Scalper1 News

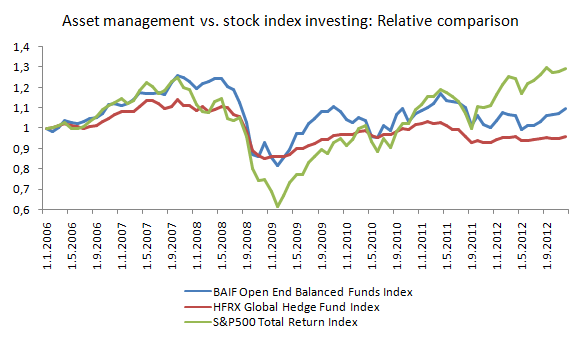

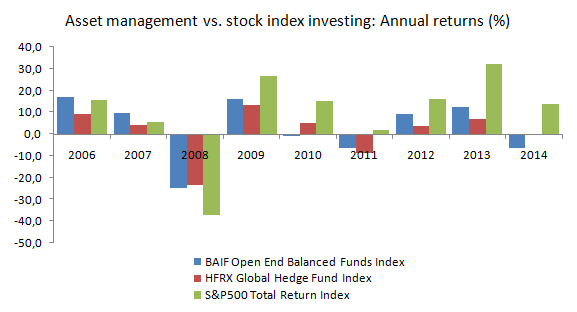

Summary In the current highly dynamic and uncertain global market environment, many investors are looking for safe havens where they can place their money and have a restful sleep. Hedge funds might be suitable investment vehicles, as they are well-known for their focus on risk adjusted returns. Highland Capital Management recently launched three new ETFs tracking various hedge fund strategies, which might serve as a good enhancement of almost every investment portfolio’s statistics. Amid U.S. stock indices near historical highs, the slowing Chinese economy, geopolitical tensions between Russia and the Western world, Japan trying to revert the course of its economy by an unprecedented program of quantitative easing and the culminating Greek crisis, more and more investors are seeking absolute rather than alpha returns. Absolute returns are a domain of hedge funds that employ sophisticated strategies and advanced investment instruments in order to deliver positive returns, regardless of the market conditions. Hedge funds are often incorrectly compared with stocks and are often criticized for their underperformance during periods of strong equity markets growth. However, they are unappreciated by the majority of investors during times of pronounced market corrections and crashes, which is when they tend to suffer much smaller losses than stock indices do. The 2008 financial meltdown was not an exception. The graphs below capture relative performance of hedge funds represented by the HFRX Global Hedge Fund Index, actively managed open-end balanced UCITS compliant funds represented by the BAIF Open End Balanced Funds Index and a portfolio of bluechips represented by the S&P 500 Total Return Index. As you can see from the graphs, hedge funds and actively managed funds are considerably less volatile investments and can therefore serve as ideal investments for conservative investors who want to primarily protect their capital and avoid significant changes in value over time. Nevertheless, in the current highly dynamic and uncertain global market environment, absolute return products should also have a place in every medium risk investment portfolio. Not only do they perform better than short-dated government bonds and term deposits, but thanks to low correlation with other asset classes and comparatively high risk adjusted returns, they also improve general statistics of almost any investment portfolio. Moreover, investments into hedge funds are no longer available solely for high-net-worth individuals. Thanks to ETFs, there is basically no minimal investment and lock-up periods are not an issue. Besides the largest and most liquid ETF tracking overall hedge funds performance – the IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA: QAI ) – three new hedge funds replicating ETFs recently came to market. The first of them, The Highland HFR Global ETF (NYSEARCA: HHFR ), similarly to QAI, tries to mimic the performance of traditional multi-strategy hedge funds that incorporate fixed income and shorting as well as long equity positions. Hence, we could suppose high correlation with QAI. However, after taking a closer look at top holdings of both funds, serious doubts about the similarity arise. QAI’s Top Ten Holdings Name & Ticker Weight (%) Vanguard Total Bond Market Index Fund (NYSEARCA: BND ) 19.13 SPDR Barclays Convertible Securities ETF (NYSEARCA: CWB ) 18.19 iShares Core U.S. Aggregate Bond ETF (NYSEARCA: AGG ) 17.77 iShares iBoxx USD Investment Grade Corporate Bond ETF (NYSEARCA: LQD ) -11.05 Vanguard Short Term Bond Index Fund ETF (NYSEARCA: BSV ) 9.01 PowerShares Senior Loan Portfolio (NYSEARCA: BKLN ) 8.67 iShares Russell 2000 Growth ETF (NYSEARCA: IWO ) 6.46 PowerShares DB G10 Currency Harvest Fund (NYSEARCA: DBV ) 4.84 iShares 1-3 Year Treasury Bond ETF (NYSEARCA: SHY ) 4.42 iShares Russell 2000 Value ETF (NYSEARCA: IWN ) -4.31 Data Source: QAI’s latest Fact Sheet Note: Minus before weight means short position HHFR’s Top Ten Holdings Name & Ticker Weight (%) LinkedIn Corp (NYSE: LNKD ) 3.58 R.R. Donnelley & Sons Co (NASDAQ: RRD ) 3.43 Sungard Data Systems 3.04 Kinetics Concept 3.03 Hertz Corp (NYSE: HTZ ) 3.03 Chrysler (Pending: CGC ) 3.02 Allergan Inc (NYSE: AGN ) 3.02 Univision Comm 3.01 First Data Corp (Pending: FDATA ) 3.00 DirectTV (NASDAQ: DTV ) 2.59 Data Source: HHFR’s website While more than a half of QAI’s holdings are bond ETFs, Highland Capital Management’s HHFR actually consists mostly of equities. The other two funds track different hedge fund strategies. The Highland HFR Equity Hedge ETF (NYSEARCA: HHDG ) consists of traditional hedged equity strategies that can both go long and go short on selected securities. And the last one, the Highland HFR Event-Driven ETF (NYSEARCA: DRVN ), capitalizes on a discipline in the hedge fund community that takes advantage of pending corporate events or other near-term catalysts for revaluation, albeit upward or downward. Despite the post-crisis run-up on global equity markets, I think investors should thoroughly consider how their portfolios will thrive in the upcoming years. Now might be the perfect time to hedge long-only portfolios a little bit. