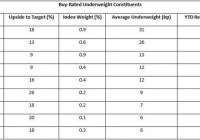

Summary Trading at ~10% discount to NAV. Discount likely to compress with activist HF pressing for tender offer and/or ETF conversion/liquidation. Downside limited due to expiration of standstill agreement if discount rises above 12% of NAV. Background on Closed End Funds For those new to the space, a closed-end fund is a publicly traded investment company that raises a fixed amount of capital, and is then structured, listed and traded like a stock on a stock exchange. Whereas conventional mutual funds and ETFs frequently redeem / issue new shares to ensure that the price per share remains in line with the net asset value of the underlying holdings in the funds, this is not the case for CEFs. Rather the share price of CEFs is driven by the market forces of supply and demand, and can at times trade at either large discounts or premiums to NAV of the funds’ actual holdings. The Clough Global Equity Fund (NYSEMKT: GLQ ) is an example of one fund that is trading at a meaningful discount to NAV, mainly due to investors’ disappointment with the manager’s history of underperformance. As they have done with many similar CEFs, activist hedge fund Bulldog Investors has taken a major position in GLQ and initiated steps to cause to discount to decline. This presents an attractive opportunity for investors to ride Bulldog’s coattails and generate alpha from the declining discount. Overview of Clough Global Equity Fund GLQ was formed in 2005, and its mandate is to invest at least 80% of its portfolio in equity and equity-related securities in U.S. and non-U.S. markets, and the remainder in fixed income securities, including both corporate and sovereign debt, in both U.S. and non-U.S. markets. Currently, the portfolio is diversified across more than 200 positions and predominately invested in US equities, as summarized below. The fund uses a moderate amount of leverage, with the leverage ratio standing at ~26% as of 5/31. (click to enlarge) Source: Clough Global Equity Fund Monthly Fact Sheet Despite the relatively traditional composition of the portfolio, performance has been lackluster. As shown below, an investment in GLQ has returned > 2% less per year (based on market price) than the S&P 500, with the level of underperformance accelerating recently. Source: Clough Global Equity Fund Monthly Fact Sheet In the first quarters following the fund’s IPO in 2005, GLQ traded at a slight premium to NAV as investors were satisfied with the manager. However, unsurprisingly given the fund’s subsequent performance, it has traded at a persistent discount to NAV in recent years. Currently, the discount stands at approximately 10%. (click to enlarge) Source: CEF Connect Bulldog’s Involvement Even prior to recent pressure from Bulldog, GLQ began some small preemptive steps to reduce the discount. In particular, they increased the level of distributions twice over the past couple of years, and recently adopted an open-market repurchase program pursuant to which the Fund is authorized to repurchase up to 5% of its outstanding common shares between April 20, 2015 and October 31, 2015. After accumulating a position of ~1.28 million shares of GLQ (i.e., approximately 7.15% of total shares outstanding), Bulldog Investors has become more active in recent months in seeking larger actions to reduce the discount. In particular, they requested that the fund include the following proposal in this year’s proxy material: Board of Trustees [should] authorize a self-tender offer for all outstanding common shares of the Fund at or close to net asset value. If more than 50% of the Fund’s outstanding common shares are submitted for tender, the Board is requested to cancel the tender offer and take those steps that the Board is required to take to cause the Fund to be liquidated or converted to an exchange traded fund or an open-end mutual fund.” Source: Company 14A SEC Filing GLQ subsequently entered into a standstill agreement with Bulldog, which is outlined in Bulldog’s recent 13D filing . Under this agreement, the fund indicated that it would include the proposal for a shareholder vote at the fund’s annual meeting scheduled for July 28th. In order to pass, this proposal requires the affirmative vote of the holders of a majority of the Common Shares entitled to vote and represented at the meeting. If the shareholder proposal passes the Fund will conduct a tender offer based on the terms described in the shareholder proposal. Further, if the Fund commences this tender offer and more than 50% of the Fund’s shares are tendered, then, consistent with the terms of the shareholder proposal, the Fund would terminate the tender offer and the Board, would consider whether to approve and to submit to shareholders a proposal to liquidate the Fund or convert the Fund into an open-end fund or ETF. In exchange for including the proposal, Bulldog agreed to a number of conditions, including to generally refrain from activist activities through the 2016 annual shareholder meeting if less than 40% of the shares present and entitled to vote at the Meeting vote for the proposal, so long as the Fund’s discount to NAV does not exceed 12% for 20 consecutive business days. Potential Outcomes Institutions own a large portion (~41%) of the shares outstanding, and in all likelihood will represent a much larger portion of shares present at the upcoming shareholder meeting. Of the top holders (shown below), most appear to fall into two camps: 1) sophisticated CEF investors like SIT and Rivernorth that have recently been adding to their positions (likely in large part motivated by potential for reduction in the fund’s discount), and 2) other longer term holders like Advisors Asset Management that have sought to meaningfully reduce their stakes. A large portion of investors in both groups would likely favor a major tender offer that would enable them to exit some of their holdings at close to NAV. Therefore, I believe Bulldog’s proposal has a good chance of passing. Source: Nasdaq However, even if the proposal does not pass, downside appears to be limited due to the fact that the standstill agreement will expire if the discount to NAV rises above 12% (i.e., ~2% higher than the current level), as previously discussed. GLQ management will be highly incentivized to keep the discount from exceeding this level, for instance by repurchasing shares under their buyback program. If this is not effective and the discount does rise above 12%, Bulldog will be able to reinitiate further activist actions to seek to narrow the discount. With around 10% of potential alpha in an upside scenario and -2% in a downside scenario, I believe GLQ now represents an attractive risk/reward. Other Risks/Considerations Given that GLQ’s portfolio is comprised mostly of US equities, it will of course carry exposure to the general market. It is also worth noting that in the past, Bulldog has used some of its positions in CEFs to press for the transfer of investment advisory control from the funds’ managers to itself, enabling it to collect management fees without eliminating the discount. I believe an important protection against this in the case of GLQ is the fact that there are a number of other large institutional shareholders, including some others that are willing to engage in activism. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GLQ over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.