Scalper1 News

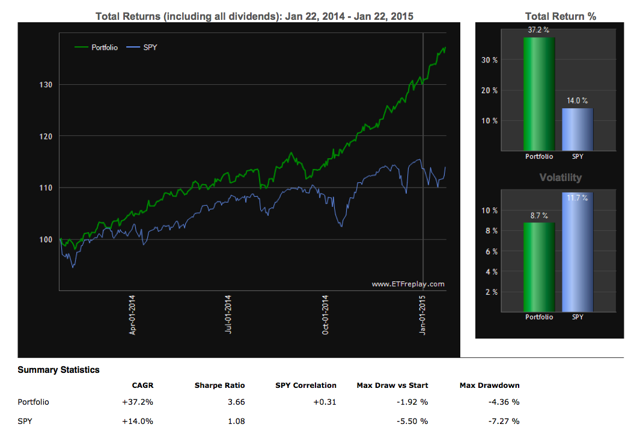

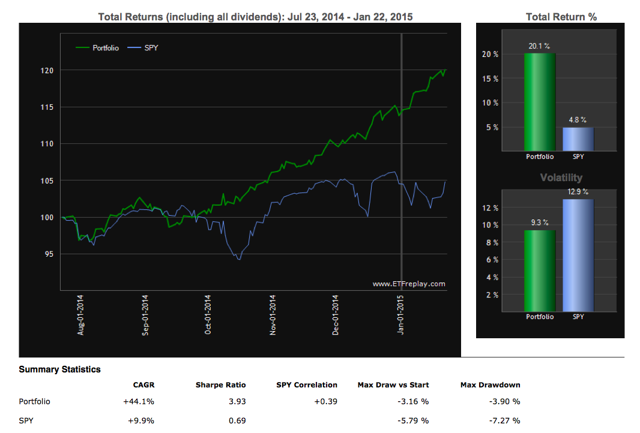

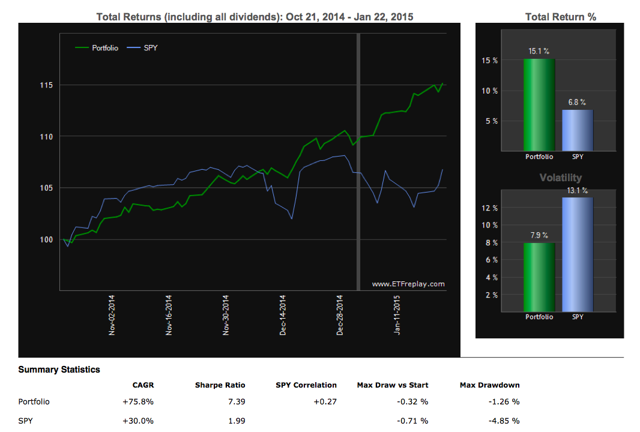

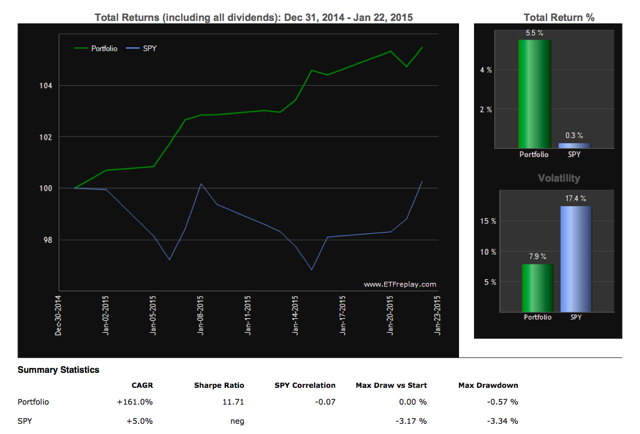

Our provisional Ultra-Low Volatility Index has reached an all time high. It handled recent market volatility splendidly. Recent market volatility has served as an excellent out-of-sample test. As before, here are the provisional Ultra-Low Volatility Index strategy’s rules. Buy the PowerShares S&P 500 Low Volatility ETF (NYSEARCA: SPLV ) with 80% of the dollar value of the portfolio. Buy the Direxion Daily 20+ Yr Trsy Bull 3X ETF (NYSEARCA: TMF ) with 20% of the dollar value of the portfolio. Rebalance annually to maintain the 80%/20% dollar value split between the positions. Here are the results in a linear scale: (click to enlarge) There is no denying that the performance of the strategy has destroyed the S&P 500 on a risk/return basis. The outperformance continues in the last 12 months: (click to enlarge) The last 6 months: (click to enlarge) The last 3 months: (click to enlarge) And YTD 2015: (click to enlarge) Personally, even though the performance is outstanding, I do not feel comfortable with strategies which do not use multiple markets for hedging, but for investors who only like stock/bond mixes, this strategy index is interesting food for thought. I do not feel comfortable with strategies which rely heavily upon bonds as the hedging mechanism for equity exposure , because these strategies, such as risk parity, have benefited from a multi-decade secular bond bull market. As Bruce Kovner once said, one of his main jobs is to imagine configurations of the world that do not yet exist, but could. I believe that a multi-year, secular bear market in bonds is a high probability potential future event path. Therefore, I believe that hedging using multiple markets is the responsible thing to explore, even though our ideas for an Ultra-Low Volatility index have performed well historically and in the very recent past. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Our provisional Ultra-Low Volatility Index has reached an all time high. It handled recent market volatility splendidly. Recent market volatility has served as an excellent out-of-sample test. As before, here are the provisional Ultra-Low Volatility Index strategy’s rules. Buy the PowerShares S&P 500 Low Volatility ETF (NYSEARCA: SPLV ) with 80% of the dollar value of the portfolio. Buy the Direxion Daily 20+ Yr Trsy Bull 3X ETF (NYSEARCA: TMF ) with 20% of the dollar value of the portfolio. Rebalance annually to maintain the 80%/20% dollar value split between the positions. Here are the results in a linear scale: (click to enlarge) There is no denying that the performance of the strategy has destroyed the S&P 500 on a risk/return basis. The outperformance continues in the last 12 months: (click to enlarge) The last 6 months: (click to enlarge) The last 3 months: (click to enlarge) And YTD 2015: (click to enlarge) Personally, even though the performance is outstanding, I do not feel comfortable with strategies which do not use multiple markets for hedging, but for investors who only like stock/bond mixes, this strategy index is interesting food for thought. I do not feel comfortable with strategies which rely heavily upon bonds as the hedging mechanism for equity exposure , because these strategies, such as risk parity, have benefited from a multi-decade secular bond bull market. As Bruce Kovner once said, one of his main jobs is to imagine configurations of the world that do not yet exist, but could. I believe that a multi-year, secular bear market in bonds is a high probability potential future event path. Therefore, I believe that hedging using multiple markets is the responsible thing to explore, even though our ideas for an Ultra-Low Volatility index have performed well historically and in the very recent past. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News