A Top-Ranked India ETF To Tap The Growing Consumer Sector

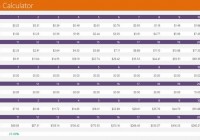

The Indian stock market has hardly looked back from the astounding journey it set forth on in May 2014 following the formation of the new government. Most economic factors are presently in favor of Asia’s third-largest economy, including the revival of the currency, a drastic fall in inflation thanks mainly to the oil price crash and an improvement in current account deficit. India’s wholesale price inflation – which was an acute concern leading to a series of rate hikes in the past couple of years – plunged to a five-year low in September. Though India’s Q3 GDP growth rate of 5.3% was not great, analysts from HSBC expect over 6% growth rate from this nation next year. This is noteworthy since the nation’s bourses suffered a lot last year as foreign investors remained skittish about putting more capital in the nation, leaving many questions about the potential of the country in the near term. Actually, given that India isn’t a commodity-oriented emerging market like its BRIC brothers Brazil or Russia, the nation has immensely benefited from the recent natural resource weakness. If this is not enough, Credit Suisse forecasts that Indian economy will log ‘fastest USD nominal growth in the world’ next year as noted by Reuters. To add to this, Credit Suisse believes that Indian equities are not pricey relative to the nation’s growth outlook. This recent bullish tone did spread cheers across every corner of the Indian economy as evident by at least a 25% return received from each India ETF this year. However, some specific corners need special mention. One such space is the Indian consumer sector. What Drives Consumer Sector Higher? The middle income population in India is mushrooming. This fraction of the population has an inclination to spend on discretionary items like travel and leisure which in turn boosts the sales of consumer products like automobiles and personal goods. For example, auto sales displayed a speedy annual expansion of 10% in November (yoy). Notably, auto sales are often regarded as a well-being of an economy. Lower fuel prices seemed to have done the trick. Moreover, with cooling inflation, many are speculating a rate cut in the coming days, though no such thing has taken place formally as of yet. And if in any case, the interest rate goes down, the auto industry should soar. India basically has a compelling investment proposition with its rising importance as a ‘consumer driven’ economy. As per Indian Brand Equity Foundation (IBEF), the present consumer spending will likely grow two-fold by 2025. The consumer confidence score rose to 126 in Q3 of this year from an all-time low of 92 reached in Q1 of 2010. The market is motivated by favorable demographics and expanding disposable income. IBEF also predicts that per capita income in India will likely see a meaningful CAGR of 5.4% within the span of 2010-2019 with food products and personal care taking about 65% share of the market revenue. Other forecasts by IBEF include doubling of the consumer durables market by FY15 from FY10. The young generation’s inclination toward tech-driven products will also facilitate this growth trajectory. This calls for a bullish stance over the consumer sector of the Indian economy. Here we would like to highlight the Zacks top-ranked ETF providing exposure to this very corner of the Indian market. EGShares India Consumer ETF ( INCO ) has a Zacks ETF Rank #1 (strong Buy) with a Medium risk outlook and we expect it to outperform most of its peers in the coming months meaning it could be an excellent pick for investors seeking more exposure to this economy. INCO in Focus This ETF targets the consumer industry of India and follows the Indxx India Consumer Index. It holds 30 stocks in its basket and has amassed $21.5 million in its asset base. The fund trades in a paltry volume of 15,000 shares, suggesting additional cost in the form of wide bid/ask spread beyond the expense ratio of 0.89%. The fund offers a moderately concentrated bet in the top 10 holdings as indicated by its 52% exposure to these stocks. Among individual holdings, MRF Ltd., Motherson Sumi Systems Ltd. and Bosch Ltd form the top positions of the fund with total investment of 17.7%. The fund allocates 79.42% of its asset base to consumer goods. A small proportion of the asset base has also been assigned to Industrials (15.4%) and Consumer Services (4.8%). Industry-wise, automobiles – which is presently a well-performing sector in India – accounts for 37.5% followed by personal goods (27.14%) and industrial engineering (15.4%). INCO has hit a low of $19.64 and a 52-week high of $34.89. The fund is currently hovering near its 52-week high price and could be an interesting choice in 2015 for investors seeking more Indian market exposure.