Scalper1 News

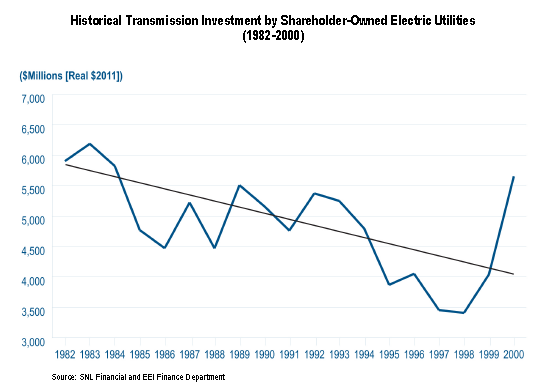

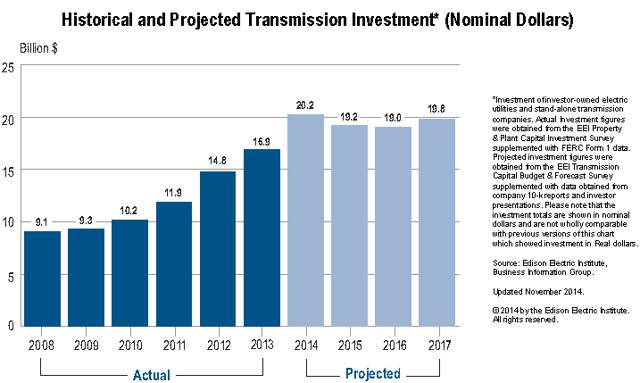

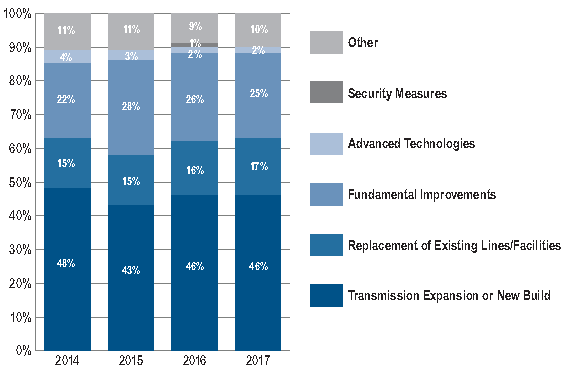

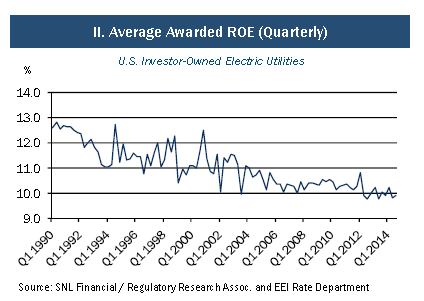

With an average FERC base-rate ROE of 10%, electric transmission firms could earn $1 billion a year in allowed returns from investments made 2014-2017. Last fall, the IRS ruled transmission firms could quality as a REIT structure. REIT structures could entice large utility firms to spin-off their transmission business. The electric transmission business may be starting to tiptoe into a vast sea of change. With the exception of ITC Holdings (NYSE: ITC ), the majority of transmission assets are held within much larger diversified electric utilities. For example, American Electric Power (NYSE: AEP ) owns the largest transmission network in the US with about 32,000 miles of line. First Energy (NYSE: FE ) is not far behind with 24,000 miles. Other major utilities with substantial transmission assets are: Southern Company (NYSE: SO ), Duke Energy (NYSE: DUK ), PG&E (NYSE: PCG ) and Edison International (NYSE: EIX ). Pacific Corp is building 4,300 miles of new lines and Xcel (NYSE: XEL ) has 3,300 miles of projects on the books. AEP is building 27 projects consisting of 3,200 miles of lines in partnership with others. Combined, AEP’s projects total $9 billion. The partnership of Duke and American Transmission is not far behind with 2,700 miles of additions. American Transmission is a joint venture of several utilities and municipalities in Wisconsin. Even the Oracle of Omaha is collaborating with AEP in a 50-50 partnership to build transmission projects in Texas. It is common knowledge that the grid has suffered from years of neglect and is demonstrated by the graph outlining transmission investments from 1982 to 2000. After hitting bottom at under $3.5 billion, annual investments are stabilizing over the next three years at $20 billion a year. The following graph outlines industry wide investments from 2008 to projected 2017. Source: eei.com (click to enlarge) Source eei.com About 45% of cap ex is dedicated to expansion of the network, and an additional 15% goes for replacement due to age, obsolescence, and storm damage. Between 2014 and 2017, there are expected to be 22,800 additional miles of transmission lines in the US. The balance of investments is grid network improvements such as fundamental, advanced technologies, and enhanced security. Projected Transmission Capital Expenditures by Type of Activity Years 2014 to 2017 Source eei.com Transmission investments industry-wide are expected to total $78 billion between 2014 and 2017. If 50% if this investment is considered equity and the FERC-allowed average ROE is 10%, the total industry-wide allowed return could translate to an additional $1 billion a year from investments made from 2014 to 2017. Historically, FERC regulated assets are more profitable than state regulated assets. For example, prior to FERC’s recent ruling in New England, ITC could earn between 12% and 13% return on equity vs. the most recent state average allowed return of just under 10%. Below is a chart from eei.com (pdf) outlining the average state regulated rates going back to 1990. The chart is from their quarterly report “Rate Case Summary” Source eei.com The FERC is under pressure to reevaluate its rate structure in some regions in the country. For example in the Northeast, the FERC settled a complaint by reducing the allowed return on transmission assets. Consumer advocates are pushing the New England rate structure as a nationwide model. In a press release , last year, the FERC announced a new maximum allowed base ROE of 10.57% for assets in the New England region, and was a reduction from the previous rate. In addition, there are several incentive clauses that could increase the base rate, such as a 0.5% incentive for stand-alone, independent companies. Currently ITC is the only publicly traded utility that qualifies for this incentive. More information on ITC can be found in a SA review from last May here and more information on the transmission business from the Edison Electric Institute here . But that may soon change. The dawn of utility asset