Scalper1 News

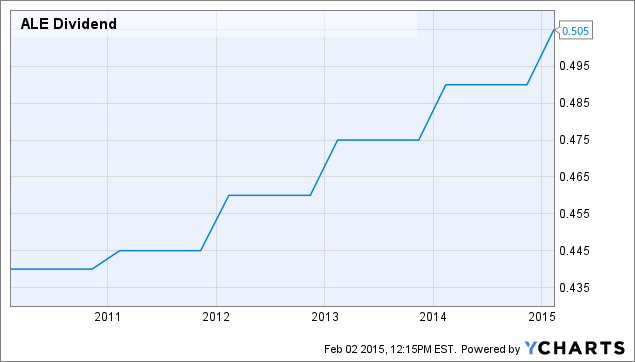

The company has paid dividends consecutively since 1950. The shares currently sport a yield of about 3.57%. Growth of the company points directly to further growth of the dividend. As I continue my never-ending quest to find quality companies with safe, and attractive dividends, my search led me to ALLETE, Inc (NYSE: ALE ). The diversified utility company mainly focuses on electric generation in Minnesota, North Dakota, and Wisconsin. Founded in 1906, the company has a rich history, but I am more interested in its dividend history. In late January it raised its dividend 3.1% to 50.5 cents a quarter. With the raise the company now sports a 3.57% yield that is very attractive in my eyes. This was the fourth straight year of a raise, according to Dividends.com. This doesn’t seem like that much, but what I view as being just as important is consistency. Even so I believe going forward the company will continue this track of dividend growth and that is one of the main reasons I’m a fan. ALE Dividend data by YCharts The company has paid a consecutive dividend since 1950, and this is most definitely not going to change anytime soon. Some don’t like to reference the past to point to the future, however, I always believe a strong dividend history is a plus. It shows the company is dedicated to maintaining its dividend even when the market may be bad overall. On a different note, growth is setting up nicely for the company and the chart below illustrates this beautifully. year Revenue Earnings Per Share 2013 $1.02B $2.63 2014(Est) $1.09B $2.93 2015(Est) $1.15B $3.21 (Source: Yahoo Finance ) The company is expected to release its Q4 2014 results along with its FY 2014 results on February 17th before market open. Revenue, as seen above, is estimated to be reported up 7.4% compared with last year. EPS is expected to be up 11.4% compared with last year, and that trend looks to continue with EPS forecasted to be up another 9.55% for FY 2015. I have heard a lot lately about utilities being overpriced, and for some names I am in agreement. Currently the shares are trading at 19.33 times earnings, which is lower than the industry average at 21.8. The forward price to earnings is 17.9, and this is why I believe the shares are not currently overpriced. The company currently has a payout ratio of about 65%, which is a very safe number for a business in a quite stable and consistent industry. EPS of $3.21 for 2015 point to a payout ratio of just 62.8%. This then points to the company being in a great position to raise the dividend again in the next year. Beyond that, things also look good for more raises with earnings increasing nicely into 2016. A mid-term growth catalyst for the company is its recent acquisition of U.S. Water Services. This further diversifies its holdings and will provide an extra boost to growth. U.S. Water generated $120 million in revenue in 2014 and the company projects it to grow revenue 10%-15% on an annual basis going forward. This is a great investment for the company and should definitely begin to pay off during the next few years. I love this diversification because as a diversified utility, it offers good exposure for one’s portfolio. In conclusion, ALLETE is yet another strong dividend payer in the utilities sector. Although the company’s core business is electricity generation, it does have a fairly diversified portfolio of holdings, adding to it most recently with the purchase of U.S. Water. The growth trend looks to be strong, and the company has lots of room to continue to raise its dividend in the future. I believe as a long-term play, ALLETE will continue to reward its shareholders both through growth in the business and the dividend. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Always do your own research before investing. Scalper1 News

The company has paid dividends consecutively since 1950. The shares currently sport a yield of about 3.57%. Growth of the company points directly to further growth of the dividend. As I continue my never-ending quest to find quality companies with safe, and attractive dividends, my search led me to ALLETE, Inc (NYSE: ALE ). The diversified utility company mainly focuses on electric generation in Minnesota, North Dakota, and Wisconsin. Founded in 1906, the company has a rich history, but I am more interested in its dividend history. In late January it raised its dividend 3.1% to 50.5 cents a quarter. With the raise the company now sports a 3.57% yield that is very attractive in my eyes. This was the fourth straight year of a raise, according to Dividends.com. This doesn’t seem like that much, but what I view as being just as important is consistency. Even so I believe going forward the company will continue this track of dividend growth and that is one of the main reasons I’m a fan. ALE Dividend data by YCharts The company has paid a consecutive dividend since 1950, and this is most definitely not going to change anytime soon. Some don’t like to reference the past to point to the future, however, I always believe a strong dividend history is a plus. It shows the company is dedicated to maintaining its dividend even when the market may be bad overall. On a different note, growth is setting up nicely for the company and the chart below illustrates this beautifully. year Revenue Earnings Per Share 2013 $1.02B $2.63 2014(Est) $1.09B $2.93 2015(Est) $1.15B $3.21 (Source: Yahoo Finance ) The company is expected to release its Q4 2014 results along with its FY 2014 results on February 17th before market open. Revenue, as seen above, is estimated to be reported up 7.4% compared with last year. EPS is expected to be up 11.4% compared with last year, and that trend looks to continue with EPS forecasted to be up another 9.55% for FY 2015. I have heard a lot lately about utilities being overpriced, and for some names I am in agreement. Currently the shares are trading at 19.33 times earnings, which is lower than the industry average at 21.8. The forward price to earnings is 17.9, and this is why I believe the shares are not currently overpriced. The company currently has a payout ratio of about 65%, which is a very safe number for a business in a quite stable and consistent industry. EPS of $3.21 for 2015 point to a payout ratio of just 62.8%. This then points to the company being in a great position to raise the dividend again in the next year. Beyond that, things also look good for more raises with earnings increasing nicely into 2016. A mid-term growth catalyst for the company is its recent acquisition of U.S. Water Services. This further diversifies its holdings and will provide an extra boost to growth. U.S. Water generated $120 million in revenue in 2014 and the company projects it to grow revenue 10%-15% on an annual basis going forward. This is a great investment for the company and should definitely begin to pay off during the next few years. I love this diversification because as a diversified utility, it offers good exposure for one’s portfolio. In conclusion, ALLETE is yet another strong dividend payer in the utilities sector. Although the company’s core business is electricity generation, it does have a fairly diversified portfolio of holdings, adding to it most recently with the purchase of U.S. Water. The growth trend looks to be strong, and the company has lots of room to continue to raise its dividend in the future. I believe as a long-term play, ALLETE will continue to reward its shareholders both through growth in the business and the dividend. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Always do your own research before investing. Scalper1 News

Scalper1 News