Scalper1 News

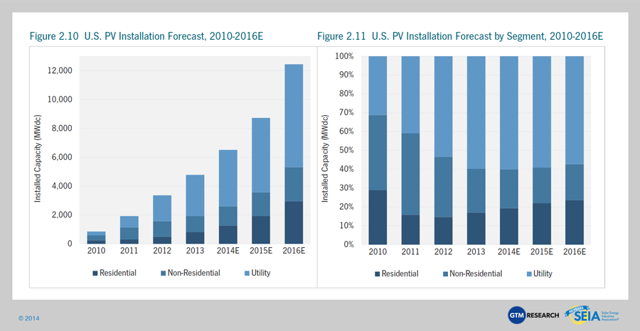

Summary NRG Energy is a uniquely forward-looking utility in its renewable energies commitment. NRG Energy’s entrance into the residential solar space could be the most important aspect of the company moving forward. The company boasts many unique advantages over its residential solar competitors. While there is little doubt that NRG Energy will become a major player in the residential solar sector, the company is unlikely to take over SolarCity as the market leader. NRG Energy (NYSE: NRG ) is primarily known as a fossil fuels utility, but it also has an affinity to renewable energies unlike any other utility company in the country. In 2013, they had even company ranked as the second largest utility-scale solar contractor, right behind First Solar (NASDAQ: FSLR ). Despite NRG Energy’s enormous presence in utility-scale solar generation, the company’s increasing residential solar focus is the most exciting aspect of the company. While the company is barely on the radar in the residential solar sector, having accounted for only 13.5 MW installed in 2013 as opposed to industry-leaders [SolarCity (NASDAQ: SCTY )] 280 MW, the company still has grand plans to become the largest residential solar company in the U.S. In order to evaluate the legitimacy of this claim, the company must be examined in relation to the current residential solar landscape. The State of the Residential Solar Industry The residential solar sector is currently in the process of heavy consolidation. Larger companies like SolarCity and Vivint Solar (NYSE: VSLR ) are devouring market share at an extremely rapid rate. In little more than a year, for instance, SolarCity and Vivint Solar went from a combined marketshare of about 33% to almost 60%. What is even more impressive about this industry-wide marketshare consolidation is that the process has not even come close to slowing down. It would not be terribly surprising to see SolarCity gain 50% of the marketshare within the next year or so. Analysts have repeatedly underestimated the economies of scale present in residential solar. The conventional wisdom has been that local/smaller companies would have an advantage over larger corporations due to their higher regional expertise. Despite this, it appears that the huge financing, structural, and integrations advantages that larger corporations posses vastly outweigh their relative weaknesses. This fact, of course, is great news for NRG Energy, as they are a huge company with virtually limitless resources, especially in context to the budding residential companies. NRG Energy has even gone so far as to state that “we’re a fortune 250 company that… is competing with some well-performing startups. While this is certainly an exaggeration, it nonetheless hints at the company’s huge comparative size. Graphical representation of residential solar’s potential (click to enlarge) Source: GTM Research Advantages NRG Energy’s residential market share is only a few percentage points, which makes the company’s goal of becoming the largest residential installer sound ridiculous. This claim though, is not as crazy as it sounds upon closer inspection. While NRG Energy has not installed many MW’s of residential solar, the company has spent years building out an extensive infrastructure . In addition, NRG Energy boasts many advantages that are unique to its situation. The most obvious advantage that NRG Energy possesses is its size. The company has been forward thinking enough to be one of the first large utilities to truly embrace the residential solar trend, and this foresight will pay huge dividends for the company in the future. The size of NRG Energy could give it a significant competitive advantage over its residential solar competitors in the form of cheaper capital, scaling, financing, etc. Even SolarCity, the largest residential installer, does not compare to the financial clout of NRG Energy. By virtue of being one of the first large utilities to enter into residential solar, NRG Energy has set itself up in a great position over its future competitors. In addition, NRG Energy is one of the largest utilities in the U.S., boasting over 2 million retail customers. The company’s 2 million customer base will give it an unrivalled platform of potential customers. Even if a small percentage of this number were to switch to residential solar, this would give NRG Energy a residential market share on par with the likes of Vivint Solar, or even SolarCity. Of course, NRG Energy would not actually be gaining any new customers, as the company is essentially just converting some of its old customers to solar. Regardless, the market share they gain in the residential solar sector because of this is perhaps the most important outcome, as marketshare is perhaps the most important metric in an early stage industry. The residential solar is poised to be huge, and any opportunity to gain market share early on should be taken. NRG Energy’s commitment to residential solar cannot be denied. The company is so serious about this blooming sector that is has even created a separate division for it called NRG Home Solar. As per Kelcy Pegler (President of NRG Home Solar), “we are in this residential solar space to win.” Potential Obstacles/Risks Despite all the advantages that NRG Energy would enjoys, taking over SolarCity as the top residential solar company would be an extremely tall