With High-Yield ETFs, Costs Can Be Hidden

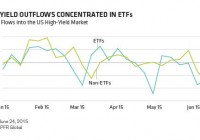

By Gershon Distenfeld More and more investors see exchange-traded funds (ETFs) as an easy and inexpensive way to tap into the high-yield market. We have some friendly advice for them: look again. Financial advisors who use ETFs as core holdings in their clients’ portfolios-and even some institutional investors-often tell us they like them for two big reasons. First, ETFs passively track an index, which means they’re cheaper than actively managed funds. Second, they’re liquid. Unlike mutual funds, which are priced just once a day, ETFs can be bought and sold at any time, just like stocks. But when it comes to high yield, ETFs aren’t really that cheap or that liquid. Look for the Hidden Costs Let’s start with costs. Sure, some ETF management fees are quite a bit lower than mutual fund fees-but that mostly goes for ETFs that invest in highly liquid assets such as equities. In a less liquid market, like high yield, expense ratios can be as high as 40 or 50 basis points-not that much lower than many actively managed mutual funds. It’s also easy to overlook some of the hidden costs. For instance, anyone who wants to buy or sell an ETF must pay a bid-ask spread, the difference between the highest price that buyers are willing to offer and the lowest that sellers are willing to accept. That spread might be narrow for small amounts but wider for larger blocks of shares. And when market volatility rises, bid-ask spreads usually widen across the board. And ETF managers can rack up trading costs even when market volatility is low. This is partly because bonds go into and out of the high-yield benchmarks often-certainly more often than stocks enter and exit the S&P 500 Index. To keep up, ETF managers have to trade the bonds that make up the index more often. Frequent trading can also cause ETF shares to trade at a premium or discount to the calculated net asset value. In theory, this situation shouldn’t last long. If an ETF’s market price exceeds the value of its underlying assets, investors should be able to sell shares in the fund and buy the cheaper underlying bonds. But the US high-yield market has more than 1,000 issuers and even more securities, and it can be difficult for investors to get their hands on specific bonds at short notice. That means investors often end up overpaying. This can work the other way around, too. If something happens to make investors want to cut their high-yield exposure, the easiest way to do that is to sell an ETF. That can push ETF prices down more quickly than the prices of the bonds they invest in, adding to ETF investors’ losses. We saw this in May and June, when worries about higher interest rates rattled fixed-income investors. Outflows from high-yield ETFs outpaced those from the broader high-yield market ( Display ). Are Passive ETFs Really Passive? Investors might also want to consider whether high-yield ETFs are truly passive. For example, the manager of an S&P 500 equity ETF can easily buy all the stocks that make up the index. But as we’ve seen, that isn’t so easy in high yield-the market isn’t as liquid. ETF managers compensate for this by using sampling techniques to help them decide which securities to buy. Can a fund that requires active decision making and frequent trading be considered passive? We think that’s a fair question. Not as Deep as You Think Here’s another question worth asking: just how liquid are ETFs? Those who look closely may find that the pool isn’t quite as deep as they thought. Why? The growing popularity of ETFs means they have to hold an ever larger share of less liquid assets. If the underlying asset prices were to fall sharply, finding buyers might be a challenge, and investors who have to sell may take a sizable loss. Does this mean ETFs have no place in an investment portfolio? Of course not. We think that a well-diversified portfolio may well include a mix of actively managed funds and ETFs-provided that the ETFs are genuinely low cost and passive. We just don’t think those attributes apply to high-yield ETFs. And we suspect that investors who decide to use them as a replacement for active high-yield funds will come to regret it. The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.