Scalper1 News

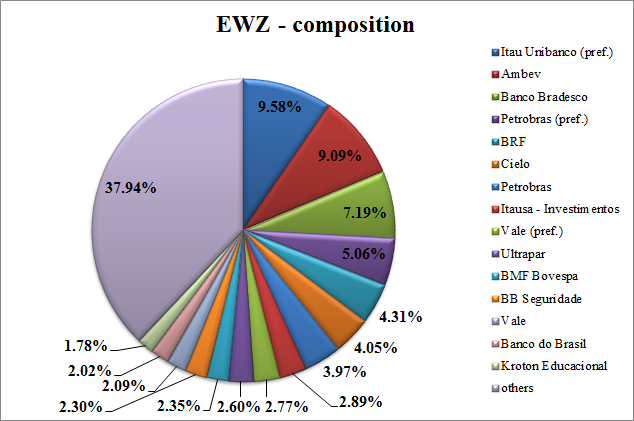

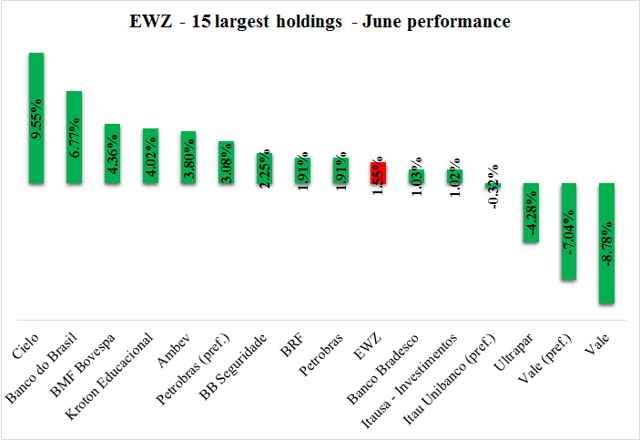

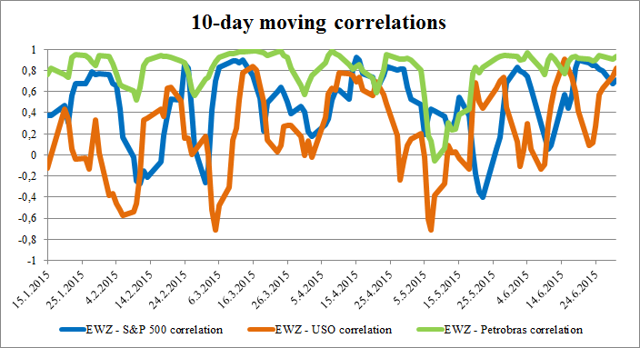

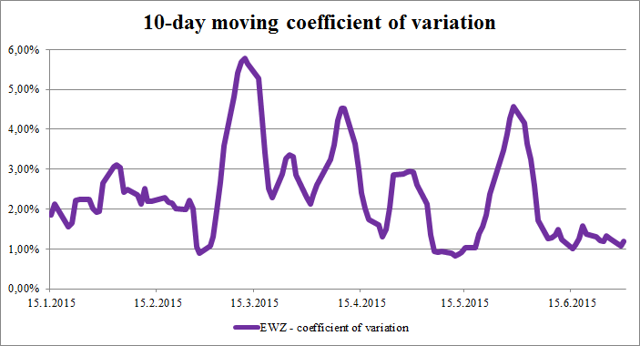

Summary The iShares MSCI Brazil Capped ETF grew by 1.55% in June. Out of the 15 biggest EWZ holdings, Cielo was the biggest gainer and Vale was the biggest looser. The Petrobras corruption scandal still impacts Brazilian share markets significantly. The iShares MSCI Brazil Capped ETF (NYSEARCA: EWZ ) grew by 1.55% in June. Although the first half of the month was very good and EWZ’s share price was up by 7% at one point, it started to decline in the second half of June, as the Petrobras (NYSE: PBR ) corruption scandal started to weigh on Brazilian share markets again. On June 19, Reuters reported that police arrested top executives of the two biggest Brazilian construction companies. And on June 25, a wave of panic flooded the markets, as a rumor claimed that the former Brazilian president da Silva should be investigated. Although the rumor was denied quickly, the panic reactions have demonstrated that investors are still extremely sensitive to any news related to the corruption scandal that is still far from over. The portfolio of EWZ consists of 68 share titles. The 15 largest holdings represent more than 60% of assets of the fund. The biggest holdings are prefferred shares of Itau Unibanco (NYSE: ITUB ), the biggest Brazilian bank, followed by shares of Ambev (NYSE: ABEV ), a major South American beer and soft drinks producer. Ordinary shares of the second biggest Brazilian bank, Banco Bradesco (NYSE: BBD ), create 7.19% of the portfolio. And the weight of preferred shares of Petrobras is 5.06%. Source: Own processing, using data of iShares.com The chart below shows the June performance of the 15 biggest holdings. The biggest price increase experienced shares of electronic payment solutions company Cielo ( OTCQX:CIOXY ) (9.55%), shares of Banco do Brasil ( OTCPK:BDORY ) (6.77%) and shares of the stock exchange BMF Bovespa (4.36%). On the other hand, June wasn’t good for shares of the energy sector holding company Ultrapar (NYSE: UGP ) (-4.28%) and for diversified mining company Vale (NYSE: VALE ) (-7.04% and -8.78%). (click to enlarge) Source: Own processing, using data of Bloomberg The share price of Cielo grew by 9.55% in June. The growth was fueled by the announcement that Cielo will acquire 30% of Stelo S.A. The transaction should help Cielo, the biggest Brazilian electronic payment solution company, to expand to the electronic wallet segment. Shares of Vale were crushed by weak metals prices. The iron ore price started to grow after it bottomed in early April near the $46/tonne level and it reached $62/tonne in the first decade of June. But it started to decline again and it was at $55/tonne in late June. Copper price declined by 4% and Vale’s investors started to be nervous again. Not only the share price of Petrobras is negatively affected by the corruption scandal. Also the future growth prospects of the company are negatively affected. The company intends to cut its investments by 37% over the next five years. Petrobras plans to invest $130 billion over the 2015-2019 time period, although the original plan was to spend $207 billion. The company needs to reduce its huge debt, but this decision will reduce its growth significantly. (click to enlarge) Source: Own processing, using data of YahooFinance As shown by the chart above, the EWZ share price is strongly