order. NRG Energy is somewhat late to the game, and the company still has a lot of catching up to do. The good news is that the only real competition in the residential sector so far is SolarCity and Vivint. Despite this, these two companies, especially SolarCity, are extremely well-managed and competitive. First off, it is highly unlikely that NRG Energy would have a cost structure anywhere near that of SolarCity, and to a lesser degree Vivint Solar. In order to stay competitive with the top residential companies, NRG Energy may have to sacrifice its margins early on to stake out a significant piece of market share. While this may be troublesome for smaller companies, NRG Energy has a balance sheet that could sustain the potential cash bleed. Additionally, while the company is considered forward thinking for a utility, it is highly unlikely that NRG Energy compares to SolarCity in terms of innovation. SolarCity has been virtually pushing the residential solar industry by itself for the past few years. In fact, it could be argued that the residential solar industry is in the state it is today precisely because of SolarCity. While there is little doubt that NRG Energy’s residential solar team is talented, it hardly compares to SolarCity’s management team, which boasts the likes of Elon Musk, Lyndon Rive, Peter Rive, Brad Buss, etc. Conclusion NRG Energy’s residential goals are certainly ambitious, with the company planning to have 35,000 to 40,000 installations by the end of 2015. Although this number would only be a fraction of SolarCity’s, it is still a huge leap from where they are today. The company is in fact planning a stupendous growth rate of 300-400% for the next few years. If any company can threaten the dominance of SolarCity, it is NRG Energy. Despite this, it is highly unlikely that NRG Energy will be able to overtake SolarCity as the market leader. On top of the fact that SolarCity already owns 40% of the residential solar market share, the company has intangibles that NRG Energy will unlikely be able to overcome, even in light of NRG Energy’s numerous advantages. Having said that, there is a distinct possibility of NRG Energy becoming a huge player in the residential solar space, and even beating out Vivint Solar for the number 2 spot. Given the massive potential of the residential solar industry, NRG Energy’s entrance into residential solar will be a win no matter what. With a market capitalization of $9.16B, NRG Energy’s valuation is pretty much in line with comparable fossil fuel utilities. This valuation though, largely ignores the company’s involvement in the immensely promising solar sector. At its current market capitalization, the company holds great upside in the long-term. Scalper1 News

Summary NRG Energy is a uniquely forward-looking utility in its renewable energies commitment. NRG Energy’s entrance into the residential solar space could be the most important aspect of the company moving forward. The company boasts many unique advantages over its residential solar competitors. While there is little doubt that NRG Energy will become a major player in the residential solar sector, the company is unlikely to take over SolarCity as the market leader. NRG Energy (NYSE: NRG ) is primarily known as a fossil fuels utility, but it also has an affinity to renewable energies unlike any other utility company in the country. In 2013, they had even company ranked as the second largest utility-scale solar contractor, right behind First Solar (NASDAQ: FSLR ). Despite NRG Energy’s enormous presence in utility-scale solar generation, the company’s increasing residential solar focus is the most exciting aspect of the company. While the company is barely on the radar in the residential solar sector, having accounted for only 13.5 MW installed in 2013 as opposed to industry-leaders [SolarCity (NASDAQ: SCTY )] 280 MW, the company still has grand plans to become the largest residential solar company in the U.S. In order to evaluate the legitimacy of this claim, the company must be examined in relation to the current residential solar landscape. The State of the Residential Solar Industry The residential solar sector is currently in the process of heavy consolidation. Larger companies like SolarCity and Vivint Solar (NYSE: VSLR ) are devouring market share at an extremely rapid rate. In little more than a year, for instance, SolarCity and Vivint Solar went from a combined marketshare of about 33% to almost 60%. What is even more impressive about this industry-wide marketshare consolidation is that the process has not even come close to slowing down. It would not be terribly surprising to see SolarCity gain 50% of the marketshare within the next year or so. Analysts have repeatedly underestimated the economies of scale present in residential solar. The conventional wisdom has been that local/smaller companies would have an advantage over larger corporations due to their higher regional expertise. Despite this, it appears that the huge financing, structural, and integrations advantages that larger corporations posses vastly outweigh their relative weaknesses. This fact, of course, is great news for NRG Energy, as they are a huge company with virtually limitless resources, especially in context to the budding residential companies. NRG Energy has even gone so far as to state that “we’re a fortune 250 company that… is competing with some well-performing startups. While this