Scalper1 News

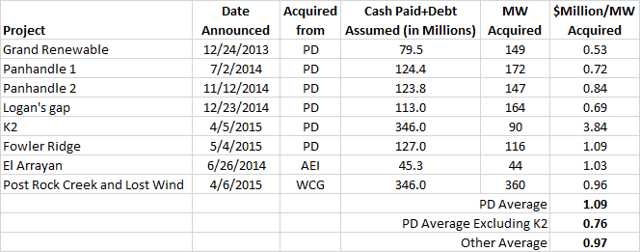

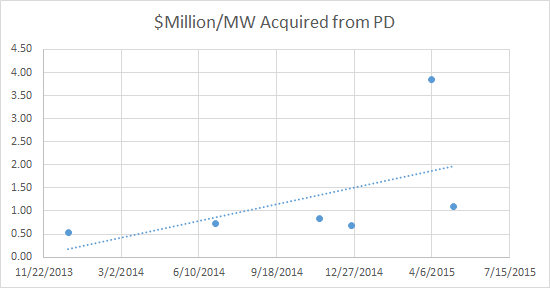

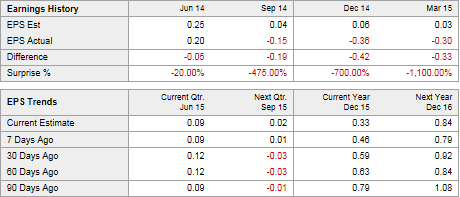

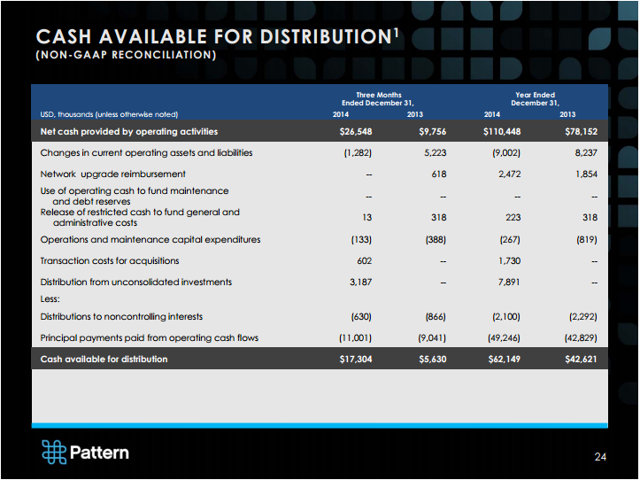

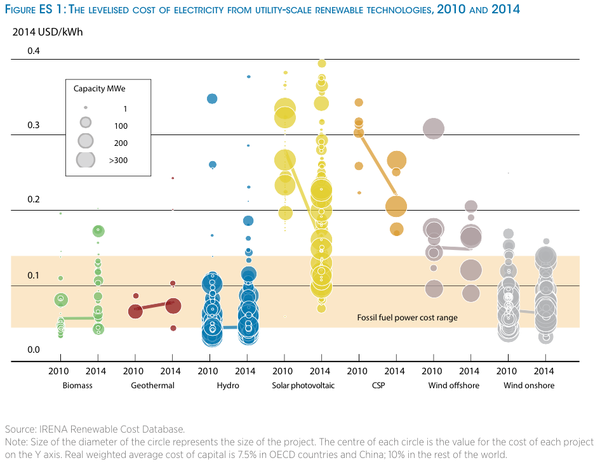

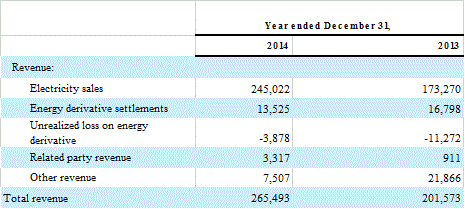

Dividends are increasing despite shrinking Cash Available For Distribution, earnings estimates falling considerably, and increasing share count. PEGI’s parent company, Pattern Development, is dumping shares while selling assets to PEGI at higher and higher prices and sharing a CEO and other executives with PEGI. PEGI’s acquisitions from PD and the dividends are funded by public offerings which are dependent on dividend-hungry investors. Something has to give. Pattern Energy Group (NASDAQ: PEGI ) is an “independent power company focused on owning and operating power projects … [they] hold interests in twelve wind power projects located in the United States, Canada and Chile that use proven, best-in-class technology and have a total owned capacity of 1,636 MW.” Pattern is part of a recently developed genre of so-called “YieldCos”, which also includes companies like TerraForm Power (NASDAQ: TERP ), Abengoa Yield (NASDAQ: ABY ) and Nextera (NYSE: NEP ). These companies generally buy energy projects from a parent company and then distribute the proceeds from their operations as dividends. There are three things about Pattern that in my eyes sets them apart from other YieldCo’s. Any of these things individually isn’t necessarily a problem, but together they paint an interesting picture: Their portfolio is exclusively (with one small exception) wind energy projects and thus more susceptible to irregular weather patterns like El-Nino. Pattern’s parent has only a 25% (and shrinking) ownership interest in Pattern. Pattern shares executives with their parent company. This article is nothing more than a close reading of PEGI’s 2014 10-K. ( https://www.sec.gov/Archives/edgar/data/1561660/000119312515073104/d842437d10k.htm ). Let’s get to the 10-K, where PEGI discusses another company, Pattern Development (I will refer to them as PD): We are party to the Management Services Agreement, pursuant to which each of our executive officers (including our Chief Executive Officer), with the exception of our Chief Financial Officer and Senior Vice President, Operations, is a shared PEG executive and devotes time to both our company and Pattern Development as needed to conduct our respective businesses. As a result, these shared PEG executives have fiduciary and other duties to Pattern Development. Conflicts of interest may arise in the future between our company (including our stockholders other than Pattern Development) and Pattern Development (and its owners and affiliates). .. Pattern Development’s general partner and certain of its officers and directors also have a fiduciary duty to act in the best interest of Pattern Development’s limited partners, which interest may differ from or conflict with that of our company and our other stockholders. Emphasis mine. PEGI and PD share a CEO and other officers. This may be a problem since PEGI acquires power projects from PD. In fact, acquiring from PD is PEGI’s stated growth strategy. It is also worth noting that many of their executives immediately before Pattern worked at Babcock and Brown, an investment firm that went bankrupt in 2009. Our growth strategy is focused on the acquisition of operational and construction-ready power projects from Pattern Development and other third parties that we believe will contribute to the growth of our business and enable us to increase our dividend per Class A share over time. We expect that our continuing relationship with Pattern Development, a leading developer of renewable energy projects, will be an important source of growth for our business. I have assembled the data about Pattern’s acquisitions. Here is what I have observed: (click to enlarge) As you can see, they are generally pretty fair regarding prices paid to PD versus prices paid to other parties, with one giant exception, that being K2 which was announced in early April of this year. The average price paid to PD per MW of the above is $1.09M. The average price paid to others is $0.97M, and the average price paid to PD, excluding K2, is $0.76M. In other words, the recent K2 acquisition sticks out like a sore thumb and I would be curious to know their rationale for paying such a high price, especially given that it is the largest acquisition in absolute dollars as well as $/MW but one of the smallest in terms of MW of capacity acquired. Maybe they got a