Scalper1 News

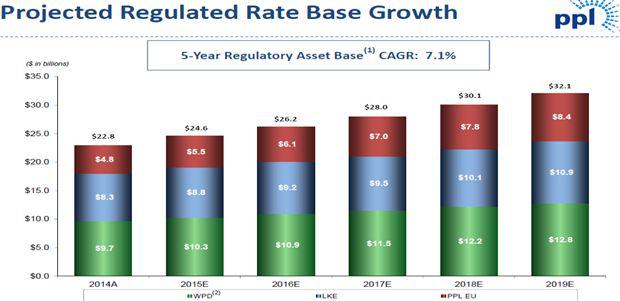

Summary Growth investments directed at becoming a regulated utility company and recent competitive business spin-off will ensure earnings growth in the years ahead. Transformation into 100% regulated utility will ensure cash flow stability and strengthen EPS. PPL currently offers an attractive dividend yield of 4.90%, and remains on track to consistently increase dividends in years ahead. I reiterate my bullish stance on PPL Corporation (NYSE: PPL ); the company is moving ahead with its long-term growth generating investments in order to better its operational performance and keep its financial growth momentum healthy. Moreover, with the completion of its competitive business unit spin off, PPL has increased its focus on regulated utilities, which will mean more upside for its future earnings growth. Considering the fact that the company has been improving its regulated operations and is continuing with growth investments to expand them further, I believe PPL’s cash flows will remain strong in the years ahead, which will ensure the sustainability of its future dividend payments. Furthermore, the company’s future dividend growth is expected to improve. Growth Initiatives Remain On Track In the recent past, utility companies have been making infrastructure development spending to expand their operational bases. As per EIA reports, utility companies’ growth investments will help increase electricity generation in the U.S. by 1.1% and 0.9% in 2015 and 2016, respectively. Moreover, EIA reports have predicted that the increased generation capacity will help utilities raise retail residential prices in 2015 by 1.1% and in 2016 by 1.8%. Given this constructive utility sector’s rate outlook, I believe that utility companies will continue with their infrastructure development projects, which will portend well for earnings and cash flow growth of the industry in the years ahead. As far as PPL is concerned, under its robust strategic growth efforts, the company has been making growth investments towards the development of its transmission and distribution networks in order to capitalize on the available growth potentials. In the past decade, PPL had invested almost $4.7 billion for network rebuilding and up-gradation and it expects to make an additional $5.7 billion of investment over the next five years. As part of its growth investment plan, the company had previously invested in the Susquehanna-Roseland power project, which will strengthen its regulated transmission operations in the region. Moreover, the $1.4 billion power-line construction project will benefit the customers by delivering them power without putting an extra burden on other regional power lines. Moreover, PPL’s $563 million worth Kentucky-based combined natural gas cycle plant Cane Run 7 will be operational soon. These ongoing investments in construction projects will serve as an important means of regulated rate base growth in the years ahead, which will benefit the company’s top-line and will strengthen its cash flows. The following chart shows that PPL’s management expects healthy, regulated rate base growth over the next five years. Source: Company’s Earnings Presentation Making its moves towards generating regulated rate base growth, PPL has filed a rate base increase case with the Pennsylvania Utility Commission (PUC) on an estimated ROE of 10.95%; if approved, the rate hike will add revenues of almost $167.5 million per year, after coming into effect on 1st January 2016. I believe that the rate increase will in fact improve its cash flows, which will back its ongoing growth investments. Moreover, the company, combined with other parties of LG&E and KU generation stations, has reached a settlement agreement of raising electric and gas rates by $132 million. Effective from 1st July 2015, the new rate hike will help it recover the cost of constructing Cane Run natural gas plant and will better its long-term earnings growth prospects. Furthermore, as part of its plan to focus on a broader regulated asset base, PPL recently completed the spinoff of its competitive energy business by combining with River Stone Holdings, and formed a separate entity named Talen Energy Corporation. I believe that after the spinoff, PPL being solely focused on regulated asset base, will strengthen its top-line and bottom-line numbers, and its cash flow certainty will improve, which will support its dividend growth. Safe & Sustainable Dividends PPL has been making attractive cash returns to its shareholders by regularly returning cash flows in the form of dividends. During 1Q’15, dividend payments made by the company were $250 million, up 6.8%, year-over-year. Moreover, PPL had recently announced its quarterly dividend payment of $0.3725 per share , which translates into a healthy dividend yield of 4.90% . Moving ahead, AEP’s cash flow will improve, which will help PPL make regular dividend payments. Owing to the company’s correct growth measures, I believe the company’s future cash flows will remain strong, which will allow the company to consistently increase dividends. Guidance Due to the company’s strong financial performance and due to its attractive, planned infrastructure development projects, the management’s confidence in PPL’s earnings growth prospects have been restored, due to which they have reiterated their previously earnings guidance. The company continues to believe that its EPS for full year 2015 will remain in a range of $2.05-to-$2.25 . Moreover, PPL’s management remains confident about achieving its long-term annual earnings growth rate 4%-to-6%. Risks The company’s future financial performance remains exposed to a risk of increase in regulatory restrictions. Moreover, any laxness shown by the management during the execution of its well thought-out capital expenditure plan will hurt PPL’s long-term earnings growth potentials. In addition, unforeseen negative economic changes, currency headwinds and unfavorable weather changes are key risks that might hamper the company’s future stock price performance. Conclusion I am bullish on PPL; the company has an attractive growth outlook. PPL’s growth investments directed at becoming a regulated utility company, and the recent competitive business spin-off have directed it in the direction of earning better revenues and experiencing earnings growth in the years ahead. In fact, transformation into a 100% regulated utility will ensure cash flow stability and strengthen its EPS, which makes it attractive for dividend-seeking investors. The company currently offers an attractive dividend yield of 4.90%, and remains on track to consistently increase dividends in the years ahead. