Scalper1 News

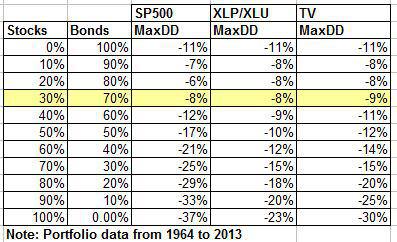

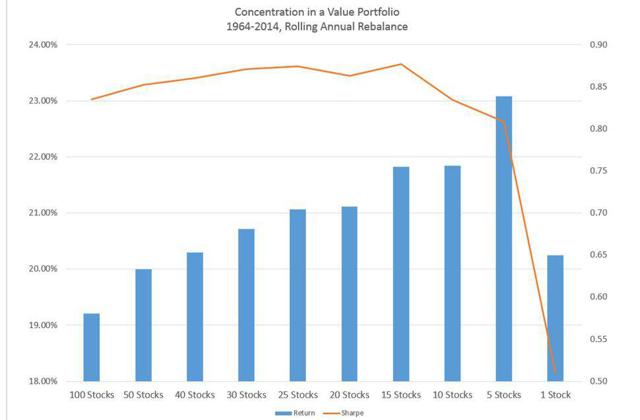

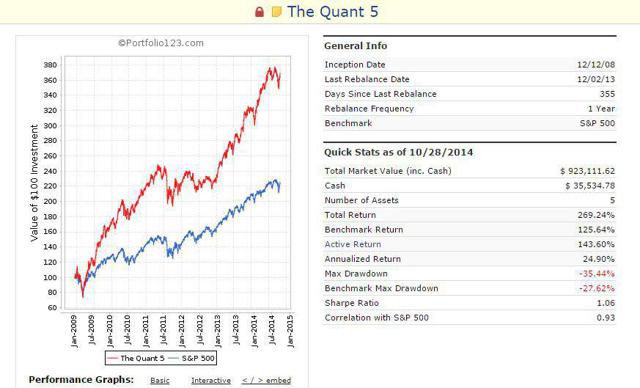

One of the more overlooked areas of quantitative investing is how to integrate quant strategies into a diversified portfolio. Let’s look at a few of the issues involved and some possible solutions. I’ve discussed the big allocation decision already, i.e. how much to put into quant strategies vs. bonds already. I think this decision should be primarily driven by how much risk one is willing to take. I use maximum portfolio drawdown as the primary metric to judge how much risk I’m willing to take. Here is the max drawdown table from that post. For example, to limit annual drawdowns to less than 10% and 30% quant portfolio 70% bond portfolio would be the appropriate allocation. If a 15% max DD is more suited to your risk tolerance then you can go up to a 70% quant portfolio 30% bond portfolio allocation. Of course, this is dependent on the type of quant strategies used but surprisingly it doesn’t matter as much as you may think. The XLP/XLU quant strategy is one of the most conservative strategies while TV is one of the most aggressive and best performing, yet in terms of max DD there is not that big a difference. OK, now for some of the subtle details of building quant portfolios. First, why pick more than one quant strategy? Shouldn’t you just pick the best one with respect to whatever metric you want? I would argue no, mainly due to behavioral factors. Investors have a hard time with underperformance, no matter what the long term track record of a strategy may be. Let’s take this year as an example and compare one of the best performing quant strategies over time, a value and momentum microcap stock quant portfolio, to a conservative utility value strategy. The micro cap quant strategy has returned over 22% a year since the late 60s as compared to 16% a year for the utility value strategy. In 2014, the micro cap strategy is up 3% while the utility strategy is up over 29%! That kind of divergence is hard to swallow for most investors and leads to performance chasing. The best way to avoid this is to choose multiple strategies and choose strategies with high base rates . At the simplest level using more strategies increases the odds that at least one is outperforming and thus lessens the odds of making behavioral mistakes. OK, now that we’re going to choose multiple quant strategies, we need to avoid a few pitfalls. The two big ones for me are over-diversification and excessive fees. The quant strategies I’ve presented on the blog usually have 25 individual stocks in a portfolio. If you’re going to go with 3 quant strategies then we’re talking about 75 individual stocks. Besides paying way more in fees by holding too many stocks we reduce the power of the quant strategies. Two great post on this subject are, Avoid Diworsification , and You need to Dare to be Great . Here is the money pic. (click to enlarge) 10-15 individual stocks gives about the best bang for the buck for any one of the individual quant systems. So let’s say we go a bit crazy and choose 5 different quant systems that we’d like in our overall portfolio. We’ll choose the TV2 systems, the EDY system, the Large stock SHY system, the XLP system, and the XLU system. I’ve posted all of these systems before. See here for a list of all my quant posts. 10 stocks each. Yearly holding period and go back as far as we can, Dec 2008, for the P123 book simulation tool that I use. I’ll call this the Quant 5. Results of the overall quant portfolio are below. (click to enlarge) Pretty impressive results. Over the full period, all of the quant systems beat the market handily. But there have been significant periods of underperformance for several of the systems. For example, over the last 3 years, the EDY systems and the XLU system have underperformed the market and the other systems. The top quant system over the full period from 2008 turned out to be the large stock SHY system even though going back further to 1999, other systems have performed better. Of course, how could you know that before hand? You can’t. Bottom line: It pays to diversify, but not too much. Not just in terms of risk adjusted returns but probably more importantly in terms of an investor being able to stick with quant investing over the long term. Scalper1 News

