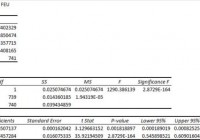

Summary Contrary to Buffett’s advice, you should not use the S&P 500 as the sole proxy for the domestic market. Some ETF domestic allocations do seem better than others. Static domestic equity allocations limit alpha. There is a lot of advice on the strategy within the equity allocation space, but little in the way of practical comparisons. Many analyses focus on the characteristics of the ETFs themselves rather than how they fit together within a portfolio. This article looks at how they might play together in some of the standard configurations. Why a Static Allocation Approach? The U.S. stock market is by far the most efficient financial market on the planet. Its common language (ever tried to read a corporate report in Norwegian via Google Translate?), legal framework, financial depth, lack of transaction taxes, and common (reserve) currency conspire to make it much more efficient than even Europe’s developed markets. These, along with the fact, that its home to some of the world’s biggest companies, followed by both hordes of equity analysts and legions of small investors active in the small-cap space also contribute to its prime position. This exceptional efficiency has also given rise to a fixed allocation model for domestic equities, typically consisting of 1-10 ETFs. But both the number and type of passive fund is open for discussion. The number of assets varies from one to perhaps fifteen with a sector-based strategy or individual stock strategy à la Peter Lynch & Jim Cramer. Which Fund? When it comes to which fund, opinions also vary. Warren Buffett advocates a cheap S&P 500 fund. Seeking Alpha contributor Joe Springer advocates a mid-cap fund rather than the S&P 500 fund to capture the gains as stocks transition from small to large but avoids buying more at inflated prices. Academia tells us to hold the market portfolio. Using an equal-weighted portfolio exploits the random nature of returns. To minimize risk, theory tells us to use the minimum variance portfolio. Jim Cramer advocates 5-15 individual stocks in different sectors. More advanced portfolios rely on a sector-based allocation strategy. So which is right for a domestic equity allocation? It Depends on Your Objectives Part of this conflicting advice comes from the fact that not all participants have the same investing objectives; this is why it is important for you to clarify your own. Many investors, overwhelmed by financial markets, might want a single vehicle with which to save. There is evidence that people just want the most “juice” possible out of their equity portion by picking a strategy that maximizes returns, such as with an equal-weighted or high beta portfolio, but cannot or do not want to use margin to get those returns. Retirees, who may simply want some equity exposure to hedge against inflation, might seek only to minimize downside risk at the expense of capping gains. Others, who want the chance at generating alpha or enjoy trading, might deploy both more numerous and more narrow ETFs or even individual stocks within the domestic equity allocation. I personally am interested in the most risk-efficient returns while taking the general amount of equity risk. In short, there is no single right answer to both the number and type of equity asset to hold. Nevertheless, it is worth investigating the properties of common domestic equity allocations so that one may make an informed decision. To that end, the next section introduces several common equity allocation and portfolio strategies. Meet the U.S. Equity Portfolios The main portfolios were implemented using ETFs rather than individual stocks. This is more realistic for the typical small investor, who cannot compute and rebalance portfolios cost effectively. The intent of this exercise is to examine a plausible portfolio strategy, which