Scalper1 News

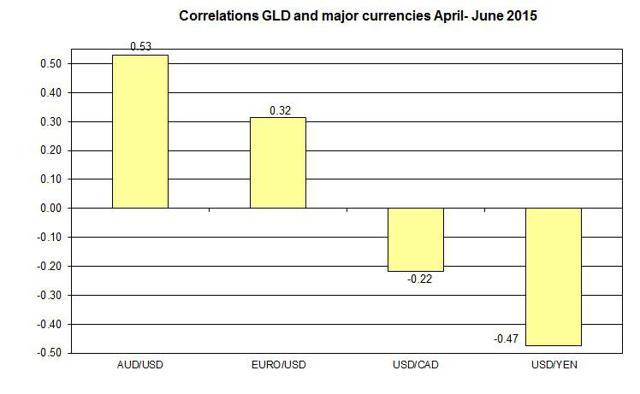

Summary The Greek drama keeps moving the markets and the price of GLD also reacts mainly via the movements in the foreign exchange markets. The price of GLD is likely to keep reacting to the progress of the U.S. economy. The non-farm payroll report could move again the price of GLD and raise the odds of a rate hike in September. The Greek drama continues to lead the news cycle and keeps to move the euro against major currencies including the U.S. dollar. The strengthening of the U.S. dollar against the euro could have an adverse impact on the price of the SPDR Gold Trust ETF (NYSEARCA: GLD ). Besides the ongoing bets of whether Greece exits the Eurozone, this week we also have the release of the non-farm payroll report. This report is likely to keep moving the gold market in general and GLD, as the markets try to figure whether the current economic conditions are good enough for the Federal Reserve to raise rates in September. The decision of Alexis Tsipras to call for a referendum is understandable given the high stakes involved, but should have been made a while back, and not so close to the IMF’s payment deadline. For now, the polls suggest the Greeks are likely to accept this deal. Because they are more frightened of what lies ahead with a Grexit over remaining in the Eurozone or in other words better the devil you know… Behind door number one, in the event of a Grexit, the Greeks could face very weak currency, high inflation, unstable, if at all, banking system for years to come. But door number two isn’t too appealing either: elevated unemployment, much higher taxes, lower pensions, and high debt payments for decades. At least under this status quo option, they keep having a strong currency and a working baking system. Who would want to make this lesser of two evils choice? When it comes to the potential impact of the news about a Greek exit or default on its debt on the euro, the situation isn’t straight forward. For one, investors and traders react to the uncertainty following a messy Greek exit with falling stock prices throughout Europe, Asia and U.S. and falling euro against leading currencies. But over the longer run, such a scenario should move the euro upward as part of the weakness of this currency relates to the high debt European countries including Greece. One fewer highly leveraged country in the EU should lead, down the line, to an appreciation of the euro. For GLD, even though higher uncertainty in the financial markets tends to play in favor of precious metals, the potential appreciation of the U.S. dollar against the euro could drag down the price of GLD. (click to enlarge) Source of data: Author’s calculations The other big news item for the week is the non-farm payroll report. This week, the report will be released on Thursday and could move the price of GLD as it has in the past. Last month, the employment report showed a 280,000 gain in number of jobs, which was higher than expected. This time, the market estimates a gain of 231,000 jobs. If the report were to show a higher increase in number of jobs, this could lead to another drop in the price of GLD. (click to enlarge) Source of data: U.S. Bureau of Labor Statistics and Google Finance Besides the short-term impact of the news of the progress of the U.S. labor market, this news could also raise the odds, which have gone down after the last FOMC meeting, of a rate hike in September. Another issue to keep tabs on is the changes in wages, which have gone up slowly in the past few months – the growth rate reached 2.3% last month. A higher growth rate could also raise the odds of a potential rate hike – it’s another closely monitored data point in the labor report, and so far this year, we have only seen a modest increase in wages. As of the beginning of this week, the implied probabilities for a rate hike in September have reached 14%; for the October meeting, the odds are 28%; and for December, the probabilities are only 50%. These odds still suggest the market isn’t convinced the FOMC plans to raise rates in September. The upcoming non-farm payroll report could have another short-term impact on the price of GLD and move the odds of the possible rate hike in the coming months. The minutes of the last FOMC meeting will be released next week, but aren’t likely to provide more guidance than the last FOMC meeting. So far, the Fed keeps using the same mantra – the decision to raise rates will be “data dependent” – and as such, we will have to continue to closely monitor the progress of the U.S. economy. For more, please see: ” Gold and Inflation – Is there is