Scalper1 News

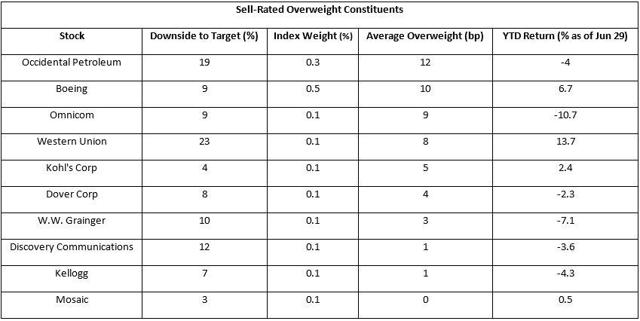

According to analysts at Goldman Sachs, Large cap mutual fund managers have had a successful start to this year. In 2014, 11% of large cap value mutual funds had outperformed the Russell 1000 large cap index. In 2015, so far, this number has soared to 76% of large cap value mutual funds beating the index. However, the equation changes when comparing with the S&P 500 performance. After fees, 43% of the funds could beat the S&P 500 year to date. So, 57% of funds are underperforming considering fees, when reviewing 248 large cap equity mutual funds. Goldman Sachs analysts have also released a conviction buy and sell lists. Interestingly, these lists are to help managers pick stocks that are underweight in the value mutual fund sector. Underweight Stocks Large cap mutual funds have been underweight on stocks such as Netflix (NASDAQ: NFLX ), Amazon.com (NASDAQ: AMZN ) and Yum! Brands (NYSE: YUM ). Year to date, these stocks have astounding returns of 89%, 38% and 23%, respectively. On the other hand, funds were overweight on Comcast Corporation (NASDAQ: CMCSA ) (NASDAQ: CMCSK ), Lowe’s Companies (NYSE: LOW ) and Time Warner Inc. (NYSE: TWX ) But these stocks have performed poorly. While Comcast and Time Warner are up 3.4% and 1.3%, Lowe’s is down 1.8% year to date. The point here is, Goldman Sachs analysts are recommending large cap fund managers to hold stocks, which have a predominantly underweight view. Below we present Goldman Sachs’s conviction lists. The first one lists buy-rated stocks on which the average large-cap core fund is most underweight and the second list shows sell-rated stocks on which the average large-cap core fund is most overweight (as of Jun 2): (click to enlarge) (click to enlarge) Source: Lionshares, FactSet and Goldman Sachs Our Take If we calculate the average return of buy-rated underweight constituents, it is a healthy 11.4%. On the other hand, the average return of the sell-rated overweight constituent is a negative -0.9%. Though the average return speaks in favor of the buy-rated underweight constituents, we believe holding specifically these stocks is not the only necessary step. The New York Times Company reported in April that Morningstar data revealed that only 12% of Goldman Sachs’s mutual funds had beat their analyst-assigned benchmarks over the last 10 years. What is more important is to pick stocks, sectors or industries that are fundamentally strong and offer great growth potential. Potential winners with positive historical performance should also be a good indicator. For example, the healthcare sector has been a strong performer. Incidentally, to prove this true, the top 20 US stock holdings for the Goldman Sachs fund family only featured one of the sell-rated overweight constituents. It was just W.W. Grainger (NYSE: GWW ) who made it to the top 20 holdings, while Navient Corp., (NASDAQ: NAVI ) Apple (NASDAQ: AAPL ) and Cardinal Health (NYSE: CAH ) were at the top of the holdings list (as of Jun 26). Goldman Sachs’s year-to-date total return of 2.2% lagged the category average of 2.9% (as of May 31). However, it has consistently outperformed the category average in 2014, 2013 and 2012. To pick the potential gainers, we will consider the Zacks Mutual Fund Rank. Remember, the goal of the Zacks Mutual Fund Rank is to guide investors to identify potential winners and losers. Unlike most of the fund-rating systems, the Zacks Mutual Fund Rank is not just focused on past performance, but the likely future success of the fund. Below we present 3 mutual funds from the Goldman Sachs fund family that either carry a Zacks Mutual Fund Rank #1 (Strong Buy) or a Zacks Mutual Fund Rank #2 (Buy). These funds have a low expense ratio and carry no sales load. The minimum initial investment is within $5000. These funds are not only in the green so far this year, but have positive total return over the last 1, 3 and 5-year periods. They also have encouraging average EPS