covers the entire investible market, comparable to the market portfolio, rather than examine the performance of individual funds or stocks. In selecting the ETFs, I tried to choose the biggest one by assets under management according to ETFdb.com rather than by using any performance or cost characteristics. The “Jim Cramer” stock portfolio was arbitrarily assembled based on his recommendations, charitable trust picks, and the CEO appearances on his ” Mad Money ” show, whilst respecting his tenet of sector diversification. With the exception of Apple (NASDAQ: AAPL ), which I have held, I did not look at the individual stocks’ performance when choosing, but I believe my choices of his choices generally represent the types of large-cap stocks he and his callers tend to favor. The sector-based portfolio was implemented using Vanguard’s funds rather than the more popular “XL sector” SPDRs from State Street because they cover all capitalizations, rather than just S&P 500 stocks. This is theoretically more congruent with holding the market portfolio. For the risk-efficient portfolio, I had to fudge a bit in that, to my knowledge, there is no ETF for minimum variance portfolio consisting solely of U.S. stocks, which includes small-cap stocks. Instead, the risk-efficient portfolio comprises a variance-optimized slice based on the large and mid-cap stocks, and a low-volatility slice for the small caps. While the individual variance of the stocks plays a role in variance minimization, this is not quite the same as optimizing across all stocks, which exploits the covariance structure amongst the assets. Where there was a deep enough ETF pool, I computed a few variants, but report only the main ones to focus on the most common (If there’s enough interest, I might report the others or entertain requests, but it seemed overkill for the purpose at hand). Table 1: Portfolios for U.S. Equity Allocation Portfolio Rationale Implementation Benchmark The market portfolio is the most efficient portfolio possible. Market-cap weighting also does a decent job of approximating the opportunities available. The Vanguard Total Stock Market ETF (NYSEARCA: VTI ) Mid-Cap Mid-cap companies strike a good balance between stability and returns while the index avoids the bubble upside and bankruptcy downside extrema of the upper and lowermost equity slices. The iShares Core S&P MidCap ETF (NYSEARCA: IJH ) S&P 500 Both the depth of coverage and liquidity of biggest stocks with global business provide the most efficient returns. The SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) Market Cap Traditional 3-slice large cap/mid/small seen in many brokerage models. It is a way of capturing the entire market, and accessing the superior expected returns of the small and mid-cap companies without relying on a single fund. SPY, IJH, the iShares Russell 2000 ETF (NYSEARCA: IWM ) Value Moment Both value and momentum exhibit excess returns over the market portfolio, but both are inversely correlated, ergo a portfolio of these ought to exhibit superior risk-adjusted returns. The iShares Russell 1000 Value ETF (NYSEARCA: IWD ), the SPDR S&P 1500 Momentum Tilt ETF (NYSEARCA: MMTM ) Equal Weight Cap-weighted indices tend to buy high and sell low; moreover, they have a bias towards “safer” stocks, which lowers expected returns. Equal-weighted indices militate against these tendencies, sacrificing short-term momentum for long-term appreciation. The Guggenheim S&P Equal Weight ETF (NYSEARCA: RSP ), the Guggenheim Russell Midcap Equal Weight ETF (NYSEARCA: EWRM ), the Guggenheim Russell 2000 Equal Weight ETF (NYSEARCA: EWRS ) Factor Equity portfolio returns are dictated by: beta, value, size, and momentum. A portfolio comprising these components should perform better than holding the diluted market portfolio. The PowerShares S&P 500 High Beta Portfolio ETF (NYSEARCA: