< div i.d.= "articleText" legibility=" 62.350813743219" > Considering the rooting holdings of the ETFs in our protection world at < a href =" https://www.etfchannel.com/ "rel =" nofollow" > ETF Network, we have actually matched up the investing rate of each holding versus the normal professional 12-month onward aim at cost, as well as calculated the heavy typical recommended analyst aim at price for the ETF itself. For the iShares Edge MSCI Multifactor UNITED STATE ETF (Sign: LRGF), our company discovered that the indicated expert target price for the ETF derived after its own underlying holdings is actually $ 26.58 per unit.

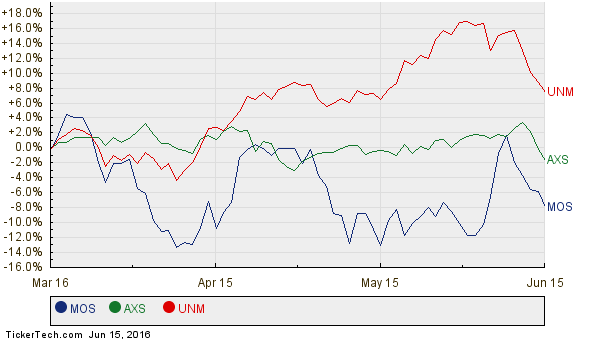

Along with LRGF exchanging at a recent cost near $ 24.00 per system, that suggests that professionals find 10.73% upside for this ETF checking out to the normal professional intendeds from the rooting holdings. Three of LRGF’s hiddening holdings with remarkable advantage to their analyst intended costs are Mosaic Carbon monoxide (Sign: MONTHS), CENTER Initial Holdings Ltd (Symbol: AXS), as well as Unum Group (Symbol: UNM). Although MOS has traded at a current cost of $ 26.29/ contribute, the typical analyst aim at is actually 13.77% greater at $ 29.91/ contribute. Similarly, AXS has 10.86% upside coming from the latest share price from $ 53.35 if the normal expert aim at cost of $ 59.14/ contribute is reached out to, and also professionals on average are actually expecting UNM to connect with an aim at price of $ 37.55/ contribute, which is 10.78% over the current rate of $ 33.90. Below is actually a twelve month price background chart contrasting the supply functionality of MOS, AXS, and UNM:  Below is a rundown table of the existing analyst intended costs discussed over:

Below is a rundown table of the existing analyst intended costs discussed over:

| < table | class= | ” hctblstyle” boundary=” 0″ cellspacing =” 0″ cellpadding= | ” 0″ legibility=” 2″ > | Name< th align =" facility |

|---|---|---|---|---|

| ” > Sign< th align=" right "> Current Cost< th align= "right" | > | Avg. Professional 12-Mo. Aim at % Upside to Intended | < tr readability | |

| =” 2″ > | iShares Side MSCI Multifactor USA ETF | < td align=" facility" > | LRGF< td align=" | |

| right “>$ 24.00< td | align=” right” >$ 26.58< td align=" right" > 10.73% Mosaic Carbon monoxide< td align=" center" > | |||

| MOS< td align=" right" >$ 26.29< td align=" right" >$ 29.91< td align=" right" > 13.77%< tr legibility=" 2" > CENTER Financing Holdings Ltd< td align= |

“center” > AXS $ 53.35< td align=" right "> $ 59.14< td align=" right" > 10.86 % Unum Team< td align= "facility" > UNM< td align=" right" > $ 33.90< td align=" right" > $ 37.55< td align= "right" > 10.78 % Are professionals justified in these aim ats, or even very hopeful about where these supplies will be trading 1 Year coming from right now? Perform the professionals possess a valid justification for their aim ats, or are they responsible for the arc on recent company and also field developments? A higher price intended family member to an inventory’s exchanging rate could mirror positive outlook concerning the future, but can easily additionally be a precursor to target price downgrades if the targets were a relic from the previous. These are inquiries that need further real estate investor research study.

![]() < img class= "articleImgTiny" distance=" 16 "height=" 16" src =" https://www.scalper1.com/wp-content/uploads/2016/06/nslideshow-11.gif"/ >< a href ="

< img class= "articleImgTiny" distance=" 16 "height=" 16" src =" https://www.scalper1.com/wp-content/uploads/2016/06/nslideshow-11.gif"/ >< a href ="

http://www.etfchannel.com/slideshows/ten-etfs-with-most-upside/” rel =” nofollow “> 10 ETFs With Many Upside To Analyst Targets” The beliefs and viewpoints conveyed here are the views and opinions of the writer and do certainly not automatically indicate those of Nasdaq, Inc.

Most current Contents Plantations International