Tough Times Ahead For REC Silicon ASA

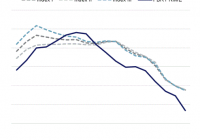

REC Silicon posted yet another abysmal quarter with no respite in sight. As predicted, the company’s inventory build plan backfired, and the company raised capital through debt and equity offerings in the last 24 hours. We believe the management is too optimistic, and as such do not see much joy for shareholders for quite some time to come. REC Silicon ( OTCPK:RNWEF ), as we forecasted , reported horrendous second quarter results on Tuesday. While revenues of $93M is an improvement over $74.4M from Q1, they come at a steep cost to the company in terms of plummeting ASPs. As a result of the plummeting ASPs, EBITDA declined again from $24.8M in Q1 to $5.8 million in Q2. The process-in-trade loophole, through which the company has been shipping polysilicon to China in the recent past is no longer available to the company, and effectively a big part of the company’s customers disappeared overnight. Against this backdrop, the company built another 1248 MT of inventory as it was unable to sell its poly production in the market. This inventory build in a downward pricing environment sapped the company’s cash flow, and the company has now come to the realization that its current business vector is not sustainable. However, as we wrote earlier, this handwriting was on the wall when the company decided to build inventories instead of selling product due to low ASPs in Q1. In the face of further declining prices and balance sheet stress, the company opted to sell product at distressed prices. While the FBR poly produced by REC Silicon has typically commanded lower ASPs than Siemens poly that most of the industry produces, the gap between the prices has increased dramatically in the recent quarters. This gap opened up further at the end of Q2 (see chart below). We believe there are two reasons for this widening gap. The first is that instead of withholding selling at the low prices as the company did in Q1, the company sold product at artificially low price to raise some much-needed cash. Secondly, customers sensing the upcoming changes to Process-in-Trade, and the company’s financial position, appear to have negotiated hard and gotten steeper discounts than usual. While the company sold a significant amount of polysilicon at low prices in the quarter, the production continued to be ahead of sales. The resulting 1248 MT inventory build in the quarter has now increased the company’s inventory to approximately 6000 MT – approximately 4 months of sales. Finally, the company decided that it cannot keep building inventory and has decided to cut its production at its Moses Lake facility. This reduced the company’s manufacturing capacity by about 2000 MT. The company also decided to put on hold its expansion plans. REC Silicon had previously planned 3000 MT of new capacity using its updated FBR-B process. This new process could have helped the company further improve cost structure but is now being halted with an eye towards a future restart. The company is conducting an orderly shutdown process and expects to be able to bring the facility to production within a year once it decides to restart the work. With these production moves, the company is dramatically reducing its capacity and expects that it will deplete its current inventory by 1500 MT in Q3. This would help generate some much needed cash flow for the company. The company also made an equity offering last night and sold about 10% of the company shares. REC Silicon allocated 230,000,000 new ordinary shares at a price of NOK 1.55 per share in the Private Placement to existing shareholders and new investors, with gross proceeds of NOK 356.5 million (approx. $43M). The company also announced Thursday morning that it also has sold or agreed to sell a nominal value of NOK 155,000,000 (approx. $19M) of bonds held in treasury to investors to raise additional money. These moves dramatically strengthen the company’s balance sheet and reduce the fears of possible default of debt payments coming up in 2016. In the earnings call this morning , management commented that the adversity is temporary and caused by the tariff war between US and China, and that the company expected the trade situation to be resolved by early 2016. Over the short term, the company sees Korean manufacturers supplying 60% of China import needs, German manufacturers supplying 30% of the needs, and the US poly manufacturers essentially shut out of the market. With the tariffs, the company expects that Korea production will mostly go to China leaving the US producers to chase Malaysia, Taiwan and other countries. REC management contends that the current low polysilicon prices are due to tariffs and Chinese government subsidies will not prevail in the long term. The company’s worst case plan involves shipping product to countries outside of China and continuing with interim measures such as tolling until the Company’s Yulin JV enters production, at which time, the company expects to be able to serve the China market. REC sees polysilicon becoming the choke point in PV production and expects poly prices to recover. The company, with over a billion dollars in assets, is not taking any impairment charges in spite of these developments because it expects the trade situation to be resolved by the beginning of 2016. We see the management’s view, even the most pessimistic version, as likely too optimistic. We do not see any indication that the tariffs are likely to go away quickly and we do not see an end to production from China’s SOEs and other heavily subsidized Chinese manufacturers. We also do not buy the commentary that a long-term shortage of poly will develop and that the poly prices will move up meaningfully. Even a more moderate set of assumptions would suggest that the company’s thesis that the current market economics will not work and the prices will go up over time is highly speculative. Unfortunately for the company, the reduction of production means the fixed cost absorption will be a problem and the company will have an inferior cost structure going forward. The company’s manufacturing roadmap, which relied on the lower cost FBR-B production, is now problematic. Because of these factors, we believe it is highly likely that the company’s assets are severely impaired. The company’s silicon gas sales, which do not depend on the polysilicon business, provide a respite to the company. However, this product line offers no significant long-term growth benefit to the company’s story. While the management presents itself as planning for worst case, we believe the company is far too optimistic. Given the tariff uncertainty, likely low polysilicon prices, impending new capacity, and commodity nature of the industry, investors in the company may not have much to celebrate for a long time to come. Our view on RNWEF: Avoid. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.