high $/MWh power purchase contract out of it. I should note that $/MW isn’t the end-all-be-all of metrics, but it’s all we have, and as Berkshire Hathaway’s Charlie Munger has said, roughly, “If we see someone who weighs 300 pounds or 320 pounds, it doesnt matter-we know they’re fat.” The cost paid per MW for acquisitions from PD has steadily risen, whether we include K2 or not: Meanwhile, PD is dumping PEGI shares while PEGI does public offerings. Additionally, PD is using their PEGI shares as margin on a loan: In May 2014, we completed a follow-on offering of our Class A shares. In total, 21,117,171 Class A shares were sold. Of this amount, we sold 10,810,810 Class A shares and Pattern Development, a selling stockholder, sold 10,306,361 of our Class A shares . In addition, in February 2015, we completed another follow-on offering of our Class A shares. In total 12,000,000 Class A shares were sold. Of this amount, we issued and sold 7,000,000 Class A shares and Pattern Development, a selling shareholder, sold 5,000,000 of our Class A shares … …In addition, on May 6, 2014, Pattern Development entered into a loan agreement pursuant to which it may pledge up to 18,700,000 Class A shares to secure a $100.0 million loan . If Pattern Development were to default on its obligations under the loan, the lenders, upon the expiration of certain lock-up agreements, would have the right to sell shares to satisfy Pattern Development’s obligation. Such an event could cause our stock price to decline… Last year, PEGI paid about $52M in dividends. This year, they converted their Class B shares to Class A, and issued more class A shares as mentioned above, so they’ll have to pay more in total dollar terms for the same amount of dividends per share. They recently reported Q1 2015 quarterly Cash Available for Distribution (CAFD) of $9M and announced a quarterly dividend of around $23M. Thus, CAFD as they define it wasn’t enough to cover their recent dividend. On the recent conference call, they mentioned that they have some “CAFD-like” cash-flows that aren’t included in CAFD but can be used to cover the dividend. This seems to me to be “moving the goalposts” but it is perfectly possible that it is the case. PEGI’s earnings have been consistently below estimates, and their future earnings estimates are falling considerably, creating doubt in my mind that they can hit their growth targets. The following shows their Q4 2014 calculation of “Cash Available For Distribution”, or CAFD, which they just announced will grow at a 12-15% CAGR for the next 3 years ( http://files.shareholder.com/downloads/AMDA-25NBHH/80126018x0x814874/0629F770-71BB-47FE-83CD-658E363DCA8B/03.03.15_PEGI_presentation.pdf ): (click to enlarge) You will notice that in their calculation of Cash available for distribution, they account for Operations and Maintenance (O&M) capex. Somehow, this may not be enough to maintain their operating performance. From the same document: However, cash available for distribution has limitations as an analytical tool because it excludes depreciation and accretion, does not capture the level of capital expenditures necessary to maintain the operating performance of our projects , is not reduced for principal payments on our project indebtedness except to the extent it is paid from operating cash flows during a period, and excludes the effect of certain other cash flow items, all of which could have a material effect on our financial condition and results from operations. Emphasis mine. If “O&M capex” isn’t enough to maintain the operating performance, then either they are skimping on O&M capex, or more capex should be considered O&M capex for their calculation of CAFD. Either way, by their own admission, CAFD doesn’t reflect the amount of CapEx necessary to maintain operating performance. Long term, wind energy is of questionable value compared to solar in my view. However, Pattern has locked in fixed purchased power agreements where they get to sell all of the power produced at a price that either is fixed or escalates with CPI. Thus, they have protected themselves from falling electricity demand. On the flip side, if demand rises they don’t have pricing power. Fixed prices are not advantageous if inflation ever picks up, since their costs would rise much faster than revenues. Near term, there are not major threats to wind production, but in the very long term, distributed solar generation could make it difficult for utilities to add more fixed purchased power contracts, or to follow through with their fixed power purchase contracts. The cost of solar power decreases (see Swanson’s Law ) by roughly one-half every 10 years. Wind energy does not have the same advances in efficiency: There may be a time in the future where solar power is efficient to the point that wind power is rendered too expensive to use, the cash flows from wind projects may not run as far into the future as expected when they are built. One last interesting bit I noticed in the 10-K: Our proportional MWh sold in the year ended December 31, 2014 was 2,914,810 MWh, as compared to 1,771,772 MWh in the year ended December 31, 2013, representing an increase of 1,143,038 MWh or approximately 65% . This increase in proportional MWh sold during 2014 as compared to 2013 was primarily attributable to the commencement of commercial operations at South Kent, El Arrayán, Panhandle 1 and Panhandle 2 at various times during the year and an increase in production from an additional 42 MW at Ocotillo for the full year of 2014. Our average realized electricity price was approximately $88 per MWh during the year ended December 31, 2014 as compared to approximately $88 per MWh in the prior year. Between 2013 and 2014 prices per MWh remained constant while proportional MWh sold increased a whopping 65%! However, as far as I can tell, no meaningful part of their revenue grew 65%. Perhaps they use a simple average rather than a weighted average, but that wouldn’t make sense in my view. In conclusion, while the ~5% dividend yield may look attractive, it would be inadvisable to buy this stock for a sustained dividend, in view of the above. There are of course risks to the concerns raised in this article. It is possible that the wind picks up substantially, they are able to generate enough cash from their new acquisitions to sustain the dividend, they can tap the capital markets to cheaply raise more cash, and that the amount of capex necessary to maintain operating performance is negligibly larger than the O&M capex they use to calculate CAFD. Perhaps they are able to diversify into more solar projects. Trading at over 7x Sales, though, a lot has to go right to justify their valuation in my view. I reached out to their IR department through their website about conflicts of interest, the Conflicts Committee, their acquisitions, O&M Capex, and why revenues didn’t grow as much as Average Price times MWh sold. I received no response. Disclosure: The author is short PEGI. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Dividends are increasing despite shrinking Cash Available For Distribution, earnings estimates falling considerably, and increasing share count. PEGI’s parent company, Pattern Development, is dumping shares while selling assets to PEGI at higher and higher prices and sharing a CEO and other executives with PEGI. PEGI’s acquisitions from PD and the dividends are funded by public offerings which are dependent on dividend-hungry investors. Something has to give. Pattern Energy Group (NASDAQ: PEGI ) is an “independent power company focused on owning and operating power projects … [they] hold interests in twelve wind power projects located in the United States, Canada and Chile that use proven, best-in-class technology and have a total owned capacity of 1,636 MW.” Pattern is part of a recently developed genre of so-called “YieldCos”, which also includes companies like TerraForm Power (NASDAQ: TERP ), Abengoa Yield (NASDAQ: ABY ) and Nextera (NYSE: NEP ). These companies generally buy energy projects from a parent company and then distribute the proceeds from their operations as dividends. There are three things about Pattern that in my eyes sets them apart from other YieldCo’s. Any of these things individually isn’t necessarily a problem, but together they paint an interesting picture: Their portfolio is exclusively (with one small exception) wind energy projects and thus more susceptible to irregular weather patterns like El-Nino. Pattern’s parent has only a 25% (and shrinking) ownership interest in Pattern. Pattern shares executives with their parent company. This article is nothing more than a close reading of PEGI’s 2014 10-K. ( https://www.sec.gov/Archives/edgar/data/1561660/000119312515073104/d842437d10k.htm ). Let’s get to the 10-K, where PEGI discusses another company, Pattern Development (I will refer to them as PD): We are party to the Management Services Agreement, pursuant to which each of our executive officers (including our Chief Executive Officer), with the exception of our Chief Financial Officer and Senior Vice President, Operations, is a shared PEG executive and devotes time to both our company and Pattern Development as needed to