Clean Energy Fuels – 2 Reasons And 4 Charts Show Why It’s A ‘Buy On The Dip’ Opportunity

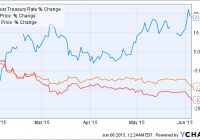

Summary CLNE will benefit from the increasing usage of natural gas in electricity generation in the long run as this will push up the price of the commodity. Though natural gas trucks cost $50,000 more than diesel trucks, they can deliver annual fuel savings of around $25,000, creating a tailwind for CLNE as this will increase NGV adoption. The drop in diesel prices hasn’t discouraged fleet operators from buying more natural gas trucks, and this will allow CLNE to maintain its volumes even in adverse circumstances. CLNE is gradually building up fueling infrastructure that will help it increase its addressable market and land more customers for fueling services in the long run. Clean Energy Fuels (NASDAQ: CLNE ) has appreciated over 50% in 2015, but the stock has lost momentum ever since it posted weak Q1 results around a month ago. In the past one month, Clean Energy shares have dropped over 13% since the company missed consensus estimates owing to slower adoption of natural gas vehicles and the decline in natural gas prices. As a result, despite an increase in volumes of natural gas delivered, Clean Energy’s financial performance contracted and its revenue was affected to the tune of $3.7 million due to weak natural gas pricing. But, in my opinion, the drop in Clean Energy’s stock price over the past one month has given investors an opportunity to buy the stock on the dip. If we look at the long run, Clean Energy will benefit from two key factors — an increase in natural gas prices and the increasing adoption of natural gas fleets. In this article, we will take a closer look at these points and see why Clean Energy is a good buy-on-the-dip opportunity. Natural gas prices have started recovering Natural gas prices have recovered slightly since the end of April as shown in the chart below: Henry Hub Natural Gas Spot Price data by YCharts The recent recovery in natural gas prices is being driven by the injection season, as demand for the fuel has increased due to low pricing and the hot weather. In fact, the latest injection season has seen strong refill activity that has exceeded the five-year average injections by a comfortable margin, according to the EIA. Additionally, the hot summer season has led to an increase in the usage of air conditioners, which has again pushed up demand for natural gas. Now, it should be noted that natural gas is increasingly replacing coal as a source of electricity generation as shown below: The basic point that I am trying to put across over here is that demand for natural gas is increasing, and this will help decrease the oversupply in the U.S. natural gas market. In fact, over the long run, usage of natural gas in electric generation will continue increasing at a steady pace as more power plants switch from coal to gas. This is because the conversion rate of natural gas into electricity stands at 90% as compared to only 30% in case of conventional fuels. Thus, as the demand-supply situation in the natural gas market improves, prices will get better. This will act as a tailwind for Clean Energy as the company suffered last quarter due to a drop in prices. In fact, over the long run the EIA expects natural gas prices to recover strongly as pointed out in its latest Annual Energy Outlook as shown below: (click to enlarge) Source Thus, investors should not worry much regarding the short-term concern around natural gas prices as the future of the commodity looks robust in the long run. Corporations are switching to natural gas vehicles despite the decline in oil prices The massive decline in oil prices over the past year has made diesel cheaper. As a result, there is not much incentive for fleet operators to convert to natural gas, as each natural gas truck costs around $50,000 more than a diesel truck. However, fleet operators are still buying natural gas-powered trucks. This is not surprising as natural gas engines can deliver identical power and acceleration as compared to diesel engines, but at the same time, natural gas is around 50% cheaper than gasoline or diesel. This will help fleet operators record major savings in the long run. For instance, a class 8 truck in the U.S. runs around 67,000 miles a year as per the Federal Highway Administration , and has a mileage of 5.2 miles per gallon of gasoline. Now, considering a conversion cost of around $50,000 per truck, a fleet operator will be a able to record strong savings as shown below: (click to enlarge) Source Hence, fleet owners will continue converting into natural gas, and this will be a tailwind for Clean Energy. As a result, it is not surprising to see that the company has signed new agreements with Potelco and Dean Foods (NYSE: DF ) to refuel their natural gas fleets. The Potelco agreement will enable Clean Energy to fuel 75 heavy-duty LNG trucks. In fact, the company has opened two truck-friendly fuel stations in Arizona and Kansas City that will support 58 CNG trucks for seaboard transport. On the other hand, the agreement with Dean Foods will allow Clean Energy to build a private CNG fueling station to fuel 64 trucks at Dean Foods’ Oak Farms Dairy plant in Houston, Texas. More importantly, Clean Energy is investing in infrastructure in order to improve the adoption of natural gas vehicles. It has opened 16 fueling stations since the beginning of the year as a part of its plan to build around 35 stations for its customers this year. As a result, Clean Energy will benefit from investments by truck makers, engine manufacturers, and other component OEMs that are increasingly focusing on natural gas vehicles. Conclusion The two key points discussed in the article clearly indicate that Clean Energy Fuels’ weak performance is temporary. The advantages of natural gas over diesel will help it get better going forward, and the increase in pricing will be another key catalyst. Thus, it makes sense for investors to buy the drop in Clean Energy’s stock price as it can be a good long-term investment. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.