growth. Goldman Sachs Strategic Growth Fund Retirement (MUTF: GSTTX ) seeks capital growth over the long term. A minimum of 90% of total assets are invested in publicly traded domestic securities. A maximum of 25% of assets may also be invested in non-US securities. GSTTX currently carries a Zacks Mutual Fund Rank #2. Goldman Sachs Strategic Growth IR has gained 4.4% and 13.7% year to date and over the last 1-year period, respectively. The 3 and 5-year annualized returns stand at 20.1% and 16.3%. Expense ratio of 0.91% is lower than the category average of 1.19%. The average EPS growth is 14.5%. Goldman Sachs Large Cap Growth Insights Fund Retirement (MUTF: GLCTX ) seeks capital appreciation with dividend income being the secondary objective. GLCTX invests a minimum of 80% of its assets in a diversified portfolio of equity investments of large-cap US issuers. Investments are also made in non-US issuers, but which are domestic in the US. GLCTX currently carries a Zacks Mutual Fund Rank #1. Goldman Sachs Large Cap Growth Insights IR has gained 3.9% and 12.9% year to date and over the last 1-year period, respectively. The 3 and 5-year annualized returns stand at 21.6% and 18.8%. Expense ratio of 0.71% is lower than the category average of 1.19%. The average EPS growth is 11.8%. Goldman Sachs Concentrated Growth Fund Retirement (MUTF: GGCTX ) invests, under normal circumstances, at least 90% of its total assets in equity investments selected for their potential to achieve capital appreciation over the long term. The fund may invest up to 10% of its total assets in fixed-income securities, such as government, corporate and bank debt obligations. GGCTX currently carries a Zacks Mutual Fund Rank #2. Goldman Sachs Concentrated Growth IR has gained 4.2% and 13.3% year to date and over the last 1-year period, respectively. The 3 and 5-year annualized returns stand at 18.9% and 15.6%. Expense ratio of 1.02% is lower than the category average of 1.19%. The average EPS growth is 13.4%. Original Post Scalper1 News

According to analysts at Goldman Sachs, Large cap mutual fund managers have had a successful start to this year. In 2014, 11% of large cap value mutual funds had outperformed the Russell 1000 large cap index. In 2015, so far, this number has soared to 76% of large cap value mutual funds beating the index. However, the equation changes when comparing with the S&P 500 performance. After fees, 43% of the funds could beat the S&P 500 year to date. So, 57% of funds are underperforming considering fees, when reviewing 248 large cap equity mutual funds. Goldman Sachs analysts have also released a conviction buy and sell lists. Interestingly, these lists are to help managers pick stocks that are underweight in the value mutual fund sector. Underweight Stocks Large cap mutual funds have been underweight on stocks such as Netflix (NASDAQ: NFLX ), Amazon.com (NASDAQ: AMZN ) and Yum! Brands (NYSE: YUM ). Year to date, these stocks have astounding returns of 89%, 38% and 23%, respectively. On the other hand, funds were overweight on Comcast Corporation (NASDAQ: CMCSA ) (NASDAQ: CMCSK ), Lowe’s Companies (NYSE: LOW ) and Time Warner Inc. (NYSE: TWX ) But these stocks have performed poorly. While Comcast and Time Warner are up 3.4% and 1.3%, Lowe’s is down 1.8% year to date. The point here is, Goldman Sachs analysts are recommending large cap fund managers to hold stocks, which have a predominantly underweight view. Below we present Goldman Sachs’s conviction lists. The first one lists buy-rated stocks on which the average large-cap core fund is most underweight and the second list shows sell-rated stocks on which the average large-cap core fund is most overweight (as of Jun 2): (click to enlarge) (click to enlarge) Source: Lionshares, FactSet and Goldman Sachs Our Take If we calculate the average return of buy-rated underweight constituents, it is a healthy 11.4%. On the other hand, the average return of the sell-rated overweight constituent is a negative -0.9%. Though