Scalper1 News

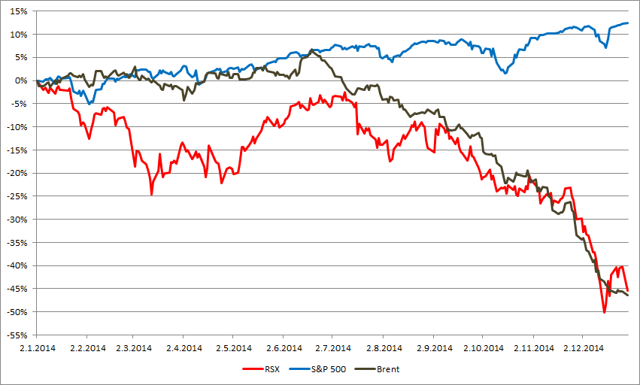

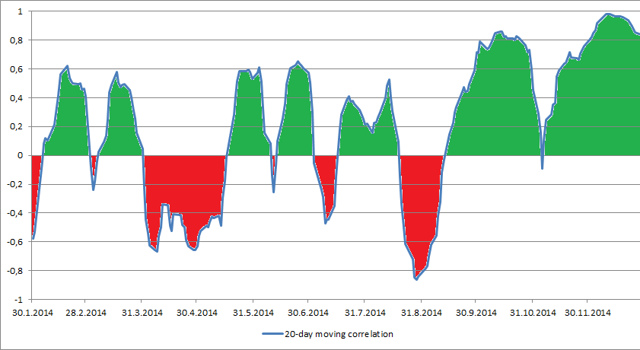

Summary The French president proclaimed that the sanctions against Russia should be lifted. The main problem of the Russian stock market is the collapse of oil prices right now. The investors shouldn’t expect that the end of sanctions will have a strong effect on the Market Vectors Russia ETF. The French president Francoise Hollande said that the sanctions against Russia should be lifted . The sanctions were imposed during 2014 in order to force Russia to not support the rebels in eastern Ukraine. The sanctions have limited the access of some of the biggest Russian companies to financial markets. But the real problem for the Russian economy and the Russian share market is the collapse of oil prices right now. The chart below shows the 2014 development of the Market Vectors Russia ETF (NYSEARCA: RSX ), S&P 500 and Brent valuations. As we can see RSX had very volatile first half of 2014. But it managed to recover most of the losses during May and June. The major decline has started in early July and it coincided with the start of the oil price collapse. Both of the curves are almost identical on the September-December time frame. (click to enlarge) Source: own processing The correlation coefficient between RSX and Brent was 0.866 in 2014. It was only 0.355 in the 1H 2014 but it rose to 0.96 in the 2H 2014, which means almost perfect positive correlation. The chart below shows 20-day moving correlation between RSX and Brent prices. It clearly shows that the huge decline of the RSX price is related to the oil price collapse more than to anything other. (click to enlarge) Source: own processing Yes, the sanctions are a complication for Gazprom ( OTCQX:GZPFY ), Sberbank ( OTCPK:SBRCY ), VTB or Rosneft ( OTC:RNFTF ). But the Western financial markets are not the only source of money. There is a country called China right to the south of Russia. And although China has some problems right now it still holds huge foreign currency reserves. Investing in Russia would help to diversify the Chinese reserves out of dollars and it would also help them to satisfy their long term appetite for natural resources. So yes, the sanctions are a complication for the Russian companies but it is nothing that should be able to endanger their existence and bring their share prices to the current levels. The ultimate problem is the collapse of oil prices. Conclusion The opinion of president Hollande is really positive and the sanctions should be definitely canceled. The European economy is impacted by the sanctions and anti-sanctions probably equally if not even more than the Russian economy. Also the situation in Ukraine has calmed down lately and the peace talks are underway. But if the sanctions will be or won’t be lifted, it will have only a limited impact on the Russian share market and on the price of RSX. All RSX needs to start growing is growth of the oil price and its stabilization somewhere over $80/barrel. I am sure that the oil price will return to the $100 level and above it but I don’t know whether it will be in 2015, 2016 or maybe in 2017. The big Russian companies will survive the waiting but they will not shine. This time period is a good opportunity to accumulate shares of selected companies and RSX. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Summary The French president proclaimed that the sanctions against Russia should be lifted. The main problem of the Russian stock market is the collapse of oil prices right now. The investors shouldn’t expect that the end of sanctions will have a strong effect on the Market Vectors Russia ETF. The French president Francoise Hollande said that the sanctions against Russia should be lifted . The sanctions were imposed during 2014 in order to force Russia to not support the rebels in eastern Ukraine. The sanctions have limited the access of some of the biggest Russian companies to financial markets. But the real problem for the Russian economy and the Russian share market is the collapse of oil prices right now. The chart below shows the 2014 development of the Market Vectors Russia ETF (NYSEARCA: RSX ), S&P 500 and Brent valuations. As we can see RSX had very volatile first half of 2014. But it managed to recover most of the losses during May and June. The major decline has started in early July and it coincided with the start of the oil price collapse. Both of the curves are almost identical on the September-December time frame. (click to enlarge) Source: own processing The correlation coefficient between RSX and Brent was 0.866 in 2014. It was only 0.355 in the 1H 2014 but it rose to 0.96 in the 2H 2014, which means almost perfect positive correlation. The chart below shows 20-day moving correlation between RSX and Brent prices. It clearly shows that the huge decline of the RSX price is related to the oil price collapse more than to anything other. (click to enlarge) Source: own processing Yes, the sanctions are a complication for Gazprom ( OTCQX:GZPFY ), Sberbank ( OTCPK:SBRCY ), VTB or Rosneft ( OTC:RNFTF ). But the Western financial markets are not the only source of money. There is a country called China right to the south of Russia. And although China has some problems right now it still holds huge foreign currency reserves. Investing in Russia would help to diversify the Chinese reserves out of dollars and it would also help them to satisfy their long term appetite for natural resources. So yes, the sanctions are a complication for the Russian companies but it is nothing that should be able to endanger their existence and bring their share prices to the current levels. The ultimate problem is the collapse of oil prices. Conclusion The opinion of president Hollande is really positive and the sanctions should be definitely canceled. The European economy is impacted by the sanctions and anti-sanctions probably equally if not even more than the Russian economy. Also the situation in Ukraine has calmed down lately and the peace talks are underway. But if the sanctions will be or won’t be lifted, it will have only a limited impact on the Russian share market and on the price of RSX. All RSX needs to start growing is growth of the oil price and its stabilization somewhere over $80/barrel. I am sure that the oil price will return to the $100 level and above it but I don’t know whether it will be in 2015, 2016 or maybe in 2017. The big Russian companies will survive the waiting but they will not shine. This time period is a good opportunity to accumulate shares of selected companies and RSX. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News