Improve Your Volatility Trading By Listening To The Curve

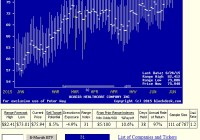

Summary Successful volatility trading requires you to understand the futures curve. There’s more to the volatility curve than just contango and backwardation. The futures curve is telling you what the market believes about the duration of the disruption. This article is for intermediate volatility traders who already understand the various exchange-traded volatility instruments. Whenever volatility spikes, Seeking Alpha readers are presented with a spate of articles suggesting that they should go short volatility. Frequently, this is a good trade. But not today. If you learn to tell the difference between these situations, you can optimize your volatility trading returns. The past couple of weeks have been rough for volatility traders. After nearly four years of declining volatility, the broader markets decided that a long-expected correction was finally in order. Consequently, volatility spiked in mid-August and remains elevated to the time of this writing, gutting the typical short volatility trade (e.g., shorting VXX or UVXY , or going long their inverse instruments, XIV or SVXY ). Simple Volatility Trading Strategies Failed Unfortunately, over the past couple weeks, Seeking Alpha readers were bombarded with a series of articles with titles like (paraphrasing): Now is the Time to Short Volatility The Volatility Short is Ready Again Short Volatility Now Many of these articles are based on simple volatility trading strategies, such as: Go short when the VIX is above 20, or another magic number the trader happens to like. Exit when the VIX is below 14 or so. If you’re very brave and the VIX is very low (say 11 or 12), reverse and go long volatility. Other authors use the VIX futures curve and look at contango and backwardation. For instance: Go short whenever the futures curve goes into backwardation. Exit when it goes back into contango, possibly after a few days delay to eek out a better return. Some authors use standard stock indicators like MACD, stochastic, or RSI to detect elevated prices of VXX or UVXY and then go short, selling when those indicators return to “normal.” Still others recommend the reader just buy into XIV or SVXY and hold for a long period, ignoring the smaller spikes or using them as periodic entry opportunities. At some level, you can’t fault these authors. For the past few years, whenever volatility has spiked, going short volatility using one of these simple strategies has been a reasonable tactic. Unfortunately, readers who blindly followed these strategies during the last month have seen their positions crushed with massive losses. XIV is down more than 50 percent from its high in early August, for instance, and could easily fall another 50 percent over the next couple of weeks. XIV data by YCharts If you were unlucky enough to short UVXY a couple weeks ago, you saw it triple, and nearly quadruple at its recent high, possibly leading to margin calls and other unpleasant conversations. UVXY data by YCharts What happened? Could these losses have been avoided? The simple answer is “partially.” Most experienced volatility traders, myself included, lost some money during the first few days of the spike by going short. But for those in the know, it was small in comparison to what it would have been if we had held. These traders exited their positions quickly when it became apparent that this was not a short-term spike. Some, depending on their risk tolerance, may have actually made significant gains by reversing their positions and going long. What signs tipped them off? Listen to the Futures Curve If you’re going to take your volatility trading to the next level, you need to understand the futures curve. Most volatility traders know about vixcentral.com and use it to understand whether the futures curve is in contango or backwardation, but the analysis often stops there. The reality is, the futures curve is giving you information about the market consensus for volatility in the future (yes, I know that sounds obvious). First off, it’s important to remember that VIX futures act as a sort of insurance system for the equities markets. Traders who are long equities will often buy VIX futures as an “insurance policy” (a hedge) against rapid market drops just like those we’ve seen in August. Speculators typically take the opposite side of that trade, selling “insurance” and harvesting a risk premium when the markets are flat or up. It’s the time dimension of VIX futures that we’re most interested in for this article. Specifically, while the VIX may shoot skyward for any number of reasons, traders in the VIX futures market are always evaluating whether the market disruption causing the VIX spike is likely to be a short-term or long-term event. For instance, if the market believes that the disruption will be very temporary, then only the front month VIX contract will rise significantly and go into backwardation. Equities traders will buy a near-dated contract to best hedge their positions, pushing prices up. Short sellers (the insurance sellers) will demand more risk premium for the front month, allowing it to rise, but will still compete aggressively for the far-dated contracts, keeping those prices suppressed. When the market thinks the spike will be short-lived, the futures curve tends to look like this, from March 14, 2014: (click to enlarge) On the other hand, if the market believes the disruption will be longer term, more of the futures curve will go into backwardation. Equities traders will buy far-dated contracts to protect their positions out in time. Similarly, short-selling insurance salesmen will demand a greater premium for far-dated contracts to protect themselves. Thus, when the market thinks the disruption will be longer, the futures curve tends to look like this, from August 4, 2011. (click to enlarge) In extreme cases, the whole futures curve will go into backwardation. We saw this in 2008, for instance. This might be interpreted as the market saying, “We don’t have a clue when this is going to end. It’s just going to be bad for a long time.” During November of 2008, the curve looked like this: (click to enlarge) Lessons for Volatility Traders The main lesson here for volatility traders is that the shape of the futures curve is determined