How To Avoid The Worst Style ETFs: Q2’15 In Review

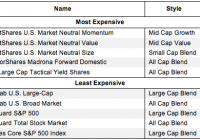

Summary The large number of ETFs has little to do with serving your best interests. Below are three red flags you can use to avoid the worst ETFs. The following presents the least and most expensive style ETFs as well as the worst overall style ETFs per our 2Q15 sector ratings. Question: Why are there so many ETFs? Answer: ETF providers tend to make lots of money on each ETF so they create more products to sell. The large number of ETFs has little to do with serving your best interests. Below are three red flags you can use to avoid the worst ETFs: 1. Inadequate Liquidity This issue is the easiest to avoid, and our advice is simple. Avoid all ETFs with less than $100 million in assets. Low levels of liquidity can lead to a discrepancy between the price of the ETF and the underlying value of the securities it holds. Plus, low asset levels tend to mean lower volume in the ETF and larger bid-ask spreads. 2. High Fees ETFs should be cheap, but not all of them are. The first step here is to know what is cheap and expensive. To ensure you are paying at or below average fees, invest only in ETFs with total annual costs below 0.49%, which is the average total annual cost of the 289 U.S. equity Style ETFs we cover. Figure 1 shows the most and least expensive Style ETFs. QuantShares provides three of the most expensive ETFs while Schwab ETFs are among the cheapest. Figure 1: 5 Least and Most-Expensive Style ETFs Sources: New Constructs, LLC and company filings Investors need not pay high fees for quality holdings. Arrow QVM Equity Factor (NYSEARCA: QVM ) earns our Very Attractive rating and has low total annual costs of only 0.72%. On the other hand, no matter how cheap an ETF, if it holds bad stocks, its performance will be bad. The quality of an ETFs holdings matters more than its price. 3. Poor Holdings Avoiding poor holdings is by far the hardest part of avoiding bad ETFs, but it is also the most important because an ETF’s performance is determined more by its holdings than its costs. Figure 2 shows the ETFs within each style with the worst holdings or portfolio management ratings . Figure 2: Style ETFs with the Worst Holding Sources: New Constructs, LLC and company filings State Street, iShares, and PowerShares appear more often than any other providers in Figure 2, which means that they offer the most ETFs with the worst holdings. Our overall ratings on ETFs are based primarily on our stock ratings of their holdings. The Danger Within Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. Put another way, research on ETF holdings is necessary due diligence because an ETF’s performance is only as good as its holdings’ performance. PERFORMANCE OF ETF’s HOLDINGS = PERFORMANCE OF ETF Disclosure: David Trainer and Max Lee receive no compensation to write about any specific stock, style, or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.