SPHB ), IWW, MMTM, IWM Dividend Aside from revealing value, dividends act as signal on cash-flow stability, mitigate downside risk by returning some principal, and exert some spending discipline over management. The WisdomTree LargeCap Dividend ETF (NYSEARCA: DLN ), the WisdomTree MidCap Dividend ETF (NYSEARCA: DON ), the WisdomTree SmallCap Dividend ETF (NYSEARCA: DES ) Personal Conceptually, the large-mid cap minimum variance portfolio is a reasonable choice for what I believe to be an overvalued U.S. equity market. Small value stocks exhibit excess returns over time, and are risk-efficient. The iShares MSCI USA Minimum Volatility ETF (NYSEARCA: USMV ), DES Sector Sectors have cycles that are phase shifted, and thus not completely correlated, a portfolio of sector-based funds should exhibit superior risk-adjusted returns. The number of funds allows for some alpha potential. The Vanguard Consumer Discretionary ETF (NYSEARCA: VCR ), the Vanguard Consumer Staples ETF (NYSEARCA: VDC ), the Vanguard Energy ETF (NYSEARCA: VDE ), the Vanguard Financials ETF (NYSEARCA: VFH ), the Vanguard Health Care ETF (NYSEARCA: VHT ), the Vanguard Industrials ETF (NYSEARCA: VIS ), the Vanguard Information Technology ETF (NYSEARCA: VGT ), the Vanguard Materials ETF (NYSEARCA: VAW ), the Vanguard REIT Index ETF (NYSEARCA: VNQ ), the Vanguard Telecom Services ETF (NYSEARCA: VOX ), the Vanguard Utilities ETF (NYSEARCA: VPU ) Cramer You can do better than the market by holding 5-15 individual solid stocks in various sectors. Popeyes Louisiana Kitchen (NASDAQ: PLKI ), Clorox (NYSE: CLX ), Royal Dutch Shell (NYSE: RDS.A ) (NYSE: RDS.B ), AIG (NYSE: AIG ), Bristol-Myers Squibb (NYSE: BMY ), Flextronics International (NASDAQ: FLEX ), Apple, Weyerhaeuser (NYSE: WY ), Ventas (NYSE: VTR ), Verizon (NYSE: VZ ), American Electric Power Company (NYSE: AEP ) Random Random choice of 11 stocks listed at least 5 years on the NYSE or NASDAQ (i.e. no penny stocks). Allegheny Technologies (NYSE: ATI ), Oritani Financial (NASDAQ: ORIT ), National Fuel Gas (NYSE: NFG ), RCM Technologies (NASDAQ: RCMT ), j2 Global (NASDAQ: JCOM ), Heartland Express (NASDAQ: HTLD ), SandRidge Energy (NYSE: SD ), Regency Centers (NYSE: REG ), Dawson Geophysical (NASDAQ: DWSN ), LaSalle Hotel Properties (NYSE: LHO ), Unifi (NYSE: UFI ) Risk Efficient The minimum variance portfolio reduces volatility and drawdown. The XSLMV is a risk-efficient small-cap fund, which complements the mid/large cap fund. USMV, the PowerShares S&P SmallCap Low Volatility Portfolio ETF (NYSEARCA: XSLV ) Data and Methods The data come from the data facility of Yahoo! Finance, but are limited to about 8 years at the most. Some of the ETFs have had a very short life (i.e. less than 2 years) during a raging bull market, so their return distributions are likely heavily skewed. To combat this effect and render comparisons more realistic, the market benchmark portfolio was recalculated for the same period. For simplicity and to remove skill effects, the portfolios are strictly equally weighted in the initial review. We shall relax this assumption somewhat by assuming some trading ability further on. The continuous logged total returns for the portfolios are computed from their split and volume-adjusted prices using the quantmod package for R . The dividends are accrued daily over the observed period. The daily return and standard deviation statistics are then annualized using 252 trading days; in this sense, the results in Table 2 below reflect the underlying generative process rather than the realized gains. For simplicity, the real risk-free rate is assumed to be 0% (depending on the benchmark, it’s currently about +0.5% or -1.75%). Portfolios are evaluated using: annualized returns, Sharpe ratio (return efficiency), Calmar ratio (drawdown efficiency), and inverse beta (systemic risk). These statistics