Puerto Rico Debt Worries Loom: 2 ETFs To Watch

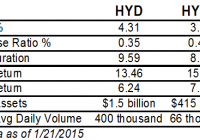

While Greece recently defaulted on its payments to the International Monetary Fund, America’s island Puerto Rico has managed to avert a last minute July 1 default giving some relief to its creditors. The island has paid back $645 million of general obligation bonds along with a $415 million installment from the troubled Puerto Rico Electric Power Authority (PREPA). Moreover, Puerto Rico has paid back a short-term bank loan of about $245 million. Though the last minute payment has helped the island to buy some time to negotiate with its creditors, it still has a huge debt load to repay in the coming months and years. In fact, the island has a massive debt load of $72 billion amassed by the government and its agencies. The government owned utility company – PREPA – is crippled by debt and is in talk with creditors to renegotiate its $9 billion of debt. Though Puerto Rico has managed to avert the default, Moody’s Investors Service has cut about $56 billion of Puerto Rico’s other bonds into junk category . The island has been in recession for nearly a decade and there are meager chances of its paying back its debt. This is especially true as many residents of the island are moving to the mainland U.S. in search of better job opportunities which further reduces the island’s tax base. The island’s debt problems also have a significant bearing on the financial market and the investor community, given the fact “estimated in 2013 that 180 mutual funds in the United States and elsewhere have at least 5% of their portfolios in Puerto Rican bonds,” as per investment research firm Morningstar, in a report for USA Today . Apart from mutual funds, a lot of ETFs also have exposure to Puerto Rican debt. Below we have highlighted two ETFs which have significant exposure to Puerto Rican bonds. SPDR Nuveen S&P High Yield Municipal Bond ETF (NYSEARCA: HYMB ) The fund tracks the S&P Municipal Yield Index, measuring the performance of high yield municipal bonds issued by U.S. states and territories or local governments or agencies. Puerto Rico takes the second spot with 10.45% exposure in the fund, ahead of California which has 12.7% allocation. The fund has a portfolio of 432 bonds with an average maturity of 19.74 years and a 30-day SEC yield of 4.60%. Sector-wise, Industrial Revenue takes the top spot with 28.3% allocation, followed by Healthcare and Special Tax each with double-digit exposure. The fund manages an asset base of $393.5 million and trades with moderate volume of 75,000 shares a day. The ETF currently has a Zacks Rank #4 or Sell rating. Short High-Yield Municipal Index ETF (NYSEARCA: SHYD ) The fund tracks The Barclays Municipal High Yield Short Duration Index giving exposure to the high-yield municipal bond market. The fund holds a total of 328 bonds with a modified duration of 3.96 years and a weighted average maturity of 7.23 years. SHYD has a 30-day SEC yield of 3.39%. Puerto Rico has 4.5% weightage in the fund. Sector-wise, Industrial Revenue takes the top spot with a little more than one-third assets, followed by HealthCare (22.6%) and Transportation (10.1%). The fund manages a small asset base of $105.4 million and trades with low volume of less than 30,000 shares a day. SHYD also has a Zacks Rank #4. Original Post