ETG And ETO: What’s The Difference Between This Pair Of Confusingly-Named Eaton Vance CEFs

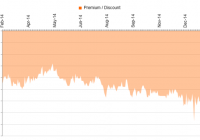

Summary Eaton Vance has a bad habit of using similar names for its CEFs; ETO and ETG are yet another example. The difference appears to come down to a different investment focus that may not be meaningful right now. Performance, meanwhile, has been vastly different. What’s in a name? When it comes to Eaton Vance closed-end funds, or CEFs, a single word or number is sometimes the only thing – but it can mean a lot… or sometimes a little. In the case of the Eaton Vance Tax-Advantaged Global Dividend Income Fund (NYSE: ETG ) and the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (NYSE: ETO ), the switch of “income” and “opportunities” has meant a lot to performance though it’s tough to see how it changes the two portfolios at a high level right now. Seen this story before So ETG and ETO share a lot of the same traits as other Eaton Vance CEF pairs I’ve looked at, including ETB and ETV . For example, ETG and ETO both came public within the same three-month span in early 2004. The management team is identical. And the two funds have, word for word, the same objective: “The Fund’s investment objective is to provide a high level of after-tax total return.” That said, ETG, the older of the two funds, is a much larger fund with around $1.4 billion in assets to ETO’s around $350 million or so. On the surface, this suggests that ETG’s IPO went a little more smoothly than ETO’s IPO, which wouldn’t be surprising since coming back to the same customers a second time with a similarly named fund would probably be a hard sell for brokers. However, there’s also the issue of “opportunity.” Look at that performance When I looked at previous pairs of Eaton Vance CEFs, their performance was different, but fairly similar. One fund would have an edge over the other, but not a commanding lead. That’s not the case with ETG and ETO. For example, according to Morningstar’s total return figures, which include reinvesting of distributions, ETV and ETB’s trailing five-year annualized returns through the end of January were 11.4% and 11%, respectively. The edge goes to ETV, but just slightly. For EOS and EOI , the trailing 10-year annualized returns were 7.2% and 6.4%, respectively. A wider lead with EOS getting the edge, but still fairly close. ETO and ETG, on the other hand, had trailing 10-year annualized returns of 8.6% and 5.8%, respectively. That’s a much wider margin that clearly favors ETO, the smaller of the two CEFs. Interestingly, the two other pairs I’ve examined each outperformed the Morningstar categories in which they were placed over the time periods noted above. However, this pair was split. ETO outperformed while ETG trailed the World Allocation Morningstar category over the trailing ten years through January, and both had roughly similar standard deviations, a measure of volatility, over the trailing decade. That said, over the trailing one, three, and five-year periods through January, ETG is the better performer. Although it’s hard to attribute ETG’s short-term outperformance and ETO’s long-term outperformance to any one thing, the last few years have been relatively bad for natural resources while the years before that were extremely good ones for that segment of the market as China’s growth fueled huge demand for commodities. Which brings us to a major difference. What gives? The biggest difference I could find was in the fund highlight sections of the funds’ fact sheets. For ETO, “The Fund employs a value style, and may emphasize investments in common stocks of issuers whose business are related to ‘hard assets,’ such as energy, other natural resources during periods of high inflation or rising concerns about inflation.” ETG’s fund highlight provided the more bland: “The Fund employs a value investment style and seeks to invest in dividend-paying common stocks that have the potential for meaningful dividend growth.” While that could easily explain the short-term/long-term performance difference, the two portfolios are fairly similar today. For example, the two have roughly similar allocations to U.S. stocks, foreign stocks, and preferred stocks. Their global allocations are pretty close. And seven of their top ten holdings are the same. Looking at their sector allocations, both funds are both materially overweight in the financial sector (largely a result of their preferred holdings), with ETG appearing to stick closer to the benchmark overall. Both have about the same amount of leverage (neither uses an option strategy). And their yields based on market price are around the same area, with ETO offering an 8.1% yield and ETG a 7.8% yield, according to the Closed-End Fund Association. Another notable difference, however, arises with regard to discounts. ETO is trading at around 3% discount versus ETG’s about 8.5% discount. ETO’s discount is well below its 5-year and 10-year averages of around 9%. ETG is about in line with its 10-year average discount, but wider than its 5-year average of around 6%. Hard to call I can give a convincing argument to the fact that ETO is the better long-term performer with a higher yield. And, based on that, it’s a better option, but you should wait for a pullback. I could also go with the argument that ETG is trading at a wider discount and has been a better performer of late, so despite its slightly lower yield, it’s a better option right now. In the end, I think the difference should come down to the different focus on natural resources. In the current environment, ETO’s ability to focus on this sector isn’t particularly helpful. However, if natural resources pick up again, it could be. That would likely lead it to outperform ETG again. However, if you prefer a global offering that sticks a little closer to its benchmark, ETG would probably be the better call. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.