is certainly an exaggeration, it nonetheless hints at the company’s huge comparative size. Graphical representation of residential solar’s potential (click to enlarge) Source: GTM Research Advantages NRG Energy’s residential market share is only a few percentage points, which makes the company’s goal of becoming the largest residential installer sound ridiculous. This claim though, is not as crazy as it sounds upon closer inspection. While NRG Energy has not installed many MW’s of residential solar, the company has spent years building out an extensive infrastructure . In addition, NRG Energy boasts many advantages that are unique to its situation. The most obvious advantage that NRG Energy possesses is its size. The company has been forward thinking enough to be one of the first large utilities to truly embrace the residential solar trend, and this foresight will pay huge dividends for the company in the future. The size of NRG Energy could give it a significant competitive advantage over its residential solar competitors in the form of cheaper capital, scaling, financing, etc. Even SolarCity, the largest residential installer, does not compare to the financial clout of NRG Energy. By virtue of being one of the first large utilities to enter into residential solar, NRG Energy has set itself up in a great position over its future competitors. In addition, NRG Energy is one of the largest utilities in the U.S., boasting over 2 million retail customers. The company’s 2 million customer base will give it an unrivalled platform of potential customers. Even if a small percentage of this number were to switch to residential solar, this would give NRG Energy a residential market share on par with the likes of Vivint Solar, or even SolarCity. Of course, NRG Energy would not actually be gaining any new customers, as the company is essentially just converting some of its old customers to solar. Regardless, the market share they gain in the residential solar sector because of this is perhaps the most important outcome, as marketshare is perhaps the most important metric in an early stage industry. The residential solar is poised to be huge, and any opportunity to gain market share early on should be taken. NRG Energy’s commitment to residential solar cannot be denied. The company is so serious about this blooming sector that is has even created a separate division for it called NRG Home Solar. As per Kelcy Pegler (President of NRG Home Solar), “we are in this residential solar space to win.” Potential Obstacles/Risks Despite all the advantages that NRG Energy would enjoys, taking over SolarCity as the top residential solar company would be an extremely tall order. NRG Energy is somewhat late to the game, and the company still has a lot of catching up to do. The good news is that the only real competition in the residential sector so far is SolarCity and Vivint. Despite this, these two companies, especially SolarCity, are extremely well-managed and competitive. First off, it is highly unlikely that NRG Energy would have a cost structure anywhere near that of SolarCity, and to a lesser degree Vivint Solar. In order to stay competitive with the top residential companies, NRG Energy may have to sacrifice its margins early on to stake out a significant piece of market share. While this may be troublesome for smaller companies, NRG Energy has a balance sheet that could sustain the potential cash bleed. Additionally, while the company is considered forward thinking for a utility, it is highly unlikely that NRG Energy compares to SolarCity in terms of innovation. SolarCity has been virtually pushing the residential solar industry by itself for the past few years. In fact, it could be argued that the residential solar industry is in the state it is today precisely because of SolarCity. While there is little doubt that NRG Energy’s residential solar team is talented, it hardly compares to SolarCity’s management team, which boasts the likes of Elon Musk, Lyndon Rive, Peter Rive, Brad Buss, etc. Conclusion NRG Energy’s residential goals are certainly ambitious, with the company planning to have 35,000 to 40,000 installations by the end of 2015. Although this number would only be a fraction of SolarCity’s, it is still a huge leap from where they are today. The company is in fact planning a stupendous growth rate of 300-400% for the next few years. If any company can threaten the dominance of SolarCity, it is NRG Energy. Despite this, it is highly unlikely that NRG Energy will be able to overtake SolarCity as the market leader. On top of the fact that SolarCity already owns 40% of the residential solar market share, the company has intangibles that NRG Energy will unlikely be able to overcome, even in light of NRG Energy’s numerous advantages. Having said that, there is a distinct possibility of NRG Energy becoming a huge player in the residential solar space, and even beating out Vivint Solar for the number 2 spot. Given the massive potential of the residential solar industry, NRG Energy’s entrance into residential solar will be a win no matter what. With a market capitalization of $9.16B, NRG Energy’s valuation is pretty much in line with comparable fossil fuel utilities. This valuation though, largely ignores the company’s involvement in the immensely promising solar sector. At its current market capitalization, the company holds great upside in the long-term. Scalper1 News

Scalper1 News