Scalper1 News

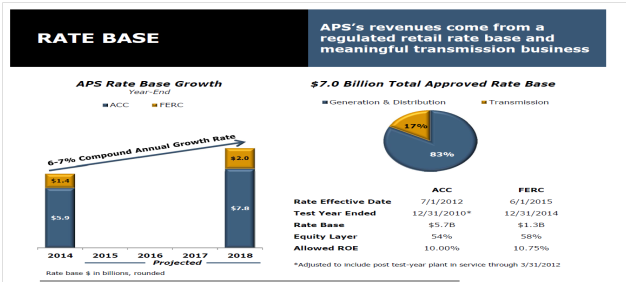

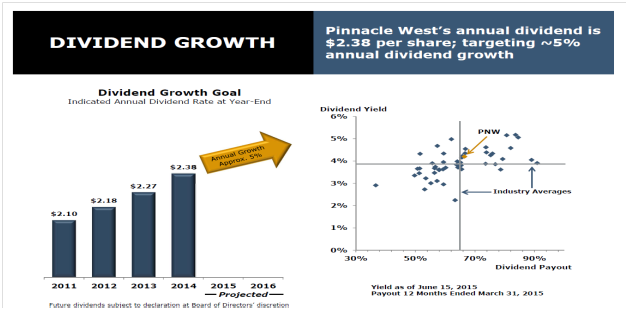

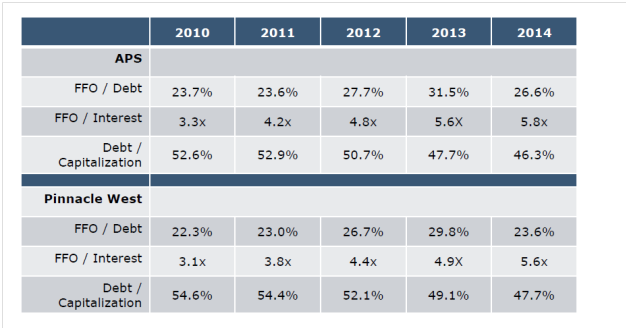

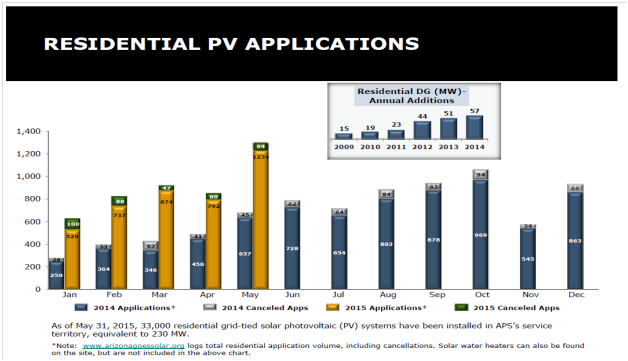

Summary Given PNW’s stock trading at a discount with strong fundamentals, I believe it is a good opportunity for investors to take a position. Strong earnings growth supports dividend growth. Key credit metrics are strong with scope for further improvement. Strong case to take position at the current level. I believe the key drivers for Pinnacle West Capital Corporation’s (NYSE: PNW ) earnings include: (1) solid base growth outlook, (2) around $1.4bn of capex spend/annum, (3) improving industry fundamentals (mainly housing recovery in Arizona), (4) a rate case filing in 2016 for 2017 rates ($60-70m revenue increase), and (5) an attractive valuation. Strong growth outlook More than 90% of PNW’s revenues come from a regulated retail rate base and transmission business (a stable growth business). The rate base growth opportunity for PNW is better than most of the regulated utilities companies (4-6%). The company has guided a rate base growth of 6-7% CAGR from 2014 to 2018. Where is the expected growth to come from? The company has a large spending plan of $3.7bn for 2015-2017, which is higher than its previous $2.7bn spend from 2012-2014. Interestingly, most of the spending will be in transmission and distribution. Investors should know that the increased spending plan should result in compounded annual rate-base growth of above 6%. I believe the company will use most its earnings (around 50%) and raise debt to fund capex and not require any equity issuance that will support the upside for stock. On the margin side, I expect higher margins for PNW given its well-disciplined cost management. Though revenues have grown by 9% in the last four years, operations and maintenance costs (O&M) have grown only by 4%. Moreover, the company estimates flat O&M in a growing phase in the next four years. The company has also guided an EPS growth of 4-6% CAGR from 2014 to 2018. Source: PNW investor presentation Better than industry dividend growth with scope for improvement PNW’s management raised dividend growth guidance last year from 4% off a 2013 base of $2.27 to 5% off a 2014 base of $2.38. The increase in dividend signals that the management is expecting a high EPS growth. I believe this is a positive move from PNW given its high capex spend plan for the next 3 years. The current one-year forward (FY15) dividend yield for PNW is around 4.3%, which is well above the industry average of 4%. I estimate that the dividend payout ratio will stay at the low 60s (similar to the utilities industry) even with 5% annual growth in dividend as the capex spend will take out most of its earnings. Source: PNW investor presentation Key credit metrics remain strong PNW has a solid capital structure with 46% debt/capital. I expect this ratio to increase slightly given higher rate of capex spend (capex guided at 13% CAGR from 2014 to 2017). PNW had an FFO/interest expense ratio of 5.8 in 2014, which is well above the 4-5 times of a typical utility. I expect the ratio to be in a range of 4.5-5 times during the next five years as a result of higher capex spend and interest expenses. The company has around $300m of debt maturing in 2015, $250m in 2016 and $125m in 2017. It has no debt maturities in 2018. In the current debt markets, I do not expect any trouble issuing new debt. I am positive on the company’s approach in using debt and free cash flow to fund future capex/acquisitions and not resorting to equity issuance. Source: PNW investor presentation Increase in solar penetration is not worrisome for PNW but benefiting APS’s power portfolio, a wholly