capture the main portfolio attributes of interest for an equity investor, and are highly correlated with other measures (Fling & Schumacher 2006). These four statistics are then computed relative to the market portfolio, and their harmonic mean is taken to arrive at a general score (last column). Table 2 shows the results of this computation. Table 2: Strict Equal Weight Portfolios PORTFOLIO DATA (years) Portfolio Stats Comparable Period Benchmark Relative Stats (stat_portfolio/stat_benchmark) R SD Sharpe Calmar Beta R SD Sharpe Calmar R Sharpe Calmar Beta^-1 Score Risk Efficient 1.9 20.1% 10% 2.011 3.721 0.795 20.7% 11.6% 1.79 2.83 0.97 1.12 1.32 1.26 1.16 Value Moment 2.2 23.0% 9% 2.438 2.984 0.694 23.1% 11.6% 1.99 3.15 1.00 1.23 0.95 1.44 1.14 Personal 3.2 21.6% 12% 1.808 2.821 0.844 22.0% 13.4% 1.65 2.24 0.98 1.10 1.26 1.19 1.13 Mid-Cap 8.0 9.7% 25% 0.394 0.119 1.076 8.4% 22.2% 0.38 0.11 1.17 1.05 1.06 0.93 1.05 Factors 1.6 25.2% 12% 2.12 4.831 0.987 23.1% 11.6% 1.99 4.96 1.09 1.07 0.97 1.01 1.04 Market 8.0 8.4% 22% 0.376 0.113 1 8.4% 22.2% 0.38 0.11 1.00 1.00 1.00 1.00 1.00 S&P 500 8.0 7.9% 22% 0.358 0.106 0.989 8.4% 22.2% 0.38 0.11 0.95 0.95 0.95 1.01 0.96 Dividend 8.0 8.4% 24% 0.348 0.104 1.041 8.4% 22.2% 0.38 0.11 1.01 0.93 0.92 0.96 0.95 Sectors 8.0 8.1% 23% 0.353 0.104 1.014 8.4% 22.2% 0.38 0.11 0.96 0.94 0.92 0.99 0.95 Market Cap 8.0 8.4% 24% 0.345 0.099 1.079 8.4% 22.2% 0.38 0.11 1.01 0.92 0.88 0.93 0.93 Cramer 8.0 8.5% 26% 0.325 0.096 1.073 8.4% 22.2% 0.38 0.11 1.02 0.86 0.85 0.93 0.91 Equal Weight 4.1 15.2% 18% 0.86 0.523 1.059 17.0% 15.8% 1.08 0.80 0.90 0.80 0.66 0.94 0.82 Random* 7.2 1%* 32% 0.032 -0.036 1.25 8.2% 23.0% 0.36 0.11 0.13 0.09 -0.33* 0.8 NaN* *Due to the slight difference in how returns are calculated between the method outlined and the Calmar ratio in the performance analytics package for R, an imaginary solution is produced when the harmonic mean is taken. The results in Table 2 seem to support the notion that the market is efficient. Most portfolios do not do much better than the market portfolio when scored on all attributes. Nevertheless, some highlights worth discussing do stand out. The risk-efficient portfolio does very well vis-à-vis the benchmark. The observed period however is very short, wherein hordes of bond-market refugees have been forcibly evicted by the world’s central banks from their tranquil abode in fixed income into the turbulent equity market. They have found sanctuary in mostly low volatility utilities, staples, and healthcare stocks, which have been pumped to very pricey historical levels. (As an example, Clorox, a maker of bleach, has a PEG of 4.24, and trades at 22x FW earnings!). Whether this outperformance will persist in these “bond-market” equivalents is dubious. The value-momentum portfolio stands out in that its standard deviation is markèdly lower than the market portfolio. The excellent feature of this portfolio is that its beta is about 30% less than that of the market portfolio, implying that using about 44% leverage would bring the portfolio up to a beta of one, yielding 33% annualized return within the observed period, nice! Warren Buffett’s S&P 500-only suggestion scores considerably worse than what academia advocates by holding the market portfolio, or what the Seeking Alpha’s contributor has pointed out about mid-cap companies having favorable attributes. Both the market, VTI, and mid-cap indices, VO, outperform even after adjusting for risk. We see the “Cramer” portfolio performing in line with the market, and doing considerably better than the random 11 stock portfolio. This stark contrast hints that Cramer does a decent job of avoiding some of the landmines that make the random portfolio the worst of the cohort examined here. It also might indicate that even a bit of stock-picking diligence in a concentrated portfolio goes a long-way toward