correlated with S&P 500 as well as with oil prices represented by The United States Oil ETF (NYSEARCA: USO ). But the strongest and most stable correlation is between EWZ and Petrobras. Although Petrobras represents only 9.03% of EWZ’s portfolio, it is one of the most important Brazilian companies and it has a strong impact on the whole Brazilian economy. Moreover the current corruption scandal leads to an increased political risk and any negative news about Petrobras tends to affect the whole Brazilian share market. The chart shows that EWZ had the highest correlation with Petrobras share price and S&P 500 in June. (click to enlarge) Source: Own processing, using data of YahooFinance The chart above shows volatility of EWZ measured by 10-day moving coefficient of variation. Although the volatility was high in late May and early June, it was relatively low and stable during the second part of the month. Conclusion The EWZ share price increased by 1.55% in June, when most of the early gains evaporated during the last decade, as the corruption scandal started to unnerve investors again. The moving correlation between EWZ and Petrobras was high and stable in late June. On the other hand the correlation between EWZ and S&P 500 was high and declining and correlation between EWZ and USO was high and growing. The development on global share markets, development of oil prices and any news related to the Petrobras corruption scandal will impact the direction of EWZ in July. Moreover the state of the Brazilian economy isn’t good, the GDP is expected to decline by 1-1.2% in 2015. Although EWZ may be an ineresting long term buy, it is quite probable that its share price will decline in the short term. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I am/we are long PBR. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The iShares MSCI Brazil Capped ETF grew by 1.55% in June. Out of the 15 biggest EWZ holdings, Cielo was the biggest gainer and Vale was the biggest looser. The Petrobras corruption scandal still impacts Brazilian share markets significantly. The iShares MSCI Brazil Capped ETF (NYSEARCA: EWZ ) grew by 1.55% in June. Although the first half of the month was very good and EWZ’s share price was up by 7% at one point, it started to decline in the second half of June, as the Petrobras (NYSE: PBR ) corruption scandal started to weigh on Brazilian share markets again. On June 19, Reuters reported that police arrested top executives of the two biggest Brazilian construction companies. And on June 25, a wave of panic flooded the markets, as a rumor claimed that the former Brazilian president da Silva should be investigated. Although the rumor was denied quickly, the panic reactions have demonstrated that investors are still extremely sensitive to any news related to the corruption scandal that is still far from over. The portfolio of EWZ consists of 68 share titles. The 15 largest holdings represent more than 60% of assets of the fund. The biggest holdings are prefferred shares of Itau Unibanco (NYSE: ITUB ), the biggest Brazilian bank, followed by shares of Ambev (NYSE: ABEV ), a major South American beer and soft drinks producer. Ordinary shares of the second biggest Brazilian bank, Banco Bradesco (NYSE: BBD ), create 7.19% of the portfolio. And the weight of preferred shares of Petrobras is 5.06%. Source: Own processing, using data of iShares.com The chart below shows the June performance of the 15 biggest holdings. The biggest price increase