owned subsidiary of PNW, includes 1,200MWs of renewable energy, most of which is solar fueled by Arizona’s abundant sunshine. In the most recent numbers from the Solar Electric Power Association, APS ranked fourth nationally in overall solar capacity, and fifth in solar capacity per customer. APS plans to install 10MWs of solar panels on roughly 1,500 customer homes. The growth in solar is a natural and productive development for Arizona given its significant natural resource base. The permits for new solar projects have remained healthy since 2014 and grown significantly since 2015 for APS. The drop in solar costs has attracted customer interest in adding solar systems leading to significant growth for APS’s renewable energy segment. APS will likely continue to have investment opportunities in both utility scale and distributed solar with the next rate case (the opportunity for the company to pursue additional investments). Source: PNW investor presentation Attractive Valuation With a solid growth outlook (EPS growth of 4-6% from 2014-2018), strong capex plans and continued O&M cost management, PNW will only see upside if the economy starts to get better. I see PNW stock as very attractive relative to peers as it is currently trading at a discount of around 4%. I believe the stock should trade above its peers in the near term, as the probability of the company’s achievement of growth targets is high. I recommend investors to take a position in PNW at the current level to earn at least 16% return (12% share appreciation + 4% dividend yield) in one year. Bear case Base case Bull case 2016 EPS $4.00 2016 EPS $4.10 2016 EPS $4.20 P/E Multiple 15.0x P/E Multiple 15.0x P/E Multiple 15.0x Discount 10.0% Premium 10.0% Premium 20.0% Value $54.00 Value $67.65 Value $75.60 Current price $60.32 Current price $60.32 Current price $60.32 Upside -10.5% Upside 12.2% Upside 25.3% Source: Google Finance Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Given PNW’s stock trading at a discount with strong fundamentals, I believe it is a good opportunity for investors to take a position. Strong earnings growth supports dividend growth. Key credit metrics are strong with scope for further improvement. Strong case to take position at the current level. I believe the key drivers for Pinnacle West Capital Corporation’s (NYSE: PNW ) earnings include: (1) solid base growth outlook, (2) around $1.4bn of capex spend/annum, (3) improving industry fundamentals (mainly housing recovery in Arizona), (4) a rate case filing in 2016 for 2017 rates ($60-70m revenue increase), and (5) an attractive valuation. Strong growth outlook More than 90% of PNW’s revenues come from a regulated retail rate base and transmission business (a stable growth business). The rate base growth opportunity for PNW is better than most of the regulated utilities companies (4-6%). The company has guided a rate base growth of 6-7% CAGR from 2014 to 2018. Where is the expected growth to come from? The company has a large spending plan of $3.7bn for 2015-2017, which is higher than its previous $2.7bn spend from 2012-2014. Interestingly, most of the spending will be in transmission and distribution. Investors should know that the increased spending plan should result in compounded annual rate-base growth of above 6%. I believe the company will use most its earnings (around 50%) and raise debt to fund capex and not require any equity issuance that will support the upside for stock. On the margin side, I expect higher margins for PNW given its well-disciplined cost management. Though revenues have grown by 9% in the last four years, operations and maintenance costs (O&M) have grown only by 4%. Moreover, the company estimates flat O&M in a growing phase in