Scalper1 News

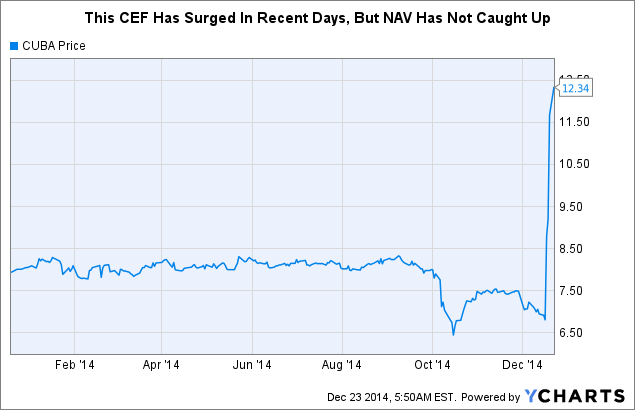

As the United States and Cuba have announced their intentions to normalize diplomatic relations, investors are excited by the prospect of economic investment in the Caribbean island nation. This has led to an over 81% jump in the shares of the Herzfeld Caribbean Basin Fund which has advanced to a 50.3% premium to NAV. Despite the fund’s ticker symbol (CUBA), the CEF has no direct exposure to Cuba and holds listed securities in a portfolio that could be built independently without such a premium. Shares of the Herzfeld Caribbean Basin Fund (NASDAQ: CUBA ) have surged by 81.2% in the past four trading sessions after the United States and Cuba announced their intentions to normalize their international relations. While the closed end fund has recently traded at a discount to NAV, the four-day rally has put the CEF at a 50.3% premium to Monday’s closing NAV. Investors have expressed optimism over the potential economic benefits of further diplomatic cooperation between the U.S. and Cuba; however, the fund does not actually own any non written off assets domiciled in Cuba. The fund lists the following as part of its investment objective: “The fund invests at least 80% of its total assets in a broad range of securities of issuers including U.S.-based companies that engage in substantial trade with, and derive substantial revenue from, operations in the Caribbean Basin Countries.”-Herzfeld Caribbean Basin Fund Investment Objective The fund’s ticker symbol has likely led to retail investor optimism despite the fund’s composition and the significant premium that it has jumped to. The Herzfeld Caribbean Basin Fund has AUM in the $30 Million range and charges a management fee of 1.45% of average daily net assets in addition to other expenses that amounted to roughly $270 thousand last fiscal year equating to a total annual expense ratio of around 2.4%. In addition to the concerns over the small size of the fund, other than in the past few trading sessions, it has experienced low levels of liquidity and trading volume. Having traded at a roughly 10% discount to NAV in its recent history, it is rather concerning that it has jumped to a 50.3% premium to NAV. CUBA data by YCharts Two Written-Off Assets May Be Reason For Investor Over-Optimism While the Herzfeld Caribbean Basin Fund owns shares of companies that would benefit from improved US-Cuba relations and general Cuban economic growth, however the fund does not actually own shares in any Cuban-domiciled corporations. The company does in fact have two written-off and transfer restricted Cuban assets both with a fair value of $0: $165 Thousand par Republic of Cuba bonds, 4.5%, 1977 that is in default and 700 shares of Cuban Electric Company that have a fair value of $0. Even if these assets were to surprisingly realize any sort of value, it would not likely be of any material significance to the fund. Rights Offering Proceeds Used To Both Fund Capital Gains Distribution And Add Capital To The CEF Earlier in December, the fund completed an oversubscribed rights offering that raised new capital for the CEF. The Herzfeld Caribbean Basin Fund sold 1.8 million shares at $6.77 per share equating to roughly $12.1 million in cash proceeds. Last Thursday, the fund announced its year-end distribution that will amount to $0.635 per share consisting of mostly long-term capital gains and some short-term capital gains. The recent rights offering will provide the necessary liquidity to pay the year-end distribution and will also leave the fund with extra capital to deploy as it sees fit. Additionally, two key members of the fund’s management hold large stakes in the CEF: Thomas J. Herzfeld, the chairman of the board, president and portfolio manager holds an 11.3% stake while his son, Erik M. Herzfeld who serves as a portfolio manager owns just over a 5% stake. While Cuba’s Economic Situation May Improve Materially, This Potential Does Not Provide Reason To Pay A 50.3% Premium For A Related Fund The latest news of increased international cooperation between the U.S. and Cuba may certainly have positive long-term impacts for Cuba’s economy. It may open the door for direct foreign investment to boost the country’s infrastructure and to draw in new capital. Cuba certainly has the potential to bring in mass amounts of tourist over the long term from a number of nations including the U.S. However, at 50.3%, the Herzfeld Caribbean Basin Fund does make a sensible investment decision. If an investor were so inclined to mimic the portfolio of the CEF, one could without paying such an immense premium to NAV. The recent news boosts the prospects for Cuba’s economy; however, investors should avoid the Herzfeld Caribbean Basin Fund as it trades at a massive premium and does offer direct exposure to the country. Note: Pricing is accurate as of the close of trading on Monday Dec. 22, 2014. Scalper1 News

