Scalper1 News

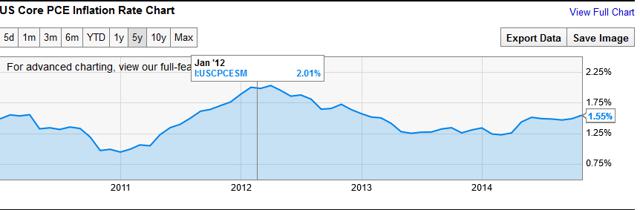

Recovering US economy together with the Fed pushing off inflationary concerns results in a hawkish Fed. This is bullish on the USD and bearish on Gold. Inflation is likely to remain subdued as low energy prices can persist. GLD would be an ideal instrument to short gold efficiently into its secular decline. Gold is priced in United States Dollars (USD) and it is affected by the actions of the Federal Reserve, inflationary pressure and issues of financial stability. In this article, we shall start with recent action by the Federal Reserve as seen in the December 2014 FOMC statement . We are currently in the interim period after the Fed has formally ended QE3 and before the first rate hike since the Great Recession of 2009. In general, a bullish Fed is bearish on the price of gold as it would push the USD higher and reduce inflation. This is exactly what we got as we go through the latest FOMC statement. The FOMC has a upbeat outlook on the US economy as we see in the quote below: “Information received since the Federal Open Market Committee met in October suggests that economic activity is expanding at a moderate pace. Labor market conditions improved further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has continued to run below the Committee’s longer-run objective, partly reflecting declines in energy prices.” In the above quote, we can see two drivers of weakness for gold. First, it is clear that the economy is recovering steadily. This is supported by labor market improvement and increasing consumption. Secondly, we are seeing the Fed’s acknowledgment that inflation is running low due to the decline of energy prices. The economy is expanding and the financial system has been cleaned up after the Credit Crunch of 2007, with strong regulatory action. With the benefit of hindsight, regulators have learned the cost of lax oversight and will be more stringent in their supervision. As the economy strengthen, the banks will strengthen accordingly. This has reduced the appeal of gold in the extreme event of a currency collapse when the banking and payment system ends as we know it. Next we see that inflation is low and below the 2% inflation target due to low oil prices. Inflation as measured by broad based measures such as the Consumer Price Index (CPI) is at 1.3% for November 2014, dropping from 1.7% from the prior 3 consecutive months. Even if we take into consideration the Fed’s preferred measure of inflation, the Personal Consumption Expenditure (PCE), it is also low at 1.55%. (click to enlarge) Source: Y-Charts Now I would like to point out that I am referring to broad based measures of inflation and not prices of individual items. A common rebuttal that I get from comments when I mention low inflation is that they would quote price increase of individual items from their grocery shopping increasing more than the mentioned inflation rates. Broad based inflationary measures such as CPI and PCE take into account a basket of goods and services which includes grocery shopping. These are what the Fed considers in its decision making process. What the Fed does have an impact on is the market and price of gold which is the main consideration of this article. Now the attitude of the Fed is crucial in linking the price of gold to inflation. In today’s fast paced world, gold would react first to expected inflation before actual inflation kicks in. One crucial source of expected inflation trend would come from the Fed. Today the Fed is giving more leeway to the below target inflation environment. Currently, the Fed sees this period of low inflation as ‘transitory’ as it expects low energy price to pass. They are not going to ease monetary conditions which would be supportive of gold prices. In this FOMC meeting, we also saw two hawkish dissents urging for an earlier rate hike on the grounds that the economy is strengthening faster than expected. The two hawkish dissents together with the overall bullish majority view outweighs the one dovish dissent urging for more accommodation to meet the Fed’s 2% inflation target. The majority view remains bullish on the US economy even as they urge patience to temper the bullishness of the FOMC Statement. In fact, credit conditions are likely to tighten as the banks pre-empt the Fed’s tightening. In this period of guessing when the Fed will start its first rate hike, the market tendency would be to assume an earlier rate hike rather than a later rate hike as the US economy recovers. As credit conditions tighten marginally and inflation risk remains subdued, gold investors are likely to exit their position and go into more productive assets. Moreover, there are grounds to believe that energy price can remain low for an extended period of time which would continue to keep a lid on inflation. A final piece of the argument acting against the price of gold is the strengthening USD. We can approach this from the theme of divergence of monetary policy in major currencies. Large economies like Japan and Europe are embarking on massive monetary easing programs of 80 Trillion yen per year and 3 Trillion euros respectively. The Fed and the Bank of England are expected