One of the more overlooked areas of quantitative investing is how to integrate quant strategies into a diversified portfolio. Let’s look at a few of the issues involved and some possible solutions. I’ve discussed the big allocation decision already, i.e. how much to put into quant strategies vs. bonds already. I think this decision should be primarily driven by how much risk one is willing to take. I use maximum portfolio drawdown as the primary metric to judge how much risk I’m willing to take. Here is the max drawdown table from that post. For example, to limit annual drawdowns to less than 10% and 30% quant portfolio 70% bond portfolio would be the appropriate allocation. If a 15% max DD is more suited to your risk tolerance then you can go up to a 70% quant portfolio 30% bond portfolio allocation. Of course, this is dependent on the type of quant strategies used but surprisingly it doesn’t matter as much as you may think. The XLP/XLU quant strategy is one of the most conservative strategies while TV is one of the most aggressive and best performing, yet in terms of max DD there is not that big a difference. OK, now for some of the subtle details of building quant portfolios. First, why pick more than one quant strategy? Shouldn’t you just pick the best one with respect to whatever metric you want? I would argue no, mainly due to behavioral factors. Investors have a hard time with underperformance, no matter what the long term track record of a strategy may be. Let’s take this year as an example and compare one of the best performing quant strategies over time, a value and momentum microcap stock quant portfolio, to a conservative utility value strategy. The micro cap quant strategy has returned over 22% a year since the late 60s as compared to 16% a year for the utility value strategy. In 2014, the micro cap strategy is up 3% while the utility strategy is up over 29%! That kind of divergence is hard to swallow for most investors and leads to performance chasing. The best way to avoid this is to choose multiple strategies and choose strategies with high base rates . At the simplest level using more strategies increases the odds that at least one is outperforming and thus lessens the odds of making behavioral mistakes. OK, now that we’re going to choose multiple quant strategies, we need to avoid a few pitfalls. The two big ones for me are over-diversification and excessive fees. The quant strategies I’ve presented on the blog usually have 25 individual stocks in a portfolio. If you’re going to go with 3 quant strategies then we’re talking about 75 individual stocks. Besides paying way more in fees by holding too many stocks we reduce the power of the quant strategies. Two great post on this subject are, Avoid Diworsification , and You need to Dare to be Great . Here is the money pic. (click to enlarge) 10-15 individual stocks gives about the best bang for the buck for any one of the individual quant systems. So let’s say we go a bit crazy and choose 5 different quant systems that we’d like in our overall portfolio. We’ll choose the TV2 systems, the EDY system, the Large stock SHY system, the XLP system, and the XLU system. I’ve posted all of these systems before. See here for a list of all my quant posts. 10 stocks each. Yearly holding period and go back as far as we can, Dec 2008, for the P123 book simulation tool that I use. I’ll call this the Quant 5. Results of the overall quant portfolio are below. (click to enlarge) Pretty impressive results. Over the full period, all of the quant systems beat the market handily. But there have been significant periods of underperformance for several of the systems. For example, over the last 3 years, the EDY systems and the XLU system have underperformed the market and the other systems. The top quant system over the full period from 2008 turned out to be the large stock SHY system even though going back further to 1999, other systems have performed better. Of course, how could you know that before hand? You can’t. Bottom line: It pays to diversify, but not too much. Not just in terms of risk adjusted returns but probably more importantly in terms of an investor being able to stick with quant investing over the long term. Scalper1 News

Scalper1 News