A Pioneering Approach To Earnings Season

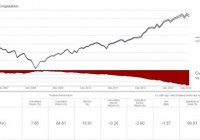

Summary US Q2 earnings season was one of the most volatile ever. We present Pioneering Quantitative Approach focusing on prices and not on fundamental data. Our analysis provides a guide per sector and per capitalization. ABSTRACT “Qui sait le passé peut conjecturer l’avenir”, Jacques-Bénigne Bossuet As we are just about to enter in the Q3 Earnings Season in the US, Uncia AM decided to provide you some keys to understand the Q2 Earnings Season. Bloomb erg already gave some keys: US stocks got biggest earnings bang since 2012 . This empirical study emphasizes many things: 1/ It is not worthwhile to keep equity position over the earnings: earnings releases are a lottery. As difficult as it may be for our equity analyst friends to admit (note: the author is an asset manager) , all available empirical data shows that it is impossible to predict market reaction following an earnings release. We thus need to distinguish the fundamental component of the reaction which is less unpredictable (related to turnover, EBITDA and other hard data) from the “price signal” component. The latter has always been impossible to predict, even if we take into account the released fundamental data. From a statistical perspective, the specific movement linked an the earnings release is on average null, as can be seen from the highly leptokurtic distribution of the movement. For an asset manager seeking to optimize their Sharpe Ratio, it is therefore not worth maintaining a position in the equity over the release period (assuming transaction & liquidity fees to be marginal) (click to enlarge) Source: Bloomberg, Uncia AM, Alphametry. Read the entire article in order to make your own opinion : 2/ Information Technology sector behaved properly during this session, on almost all indices. 3/ The specific Russell 2000 – related stocks moved a lot on earnings: maybe more interest of investors for UScentric names, as a consequence of fear over the USD strength and the world/Chinese macro slowdown. As the article may be a bit technical, here is a brief takeaway: On average, stocks from Nasdaq Composite Index (NASDAQ: CCMP ) exhibit a null return over earnings, but with large volatility. Therefore, it justifies the strategy to cut positions over earnings. In addition to that, we can notice that signals were slightly better on large caps vs small caps, and quite good in a sector such as Information Technology. “Weekly speaking”, we experienced a sharp positive signal on CCMP, but on a “PEAD” perspective only few comonotony between Earnings Moves and Drift Returns. On average, stocks from Russell 2000 Index (RTY) exhibit a null return over earnings, but with large volatility. Therefore, it justifies the strategy to cut positions over earnings. In addition to that, we can notice that signals were slightly better on large caps vs small caps, and quite good on a sector such as Information Technology, same things as we notice on CCMP. There are a lot more “PEAD” signals on RTY than on CCMP, meaning that as there are many companies belonging to both indices, many companies belonging only to RTY exhibit large signals. This means that investor attention was largely focused on UScentric companies. “Weekly speaking”, since the beginning of the year, we had very positive signals on RTY, but the summer was very complicated as we can see a downside candle at the beginning of August. Stocks from S&P 500 (SPX) are less volatile over earnings than those of CCMP, RTY or Nasdaq 100 (NDX). It may be explained by the average size of capitalization, but this is not sufficient as NDX average capitalization is higher (58.0 vs 50.2) is higher than SPX. We make the same notification about earnings release volatility that is not rewarded, unless capitalization criteria is not worthwhile anymore, nor sector criteria (even if we can see a positive skew for Information Technology sector). In terms of “Weekly signals”, we can notice numerous negative signals, emphasizing an overreaction of investors about bad news versus good news. We have only few data, but first of all, we can notice that stocks from Nasdaq 100 (NDX) exhibits the largest average capitalization, and the largest absolute earnings moves. For more technical readers, should you be interested in the underlying philosophy, please go ahead: METHODOLOGY Our sample takes into account earnings that occurred between 2015, June 30th and 2015, August 31st. We only focus on companies whose market capitalization exceeds $1 billion, the day before the earnings release (ER)/call (NYSE: EC ). We focus on 4 main US indices: Nasdaq Composite , Nasdaq 100 (NDX), S&P 500 (SPX) and Russell 2000 (RTY). Our method to estimate the move due to earnings release/call is the following: We assume that the Management Call lasts one hour, and that ER had occurred just before, which is the standard case (hugely often- we consider it happens all the time). Therefore, thinking as of Paris time, with 6-hours delay with New-York, we can set the following table: Table of earnings category Source: Uncia AM. We use the earnings return by getting rid off the total return index to the idiosyncratic move, assuming a beta for each stock = 1. For more information, you can refer to the original paper by the author, Post Earnings Announcement Drift, a Price Signal? [1] Important: in the following development, return always refers to relative return of the stock versus its index (total-return). NASDAQ COMPOSITE – CCMP: average capitalization (