to raise rates next year. This will encourage funds to flow into a higher yielding USD especially when the European Central Bank and Swiss National Bank are discouraging deposits with negative interest rates. This would include funds parked in gold, and gold being priced in USD will decline further as the USD appreciates. The chart below will show you the strength of the USD as measured against the Australian Dollar, Euro, Japanese Yen and Great Britain Pound in the spot market. This is the Dow Jones FXCM Dollar Index and these currencies against the USD make up 80% of the spot market and represents a diverse economic makeup. A pictorial view should give you a better sense of the USD strength on the bigger weekly picture. (click to enlarge) There are two ways to sell gold efficiently if you share my bearish view on gold. The first way would be to sell SPDR Gold Trust ETF (NYSEARCA: GLD ). The second way would be to sell the Central Gold-Trust (NYSEMKT: GTU ). Both are listed on the New York Stock Exchange and the prices are closely correlated to each other. GLD has a market capitalization of $27.71 billion and a volume of 7.4 million and it is more liquid than GTU with a market capitalization of $788.17 million and volume of 131 thousand. The reason for mentioning GTU is that it provides unencumbered gold holdings that are not being lent out. This will provide an alternative to investors who take issue with the ‘red flags’ that they see in the GLD prospectus and the gold audit process. (click to enlarge) (click to enlarge) Both the GLD and GTU charts above are almost identical in their trend. This would show that GLD reflects the price of gold as accurately as GTU despite the concerns over it by some investors. As GLD is more liquid than GTU, it would be the ideal instrument to profit from the slide of the gold. However I would note that GTU is a Closed End Fund, not an Exchange Traded Fund like GLD. There are some tax advantages by holding onto GTU compared to GLD. You can read more about GTU here and decide for yourself which is a better instrument for you based on your individual investment status. From both GLD and GTU, we can see that gold had a mini rally for two months from the start of November to mid December 2014 and it is now resuming its downtrend again. (click to enlarge) For a long term view of gold, I have added the monthly chart of XAU/USD. XAU is the currency term for gold and you can see for yourself the current and ongoing secular decline of gold. You can read about the history of the QE programs from the St. Louis Fed . Merry Christmas and a Happy New Year. Scalper1 News

Recovering US economy together with the Fed pushing off inflationary concerns results in a hawkish Fed. This is bullish on the USD and bearish on Gold. Inflation is likely to remain subdued as low energy prices can persist. GLD would be an ideal instrument to short gold efficiently into its secular decline. Gold is priced in United States Dollars (USD) and it is affected by the actions of the Federal Reserve, inflationary pressure and issues of financial stability. In this article, we shall start with recent action by the Federal Reserve as seen in the December 2014 FOMC statement . We are currently in the interim period after the Fed has formally ended QE3 and before the first rate hike since the Great Recession of 2009. In general, a bullish Fed is bearish on the price of gold as it would push the USD higher and reduce inflation. This is exactly what we got as we go through the latest FOMC statement. The FOMC has a upbeat outlook on the US economy as we see in the quote below: “Information received since the Federal Open Market Committee met in October suggests that economic activity is expanding at a moderate pace. Labor market conditions improved further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has continued to run below the Committee’s longer-run objective, partly reflecting declines in energy prices.” In the above quote, we can see two drivers of weakness for gold. First, it is clear that the economy is recovering steadily. This is supported by labor market improvement and increasing consumption. Secondly, we are seeing the Fed’s acknowledgment that inflation is running low due to the decline of energy prices. The economy is expanding and the financial system has been cleaned up after the Credit Crunch of 2007, with strong regulatory action. With the benefit of hindsight, regulators have learned the cost of lax oversight and will be more stringent in their supervision. As the economy strengthen, the banks will strengthen accordingly. This has reduced the appeal of gold in the extreme event of a currency collapse when the banking and payment system ends as we know it. Next we see that inflation is low and below the 2% inflation target due to low oil prices. Inflation as measured by broad based measures such as the Consumer Price Index (CPI) is at 1.3% for November 2014, dropping from 1.7% from the prior 3 consecutive months. Even if we take into consideration the Fed’s preferred measure of inflation, the Personal Consumption Expenditure (PCE), it is also low at 1.55%. (click to enlarge) Source: Y-Charts Now I would like to point out that