Scalper1 News

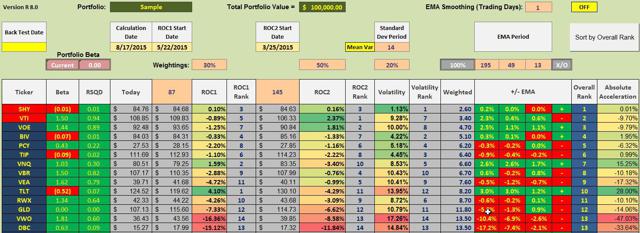

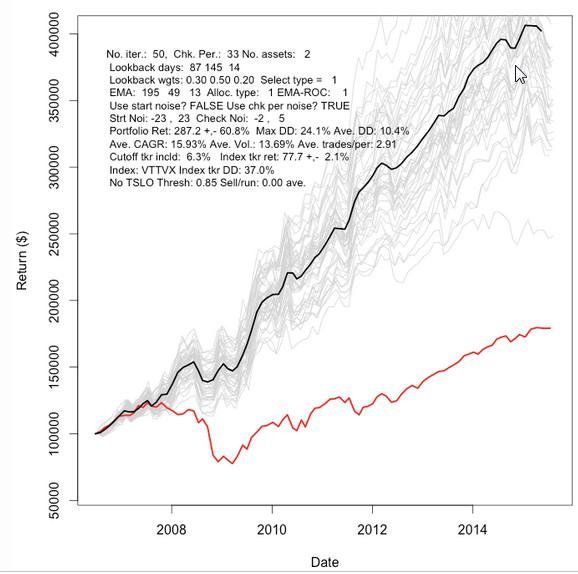

The momentum model currently recommends investing in SHY or a money market. This model outperforms the VTTVX benchmark. The momentum model also minimizes draw-down. Dual Momentum as well as other momentum models are receiving considerable attention as the momentum anomaly appears to have significant staying power. In the following ETF ranking table and the performance graph, this momentum model demonstrates how one can generate benchmark beating returns while lowering portfolio volatility. The following data table is made up of fourteen ETFs that provide global diversification. ETFs used in this example are also found in the Baker’s Dozen article with one addition, BIV, an intermediate bond fund. The fourteen ETFs are: VTI , VEA , VWO , VNQ , RWX , TIP , TLT , DBC , GLD , PCY , BIV , VOE , VBR , and SHY . This array of ETFs covers the U.S. Equities market, developed international equities, emerging market equities, U.S. REITs, international REITs, bonds, gold, commodities, and treasuries. VOE and VBR are included to take advantage of any value anomaly, should it exist. ETF Rankings: Driving the following rankings are three metrics. Performance over the past 87 calendar days. A 30% weight is assigned to this performance percentage. Performance over the past 145 calendar days where a 50% weight is assigned to this performance percentage. Low volatility is an advantage so a 20% weight is assigned to a mean-variance of 14 calendar days. Based on extensive back-testing and out-of-sample analysis, the above variables provided the best return/volatility ratio. An example of such testing is provided in the second screen-shot. As of 8/17/2015, this momentum model recommends investing 100% of the portfolio in SHY as there are no ETFs outperforming this 1-3 yr. treasury bond. Looking for ETFs that are outperforming SHY is an application of the absolute momentum principle where one does not invest in ETFs if they are under-performing the cutoff or circuit breaker ETF. SHY is that cutoff ETF. (click to enlarge) Performance Data: A frequent question is – how well does such a momentum oriented portfolio perform? Since one set of data or one back-test is insufficient to come to any conclusions, a Monte Carlo analysis is run on this set of ETFs. The portfolio is reviewed every 33 days. We are looking for ETFs that are ranked above SHY (none are in the current ranking) and if there are two, we invest equal amounts in those two securities. Should there be a tie, we invest equal amounts in the top three. ETFs under-performing SHY are sold out of the portfolio. The look-back periods are 87 and 145 calendar days as mentioned above. Beginning on 6/30/2006 we capture two bull markets and a severe bear market. The overall return of the portfolio managed using this momentum model is 287% while the VTTVX benchmark is 78%. Draw-downs (“DDs”) are always of interest and here again the momentum portfolio shines by limiting the maximum DD to 24.1% while the benchmark had a maximum DD of 27%. The average DD for the momentum portfolio was an acceptable 10.4%. The light colored or gray graphs show the 50 runs made for this set of ETFs operating under the stated guidelines. The dark line is the average. Even the worst performing run outperformed the benchmark. Not only does the momentum model provide protection against deep bear markets such as we experienced in 2008 and early 2009, the portfolio also shows a much steeper slope during the bull market since March of 2009. The above momentum model was not selected to generate the very best return. Instead, it was built to be a robust portfolio in all types of conditions. Using SHY as the circuit breaker is our volatility check and should keep one away from the depths of a bear market. The model does require discipline as one needs to review the portfolio every 33 days. The above graph shows the benefits of such discipline. Disclosure: I am/we are long VTI,SHY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: The back-test runs were performed by Ernest Stokely. Scalper1 News

