UWTI And UGAZ: A Cautionary Tale Of Fortunes Won And Lost

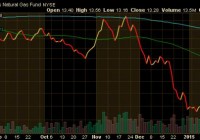

Summary 3X commodity ETNs are overwhelmingly volatile and risky. UWTI and UGAZ are widely traded ETNs that should be approached with a sober and patient mind. 3X commodity ETNs have potential for huge gains as well as catastrophic losses. Introduction This summer, I took on the arduous task of learning the ins and outs of leveraged commodity ETNs. Like many foolish investors before me, I firmly believed I could trade these volatile monsters and actually make serious money. I began with a meticulous research in an attempt to determine a central price point in which to buy and sell. I learned about the holdings of each ETN, and I learned how these funds were leveraged to attain daily 3X returns. I transferred a percentage of my funds to a commission-free brokerage account (Robinhood). Then, drunk on overconfidence in my own ability to predict future market behavior, I set out to make my fortune. ETN Functionality After extensive research, I came to the conclusion I could profit most off of the volatility of natural gas and crude oil futures. My weapons of choice included VelocityShares 3X Inverse Crude Oil ETN (NYSEARCA: DWTI ), VelocityShares 3X Long Crude Oil ETN (NYSEARCA: UWTI ), VelocityShares 3X Inverse Natural Gas ETN (NYSEARCA: DGAZ ), and VelocityShares 3X Long Natural Gas ETN (NYSEARCA: UGAZ ). I wanted to utilize the maximum amount of leverage to capitalize heavily on price swings. I learned everything I could about the benefits of 1X, 2X, and 3X leverage. I’ll include them here , but if you’re reading this article, you likely already understand the risks and rewards. I’ll briefly mention the underlying financials, but chances are you understand those too. Each ETN is issued by Credit Suisse and traded on the NYSE. All four indexes I mentioned have market capitalizations over 100 million and are traded very heavily over millions of times each day. They are designed to track daily performance, and they are not designed to be held for extended periods of time. ETNs have a veritable laundry list of risks , and they suffer from significant contango over time. Additionally, these ETNs have an expense cost and no dividends. The point is that they are essentially designed to lose money in the long run. Don’t believe me? Look at the long-term returns of each. With the exception of DWTI (for obvious reasons), ETNs perform sub optimally in the long term. They should be used for short-term performance only. Determining Price: Market Conditions I approached pricing from (what I believed to be) a logical top-down view. In regards to oil , I felt it had been oversold, because China’s economy was not slowing as much as believed, Iran had already been priced in, the Greek crisis was overblown, and rig increases were a sign of strength (not weakness). I also looked at world supply and demand, OPEC projections, and EIA estimates. I came to the conclusion that a fair short-term price for crude (WTI) was $57, though a selloff could push oil to $53. Never did I think prices would go as low as $51. For natural gas , I looked at EIA.gov forecasts, and I looked at world supply and demand. Natural gas consumption seemed (and seems) poised to gradually increase over time. The recent influx of natural gas, particularly from the shale boom and improved technology (fracking, etc.) had been decimated by cheap energy over the past year. I concluded that natural gas supply would gradually rebound as well to match rising consumption. I also came to the conclusion that the wide held notion that El Nino would cause a “cool summer” was misunderstood and false. With those underlying assumptions, I moved on to figuring out a fair price to gauge when I should buy and sell the ETN. Determining Price: Central Swing Point 3X ETNs are inherently volatile. I included UGAZ to visually provide an example of daily price swings. These securities also reset each day and often can start significantly higher or lower than they ended from the day before. They generally swing up and down around a central point and rally significantly in trending markets. ETNs also decay over time, so it is advisable to trade daily rather than over a long term. For each ETN, I created a monthly average point for each index and compared them to their underlying future prices. I created my own “fair price point”, and whenever the price dipped around 5%-10% of my preconceived fair price, I would snatch up equity. For example, my fair price for UGAZ (as I mentioned about a month ago) was 2.1. Whenever UGAZ fell to a price around 2.00, I generally would proceed to purchase the stock and wait for it to rebound above 2.1. I sold UGAZ whenever it hit 2.20. My “fair price points” for the others were $3.2 for UWTI, $62 for DWTI, and $5.55 for DGAZ. Equipped with my “fool proof” strategy, I went forth to make some money. Building a Fortune – What Went Right My first (and arguably smartest) course of action was to put my money into a zero-commission account before making a large number of trades. ETN trading is day trading, and I did not want some broker to siphon off my earnings. From June 12-June 29, I made almost 30%. For my first trade, I bought UGAZ around 2.1 (I didn’t let it fall the first time) on June 12 and sold at 2.32 on June 14. Then, I purchased DGAZ at 5.31 on June 15 and sold at 5.45 on June 17. I was already off to a decent start. Next, I moved to UWTI; I bought on June 19 at 3.37 and sold at 3.55 on the 23rd of June. I believed I was infallible. I proceeded to buy DWTI on June 23 at 61 and sold on June 29 at 69. I felt on top of the world, and ultimately my swelling pride became my downfall. Losing Everything – Where I Went Wrong On July 1st, I went all in on UWTI at 2.88, thinking I had gotten a steal. On July 6th, I sold my position at 2.12 thinking oil prices would keep dropping based on negative sentiment. I over exposed myself, and I lost the majority of my gains. I didn’t follow my own beliefs about crude (that the selloff was irrational), and I realized a loss that I shouldn’t have. I could have easily held UWTI for another couple days and sold at 2.25 even. Instead, I got cocky and then I got scared. I also lost sight of the most important fact of futures trading. No one can truly predict where prices are going to go. Energy is volatile, and speculation is rampant. 3X ETNs can easily drop off in one day. The thrill of 10% gains in a single day had gotten the best of me. Conclusion I made my last trade on July 9. I bought UGAZ at 1.90 and sold it on Monday at 2.20. With that trade, my overall returns were slightly above even, and I consoled myself with the idea that I would turn my back on futures once and for all. Now, I research long-term value stocks, but every once in a while, the thrill of trading crosses my mind. These stocks are definitely not for the faint of heart or risk averse. For those bold traders who want to make a fortune in a single day, just remember that you can lose it all at any moment. Investing in 3X ETNs is legalized gambling, and UWTI, DWTI, UGAZ, and DGAZ ought to only be considered in very specific situations (such as hedging). Heed my warning and proceed with caution when considering these three 3X ETNs. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.