critical to first look at how the overall sector stacks up relative to other sectors in value, momentum, and growth. The table below shows how the sector compares to other sectors in five valuation metrics that have been academically proven to predict returns: (click to enlarge) Source: QuantifiedAlpha.com The utilities sector looks the most attractive of any of the sectors on a book value basis, with the sector’s average price/book ratio of 2.22 being the lowest of any of the sectors. The sector looks relatively attractive on both a revenue and earnings basis, with a sales yield of 49% and earnings yield of 3.6%. Even with the big rally, the average utility stock pays a 3.4% dividend, good for third behind the Energy and Telecom sectors. Undervalued stocks tend to outperform the market, and using the average amount of excess return generated by these factors historically, our algorithms estimate how much. Overall, we expect the average utility stock to generate 1.31% of alpha attributable to value, over the next twelve months. Next, we analyze how the sector is doing on a growth & momentum basis: (click to enlarge) Source: QuantifiedAlpha.com As we said before, the utility sector has performed the best over the last twelve months, gaining 25% on average. It is the second best performing sector over the last six months, behind the Health Care sector, gaining a shade under 9%. The sector falls in the middle of the pack in average annual EPS growth, growing 18%. The sector is also in the middle of the pack in financial efficiency, returning an average of 2.8% on assets and 9.8% on equity. Each of these five metrics has been academically shown to predict stock returns, with the two price momentum metrics being the most important. Overall, we expect the average utility stock to generate 1.33% of alpha attributable to growth over the upcoming twelve months. C) Group Leaders Now that we’ve analyzed the sector on a top-down basis, we’ll now look at which stocks within the electric utility industry group look poised to lead the group. Below is a table showing which stocks in the group are the most undervalued: (click to enlarge) Source: QuantifiedAlpha.com As we can see, our top five most undervalued electrical utilities include Entergy Corporation (NYSE: ETR ), Exelon Corporation (NYSE: EXC ), Portland General Electric Company (NYSE: POR ), American Electric Power Co. (NYSE: AEP ), and Westar Energy (NYSE: WR ). Each of these companies has a sales yield (inverse of Price/Sales) over 45%, which is way above the overall market average. Each of these stocks sport similar earnings and dividend yields, each of which are again much higher than the overall market averages. These stocks also look attractive on a book value basis, with none of the company’s having a price/book ratio over 2. Overall, Entergy tops out as the value leader of the group, with our algorithms expecting the stock to generate 5.8% of value alpha over the next twelve months. With that being said, each of the five stocks is expected to significantly outperform the market due to their attractive value. Next, we’ll see which stocks are leading the sector in growth and momentum: (click to enlarge) Source: QuantifiedAlpha.com As we can see, our top five strongest growth electrical utilities include ITC Holdings Corp. (NYSE: ITC ), Hawaiian Electric Industries (NYSE: HE ), MGE Energy (NASDAQ: MGEE ), Northeast Utilities (NYSE: NU ), and Exelon Corporation. After a slow start to the year, Hawaiian has had a very strong second half of the year (+40%). Exelon has been the best performer over the past year, gaining 44%. Exelon has also had the strong EPS growth of the five, growing annual EPS by 41%. ITC Holdings tops the group in profit efficiency, returning 5.2% on assets and 21% on equity. Overall, ITC is expected to outperform the market the most owing to its growth profile over the upcoming twelve months (4.76%). Exelon is the only stock that made it onto both group leaders lists. Next, we’ll look at which stocks have been performing best relative analyst earnings expectations: (click to enlarge) Source: QuantifiedAlpha.com We’ve found through historical back testing that stocks that beat earnings estimates consistently, are extremely likely to keep beating estimates. This is crucial as stock prices can experience wild swings in price depending on how earnings come out relative to expectations. Hawaiian Electric has the best track record, having beaten EPS estimates by 12% last quarter (6 straight beats) and revenue estimates by 8% (2 straight beats). Edison International (NYSE: EIX ) has the best track record for EPS, having beaten the Wall Street consensus EPS estimates 8 times in a row. PPL Corporation (NYSE: PPL ), Westar Energy, and NextEra Energy (NYSE: NEE ) are names we haven’t seen yet, that have all outperformed expectations as well. D) Conclusion Now that we’ve analyzed the sector as a whole and the individual group leaders in the group, it is time to see which utility stock comes out on top. The table below shows the electric utility stocks we expect to outperform the market the most: (click to enlarge) Source: QuantifiedAlpha.com Exelon comes out on top on our list, with our algorithms expecting the stock to outperform the overall market by 8.73% over the next twelve months. Exelon combines strong value with solid momentum and EPS growth. Entergy, Hawaiian Electric, and Westar Energy are other stocks that were featured earlier in the article that also look very attractive. While American Electric Power is featured at #4 on our overall leader board, we advise investors to stay away from the stock as it has been missing analyst estimates recently (hence the one star Earnings Strength rating). Though the Utility sector outperformed the general market during 2014, we feel the sector is still relatively undervalued and certain names look very attractive. Scalper1 News

