Scalper1 News

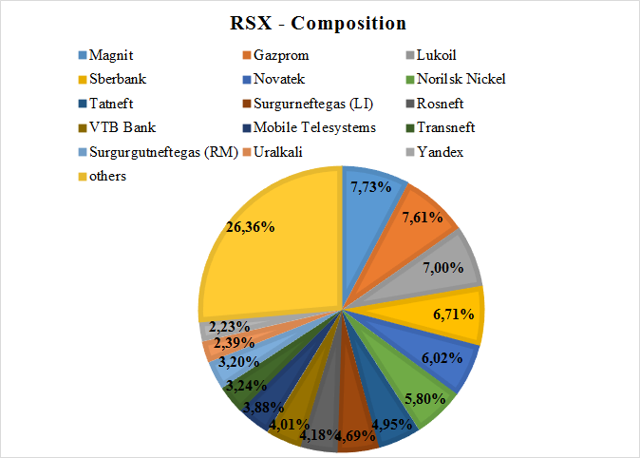

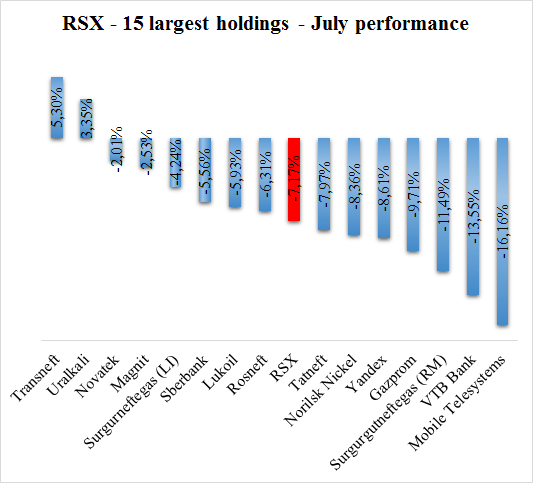

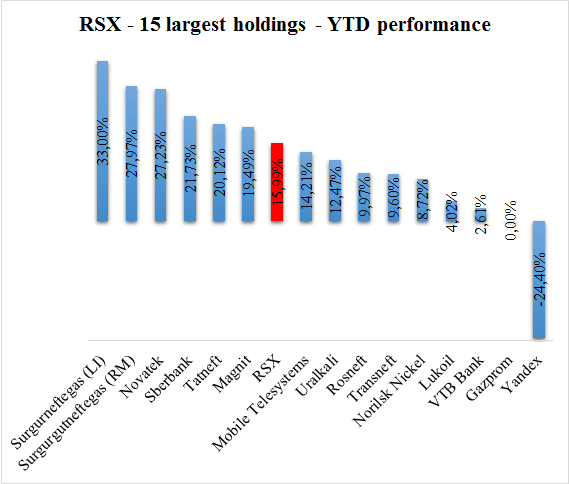

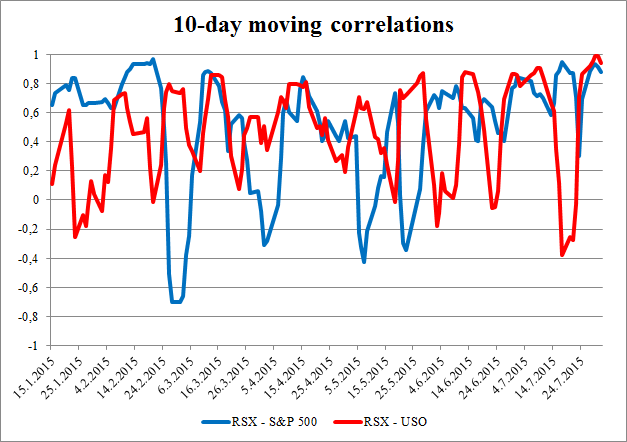

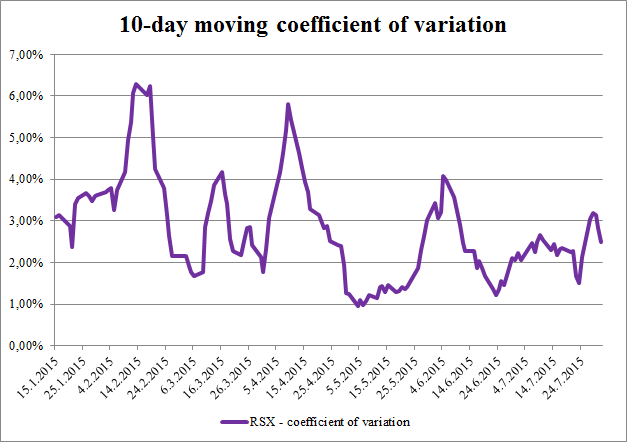

Summary The Market Vectors Russia ETF declined by 7.17% in July. The main reason for the decline were weak oil prices. The Russian economy is under pressure from declining oil prices once again. The Bank of Russia has to choose whether to fight inflation or to support the GDP growth. Weak oil prices will probably weigh on RSX also in August. The Market Vectors Russia ETF (NYSEARCA: RSX ) lost 7.17% of its value in July. The main reasons were declining oil prices and related problems of the Russian economy. Declining oil price leads to a weakening Russian Ruble and a weak Ruble leads to higher inflation. Russia needs to support its currency by hiking interest rates; however, high interest rates damage the economic growth. As a result, the Russian central bank needs to choose between lower interest rates resulting in higher GDP growth but higher inflation and higher interest rates resulting in lower inflation but lower GDP growth (stronger GDP decline respectively). The Russians have chosen GDP growth for now, as the Bank of Russia cut its key interest rate to 11%. The portfolio of RSX experienced some minor changes during July. Gazprom (OTCPK: OGZPY ) and Lukoil (OTCPK: LUKOY ) are not the biggest holdings anymore, as they were overtaken by Magnit. All of the top three holdings have weight over 7%. No new companies got amongst the top 15 holdings; however, the cumulative weight of the top 15 declined slightly, from 75.83% to 73.64%. Source: own processing, using data from vaneck.com Out of the 15 biggest holdings, only two companies experienced a positive share price development in July. Shares of Transneft and Uralkali grew by 5.3% and 3.35% respectively. The biggest decline was recorded by the telecommunication company Mobile TeleSystems (NYSE: MBT ). The company lost 16% of its value. Most of the decline occurred in the first part of the month and wasn’t related to any announcements of the company, as Q2 results will be released in August and the acquisition of NVision Group was announced in the second half of July. The oil & natural gas producers were negatively impacted by weak oil prices. Brent prices declined by 16% and WTI prices declined by more than 17% in July. Natural gas prices were relatively stable. Source: own processing, using data from Bloomberg Although the last three months were negative for RSX and the Russian share market, RSX is still 16% higher year to date. Out of the 15 biggest holdings, only shares of Yandex (NASDAQ: YNDX ) have declined since January (-24%) and the share price of Gazprom is unchanged. On the other hand, London listed shares of Surgutneftegas (OTCPK: SGTPY ) grew by 33%. Source: own processing, using data from Bloomberg The chart below shows the 10-day moving correlations between RSX and the S&P 500 and between RSX and oil prices represented by the United States Oil ETF (NYSEARCA: USO ). The correlation between RSX and the S&P 500 was high and relatively stable during July. On the other hand, the correlation between RSX and USO shows signs of instability. There was high positive correlation in the first and in the last part of the month but a huge decline in the middle of July. As a result, the oil price was declining over the whole of July but RSX managed to recover a part of the early month losses in the middle decade, only to decline even deeper during the last part of the month. Source: own processing, using data from Yahoo Finance Although RSX declined significantly in July, its volatility measured by the 10-day moving coefficient of variation