The momentum model currently recommends investing in SHY or a money market. This model outperforms the VTTVX benchmark. The momentum model also minimizes draw-down. Dual Momentum as well as other momentum models are receiving considerable attention as the momentum anomaly appears to have significant staying power. In the following ETF ranking table and the performance graph, this momentum model demonstrates how one can generate benchmark beating returns while lowering portfolio volatility. The following data table is made up of fourteen ETFs that provide global diversification. ETFs used in this example are also found in the Baker’s Dozen article with one addition, BIV, an intermediate bond fund. The fourteen ETFs are: VTI , VEA , VWO , VNQ , RWX , TIP , TLT , DBC , GLD , PCY , BIV , VOE , VBR , and SHY . This array of ETFs covers the U.S. Equities market, developed international equities, emerging market equities, U.S. REITs, international REITs, bonds, gold, commodities, and treasuries. VOE and VBR are included to take advantage of any value anomaly, should it exist. ETF Rankings: Driving the following rankings are three metrics. Performance over the past 87 calendar days. A 30% weight is assigned to this performance percentage. Performance over the past 145 calendar days where a 50% weight is assigned to this performance percentage. Low volatility is an advantage so a 20% weight is assigned to a mean-variance of 14 calendar days. Based on extensive back-testing and out-of-sample analysis, the above variables provided the best return/volatility ratio. An example of such testing is provided in the second screen-shot. As of 8/17/2015, this momentum model recommends investing 100% of the portfolio in SHY as there are no ETFs outperforming this 1-3 yr. treasury bond. Looking for ETFs that are outperforming SHY is an application of the absolute momentum principle where one does not invest in ETFs if they are under-performing the cutoff or circuit breaker ETF. SHY is that cutoff ETF. (click to enlarge) Performance Data: A frequent question is – how well does such a momentum oriented portfolio perform? Since one set of data or one back-test is insufficient to come to any conclusions, a Monte Carlo analysis is run on this set of ETFs. The portfolio is reviewed every 33 days. We are looking for ETFs that are ranked above SHY (none are in the current ranking) and if there are two, we invest equal amounts in those two securities. Should there be a tie, we invest equal amounts in the top three. ETFs under-performing SHY are sold out of the portfolio. The look-back periods are 87 and 145 calendar days as mentioned above. Beginning on 6/30/2006 we capture two bull markets and a severe bear market. The overall return of the portfolio managed using this momentum model is 287% while the VTTVX benchmark is 78%. Draw-downs (“DDs”) are always of interest and here again the momentum portfolio shines by limiting the maximum DD to 24.1% while the benchmark had a maximum DD of 27%. The average DD for the momentum portfolio was an acceptable 10.4%. The light colored or gray graphs show the 50 runs made for this set of ETFs operating under the stated guidelines. The dark line is the average. Even the worst performing run outperformed the benchmark. Not only does the momentum model provide protection against deep bear markets such as we experienced in 2008 and early 2009, the portfolio also shows a much steeper slope during the bull market since March of 2009. The above momentum model was not selected to generate the very best return. Instead, it was built to be a robust portfolio in all types of conditions. Using SHY as the circuit breaker is our volatility check and should keep one away from the depths of a bear market. The model does require discipline as one needs to review the portfolio every 33 days. The above graph shows the benefits of such discipline. Disclosure: I am/we are long VTI,SHY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: The back-test runs were performed by Ernest Stokely. Scalper1 News

Scalper1 News