experienced shares of electronic payment solutions company Cielo ( OTCQX:CIOXY ) (9.55%), shares of Banco do Brasil ( OTCPK:BDORY ) (6.77%) and shares of the stock exchange BMF Bovespa (4.36%). On the other hand, June wasn’t good for shares of the energy sector holding company Ultrapar (NYSE: UGP ) (-4.28%) and for diversified mining company Vale (NYSE: VALE ) (-7.04% and -8.78%). (click to enlarge) Source: Own processing, using data of Bloomberg The share price of Cielo grew by 9.55% in June. The growth was fueled by the announcement that Cielo will acquire 30% of Stelo S.A. The transaction should help Cielo, the biggest Brazilian electronic payment solution company, to expand to the electronic wallet segment. Shares of Vale were crushed by weak metals prices. The iron ore price started to grow after it bottomed in early April near the $46/tonne level and it reached $62/tonne in the first decade of June. But it started to decline again and it was at $55/tonne in late June. Copper price declined by 4% and Vale’s investors started to be nervous again. Not only the share price of Petrobras is negatively affected by the corruption scandal. Also the future growth prospects of the company are negatively affected. The company intends to cut its investments by 37% over the next five years. Petrobras plans to invest $130 billion over the 2015-2019 time period, although the original plan was to spend $207 billion. The company needs to reduce its huge debt, but this decision will reduce its growth significantly. (click to enlarge) Source: Own processing, using data of YahooFinance As shown by the chart above, the EWZ share price is strongly correlated with S&P 500 as well as with oil prices represented by The United States Oil ETF (NYSEARCA: USO ). But the strongest and most stable correlation is between EWZ and Petrobras. Although Petrobras represents only 9.03% of EWZ’s portfolio, it is one of the most important Brazilian companies and it has a strong impact on the whole Brazilian economy. Moreover the current corruption scandal leads to an increased political risk and any negative news about Petrobras tends to affect the whole Brazilian share market. The chart shows that EWZ had the highest correlation with Petrobras share price and S&P 500 in June. (click to enlarge) Source: Own processing, using data of YahooFinance The chart above shows volatility of EWZ measured by 10-day moving coefficient of variation. Although the volatility was high in late May and early June, it was relatively low and stable during the second part of the month. Conclusion The EWZ share price increased by 1.55% in June, when most of the early gains evaporated during the last decade, as the corruption scandal started to unnerve investors again. The moving correlation between EWZ and Petrobras was high and stable in late June. On the other hand the correlation between EWZ and S&P 500 was high and declining and correlation between EWZ and USO was high and growing. The development on global share markets, development of oil prices and any news related to the Petrobras corruption scandal will impact the direction of EWZ in July. Moreover the state of the Brazilian economy isn’t good, the GDP is expected to decline by 1-1.2% in 2015. Although EWZ may be an ineresting long term buy, it is quite probable that its share price will decline in the short term. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I am/we are long PBR. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News