financial engineering is upon us. The spin offs of natural gas pipelines and mid-stream assets into limited partnerships, along with the recent separation of NRG’s generation into NRG Yield (NYSE: NYLD ), foretells of structural changes within the transmission sector. Last fall, the IRS ruled that entities such as electric transmission assets could quality for a REIT structure. From a Moody’s article last Oct: Large US power transmission utilities are actively exploring the feasibility of using the real estate investment trust structure as a financing vehicle, says Moody’s Investors Service. It is plausible that utility REITs might emerge as early as late next year (2015). “Many US utilities are taking a look at their transmission assets to assess whether utilizing a REIT structure makes sense, given the abundance of these types of assets that produce steady cash flows,” says Moody’s Associate Managing Director Jim Hempstead in the report “US Utility Transmission Assets: Power Transmission REITs Poised to be Sector’s Next Phase of Financial Engineering.” Utilities have been pursuing “financial engineering” structures because yield-hungry investors assign premium valuations to vehicles with steady dividend growth trajectories, says Moody’s. From an article on publicpower.org explaining the IRS ruling and reporting on Moody’s report: In 2014, the Internal Revenue Service clarified existing rules that define what constitutes real estate. As a result, the REIT sector has grown as companies look to spin off their assets into new companies that are effectively exempted from corporate taxes as long as they operate within REIT guidelines. The 2014 IRS clarifications have helped open the REIT structure to non-traditional sectors, such as electric transmission in the case of utility companies; or fiber optic and copper networks, in the case of telecommunications companies. Potential REIT candidates in the utility sector include Texas-based transmission and distribution utilities and large transmission-only companies. Transmission assets make for an alluring REIT because they provide steady income that allows for dividends, a key feature for REIT investors. Utilities that create REITs out of their transmission assets are separating a yield asset from their growth assets, Moody’s said. “Regulatory contentiousness risk might increase because customer groups will object to future rate requests more aggressively,” the report said. “Other regulatory considerations that are likely to become more active include discussions over the appropriate cost of capital, the authorized return on equity and cost allocations.” Moody’s still sees ITC’s FERC-regulated transmission assets as a candidate for becoming a REIT. It also sees American Electric Power Co. Inc., FirstEnergy Corp., Xcel Energy Inc. and Entergy Corp., all companies that Moody’s said make transmission a core strategy, as likely candidates. Electric utility investors should be aware that a change in corporate structure also brings with it a potential credit downgrade as a higher portion of operating cash flow moves on to shareholders. Much like the REIT conversion craze that started in the timber industry in the last 1980s and leading to culmination of most timber companies now structured as REITs, the attraction of financial engineering transmission assets could be too tempting to avoid. All it will take is one to lead the way. ITC would be the most logical choice as it is already an independent firm. I expect larger utilities will then be under greater pressure to spin off their transmission businesses also as REITs. However, the impact of distributing greater portions of operating cash flow to shareholders to satisfy the REIT regulations, rather than reinvesting it as equity in additional growth projects, needs to be evaluated. Moody’s believes this will become a prominent topic of utility conversation by the end of this year. If they are correct, a new REIT sector will be born, offering the advantages of high shareholder distributions supported by federally regulated assets, which are more profitably than similar state-regulated investments. Author’s Note: Please review disclosure in Author’s profile. Disclosure: The author is long ITC, SO, AEP. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