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Growth investments directed at becoming a regulated utility company and recent competitive business spin-off will ensure earnings growth in the years ahead. Transformation into 100% regulated utility will ensure cash flow stability and strengthen EPS. PPL currently offers an attractive dividend yield of 4.90%, and remains on track to consistently increase dividends in years ahead. I reiterate my bullish stance on PPL Corporation (NYSE: PPL ); the company is moving ahead with its long-term growth generating investments in order to better its operational performance and keep its financial growth momentum healthy. Moreover, with the completion of its competitive business unit spin off, PPL has increased its focus on regulated utilities, which will mean more upside for its future earnings growth. Considering the fact that the company has been improving its regulated operations and is continuing with growth investments to expand them further, I believe PPL’s cash flows will remain strong in the years ahead, which will ensure the sustainability of its future dividend payments. Furthermore, the company’s future dividend growth is expected to improve. Growth Initiatives Remain On Track In the recent past, utility companies have been making infrastructure development spending to expand their operational bases. As per EIA reports, utility companies’ growth investments will help increase electricity generation in the U.S. by 1.1% and 0.9% in 2015 and 2016, respectively. Moreover, EIA reports have predicted that the increased generation capacity will help utilities raise retail residential prices in 2015 by 1.1% and in 2016 by 1.8%. Given this constructive utility sector’s rate outlook, I believe that utility companies will continue with their infrastructure development projects, which will portend well for earnings and cash flow growth of the industry in the years ahead. As far as PPL is concerned, under its robust strategic growth efforts, the company has been making growth investments towards the development of its transmission and distribution networks in order to capitalize on the available growth potentials. In the past decade, PPL had invested almost $4.7 billion for network rebuilding and up-gradation and it expects to make an additional $5.7 billion of investment over the next five years. As part of its growth investment plan, the company had previously invested in the Susquehanna-Roseland power project, which will strengthen its regulated transmission operations in the region. Moreover, the $1.4 billion power-line construction project will benefit the customers by delivering them power without putting an extra burden on other regional power lines. Moreover, PPL’s $563 million worth Kentucky-based combined natural gas cycle plant Cane Run 7 will be operational soon. These ongoing investments in construction projects will serve as an important means of regulated rate base growth in the years ahead, which will benefit the company’s top-line and will strengthen its cash flows. The following chart shows that PPL’s management expects healthy, regulated rate base growth over the next five years. Source: Company’s Earnings Presentation Making its moves towards generating regulated rate base growth, PPL has filed a rate base increase case with the Pennsylvania Utility Commission (PUC) on an estimated ROE of 10.95%; if approved, the rate hike will add revenues of almost $167.5 million per year, after coming into effect on 1st January 2016. I believe that the rate increase will in fact improve its cash flows, which will back its ongoing growth investments. Moreover, the company, combined with other parties of LG&E and KU generation stations, has reached a settlement agreement of raising electric and gas rates by $132 million. Effective from 1st July 2015, the new rate hike will help it recover the cost of constructing Cane Run natural gas plant and will better its long-term earnings growth prospects. Furthermore, as part of its plan to focus on a broader regulated asset base, PPL recently completed the spinoff of its competitive energy business by combining with River Stone Holdings, and formed a separate entity named Talen Energy Corporation. I believe that after the spinoff, PPL being solely focused on regulated asset base, will strengthen its top-line and bottom-line numbers, and its cash flow certainty will improve, which will support its dividend growth. Safe & Sustainable Dividends PPL has been making attractive cash returns to its shareholders by regularly returning cash flows in the form of dividends. During 1Q’15, dividend payments made by the company were $250 million, up 6.8%, year-over-year. Moreover, PPL had recently announced its quarterly dividend payment of $0.3725 per share , which translates into a healthy dividend yield of 4.90% . Moving ahead, AEP’s cash flow will improve, which will help PPL make regular dividend payments. Owing to the company’s correct growth measures, I believe the company’s future cash flows will remain strong, which will allow the company to consistently increase dividends. Guidance Due to the company’s strong financial performance and due to its attractive, planned infrastructure development projects, the management’s confidence in PPL’s earnings growth prospects have been restored, due to which they have reiterated their previously earnings guidance. The company continues to believe that its EPS for full year 2015 will remain in a range of $2.05-to-$2.25 . Moreover, PPL’s management remains confident about achieving its long-term annual earnings growth rate 4%-to-6%. Risks The company’s future financial performance remains exposed to a risk of increase in regulatory restrictions. Moreover, any laxness shown by the management during the execution of its well thought-out capital expenditure plan will hurt PPL’s long-term earnings growth potentials. In addition, unforeseen negative economic changes, currency headwinds and unfavorable weather changes are key risks that might hamper the company’s future stock price performance. Conclusion I am bullish on PPL; the company has an attractive growth outlook. PPL’s growth investments directed at becoming a regulated utility company, and the recent competitive business spin-off have directed it in the direction of earning better revenues and experiencing earnings growth in the years ahead. In fact, transformation into a 100% regulated utility will ensure cash flow stability and strengthen its EPS, which makes it attractive for dividend-seeking investors. The company currently offers an attractive dividend yield of 4.90%, and remains on track to consistently increase dividends in the years ahead. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News