conduct our respective businesses. As a result, these shared PEG executives have fiduciary and other duties to Pattern Development. Conflicts of interest may arise in the future between our company (including our stockholders other than Pattern Development) and Pattern Development (and its owners and affiliates). .. Pattern Development’s general partner and certain of its officers and directors also have a fiduciary duty to act in the best interest of Pattern Development’s limited partners, which interest may differ from or conflict with that of our company and our other stockholders. Emphasis mine. PEGI and PD share a CEO and other officers. This may be a problem since PEGI acquires power projects from PD. In fact, acquiring from PD is PEGI’s stated growth strategy. It is also worth noting that many of their executives immediately before Pattern worked at Babcock and Brown, an investment firm that went bankrupt in 2009. Our growth strategy is focused on the acquisition of operational and construction-ready power projects from Pattern Development and other third parties that we believe will contribute to the growth of our business and enable us to increase our dividend per Class A share over time. We expect that our continuing relationship with Pattern Development, a leading developer of renewable energy projects, will be an important source of growth for our business. I have assembled the data about Pattern’s acquisitions. Here is what I have observed: (click to enlarge) As you can see, they are generally pretty fair regarding prices paid to PD versus prices paid to other parties, with one giant exception, that being K2 which was announced in early April of this year. The average price paid to PD per MW of the above is $1.09M. The average price paid to others is $0.97M, and the average price paid to PD, excluding K2, is $0.76M. In other words, the recent K2 acquisition sticks out like a sore thumb and I would be curious to know their rationale for paying such a high price, especially given that it is the largest acquisition in absolute dollars as well as $/MW but one of the smallest in terms of MW of capacity acquired. Maybe they got a high $/MWh power purchase contract out of it. I should note that $/MW isn’t the end-all-be-all of metrics, but it’s all we have, and as Berkshire Hathaway’s Charlie Munger has said, roughly, “If we see someone who weighs 300 pounds or 320 pounds, it doesnt matter-we know they’re fat.” The cost paid per MW for acquisitions from PD has steadily risen, whether we include K2 or not: Meanwhile, PD is dumping PEGI shares while PEGI does public offerings. Additionally, PD is using their PEGI shares as margin on a loan: In May 2014, we completed a follow-on offering of our Class A shares. In total, 21,117,171 Class A shares were sold. Of this amount, we sold 10,810,810 Class A shares and Pattern Development, a selling stockholder, sold 10,306,361 of our Class A shares . In addition, in February 2015, we completed another follow-on offering of our Class A shares. In total 12,000,000 Class A shares were sold. Of this amount, we issued and sold 7,000,000 Class A shares and Pattern Development, a selling shareholder, sold 5,000,000 of our Class A shares … …In addition, on May 6, 2014, Pattern Development entered into a loan agreement pursuant to which it may pledge up to 18,700,000 Class A shares to secure a $100.0 million loan . If Pattern Development were to default on its obligations under the loan, the lenders, upon the expiration of certain lock-up agreements, would have the right to sell shares to satisfy Pattern Development’s obligation. Such an event could cause our stock price to decline… Last year, PEGI paid about $52M in dividends. This year, they converted their Class B shares to Class A, and issued more class A shares as mentioned above, so they’ll have to pay more in total dollar terms for the same amount of dividends per share. They recently reported Q1 2015 quarterly Cash Available for Distribution (CAFD) of $9M and announced a quarterly dividend of around $23M. Thus, CAFD as they define it wasn’t enough to cover their recent dividend. On the recent conference call, they mentioned that they have some “CAFD-like” cash-flows that aren’t included in CAFD but can be used to cover the dividend. This seems to me to be “moving the goalposts” but it is perfectly possible that it is the case. PEGI’s earnings have been consistently below estimates, and their future earnings estimates are falling considerably, creating doubt in my mind that they can hit their growth targets. The following shows their Q4 2014 calculation