With an average FERC base-rate ROE of 10%, electric transmission firms could earn $1 billion a year in allowed returns from investments made 2014-2017. Last fall, the IRS ruled transmission firms could quality as a REIT structure. REIT structures could entice large utility firms to spin-off their transmission business. The electric transmission business may be starting to tiptoe into a vast sea of change. With the exception of ITC Holdings (NYSE: ITC ), the majority of transmission assets are held within much larger diversified electric utilities. For example, American Electric Power (NYSE: AEP ) owns the largest transmission network in the US with about 32,000 miles of line. First Energy (NYSE: FE ) is not far behind with 24,000 miles. Other major utilities with substantial transmission assets are: Southern Company (NYSE: SO ), Duke Energy (NYSE: DUK ), PG&E (NYSE: PCG ) and Edison International (NYSE: EIX ). Pacific Corp is building 4,300 miles of new lines and Xcel (NYSE: XEL ) has 3,300 miles of projects on the books. AEP is building 27 projects consisting of 3,200 miles of lines in partnership with others. Combined, AEP’s projects total $9 billion. The partnership of Duke and American Transmission is not far behind with 2,700 miles of additions. American Transmission is a joint venture of several utilities and municipalities in Wisconsin. Even the Oracle of Omaha is collaborating with AEP in a 50-50 partnership to build transmission projects in Texas. It is common knowledge that the grid has suffered from years of neglect and is demonstrated by the graph outlining transmission investments from 1982 to 2000. After hitting bottom at under $3.5 billion, annual investments are stabilizing over the next three years at $20 billion a year. The following graph outlines industry wide investments from 2008 to projected 2017. Source: eei.com (click to enlarge) Source eei.com About 45% of cap ex is dedicated to expansion of the network, and an additional 15% goes for replacement due to age, obsolescence, and storm damage. Between 2014 and 2017, there are expected to be 22,800 additional miles of transmission lines in the US. The balance of investments is grid network improvements such as fundamental, advanced technologies, and enhanced security. Projected Transmission Capital Expenditures by Type of Activity Years 2014 to 2017 Source eei.com Transmission investments industry-wide are expected to total $78 billion between 2014 and 2017. If 50% if this investment is considered equity and the FERC-allowed average ROE is 10%, the total industry-wide allowed return could translate to an additional $1 billion a year from investments made from 2014 to 2017. Historically, FERC regulated assets are more profitable than state regulated assets. For example, prior to FERC’s recent ruling in New England, ITC could earn between 12% and 13% return on equity vs. the most recent state average allowed return of just under 10%. Below is a chart from eei.com (pdf) outlining the average state regulated rates going back to 1990. The chart is from their quarterly report “Rate Case Summary” Source eei.com The FERC is under pressure to reevaluate its rate structure in some regions in the country. For example in the Northeast, the FERC settled a complaint by reducing the allowed return on transmission assets. Consumer advocates are pushing the New England rate structure as a nationwide model. In a press release , last year, the FERC announced a new maximum allowed base ROE of 10.57% for assets in the New England region, and was a reduction from the previous rate. In addition, there are several incentive clauses that could increase the base rate, such as a 0.5% incentive for stand-alone, independent companies. Currently ITC is the only publicly traded utility that qualifies for this incentive. More information on ITC can be found in a SA review from last May here and more information on the transmission business from the Edison Electric Institute here . But that may soon change. The dawn of utility asset financial engineering is upon us. The spin offs of natural gas pipelines and mid-stream assets