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in QAI over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary In the current highly dynamic and uncertain global market environment, many investors are looking for safe havens where they can place their money and have a restful sleep. Hedge funds might be suitable investment vehicles, as they are well-known for their focus on risk adjusted returns. Highland Capital Management recently launched three new ETFs tracking various hedge fund strategies, which might serve as a good enhancement of almost every investment portfolio’s statistics. Amid U.S. stock indices near historical highs, the slowing Chinese economy, geopolitical tensions between Russia and the Western world, Japan trying to revert the course of its economy by an unprecedented program of quantitative easing and the culminating Greek crisis, more and more investors are seeking absolute rather than alpha returns. Absolute returns are a domain of hedge funds that employ sophisticated strategies and advanced investment instruments in order to deliver positive returns, regardless of the market conditions. Hedge funds are often incorrectly compared with stocks and are often criticized for their underperformance during periods of strong equity markets growth. However, they are unappreciated by the majority of investors during times of pronounced market corrections and crashes, which is when they tend to suffer much smaller losses than stock indices do. The 2008 financial meltdown was not an exception. The graphs below capture relative performance of hedge funds represented by the HFRX Global Hedge Fund Index, actively managed open-end balanced UCITS compliant funds represented by the BAIF Open End Balanced Funds Index and a portfolio of bluechips represented by the S&P 500 Total Return Index. As you can see from the graphs, hedge funds and actively managed funds are considerably less volatile investments and can therefore serve as ideal investments for conservative investors who want to primarily protect their capital and avoid significant changes in value over time. Nevertheless, in the current highly dynamic and uncertain global market environment, absolute return products should also have a place in every medium risk investment portfolio. Not only do they perform better than short-dated government bonds and term deposits, but thanks to low correlation with other asset classes and comparatively high risk adjusted returns, they also improve general statistics of almost any investment portfolio. Moreover, investments into hedge funds are no longer available solely for high-net-worth individuals. Thanks to ETFs, there is basically no minimal investment and lock-up periods are not an issue. Besides the largest and most liquid ETF tracking overall hedge funds performance – the IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA: QAI ) – three new hedge funds replicating ETFs recently came to market. The first of them, The Highland HFR Global ETF (NYSEARCA: HHFR ), similarly to QAI, tries to mimic the performance of traditional multi-strategy hedge funds that incorporate fixed income and shorting as well as long equity positions. Hence, we could suppose high correlation with QAI. However, after taking a closer look at top holdings of both funds, serious doubts about the similarity arise. QAI’s Top Ten Holdings Name & Ticker Weight (%) Vanguard Total Bond Market Index Fund (NYSEARCA: BND ) 19.13 SPDR Barclays Convertible Securities ETF (NYSEARCA: CWB ) 18.19 iShares Core U.S. Aggregate Bond ETF (NYSEARCA: AGG ) 17.77 iShares iBoxx USD Investment Grade Corporate Bond ETF (NYSEARCA: LQD ) -11.05 Vanguard Short Term Bond Index Fund ETF (NYSEARCA: BSV ) 9.01 PowerShares Senior Loan Portfolio (NYSEARCA: BKLN ) 8.67 iShares Russell 2000 Growth ETF (NYSEARCA: IWO ) 6.46 PowerShares DB G10 Currency Harvest Fund (NYSEARCA: DBV ) 4.84 iShares 1-3 Year Treasury Bond ETF (NYSEARCA: SHY ) 4.42 iShares Russell 2000 Value ETF (NYSEARCA: IWN ) -4.31 Data Source: QAI’s latest Fact Sheet Note: Minus before weight means short position HHFR’s Top Ten Holdings Name & Ticker Weight (%) LinkedIn Corp (NYSE: LNKD ) 3.58 R.R. Donnelley & Sons Co (NASDAQ: RRD ) 3.43 Sungard Data Systems 3.04 Kinetics Concept 3.03 Hertz Corp (NYSE: HTZ ) 3.03 Chrysler (Pending: CGC ) 3.02 Allergan Inc (NYSE: AGN ) 3.02 Univision Comm 3.01 First Data Corp (Pending: FDATA ) 3.00 DirectTV (NASDAQ: DTV ) 2.59 Data Source: HHFR’s website While more than a half of QAI’s holdings are bond ETFs, Highland Capital Management’s HHFR actually consists mostly of equities. The other two funds track different hedge fund strategies. The Highland HFR Equity Hedge ETF (NYSEARCA: HHDG ) consists of traditional hedged equity strategies that can both go long and go short on selected securities. And the last one, the Highland HFR Event-Driven ETF (NYSEARCA: DRVN ), capitalizes on a discipline in the hedge fund community that takes advantage of pending corporate events or other near-term catalysts for revaluation, albeit upward or downward. Despite the post-crisis run-up on global equity markets, I think investors should thoroughly consider how their portfolios will thrive in the upcoming years. Now might be the perfect time to hedge long-only portfolios a little bit. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in QAI over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News