was relatively stable, moving in the 2%-3% range for the better part of the month. Source: own processing, using data from Yahoo Finance Some of the more interesting news: Gazprom continues with preparations of the Nord Stream II project that should bring more natural gas to western Europe, via a gas pipeline beneath the Baltic Sea. Nord Stream II should build on the successful Nord Stream I project. The first Nord Stream gas pipeline was opened in November 2011. Nord Stream II should be completed by 2020. Meetings between Gazprom, OMV and BASF representatives, regarding the Nord Stream II project, took place in July. Gazprom has also announced that it will enter into partnership with NIPIGAZ in order to design and construct the Amur Gas Processing Plant. The Amur Gas Processing Plant should become the biggest gas processing enterprise in Russia and it should also include the world biggest helium production facility. Multicomponent gas from Gazprom’s deposits in the Irkutsk and Yakutia regions should be delivered via the Power of Siberia gas pipeline to the Amur Gas Processing Plant, where methane, ethane, propane, butane, pentane-hexane fraction and helium will be produced. Gazprom Neft (OTCQX: GZPFY ) announced completion of the first production well at Vostochno-Messoyakhskoye oil field. The field should start full-scale commercial production in late 2016, after the oil pipeline connecting the field to the Zapolyarne-Purpe pipeline system is completed. Gazprom Neft plans to expand also its downstream operations. It announced that it has secured the approval for construction of a new generation combined refining unit at its Moscow refinery. The new refining unit should boost light petroleum products production of the refinery by 40% and the refining efficiency should improve by 20%. Yandex has launched an interesting new product, a delivery services aggregator. The service is primarily designed for internet stores; however, it may be useful for some retail clients as well. According to the company, 83% of Russian internet users live outside Moscow but 47% of Russian internet store users live in Moscow. One of the reasons is that many internet stores don’t deliver goods to Russian regions, due to high costs, complicated logistics and administrative barriers. Yandex wants to support online shopping in Russian regions and of course get its share of the pie. It is possible that this is one of Yandex’s first steps on the way to expanding its activities into the online shopping industry. Rosneft (OTC: RNFTF ) keeps on cooperating with its foreign partners. On July 16 , the company announced that it completed pilot drilling at the North-Komsomolskoye field in collaboration with Statoil. Rosneft believes that the field holds at least 600 million tonnes of oil. On July 30 , Rosneft announced that it filed a joint bid with Exxon Mobil (NYSE: XOM ) for Mozambique license round. Mobile TeleSystems signed a binding agreement to acquire IT solutions provider NVision Group JSC for RUB 15 billion ($244 million). NVision is the developer and owner of TeleSystem’s billing system. This transaction should help the leading Russian telecommunications operator to improve its billing services, to offer complementary solutions to its clients and to reduce spending on in-house IT. Conclusion The Russian economy is under pressure of declining oil prices again. The low oil prices lead not only to weaker currency and lower GDP but also to lower RSX prices, as a significant part of RSX’s portfolio is created by shares of oil & natural gas producers. Although the June data indicated that the Russian economy may have reached its bottom , the recent oil price decline may prove this assumption to be incorrect. The decline of RSX should continue also in August, unless the oil prices start to recover. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Market Vectors Russia ETF declined by 7.17% in July. The main reason for the decline were weak oil prices. The Russian economy is under pressure from declining oil prices once again. The Bank of Russia has to choose whether to fight inflation or to support the GDP growth. Weak oil prices will probably weigh on RSX also in August. The Market Vectors Russia ETF (NYSEARCA: RSX ) lost 7.17% of its value in July. The main reasons were declining oil prices and related problems of the Russian economy. Declining oil price leads to a weakening Russian Ruble and a weak Ruble leads to higher inflation. Russia needs to support its currency by hiking interest rates; however, high interest rates damage the economic growth. As a result, the Russian central bank needs to choose between lower interest rates resulting in higher GDP growth but higher inflation and higher interest rates resulting in lower inflation but lower GDP growth (stronger GDP decline respectively). The Russians have chosen GDP growth for now, as the Bank of Russia cut its key interest rate to 11%. The portfolio of RSX experienced some minor changes during July. Gazprom (OTCPK: OGZPY ) and Lukoil (OTCPK: LUKOY ) are not the biggest holdings anymore, as they were overtaken by Magnit. All of the top three holdings have weight over 7%. No new companies got amongst the top 15 holdings; however, the cumulative weight of the top 15 declined slightly, from 75.83% to 73.64%. Source: own processing, using data from vaneck.com Out of the 15 biggest holdings, only two companies experienced a positive share price development in July. Shares of Transneft and Uralkali grew by 5.3% and 3.35% respectively. The biggest decline was recorded by the telecommunication company Mobile TeleSystems (NYSE: MBT ). The company lost 16% of its value. Most of the decline occurred in the first part of the month and wasn’t related to any announcements of the company, as Q2 results will be released in August and the acquisition of NVision Group was announced in the second half of July. The oil & natural gas producers were negatively impacted by weak oil prices. Brent prices declined by 16% and WTI prices declined by more than 17% in July. Natural gas prices were relatively stable. Source: own processing, using data from Bloomberg Although the last three months were negative for RSX and the Russian share market, RSX is still 16% higher year to date. Out of the 15 biggest holdings, only shares of Yandex (NASDAQ: YNDX ) have declined since January (-24%) and the share price of Gazprom is unchanged. On the other hand, London listed shares of Surgutneftegas (OTCPK: SGTPY ) grew by 33%. Source: own processing, using data from Bloomberg The chart below shows the 10-day moving correlations between RSX and the S&P 500 and between RSX and oil prices represented by the United States Oil ETF (NYSEARCA: USO ). The correlation between RSX and the S&P 500 was high and relatively stable during July. On the other hand, the correlation between RSX and USO shows signs of instability. There was high positive correlation in the first and in the last part of the month but a huge decline in the middle of July. As a result, the oil price was declining over the whole of July but RSX managed to recover a part of the early month losses in the middle decade, only to decline even deeper during the last part of the month. Source: own processing, using data from Yahoo Finance Although RSX declined significantly in July, its volatility measured by the 10-day moving coefficient of variation was relatively stable, moving in the 2%-3% range for the better part of the month. Source: own processing, using data