by the “wisdom of crowds” effect, with all traders in the market making an estimation about the duration of the market disturbance. The longer the perceived disturbance, the more months of the VIX futures curve that will be pushed into backwardation. There are a few important caveats here: The number of months of backwardation is only a rough indicator. It does not tell you exactly how long the duration will actually last. If the first two months are in backwardation, it doesn’t mean the disruption will last for two months. If we could predict the markets with that level of certainty, nobody would make any money as they would be perfectly efficient. The best you can say is that when just the front month VIX futures contract is in backwardation, the market currently believes (see the next point) the disruption will be relatively short. When more contracts are in backwardation, the market currently believes the disruption will be longer. Short-lived VIX spikes typically don’t drive the futures curve into more than a month, possibly two, of backwardation (I say “typically” because sometimes you will see multiple months of backwardation associated with a short spike, but it resolves itself within a day or two). Conversely, long-lived market disruptions like we saw in 2008 or 2011 force many more months of backwardation. The upshot is, when you see many months of backwardation in the curve, the futures is market is telling you to prepare for an extended period of volatility. The market consensus reflected in the shape of the futures curve changes day by day, minute by minute, as the market takes in more information. Typically, the front month contract will go into backwardation first and then subsequent months will go into backwardation as the market develops a belief that the disruption will be longer lasting. This may take place over days or even weeks. But the markets are also fickle. If new information arrives that suggests that what the market thought was going to be a long-term event will resolve itself quickly, you can see two or three months of backwardation go back into contango within a day or two. You need to watch carefully. This is why many volatility traders went short at the start of the August disruption; only the front month was in backwardation and it looked liked a temporary spike. Days later, the second and then the third month went into backwardation, suggesting that this was more than a short term event. Savvy volatility traders exited at that point, bruised but not bloodied. What About Buy and Hold? “But so what?” I hear many volatility traders say. “I sold short a couple weeks ago. Yea, I didn’t time it very well, but I’m not worried. The VIX is ‘mean reverting’ (not in a formal statistical sense) and it’ll eventually return to ‘normal’ and I’ll recoup my losses.” Is that a bad strategy? Well, the best that can be said is that these traders are probably right, but they are in for a rough ride. A buy and hold strategy for volatility is a lot like holding equities in 2007 and 2008 on the theory that the market always recovers. That’s probably true, but it can be a long, painful road back to break-even. Further, the opportunity cost during that time can be tremendous. Equities traders who exited the market in 2007 or early 2008, at the first sign of trouble, and didn’t reenter until mid-2009 recouped their small losses faster than those who held straight through the worst of it. Their returns remain far ahead of their buy-and-hold peers to this day. The same is true with volatility trading. If you can cut your losses short, bide your time, and then reenter the market when things are going your direction, you’ll be far ahead of those who hold through the worst of it. Also, remember that losses with exchange-traded short volatility products become “permanent” the longer the futures curve remains in backwardation. In other words, while the level of the VIX influences VIX futures, exchange-traded volatility instruments (e.g., VXX, UVXY, XIV, and SVXY) are really investing in a rolling set of VIX futures with a limited lifetime. If the duration of the disruption was large, then even if the VIX falls back to “normal,” the prices of these instruments will not return to where they were in early August. The share prices of the inverse instruments (XIV and SVXY) are “eaten away” by persistent backwardation during long-lived market disruptions. You may still have losses that will take you months or even years of persistent contango to recoup. Finally, every trader should remember that gains and losses are asymmetric . It takes a 100 percent gain to recover from a 50 percent loss and a 300 percent gain to recover from a 75 percent loss. What to Do Now If you recognized the signs and exited the market when this downturn started, congratulations. You probably walked away with a loss, but it could have been a lot worse. You’ll easily recoup that loss once the futures curve goes back into contango. If you bought in at the start of the spike, or even a week later, and then held to this point, you have a painful choice to make – sell or hang tough? You’re probably sitting on a large loss. Unfortunately, it’s impossible to tell whether it’s better to exit or to remain short. As of today, the first three months of the futures curve are in contango and the fourth month is flat (see figure, below). The fifth and sixth months are in backwardation and the seventh is flat. This suggests that this is going to be an extended period of volatility and we have some more pain still in store. You’re probably better off exiting and waiting for contango to return before you reenter. You might be even better off going long volatility (long VXX or UVXY) if the markets remain volatile. But be careful here! Volatility is very sensitive to market sentiment and going long against the natural short bias of volatility is always risky. There are no good answers here. (click to enlarge) In either case, make sure you listen to the volatility futures curve the next time and take appropriate action, swift and sure. Finally, if you’re interested in trading volatility, I invite you to follow me here at Seeking Alpha. Just click the “+ Follow” link up at the top of this post, by my name. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in UVXY over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.