The strong rally in utilities will continue into 2015, despite statements to the contrary from analysts, as the sector is still strongly undervalued relative to the market. Exelon combines an attractive valuation with strong price momentum and EPS growth. We expect the stock to outperform the market by 8.7% over the next 12 months. Entergy Corporation, Hawaiian Electric, and Westar Energy are other electric utilities that look poised to outperform the market in 2015. A) Introduction The Utilities sector surprised many by posting the best price performance in the market in 2014. Electric utility companies were a particularly strong subset of the sector, posting an average gain of 31% during the course of the year. At this point, many investors are questioning whether the current rally will continue, especially with rising interest rates on the horizon (high interest rates hurt utilities). On Wednesday, Michael Purves, the head of equity derivatives research at Weeden & Co, advised investors to “start to take profits given the run is getting long in the teeth.” Contrary to common sentiment, we feel the sector’s momentum and growth should serve a signal of further outperformance, as the sector is still strongly undervalued relative to the overall market. Investors unfamiliar to our style of analysis should know that we solely look at metrics that have a long historical track record of predicting stock returns. We’ll first analyze how the overall Utility sector stacks up to the other nine sectors in ten metrics that have been academically shown to predict returns. Then, we’ll look into which stocks within the Electrical Utility industry group look poised to lead the group, again looking at value, momentum, and earnings. B) Top-Down Analysis of the Utility Sector In deciding whether to invest in certain utility stocks, it is critical to first look at how the overall sector stacks up relative to other sectors in value, momentum, and growth. The table below shows how the sector compares to other sectors in five valuation metrics that have been academically proven to predict returns: (click to enlarge) Source: QuantifiedAlpha.com The utilities sector looks the most attractive of any of the sectors on a book value basis, with the sector’s average price/book ratio of 2.22 being the lowest of any of the sectors. The sector looks relatively attractive on both a revenue and earnings basis, with a sales yield of 49% and earnings yield of 3.6%. Even with the big rally, the average utility stock pays a 3.4% dividend, good for third behind the Energy and Telecom sectors. Undervalued stocks tend to outperform the market, and using the average amount of excess return generated by these factors historically, our algorithms estimate how much. Overall, we expect the average utility stock to generate 1.31% of alpha attributable to value, over the next twelve months. Next, we analyze how the sector is doing on a growth & momentum basis: (click to enlarge) Source: QuantifiedAlpha.com As we said before, the utility sector has performed the best over the last twelve months, gaining 25% on average. It is the second best performing sector over the last six months, behind the Health Care sector, gaining a shade under 9%. The sector falls in the middle of the pack in average annual EPS growth, growing 18%. The sector is also in the middle of the pack in financial efficiency, returning an average of 2.8% on assets and 9.8% on equity. Each of these five metrics has been academically shown to predict stock returns, with the two price momentum metrics being the most important. Overall, we expect the average utility stock to generate 1.33% of alpha attributable to growth over the upcoming twelve months. C) Group Leaders Now that we’ve analyzed the sector on a top-down basis, we’ll now look at which stocks within the electric utility industry group look poised to lead the group. Below is a table showing which stocks in the group are the most undervalued: (click to enlarge) Source: QuantifiedAlpha.com As we can see, our top five most undervalued electrical utilities include Entergy Corporation (NYSE: ETR ), Exelon Corporation (NYSE: EXC ), Portland General Electric Company (NYSE: POR ), American Electric Power Co. (NYSE: AEP ), and Westar Energy (NYSE: WR ). Each of these companies has a sales yield (inverse of Price/Sales) over 45%, which is way above the overall market average. Each of these stocks sport similar earnings and dividend yields, each of which are again much higher than the overall market averages. These stocks also look attractive on a book value basis, with none of the company’s having a price/book ratio over 2. Overall, Entergy tops out as the value leader of the group, with our algorithms expecting the stock to generate 5.8% of value alpha over the next twelve months. With that being said, each of the five stocks is expected to significantly outperform the market due to their attractive value. Next, we’ll see which stocks are leading the sector in growth and momentum: (click to enlarge) Source: QuantifiedAlpha.com As we can see, our top five strongest growth electrical utilities include ITC Holdings Corp. (NYSE: ITC ), Hawaiian Electric Industries (NYSE: HE ), MGE Energy (NASDAQ: MGEE ), Northeast Utilities (NYSE: NU ), and Exelon Corporation. After a slow start to the year, Hawaiian has had a very strong second half of the year (+40%). Exelon has been the best performer over the past year, gaining 44%. Exelon has also had the strong EPS growth of the five, growing annual EPS by 41%. ITC Holdings tops the group in profit efficiency, returning 5.2% on assets and 21% on equity. Overall, ITC is expected to outperform the market the most owing to its growth profile over the upcoming twelve months (4.76%). Exelon is the only stock that made it onto both group leaders lists. Next, we’ll look at which stocks have been performing best relative analyst earnings expectations: (click to enlarge) Source: QuantifiedAlpha.com We’ve found through historical back testing that stocks that beat earnings estimates consistently, are extremely likely to keep beating estimates. This is crucial as stock prices can experience wild swings in price depending on how earnings come out relative to expectations. Hawaiian Electric has the best track record, having beaten EPS estimates by 12% last quarter (6 straight beats) and revenue estimates by 8% (2 straight beats). Edison International (NYSE: EIX ) has the best track record for EPS, having beaten the Wall Street consensus EPS estimates 8 times in a row. PPL Corporation (NYSE: PPL ), Westar Energy, and NextEra Energy (NYSE: NEE ) are names we haven’t seen yet, that have all outperformed expectations as well. D) Conclusion Now that we’ve analyzed the sector as a whole and the individual group leaders in the group, it is time to see which utility stock comes out on top. The table below shows the electric utility stocks we expect to outperform the market the most: (click to enlarge) Source: QuantifiedAlpha.com Exelon comes out on top on our list, with our algorithms expecting the stock to outperform the overall market by 8.73% over the next twelve months. Exelon combines strong value with solid momentum and EPS growth. Entergy, Hawaiian Electric, and Westar Energy are other stocks that were featured earlier in the article that also look very attractive. While American Electric Power is featured at #4 on our overall leader board, we advise investors to stay away from the stock as it has been missing analyst estimates recently (hence the one star Earnings Strength rating). Though the Utility sector outperformed the general market during 2014, we feel the sector is still relatively undervalued and certain names look very attractive. Scalper1 News

Scalper1 News