into limited partnerships, along with the recent separation of NRG’s generation into NRG Yield (NYSE: NYLD ), foretells of structural changes within the transmission sector. Last fall, the IRS ruled that entities such as electric transmission assets could quality for a REIT structure. From a Moody’s article last Oct: Large US power transmission utilities are actively exploring the feasibility of using the real estate investment trust structure as a financing vehicle, says Moody’s Investors Service. It is plausible that utility REITs might emerge as early as late next year (2015). “Many US utilities are taking a look at their transmission assets to assess whether utilizing a REIT structure makes sense, given the abundance of these types of assets that produce steady cash flows,” says Moody’s Associate Managing Director Jim Hempstead in the report “US Utility Transmission Assets: Power Transmission REITs Poised to be Sector’s Next Phase of Financial Engineering.” Utilities have been pursuing “financial engineering” structures because yield-hungry investors assign premium valuations to vehicles with steady dividend growth trajectories, says Moody’s. From an article on publicpower.org explaining the IRS ruling and reporting on Moody’s report: In 2014, the Internal Revenue Service clarified existing rules that define what constitutes real estate. As a result, the REIT sector has grown as companies look to spin off their assets into new companies that are effectively exempted from corporate taxes as long as they operate within REIT guidelines. The 2014 IRS clarifications have helped open the REIT structure to non-traditional sectors, such as electric transmission in the case of utility companies; or fiber optic and copper networks, in the case of telecommunications companies. Potential REIT candidates in the utility sector include Texas-based transmission and distribution utilities and large transmission-only companies. Transmission assets make for an alluring REIT because they provide steady income that allows for dividends, a key feature for REIT investors. Utilities that create REITs out of their transmission assets are separating a yield asset from their growth assets, Moody’s said. “Regulatory contentiousness risk might increase because customer groups will object to future rate requests more aggressively,” the report said. “Other regulatory considerations that are likely to become more active include discussions over the appropriate cost of capital, the authorized return on equity and cost allocations.” Moody’s still sees ITC’s FERC-regulated transmission assets as a candidate for becoming a REIT. It also sees American Electric Power Co. Inc., FirstEnergy Corp., Xcel Energy Inc. and Entergy Corp., all companies that Moody’s said make transmission a core strategy, as likely candidates. Electric utility investors should be aware that a change in corporate structure also brings with it a potential credit downgrade as a higher portion of operating cash flow moves on to shareholders. Much like the REIT conversion craze that started in the timber industry in the last 1980s and leading to culmination of most timber companies now structured as REITs, the attraction of financial engineering transmission assets could be too tempting to avoid. All it will take is one to lead the way. ITC would be the most logical choice as it is already an independent firm. I expect larger utilities will then be under greater pressure to spin off their transmission businesses also as REITs. However, the impact of distributing greater portions of operating cash flow to shareholders to satisfy the REIT regulations, rather than reinvesting it as equity in additional growth projects, needs to be evaluated. Moody’s believes this will become a prominent topic of utility conversation by the end of this year. If they are correct, a new REIT sector will be born, offering the advantages of high shareholder distributions supported by federally regulated assets, which are more profitably than similar state-regulated investments. Author’s Note: Please review disclosure in Author’s profile. Disclosure: The author is long ITC, SO, AEP. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News