Scalper1 News

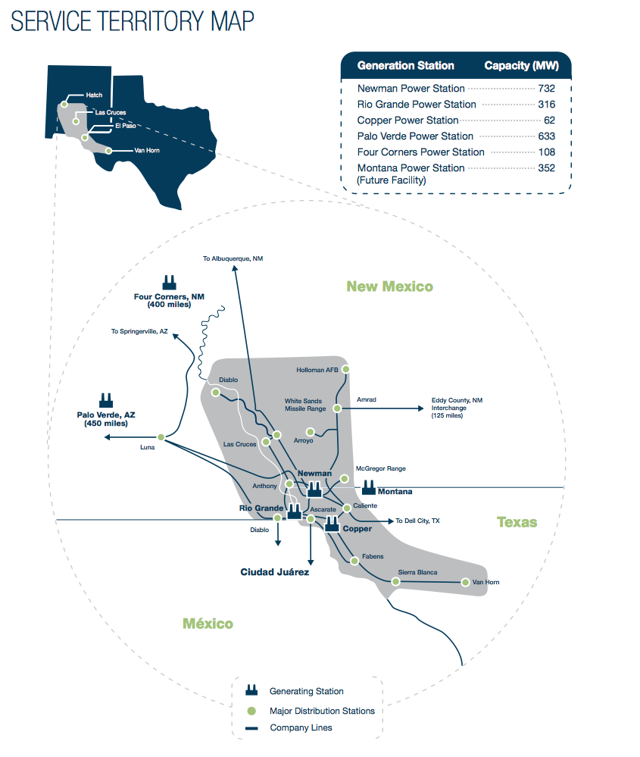

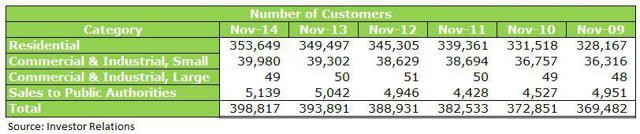

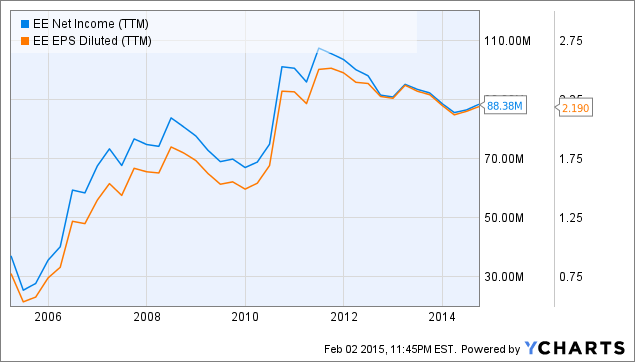

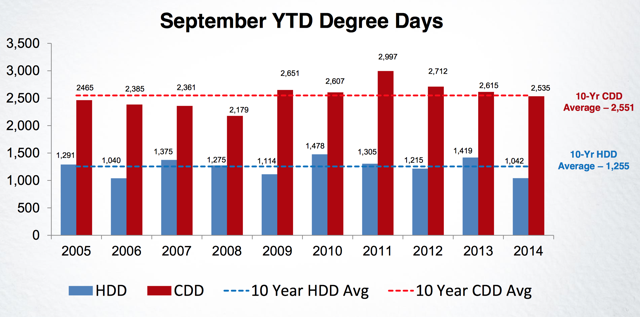

Summary The utilities sector declined nearly 4% on Friday amid strong hiring news. El Paso Electric is now trading at under 18X earnings, cheaper than S&P 500 and Dow Utility Index. After a hiatus beginning in the late-1980s, El Paso Electric is again making dividend payments, including its most recently announced .28/share payment, its 16th straight quarter. Largest market is El Paso in Texas, which is viewed as a pro-business positive net-migration state. Decision not to participate in the renewal of aged coal power-generating plant reflects the modernization and commitment of the Company to provide sustainable long-term energy production. El Paso Electric (NYSE: EE ) is a regional electric utility company that provides generation, transmission, and distribution service to the southwestern United States and Northern Mexico. Its 10,000 square mile service area includes parts of Texas, New Mexico, and two connections to Juarez and the Mexican national utility, Comision Federal de Electricidad. The Company’s principal industrial and large customers operate in the steel production, copper, oil refining and defense industries (including Fort Bliss Army Base and White Sands Missile Range). El Paso Electric’s net dependable generating capability of 1,852 megawatts. Key events and catalysts – A substantial portion of the Company’s fossil fuel generation facilities are over 50 years old. Over the last five years, El Paso Electric has spent nearly $1 billion dollars for the replacement of plant and equipment and for additional generation, transmission and distribution. – El Paso Electric constructed its first new plan in nearly 30 years, a 288 MW Newman 5 natural gas-fired combined cycle plant – Additional cap-ex expected to top $1.5 billion in the next five years – Due to favorable location in high desert and reduction in cost of solar panels, El Paso Electric has introduced significant utility scale solar generation at costs competitive with fossil fuel alternatives – The Company’s Montana Power Station (a $372 million local generation facility) is expected to go on-line by summer of 2015 – El Paso Electric will not participate in extending the operation of the nearly five decade old coal-fired Four Corners Power Generating Station after its scheduled retirement in July 2016. – New Mexico rate case finalization in April 2015 and Texas rate case finalization in August 2015 will seek to recapture costs related to construction, load growth and facility retirement Service Area (Source Annual Report) (click to enlarge) While the population of the state of New Mexico grew a paltry 1.3% from April 2010 – July 2013 (compared the US as a whole – 2.4% – most recent data available from Census Bureau), the state of Texas grew 5.2%, more than double the national rate. Power Generation Station Primary Fuel Type Owned Net Dependable Generating Capacity (NYSE: MW ) Ownership Interest Location Palo Verde Station Nuclear 633 15.8% Wintersburg, Arizona Newman Power Station Natural Gas 732 100% El Paso, Texas Rio Grande Power Station Natural Gas 316 100% Sunland Park, New Mexico Four Corners Station (Units 4&5) Coal 108 7% Fruitland, New Mexico Copper Power Station Natural Gas 62 100% El Paso, Texas Renewables Wind/Solar 1 100% Hudspeth/El Paso Counties, Texas Total 1,852 (Source: Most recent annual report) Notes on power generation: – The Nuclear Regulatory Commission renewed the license of all operating units at Palo Verde which now expire between 2045 – 2047. – The estimated