the next four years. The company has also guided an EPS growth of 4-6% CAGR from 2014 to 2018. Source: PNW investor presentation Better than industry dividend growth with scope for improvement PNW’s management raised dividend growth guidance last year from 4% off a 2013 base of $2.27 to 5% off a 2014 base of $2.38. The increase in dividend signals that the management is expecting a high EPS growth. I believe this is a positive move from PNW given its high capex spend plan for the next 3 years. The current one-year forward (FY15) dividend yield for PNW is around 4.3%, which is well above the industry average of 4%. I estimate that the dividend payout ratio will stay at the low 60s (similar to the utilities industry) even with 5% annual growth in dividend as the capex spend will take out most of its earnings. Source: PNW investor presentation Key credit metrics remain strong PNW has a solid capital structure with 46% debt/capital. I expect this ratio to increase slightly given higher rate of capex spend (capex guided at 13% CAGR from 2014 to 2017). PNW had an FFO/interest expense ratio of 5.8 in 2014, which is well above the 4-5 times of a typical utility. I expect the ratio to be in a range of 4.5-5 times during the next five years as a result of higher capex spend and interest expenses. The company has around $300m of debt maturing in 2015, $250m in 2016 and $125m in 2017. It has no debt maturities in 2018. In the current debt markets, I do not expect any trouble issuing new debt. I am positive on the company’s approach in using debt and free cash flow to fund future capex/acquisitions and not resorting to equity issuance. Source: PNW investor presentation Increase in solar penetration is not worrisome for PNW but benefiting APS’s power portfolio, a wholly owned subsidiary of PNW, includes 1,200MWs of renewable energy, most of which is solar fueled by Arizona’s abundant sunshine. In the most recent numbers from the Solar Electric Power Association, APS ranked fourth nationally in overall solar capacity, and fifth in solar capacity per customer. APS plans to install 10MWs of solar panels on roughly 1,500 customer homes. The growth in solar is a natural and productive development for Arizona given its significant natural resource base. The permits for new solar projects have remained healthy since 2014 and grown significantly since 2015 for APS. The drop in solar costs has attracted customer interest in adding solar systems leading to significant growth for APS’s renewable energy segment. APS will likely continue to have investment opportunities in both utility scale and distributed solar with the next rate case (the opportunity for the company to pursue additional investments). Source: PNW investor presentation Attractive Valuation With a solid growth outlook (EPS growth of 4-6% from 2014-2018), strong capex plans and continued O&M cost management, PNW will only see upside if the economy starts to get better. I see PNW stock as very attractive relative to peers as it is currently trading at a discount of around 4%. I believe the stock should trade above its peers in the near term, as the probability of the company’s achievement of growth targets is high. I recommend investors to take a position in PNW at the current level to earn at least 16% return (12% share appreciation + 4% dividend yield) in one year. Bear case Base case Bull case 2016 EPS $4.00 2016 EPS $4.10 2016 EPS $4.20 P/E Multiple 15.0x P/E Multiple 15.0x P/E Multiple 15.0x Discount 10.0% Premium 10.0% Premium 20.0% Value $54.00 Value $67.65 Value $75.60 Current price $60.32 Current price $60.32 Current price $60.32 Upside -10.5% Upside 12.2% Upside 25.3% Source: Google Finance Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News