< div i.d.= "articleText" readability=" 62.404199475066" > Checking out the underlying holdings from the ETFs in our protection world at < a href =" https://www.etfchannel.com/ "rel =" nofollow" > ETF Channel, our company have actually compared the trading rate from each holding versus the typical analyst 12-month forward target price, and figured out the heavy typical suggested professional target price for the ETF itself. For the First Depend on Mid Cap Value AlphaDEX Fund ETF (Symbol: FNK), we located that the indicated professional target cost for the ETF derived upon its own hiddening holdings is $ 31.33 each.

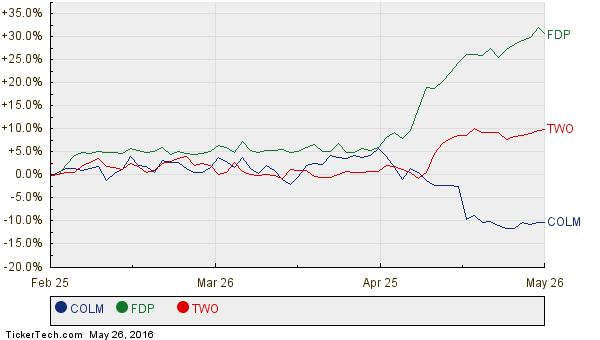

With FNK trading at a current price near $ 28.58 each, that suggests that professionals observe 9.63% advantage for this ETF browsing to the average professional aim ats of the hiddening holdings. Three of FNK’s hiddening holdings along with notable advantage to their expert intended prices are Columbia Sportswear Co. (Sign: COLM), Fresh Del Monte Create Inc. (Symbol: FDP), as well as 2 Harbors Assets Corp (Sign: TWO). Although COLM has actually traded at a current price of $ 53.03/ portion, the typical expert aim at is actually 19.83% higher at $ 63.55/ portion. Similarly, FDP has 14.99% upside coming from the recent share price of $ 52.18 if the average expert target rate from $ 60.00/ reveal is reached, as well as experts on average are actually assuming 2 to reach an aim at cost from $ 9.39/ portion, which is 10.49% above the recent rate from $ 8.50. Below is a twelve month cost background chart matching up the stock performance of COLM, FDP, and TWO:  Below is a review table of the current professional aim at prices explained above:

Below is a review table of the current professional aim at prices explained above:

| < dining table | class= | ” hctblstyle” perimeter=” 0″ cellspacing =” 0″ cellpadding= | ” 0″ readability=” 3″ > | Call< th align =" facility |

|---|---|---|---|---|

| ” > Sign< th align =" right "> Recent Rate< th align=" right" > | Avg. Expert 12-Mo. Intended % Upside to Intended | < tr readability

| =” 2″ > |

| |

| First Depend on Mid Cap Market value AlphaDEX Fund ETF< td align=" facility "> | FNK< td align=" right" >$ 28.58< td align=" right" >$ 31.33< td align=" right" > 9.63% | |||

| Columbia Sports apparel Co.< td align= "center" > | COLM< td align=" right" >$ 53.03< td align=" right" >$ 63.55< td align=" right" > 19.83% | |||

| < tr legibility =" 2" > Clean Del Monte Produce Inc.< td align=" facility" > FDP< td align=" right" >$ 52.18< td align=" right" >$ 60.00< td align=" right" > 14.99% |

2 Harbors Financial investment Corporation< td align=" center "> 2< td align=" right" > $ 8.50< td align= "right" > $ 9.39< td align=" right" > 10.49 % Are analysts justified in these targets, or overly hopeful concerning where these sells will be trading 12 months off right now? Carry out the analysts possess a legitimate reason for their aim ats, or are they about the arc on latest company and also business property developments? A high cost target about a sell’s investing price may demonstrate positive outlook concerning the future, however should additionally be actually a precursor to target cost downgrades if the intendeds were actually an antique of the previous. These are actually inquiries that call for more capitalist study.

http://www.etfchannel.com/slideshows/ten-etfs-with-most-upside/” rel =” nofollow “> 10 ETFs Along with The majority of Upside To Analyst Targets” The opinions and also opinions revealed here are actually the point of views and point of views from the author and do certainly not necessarily show those of Nasdaq, Inc.

Latest Articles Plantations International