decommissioning costs related to the Palo Verde plant is $381 million. El Paso Electric’s trust fund had a $214 million at 12/31/13. – The 50-year participation agreement among the owners of the Four Corners Station expires in July 2016. El Paso Electric has informed the other owners that it has decided to cease it participation in the plant by July 2016 opting for more economical and cost effect energy alternatives. Customer growth Growth Rate Since 2009 Total growth: 29,335, 1.5% per year Residential growth : 25,482, 1.5% per year (click to enlarge) Customer growth has been positive since 2009, but at a very modest rate in total. Earnings per share EE Net Income (NYSE: TTM ) data by YCharts While earnings per share and net income are generally positive trending over the past decade, El Paso Electric has seen drop-offs in the last several years as decommissioning and other costs have outweighed rate and customer increases. El Paso Electric’s continued profitability hinges on its ability to successfully manage delivery and production costs in a rate-regulated environment. Last Friday, positive hiring news led to declines in “safe-haven” assets including gold, bonds and utilities stocks. El Paso Electric shares fell 4.34%, consistent with sector declines. The Company now trades at 17.72x TTM earnings , which is a lower multiple than the S&P 500 (20.03x) and the Dow Jones Utility Index (19.63x). Reliance on nuclear sourced power 2013 2012 2011 2010 2009 Nuclear 46% 46% 45% 45% 45% Natural Gas 34% 32% 30% 27% 22% Coal 6% 6% 6% 6% 7% Purchased Power 14% 16% 19% 22% 26% Nuclear power makes up a substantial portion of the Company’s sourced electricity. Despite the recoverability of fuel costs for nuclear power generation, it is still expensive and can result in additional regulatory costs associated with production, waste storage and disposal. The Company current sources less than 1% of its power from solar, wind and other renewable sources, but continued investment in these alternative energy sources can help El Paso Electric to remain profitable and competitive. Weather and energy (click to enlarge) (Source: Investor Presentation) Demand for energy is in part driven by climate and weather patterns. As show above, cooling degree days (CDD) dipped below their ten year average for the first time since 2008, while heating degree days (HDD) days are down to levels not seen since 2006. Assuming global warming is real , it is not unreasonable to expect larger and more frequent temperature swings which could drive demand for electricity. Selected Ratio and financial analysis (all information from morningstar.com unless otherwise noted) Ratios and metrics TTM 2013 2012 2011 2010 2009 Gross margin % 65.6% 67.5% 70.5% 67.5% 66.7% 64.4% Operating margin % 16.3% 18.6% 19.8% 20.8% 19.3% 16.1% Debt/equity 1.12 1.06 1.21 1.07 1.05 1.11 Book value per share 24.13 23.51 20.57 19.10 19.10 16.51 The Company’s gross and operating margins have been fairly consistent, while maintaining a health debt/equity ratio and increasing tangible book value per share. One risk facing the El Paso Electric is the continued availability of debt and equity financing for construction and other projects. Cash flow and dividends TTM 2013 2012 2011 2010 2009 Operating cash flow 237M 247M 273M 252M 239M 269M Capital expenditures 326M 289M 269M 236M 224M 252M Free cash flow -89M -42M 4M 16M 15M 17M Dividends 1.09 1.05 .97 .66 – – Operating cash flow has been on the decline since 2012, which is not what I look to see from a utility. The Company is investing in business, growing capital expenditures each year since 2010, which hopefully will result in more attractive power