from Yahoo Finance Some of the more interesting news: Gazprom continues with preparations of the Nord Stream II project that should bring more natural gas to western Europe, via a gas pipeline beneath the Baltic Sea. Nord Stream II should build on the successful Nord Stream I project. The first Nord Stream gas pipeline was opened in November 2011. Nord Stream II should be completed by 2020. Meetings between Gazprom, OMV and BASF representatives, regarding the Nord Stream II project, took place in July. Gazprom has also announced that it will enter into partnership with NIPIGAZ in order to design and construct the Amur Gas Processing Plant. The Amur Gas Processing Plant should become the biggest gas processing enterprise in Russia and it should also include the world biggest helium production facility. Multicomponent gas from Gazprom’s deposits in the Irkutsk and Yakutia regions should be delivered via the Power of Siberia gas pipeline to the Amur Gas Processing Plant, where methane, ethane, propane, butane, pentane-hexane fraction and helium will be produced. Gazprom Neft (OTCQX: GZPFY ) announced completion of the first production well at Vostochno-Messoyakhskoye oil field. The field should start full-scale commercial production in late 2016, after the oil pipeline connecting the field to the Zapolyarne-Purpe pipeline system is completed. Gazprom Neft plans to expand also its downstream operations. It announced that it has secured the approval for construction of a new generation combined refining unit at its Moscow refinery. The new refining unit should boost light petroleum products production of the refinery by 40% and the refining efficiency should improve by 20%. Yandex has launched an interesting new product, a delivery services aggregator. The service is primarily designed for internet stores; however, it may be useful for some retail clients as well. According to the company, 83% of Russian internet users live outside Moscow but 47% of Russian internet store users live in Moscow. One of the reasons is that many internet stores don’t deliver goods to Russian regions, due to high costs, complicated logistics and administrative barriers. Yandex wants to support online shopping in Russian regions and of course get its share of the pie. It is possible that this is one of Yandex’s first steps on the way to expanding its activities into the online shopping industry. Rosneft (OTC: RNFTF ) keeps on cooperating with its foreign partners. On July 16 , the company announced that it completed pilot drilling at the North-Komsomolskoye field in collaboration with Statoil. Rosneft believes that the field holds at least 600 million tonnes of oil. On July 30 , Rosneft announced that it filed a joint bid with Exxon Mobil (NYSE: XOM ) for Mozambique license round. Mobile TeleSystems signed a binding agreement to acquire IT solutions provider NVision Group JSC for RUB 15 billion ($244 million). NVision is the developer and owner of TeleSystem’s billing system. This transaction should help the leading Russian telecommunications operator to improve its billing services, to offer complementary solutions to its clients and to reduce spending on in-house IT. Conclusion The Russian economy is under pressure of declining oil prices again. The low oil prices lead not only to weaker currency and lower GDP but also to lower RSX prices, as a significant part of RSX’s portfolio is created by shares of oil & natural gas producers. Although the June data indicated that the Russian economy may have reached its bottom , the recent oil price decline may prove this assumption to be incorrect. The decline of RSX should continue also in August, unless the oil prices start to recover. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News