I am referring to broad based measures of inflation and not prices of individual items. A common rebuttal that I get from comments when I mention low inflation is that they would quote price increase of individual items from their grocery shopping increasing more than the mentioned inflation rates. Broad based inflationary measures such as CPI and PCE take into account a basket of goods and services which includes grocery shopping. These are what the Fed considers in its decision making process. What the Fed does have an impact on is the market and price of gold which is the main consideration of this article. Now the attitude of the Fed is crucial in linking the price of gold to inflation. In today’s fast paced world, gold would react first to expected inflation before actual inflation kicks in. One crucial source of expected inflation trend would come from the Fed. Today the Fed is giving more leeway to the below target inflation environment. Currently, the Fed sees this period of low inflation as ‘transitory’ as it expects low energy price to pass. They are not going to ease monetary conditions which would be supportive of gold prices. In this FOMC meeting, we also saw two hawkish dissents urging for an earlier rate hike on the grounds that the economy is strengthening faster than expected. The two hawkish dissents together with the overall bullish majority view outweighs the one dovish dissent urging for more accommodation to meet the Fed’s 2% inflation target. The majority view remains bullish on the US economy even as they urge patience to temper the bullishness of the FOMC Statement. In fact, credit conditions are likely to tighten as the banks pre-empt the Fed’s tightening. In this period of guessing when the Fed will start its first rate hike, the market tendency would be to assume an earlier rate hike rather than a later rate hike as the US economy recovers. As credit conditions tighten marginally and inflation risk remains subdued, gold investors are likely to exit their position and go into more productive assets. Moreover, there are grounds to believe that energy price can remain low for an extended period of time which would continue to keep a lid on inflation. A final piece of the argument acting against the price of gold is the strengthening USD. We can approach this from the theme of divergence of monetary policy in major currencies. Large economies like Japan and Europe are embarking on massive monetary easing programs of 80 Trillion yen per year and 3 Trillion euros respectively. The Fed and the Bank of England are expected to raise rates next year. This will encourage funds to flow into a higher yielding USD especially when the European Central Bank and Swiss National Bank are discouraging deposits with negative interest rates. This would include funds parked in gold, and gold being priced in USD will decline further as the USD appreciates. The chart below will show you the strength of the USD as measured against the Australian Dollar, Euro, Japanese Yen and Great Britain Pound in the spot market. This is the Dow Jones FXCM Dollar Index and these currencies against the USD make up 80% of the spot market and represents a diverse economic makeup. A pictorial view should give you a better sense of the USD strength on the bigger weekly picture. (click to enlarge) There are two ways to sell gold efficiently if you share my bearish view on gold. The first way would be to sell SPDR Gold Trust ETF (NYSEARCA: GLD ). The second way would be to sell the Central Gold-Trust (NYSEMKT: GTU ). Both are listed on the New York Stock Exchange and the prices are closely correlated to each other. GLD has a market capitalization of $27.71 billion and a volume of 7.4 million and it is more liquid than GTU with a market capitalization of $788.17 million and volume of 131 thousand. The reason for mentioning GTU is that it provides unencumbered gold holdings that are not being lent out. This will provide an alternative to investors who take issue with the ‘red flags’ that they see in the GLD prospectus and the gold audit process. (click to enlarge) (click to enlarge) Both the GLD and GTU charts above are almost identical in their trend. This would show that GLD reflects the price of gold as accurately as GTU despite the concerns over it by some investors. As GLD is more liquid than GTU, it would be the ideal instrument to profit from the slide of the gold. However I would note that GTU is a Closed End Fund, not an Exchange Traded Fund like GLD. There are some tax advantages by holding onto GTU compared to GLD. You can read more about GTU here and decide for yourself which is a better instrument for you based on your individual investment status. From both GLD and GTU, we can see that gold had a mini rally for two months from the start of November to mid December 2014 and it is now resuming its downtrend again. (click to enlarge) For a long term view of gold, I have added the monthly chart of XAU/USD. XAU is the currency term for gold and you can see for yourself the current and ongoing secular decline of gold. You can read about the history of the QE programs from the St. Louis Fed . Merry Christmas and a Happy New Year. Scalper1 News

Scalper1 News