approaching the market return (even if not beating it). Portfolios with Slack We now make the exercise a bit more realistic in the sense that we allow the equal weight allocations to increase by 10%, which is an amount by that Vanguard found to be a good for a rebalancing policy in this paper . Aside from a rebalancing strategy, this 10% slack also allows the investor some room to “play” with the same assets within the allocation to demonstrate mythical alpha . Using quadratic programming, the ex-post mean-variance efficient allocation was computed with no margin, and a zero-bound no short-selling constraint with 10% slack to overweight. This optimizes the allocation amongst assets for the period. The solution represents a reasonable amount of alpha an investor might hope to attain with a long-only portfolio containing only a few assets. (In the real world, investors can shift money in and out of the market to generate even more alpha , but here we’re assuming they are placing informed risk-efficient bets for the entire observed period – drastically overstating their initial knowledge, but perhaps substantially understating their ability to react dynamically to new information). Table 3: Equal Weight Portfolios Mean-Variance Optimized ex post with +10% slack PORTFOLIO DATA (years) Portfolio Stats Benchmark Relative Stats (stat_portfolio/stat_benchmark) R SD Sharpe Calmar Beta R SD Sharpe Calmar R Sharpe Calmar Beta^-1 Score Cramer 8.0 13.6% 23.0% 0.59 0.219 0.986 8.4% 22.2% 0.38 0.11 1.63 1.57 1.94 1.01 1.50 Risk Efficient 1.9 20.1% 10.1% 1.99 3.752 0.798 20.7% 11.6% 1.79 2.83 0.97 1.11 1.33 1.25 1.16 Value Moment 2.2 23.0% 9.5% 2.431 2.991 0.713 23.1% 11.6% 1.99 3.15 1.00 1.22 0.95 1.40 1.13 Personal 3.2 21.8% 12.3% 1.778 2.735 0.866 22.0% 13.4% 1.65 2.24 0.99 1.08 1.22 1.16 1.11 Sectors 8.0 8.9% 22.0% 0.406 0.129 0.976 8.4% 22.2% 0.38 0.11 1.07 1.08 1.14 1.02 1.08 Factors 1.6 25.5% 11.7% 2.186 4.951 0.964 23.1% 11.6% 1.99 4.96 1.11 1.10 1.00 1.04 1.06 Mid-Cap 8.0 9.7% 24.7% 0.394 0.119 1.076 8.4% 22.2% 0.38 0.11 1.17 1.05 1.06 0.93 1.05 market 8.0 8.4% 22.2% 0.376 0.113 1 8.4% 22.2% 0.38 0.11 1.00 1.00 1.00 1.00 1.00 Dividend 8.0 8.5% 23.9% 0.355 0.106 1.028 8.4% 22.2% 0.38 0.11 1.01 0.94 0.94 0.97 0.97 S&P 500 8.0 7.9% 22.2% 0.358 0.106 0.989 8.4% 22.2% 0.38 0.11 0.95 0.95 0.95 1.01 0.96 Market Cap 8.0 8.5% 24.1% 0.352 0.102 1.069 8.4% 22.2% 0.38 0.11 1.02 0.94 0.91 0.94 0.95 Equal Weight 4.1 15.5% 17.4% 0.892 0.544 1.056 17.0% 15.8% 1.08 0.80 0.91 0.83 0.68 0.95 0.84 Random 7.2 5.3% 30.9% 0.172 0.026 1.199 8.2% 23.0% 0.36 0.11 0.65 0.49 0.24 0.83 0.50 As Table 2 & 3 reveal that a broad-based ETF allocation strategy is not conducive to generating alpha in that, even with some slack, the returns and risk properties do not change much . The results show that choosing these broad-based ETFs virtually eliminates the possibility for positive alpha in a fixed allocation model though the returns for the sector-based portfolio do improve by about 0.9% annually. But a bit to my own surprise, the “Cramer” concentrated sector and stock-based portfolio jumps to the top of the list, handily beating the market by 520 basis points annually over a fairly long period of 8 years. Even the random portfolio shows that a good cook might be able to make something decent out of an awkward hash of a portfolio, with just a minimal amount of slack, the returns improve by about 430 basis points. I think the large relative gains in the stock-based portfolios illustrate why some investors continue to hold portfolios of individual stocks rather than simply index the equity portion even in the face of evidence that most investors do not outperform. Capturing that last 4-5% of alpha would be economically substantial, and thus may be worth seeking… Disclosure: The author is long USMV, DES. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.