of “Cash Available For Distribution”, or CAFD, which they just announced will grow at a 12-15% CAGR for the next 3 years ( http://files.shareholder.com/downloads/AMDA-25NBHH/80126018x0x814874/0629F770-71BB-47FE-83CD-658E363DCA8B/03.03.15_PEGI_presentation.pdf ): (click to enlarge) You will notice that in their calculation of Cash available for distribution, they account for Operations and Maintenance (O&M) capex. Somehow, this may not be enough to maintain their operating performance. From the same document: However, cash available for distribution has limitations as an analytical tool because it excludes depreciation and accretion, does not capture the level of capital expenditures necessary to maintain the operating performance of our projects , is not reduced for principal payments on our project indebtedness except to the extent it is paid from operating cash flows during a period, and excludes the effect of certain other cash flow items, all of which could have a material effect on our financial condition and results from operations. Emphasis mine. If “O&M capex” isn’t enough to maintain the operating performance, then either they are skimping on O&M capex, or more capex should be considered O&M capex for their calculation of CAFD. Either way, by their own admission, CAFD doesn’t reflect the amount of CapEx necessary to maintain operating performance. Long term, wind energy is of questionable value compared to solar in my view. However, Pattern has locked in fixed purchased power agreements where they get to sell all of the power produced at a price that either is fixed or escalates with CPI. Thus, they have protected themselves from falling electricity demand. On the flip side, if demand rises they don’t have pricing power. Fixed prices are not advantageous if inflation ever picks up, since their costs would rise much faster than revenues. Near term, there are not major threats to wind production, but in the very long term, distributed solar generation could make it difficult for utilities to add more fixed purchased power contracts, or to follow through with their fixed power purchase contracts. The cost of solar power decreases (see Swanson’s Law ) by roughly one-half every 10 years. Wind energy does not have the same advances in efficiency: There may be a time in the future where solar power is efficient to the point that wind power is rendered too expensive to use, the cash flows from wind projects may not run as far into the future as expected when they are built. One last interesting bit I noticed in the 10-K: Our proportional MWh sold in the year ended December 31, 2014 was 2,914,810 MWh, as compared to 1,771,772 MWh in the year ended December 31, 2013, representing an increase of 1,143,038 MWh or approximately 65% . This increase in proportional MWh sold during 2014 as compared to 2013 was primarily attributable to the commencement of commercial operations at South Kent, El Arrayán, Panhandle 1 and Panhandle 2 at various times during the year and an increase in production from an additional 42 MW at Ocotillo for the full year of 2014. Our average realized electricity price was approximately $88 per MWh during the year ended December 31, 2014 as compared to approximately $88 per MWh in the prior year. Between 2013 and 2014 prices per MWh remained constant while proportional MWh sold increased a whopping 65%! However, as far as I can tell, no meaningful part of their revenue grew 65%. Perhaps they use a simple average rather than a weighted average, but that wouldn’t make sense in my view. In conclusion, while the ~5% dividend yield may look attractive, it would be inadvisable to buy this stock for a sustained dividend, in view of the above. There are of course risks to the concerns raised in this article. It is possible that the wind picks up substantially, they are able to generate enough cash from their new acquisitions to sustain the dividend, they can tap the capital markets to cheaply raise more cash, and that the amount of capex necessary to maintain operating performance is negligibly larger than the O&M capex they use to calculate CAFD. Perhaps they are able to diversify into more solar projects. Trading at over 7x Sales, though, a lot has to go right to justify their valuation in my view. I reached out to their IR department through their website about conflicts of interest, the Conflicts Committee, their acquisitions, O&M Capex, and why revenues didn’t grow as much as Average Price times MWh sold. I received no response. Disclosure: The author is short PEGI. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News