As the United States and Cuba have announced their intentions to normalize diplomatic relations, investors are excited by the prospect of economic investment in the Caribbean island nation. This has led to an over 81% jump in the shares of the Herzfeld Caribbean Basin Fund which has advanced to a 50.3% premium to NAV. Despite the fund’s ticker symbol (CUBA), the CEF has no direct exposure to Cuba and holds listed securities in a portfolio that could be built independently without such a premium. Shares of the Herzfeld Caribbean Basin Fund (NASDAQ: CUBA ) have surged by 81.2% in the past four trading sessions after the United States and Cuba announced their intentions to normalize their international relations. While the closed end fund has recently traded at a discount to NAV, the four-day rally has put the CEF at a 50.3% premium to Monday’s closing NAV. Investors have expressed optimism over the potential economic benefits of further diplomatic cooperation between the U.S. and Cuba; however, the fund does not actually own any non written off assets domiciled in Cuba. The fund lists the following as part of its investment objective: “The fund invests at least 80% of its total assets in a broad range of securities of issuers including U.S.-based companies that engage in substantial trade with, and derive substantial revenue from, operations in the Caribbean Basin Countries.”-Herzfeld Caribbean Basin Fund Investment Objective The fund’s ticker symbol has likely led to retail investor optimism despite the fund’s composition and the significant premium that it has jumped to. The Herzfeld Caribbean Basin Fund has AUM in the $30 Million range and charges a management fee of 1.45% of average daily net assets in addition to other expenses that amounted to roughly $270 thousand last fiscal year equating to a total annual expense ratio of around 2.4%. In addition to the concerns over the small size of the fund, other than in the past few trading sessions, it has experienced low levels of liquidity and trading volume. Having traded at a roughly 10% discount to NAV in its recent history, it is rather concerning that it has jumped to a 50.3% premium to NAV. CUBA data by YCharts Two Written-Off Assets May Be Reason For Investor Over-Optimism While the Herzfeld Caribbean Basin Fund owns shares of companies that would benefit from improved US-Cuba relations and general Cuban economic growth, however the fund does not actually own shares in any Cuban-domiciled corporations. The company does in fact have two written-off and transfer restricted Cuban assets both with a fair value of $0: $165 Thousand par Republic of Cuba bonds, 4.5%, 1977 that is in default and 700 shares of Cuban Electric Company that have a fair value of $0. Even if these assets were to surprisingly realize any sort of value, it would not likely be of any material significance to the fund. Rights Offering Proceeds Used To Both Fund Capital Gains Distribution And Add Capital To The CEF Earlier in December, the fund completed an oversubscribed rights offering that raised new capital for the CEF. The Herzfeld Caribbean Basin Fund sold 1.8 million shares at $6.77 per share equating to roughly $12.1 million in cash proceeds. Last Thursday, the fund announced its year-end distribution that will amount to $0.635 per share consisting of mostly long-term capital gains and some short-term capital gains. The recent rights offering will provide the necessary liquidity to pay the year-end distribution and will also leave the fund with extra capital to deploy as it sees fit. Additionally, two key members of the fund’s management hold large stakes in the CEF: Thomas J. Herzfeld, the chairman of the board, president and portfolio manager holds an 11.3% stake while his son, Erik M. Herzfeld who serves as a portfolio manager owns just over a 5% stake. While Cuba’s Economic Situation May Improve Materially, This Potential Does Not Provide Reason To Pay A 50.3% Premium For A Related Fund The latest news of increased international cooperation between the U.S. and Cuba may certainly have positive long-term impacts for Cuba’s economy. It may open the door for direct foreign investment to boost the country’s infrastructure and to draw in new capital. Cuba certainly has the potential to bring in mass amounts of tourist over the long term from a number of nations including the U.S. However, at 50.3%, the Herzfeld Caribbean Basin Fund does make a sensible investment decision. If an investor were so inclined to mimic the portfolio of the CEF, one could without paying such an immense premium to NAV. The recent news boosts the prospects for Cuba’s economy; however, investors should avoid the Herzfeld Caribbean Basin Fund as it trades at a massive premium and does offer direct exposure to the country. Note: Pricing is accurate as of the close of trading on Monday Dec. 22, 2014. Scalper1 News

Scalper1 News