A Pleasant Surprise Among Emerging Market ETFs

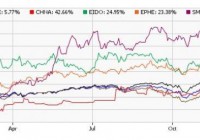

Broadly speaking, these are not the best of times for emerging market exchange traded funds. India large-cap ETFs have been significantly better or less bad than other single-country and diversified emerging markets ETFs over the past month. In the near term, India ETFs could pullback following the Reserve Bank of India’s decision Tuesday to hold interest rates at 7.25 percent. By Todd Shriber, ETF Professor Broadly speaking, these are not the best of times for emerging market exchange traded funds. Things are so bad that 22 emerging markets funds hit 52-week lows on Monday. Since the star of the current quarter, the iShares MSCI Emerging Markets ETF (NYSEARCA: EEM ) has bled nearly $2.5 billion in assets. However, there is some light among the darkness and it comes courtesy of Indian small-caps. India large-cap ETFs have been significantly better or less bad than other single-country and diversified emerging markets ETFs over the past month, but funds such as the Market Vectors India Small-Cap Index ETF (NYSEARCA: SCIF ) , the EGShares India Small Cap ETF (NYSEARCA: SCIN ) and the iShares MSCI India Small Cap Index ETF (BATS: SMIN ) have legitimately impressed . While the MSCI Emerging Markets Index has tumbled 5.6 percent over the past month, the aforementioned trio of India small-cap ETFs posted an average return of almost 5.5 percent. This is not unfamiliar territory for India ETFs, which were the shining stars of the BRIC quartet last when emerging markets equities slumped. In the near term, India ETFs could pullback following the Reserve Bank of India’s decision Tuesday to hold interest rates at 7.25 percent, but the central bank has obliged with three rate cuts earlier this year, at least two of which can be considered surprises. Interestingly, the gains for Indian small-caps over the past month arrived as investors pulled $35 million from Indian stocks last month, still a scant percentage of the $7.1. billion that has flowed into stocks in Asia’s third-largest economy this year, according to Bloomberg . Divergent Returns Significant differences between the India small-cap ETFs tell the story of divergent returns. For example, the Market Vectors India Small-Cap Index ETF features a 21.2 percent to consumer discretionary stocks, leveraging the ETF to India’s burgeoning consumer story. SMIN, the iShares offering, is also a play on India’s resurgent domestic economy with a 44.3 percent allocation to financial services and industrial names. The EGShares India Small Cap ETF devotes over half its weight to financial stocks and industrials. A BlackRock fund manager recently sounded a bullish tone on Indian non-bank financials and select sub-sectors of the industrial space. Though the fund manager did not mention the ETFs highlighted here, institutional support for Indian small-caps should drive the likes of SCIF, SCIN and SMIN higher. Indian small-caps are not a bump-free ride. For example, SCIF has a three-year standard deviation of almost 32 percent, or 2 1/2 times that of the MSCI Emerging Markets Index. However, Indian small-cap, at least as measured by SCIF and SCIN, are not excessively valued. SCIF sports a price-to-earnings ratio of just 11 , while SCIN’s price-to-book ratio is just 1.16. Disclaimer: Neither Benzinga nor its staff recommend that you buy, sell, or hold any security. We do not offer investment advice, personalized or otherwise. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.