< div i.d.= "articleText" legibility=" 62.377224199288" > Considering the hiddening holdings from the ETFs in our protection cosmos at < a href =" https://www.etfchannel.com/ "rel =" nofollow" > ETF Channel, we have matched up the trading price from each holding from the average analyst 12-month ahead target cost, and also figured out the heavy typical implied expert intended cost for the ETF on its own. For the ProShares S&P FIVE HUNDRED Ex-Energy ETF (Symbol: SPXE), our company discovered that the implied expert intended rate for the ETF derived after its hiddening holdings is actually $ 48.10 each.

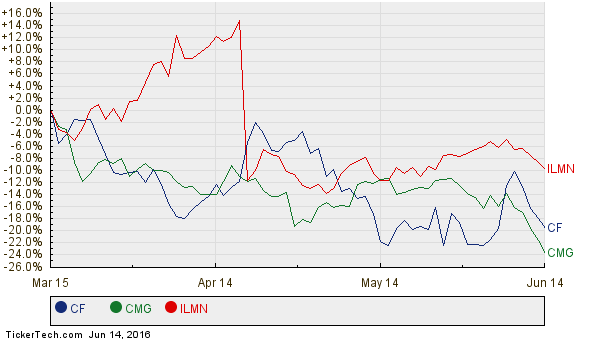

With SPXE investing at a recent rate near $ 43.14 each, that indicates that analysts find 11.50% advantage for this ETF seeming via to the ordinary analyst aim ats of the rooting holdings. 3 from SPXE’s underlying holdings along with remarkable upside to their professional aim at prices are CF Industries Holdings Inc (Icon: CF), Chipotle Mexican Grill Inc (Symbol: CMG), as well as Illumina Inc (Symbol: ILMN). Although CF has traded at a recent rate from $ 28.62/ contribute, the ordinary analyst intended is 13.54% higher at $ 32.49/ reveal. Likewise, CMG possesses 13.09% upside off the latest portion price from $ 394.00 if the normal analyst target cost of $ 445.59/ share is actually connected with, as well as professionals generally are actually assuming ILMN to reach an intended rate from $ 157.46/ reveal, which is 12.71% over the current price from $ 139.71. Below is actually a twelve month rate background record contrasting the supply performance of CF, CMG, and also ILMN:  Below is actually a conclusion table from the present professional target prices talked about above:

Below is actually a conclusion table from the present professional target prices talked about above:

| < dining table | class= | ” hctblstyle” boundary=” 0″ cellspacing =” 0″ cellpadding= | ” 0″ legibility=” 3″ > | Name< th align =" center |

|---|---|---|---|---|

| ” > Symbol< th align =&" right" > Recent Rate< th align= | ” right” > | Avg. Expert 12-Mo. Aim at % Upside to Intended | < tr legibility | |

| =” 2″ > ProShares S&P 500 Ex-Energy ETF< td align=" center" > SPXE< td align=" right" >$ 43.14< td align=" right" >$ 48.10< td align=" right" > 11.50% | ||||

| < tr readability=" 2" > CF Industries Holdings Inc | < td align=" facility" > | CF< td align=" right" >$ 28.62< td align=" | ||

| right” > | $ 32.49< td align=" right" > 13.54%< tr readability=" 2" > Chipotle Mexican Grill Inc< td align=" facility" > CMG< td align= |

“right” > $ 394.00 $ 445.59< td align=" right "> 13.09 % Illumina Inc< td align=" facility" > ILMN< td align =" right" > $ 139.71< td align =" right" > $ 157.46< td align=" right" > 12.71 % Are analysts justified in these targets, or even extremely optimistic about where these supplies will be trading Twelve Month off right now? Carry out the experts possess a valid reason for their targets, or even are they behind the contour on current firm as well as sector property developments? A high rate aim at loved one to an inventory’s trading cost can easily mirror positive outlook concerning the future, but may also be actually a forerunner to target rate downgrades if the targets were actually an antique of recent. These are actually concerns that need additional real estate investor study.

http://www.etfchannel.com/slideshows/ten-etfs-with-most-upside/” rel =” nofollow “> 10 ETFs Along with Most Upside To Professional Targets” The opinions as well as viewpoints revealed within are the beliefs as well as viewpoints of the author and perform not always reflect those from Nasdaq, Inc.

Latest Contents Plantations International