Scalper1 News

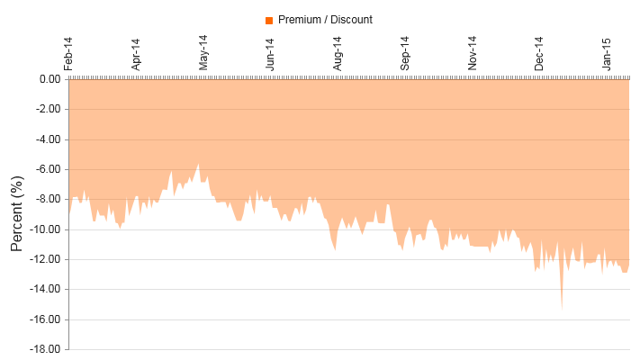

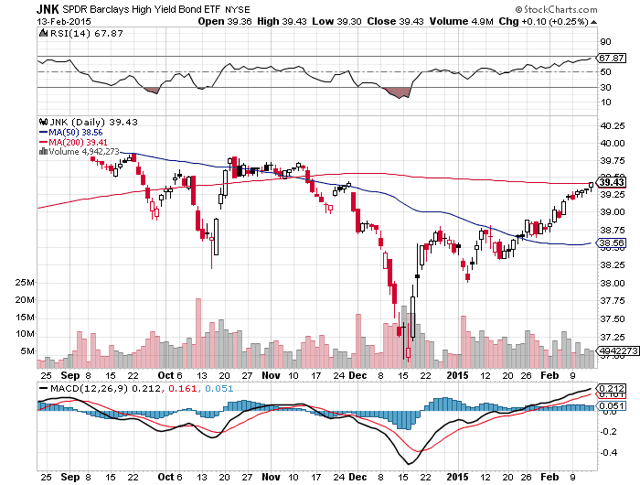

Investors are showing renewed interest in high-yielding junk bonds. With yields of government bonds near record lows, high yield bonds look increasingly attractive. Concerns about exposure to the energy sector appear overblown, especially as oil is now rebounding. Closed end funds offer some of the highest yields and still trade at significant discounts to net asset value. The Managed High Yield Plus Fund offers a rare combination of high yields and professional management, while trading at a major discount to net asset value. Managed High Yield Plus Fund (NYSE: HYF ) is a closed end fund or “CEF” that is professionally managed by UBS (NYSE: UBS ). It primarily invests in high yield bonds and offers a generous yield of nearly 9%. Besides the high yield, there are a couple of other compelling factors, including the fact that this fund pays the dividend on a monthly basis and it is trading at a historically wide discount of about 12.5%, to net asset value. The dividend also appears secure since this fund is earning more each month than it pays out. Let’s take a closer look: (click to enlarge) As the chart above shows, this closed end fund is currently trading for an exceptionally large discount to net asset value and one that is historically wide. The 3-year average discount to net asset value has been 5.78% and the 5-year average has been less than 2%. With the discount now at nearly 12.5%, this appears to be an exceptional buying opportunity. As of February 14, 2015, the net asset value is $2.18 per share and yet these shares are trading for just $1.91 per share. It’s worth noting that this fund has average earnings per share of about 1.37 cents per month, which clearly more than covers the monthly dividend it pays. That is important because it shows that the dividend is secure, and this reduces potential downside risks for investors. To see this and other information, you can see this fund data . This fund has around 359 holdings, which shows it is well-diversified. This diversification reduces potential downside risks for investors. Another consideration for bond investors is duration risk, however, this fund has an average maturity of just about 5.6 years, which means duration risks are low. This fund’s annual expense ratio of just 1.64%, which is low compared to many closed end funds. This fund pays a 1.35 cent per share dividend each month and the next payment is coming up soon. The dividend is payable on February 27th to shareholders of record as of February 19, 2015. The ex-dividend date is February 17, 2015. (click to enlarge) The SPDR Barclays High Yield Bond Fund (NYSEARCA: JNK ) is a popular way for investors to buy high yield bonds. As the chart above shows, junk bonds experienced a decline in mid-December over concerns that some energy companies could be more likely to default due to the plunge in oil prices. These concerns now appear overblown and oil has recently been trending higher. A Financial Times article points out that nearly $3 billion flowed into junk bond funds during the week of February 11, 2015 and this trend could be poised to continue, as the European Central Bank’s new bond buying program is creating more demand for high yield assets. A recent Bloomberg article details why investors are pouring back into junk bond funds, and that concerns over the plunge in oil are diminishing, it states : “Junk bonds are benefiting from demand for higher-yielding assets as the European Central Bank’s new round of bond purchases pushes yields on more than $1.7 trillion of debt worldwide below zero. The resurgence is sending down borrowing costs for speculative-grade borrowers and reopening a new-issue market that all but shut at the end of the year as oil tumbled below $45 a barrel from more than $107 in June. A rebound in crude has also boosted risk appetite. “With rates getting so low, you look at high-yield and it doesn’t look so bad,” Jack Flaherty, a money manager at New York-based GAM USA Inc., which oversees $17 billion, said in a telephone interview. “That has brought investors back in after the volatility at the end of last year scared them away. The fears from weak oil, while not gone, have lessened.” For all the reasons mentioned above, it makes sense to consider this fund if you are seeking generous yields, a monthly payout that is well-covered by current earnings, and professional management. The discount of nearly 12.5% to net asset value is an added bonus because if the discount narrows back to more historical levels, investors could also be positioned for significant capital gains. Here are some key points for the Managed High Yield Plus Fund, Inc.: Current share price: $1.92 The 52 week range is $1.75 to $2.19 Annual dividend: 16 cents per share (or 1.35 cents per month), which yields about 9% Data is sourced from Yahoo Finance. No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor. Disclosure: The author is long HYF. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Investors are showing renewed interest in high-yielding junk bonds. With yields of government bonds near record lows, high yield bonds look increasingly attractive. Concerns about exposure to the energy sector appear overblown, especially as oil is now rebounding. Closed end funds offer some of the highest yields and still trade at significant discounts to net asset value. The Managed High Yield Plus Fund offers a rare combination of high yields and professional management, while trading at a major discount to net asset value. Managed High Yield Plus Fund (NYSE: HYF ) is a closed end fund or “CEF” that is professionally managed by UBS (NYSE: UBS ). It primarily invests in high yield bonds and offers a generous yield of nearly 9%. Besides the high yield, there are a couple of other compelling factors, including the fact that this fund pays the dividend on a monthly basis and it is trading at a historically wide discount of about 12.5%, to net asset value. The dividend also appears secure since this fund is earning more each month than it pays out. Let’s take a closer look: (click to enlarge) As the chart above shows, this closed end fund is currently trading for an exceptionally large discount to net asset value and one that is historically wide. The 3-year average discount to net asset value has been 5.78% and the 5-year average has been less than 2%. With the discount now at nearly 12.5%, this appears to be an exceptional buying opportunity. As of February 14, 2015, the net asset value is $2.18 per share and yet these shares are trading for just $1.91 per share. It’s worth noting that this fund has average earnings per share of about 1.37 cents per month, which clearly more than covers the monthly dividend it pays. That is important because it shows that the dividend is secure, and this reduces potential downside risks for investors. To see this and other information, you can see this fund data . This fund has around 359 holdings, which shows it is well-diversified. This diversification reduces potential downside risks for investors. Another consideration for bond investors is duration risk, however, this fund has an average maturity of just about 5.6 years, which means duration risks are low. This fund’s annual expense ratio of just 1.64%, which is low compared to many closed end funds. This fund pays a 1.35 cent per share dividend each month and the next payment is coming up soon. The dividend is payable on February 27th to shareholders of record as of February 19, 2015. The ex-dividend date is February 17, 2015. (click to enlarge) The SPDR Barclays High Yield Bond Fund (NYSEARCA: JNK ) is a popular way for investors to buy high yield bonds. As the chart above shows, junk bonds experienced a decline in mid-December over concerns that some energy companies could be more likely to default due to the plunge in oil prices. These concerns now appear overblown and oil has recently been trending higher. A Financial Times article points out that nearly $3 billion flowed into junk bond funds during the week of February 11, 2015 and this trend could be poised to continue, as the European Central Bank’s new bond buying program is creating more demand for high yield assets. A recent Bloomberg article details why investors are pouring back into junk bond funds, and that concerns over the plunge in oil are diminishing, it states : “Junk bonds are benefiting from demand for higher-yielding assets as the European Central Bank’s new round of bond purchases pushes yields on more than $1.7 trillion of debt worldwide below zero. The resurgence is sending down borrowing costs for speculative-grade borrowers and reopening a new-issue market that all but shut at the end of the year as oil tumbled below $45 a barrel from more than $107 in June. A rebound in crude has also boosted risk appetite. “With rates getting so low, you look at high-yield and it doesn’t look so bad,” Jack Flaherty, a money manager at New York-based GAM USA Inc., which oversees $17 billion, said in a telephone interview. “That has brought investors back in after the volatility at the end of last year scared them away. The fears from weak oil, while not gone, have lessened.” For all the reasons mentioned above, it makes sense to consider this fund if you are seeking generous yields, a monthly payout that is well-covered by current earnings, and professional management. The discount of nearly 12.5% to net asset value is an added bonus because if the discount narrows back to more historical levels, investors could also be positioned for significant capital gains. Here are some key points for the Managed High Yield Plus Fund, Inc.: Current share price: $1.92 The 52 week range is $1.75 to $2.19 Annual dividend: 16 cents per share (or 1.35 cents per month), which yields about 9% Data is sourced from Yahoo Finance. No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor. Disclosure: The author is long HYF. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News