relation? ” Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Greek drama keeps moving the markets and the price of GLD also reacts mainly via the movements in the foreign exchange markets. The price of GLD is likely to keep reacting to the progress of the U.S. economy. The non-farm payroll report could move again the price of GLD and raise the odds of a rate hike in September. The Greek drama continues to lead the news cycle and keeps to move the euro against major currencies including the U.S. dollar. The strengthening of the U.S. dollar against the euro could have an adverse impact on the price of the SPDR Gold Trust ETF (NYSEARCA: GLD ). Besides the ongoing bets of whether Greece exits the Eurozone, this week we also have the release of the non-farm payroll report. This report is likely to keep moving the gold market in general and GLD, as the markets try to figure whether the current economic conditions are good enough for the Federal Reserve to raise rates in September. The decision of Alexis Tsipras to call for a referendum is understandable given the high stakes involved, but should have been made a while back, and not so close to the IMF’s payment deadline. For now, the polls suggest the Greeks are likely to accept this deal. Because they are more frightened of what lies ahead with a Grexit over remaining in the Eurozone or in other words better the devil you know… Behind door number one, in the event of a Grexit, the Greeks could face very weak currency, high inflation, unstable, if at all, banking system for years to come. But door number two isn’t too appealing either: elevated unemployment, much higher taxes, lower pensions, and high debt payments for decades. At least under this status quo option, they keep having a strong currency and a working baking system. Who would want to make this lesser of two evils choice? When it comes to the potential impact of the news about a Greek exit or default on its debt on the euro, the situation isn’t straight forward. For one, investors and traders react to the uncertainty following a messy Greek exit with falling stock prices throughout Europe, Asia and U.S. and falling euro against leading currencies. But over the longer run, such a scenario should move the euro upward as part of the weakness of this currency relates to the high debt European countries including Greece. One fewer highly leveraged country in the EU should lead, down the line, to an appreciation of the euro. For GLD, even though higher uncertainty in the financial markets tends to play in favor of precious metals, the potential appreciation of the U.S. dollar against the euro could drag down the price of GLD. (click to enlarge) Source of data: Author’s calculations The other big news item for the week is the non-farm payroll report. This week, the report will be released on Thursday and could move the price of GLD as it has in the past. Last month, the employment report showed a 280,000 gain in number of jobs, which was higher than expected. This time, the market estimates a gain of 231,000 jobs. If the report were to show a higher increase in number of jobs, this could lead to another drop in the price of GLD. (click to enlarge) Source of data: U.S. Bureau of Labor Statistics and Google Finance Besides the short-term impact of the news of the progress of the U.S. labor market, this news could also raise the odds, which have gone down after the last FOMC meeting, of a rate hike in September. Another issue to keep tabs on is the changes in wages, which have gone up slowly in the past few months – the growth rate reached 2.3% last month. A higher growth rate could also raise the odds of a potential rate hike – it’s another closely monitored data point in the labor report, and so far this year, we have only seen a modest increase in wages. As of the beginning of this week, the implied probabilities for a rate hike in September have reached 14%; for the October meeting, the odds are 28%; and for December, the probabilities are only 50%. These odds still suggest the market isn’t convinced the FOMC plans to raise rates in September. The upcoming non-farm payroll report could have another short-term impact on the price of GLD and move the odds of the possible rate hike in the coming months. The minutes of the last FOMC meeting will be released next week, but aren’t likely to provide more guidance than the last FOMC meeting. So far, the Fed keeps using the same mantra – the decision to raise rates will be “data dependent” – and as such, we will have to continue to closely monitor the progress of the U.S. economy. For more, please see: ” Gold and Inflation – Is there is relation? ” Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News