the average return speaks in favor of the buy-rated underweight constituents, we believe holding specifically these stocks is not the only necessary step. The New York Times Company reported in April that Morningstar data revealed that only 12% of Goldman Sachs’s mutual funds had beat their analyst-assigned benchmarks over the last 10 years. What is more important is to pick stocks, sectors or industries that are fundamentally strong and offer great growth potential. Potential winners with positive historical performance should also be a good indicator. For example, the healthcare sector has been a strong performer. Incidentally, to prove this true, the top 20 US stock holdings for the Goldman Sachs fund family only featured one of the sell-rated overweight constituents. It was just W.W. Grainger (NYSE: GWW ) who made it to the top 20 holdings, while Navient Corp., (NASDAQ: NAVI ) Apple (NASDAQ: AAPL ) and Cardinal Health (NYSE: CAH ) were at the top of the holdings list (as of Jun 26). Goldman Sachs’s year-to-date total return of 2.2% lagged the category average of 2.9% (as of May 31). However, it has consistently outperformed the category average in 2014, 2013 and 2012. To pick the potential gainers, we will consider the Zacks Mutual Fund Rank. Remember, the goal of the Zacks Mutual Fund Rank is to guide investors to identify potential winners and losers. Unlike most of the fund-rating systems, the Zacks Mutual Fund Rank is not just focused on past performance, but the likely future success of the fund. Below we present 3 mutual funds from the Goldman Sachs fund family that either carry a Zacks Mutual Fund Rank #1 (Strong Buy) or a Zacks Mutual Fund Rank #2 (Buy). These funds have a low expense ratio and carry no sales load. The minimum initial investment is within $5000. These funds are not only in the green so far this year, but have positive total return over the last 1, 3 and 5-year periods. They also have encouraging average EPS growth. Goldman Sachs Strategic Growth Fund Retirement (MUTF: GSTTX ) seeks capital growth over the long term. A minimum of 90% of total assets are invested in publicly traded domestic securities. A maximum of 25% of assets may also be invested in non-US securities. GSTTX currently carries a Zacks Mutual Fund Rank #2. Goldman Sachs Strategic Growth IR has gained 4.4% and 13.7% year to date and over the last 1-year period, respectively. The 3 and 5-year annualized returns stand at 20.1% and 16.3%. Expense ratio of 0.91% is lower than the category average of 1.19%. The average EPS growth is 14.5%. Goldman Sachs Large Cap Growth Insights Fund Retirement (MUTF: GLCTX ) seeks capital appreciation with dividend income being the secondary objective. GLCTX invests a minimum of 80% of its assets in a diversified portfolio of equity investments of large-cap US issuers. Investments are also made in non-US issuers, but which are domestic in the US. GLCTX currently carries a Zacks Mutual Fund Rank #1. Goldman Sachs Large Cap Growth Insights IR has gained 3.9% and 12.9% year to date and over the last 1-year period, respectively. The 3 and 5-year annualized returns stand at 21.6% and 18.8%. Expense ratio of 0.71% is lower than the category average of 1.19%. The average EPS growth is 11.8%. Goldman Sachs Concentrated Growth Fund Retirement (MUTF: GGCTX ) invests, under normal circumstances, at least 90% of its total assets in equity investments selected for their potential to achieve capital appreciation over the long term. The fund may invest up to 10% of its total assets in fixed-income securities, such as government, corporate and bank debt obligations. GGCTX currently carries a Zacks Mutual Fund Rank #2. Goldman Sachs Concentrated Growth IR has gained 4.2% and 13.3% year to date and over the last 1-year period, respectively. The 3 and 5-year annualized returns stand at 18.9% and 15.6%. Expense ratio of 1.02% is lower than the category average of 1.19%. The average EPS growth is 13.4%. Original Post Scalper1 News

Scalper1 News