generation, distribution, and delivery mechanisms. As previously mentioned, prior to 2011, El Paso Electric had not paid dividends since 1989. Since the reinstitution its dividend policy, the company has grown the total payout each year since 2011. Understanding the Mexico opportunity While El Paso Electric serves a limited geographic (southwestern United States and northern Mexico), it has a fairly diversified customer base within this region. According to El Paso Electric’s most recent annual report, no customer makes up more than 4% of non-fuel base revenues. Most of the energy distributed to the Comision Federal de Electricidad is consumed in Juarez, a city of 1.5 million. While Juarez has a reputation for crime and violence, the city represnts a solid investment opportunity for El Paso Electric as it has nearly doubled in population since 1990. Continued growth and modernization of Juarez will be a long term benefit to El Paso Electric’s bottom line. Leadership El Paso Electric announced Thursday that Chairman of the Board Michael Parks resigned to accept a job with a global investment management firm. Parks served on the board since 1996. He was replaced by long-time board member Charles Yamarone as the new chairman. Bottom line If I was looking for a moderate risk/reward small cap utility play, I would be satisfied owning El Paso Electric at current prices. It has a reasonable 2.8% forward yield , conservative 50% payout ratio, and is taking steps to move away from dirty energy and to cleaner renewable sources. There are a substantial number of utilities that offer higher yield, a longer and more consistent dividend history, and more years of profitability. El Paso Electric may be the right stock for your portfolio, but not the right stock, right now, but if you are on the fence and need a sign, put it on your watch list, and consider scaling into a position when any of the following occur: – Alternative energy as a percentage of net dependable generating capacity exceeds 10% of total. This would mean El Paso Electric has entered a new era of largely clean (natural gas and alternative) energy generation that could be a competitive advantage when the freeze-period expires and competition is introduced into EEs Texas service area. – Yield rises to 5% (but payout stays same or increases). For this to occur, El Paso Electric would need to be trading at $22.40 per share, or a dirt cheap 10.2X earnings. – All Coal and Nuclear operations are ceased and all decommissioning costs settled and final. This would remove substantial uncertainty and potential earnings volatility for intermediate horizon investors (3 – 5 years). Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The utilities sector declined nearly 4% on Friday amid strong hiring news. El Paso Electric is now trading at under 18X earnings, cheaper than S&P 500 and Dow Utility Index. After a hiatus beginning in the late-1980s, El Paso Electric is again making dividend payments, including its most recently announced .28/share payment, its 16th straight quarter. Largest market is El Paso in Texas, which is viewed as a pro-business positive net-migration state. Decision not to participate in the renewal of aged coal power-generating plant reflects the modernization and commitment of the Company to provide sustainable long-term energy production. El Paso Electric (NYSE: EE ) is a regional electric utility company that provides generation, transmission, and distribution service to the southwestern United States and Northern Mexico. Its 10,000 square mile service area includes parts of Texas, New Mexico, and two connections to Juarez and the Mexican national utility, Comision Federal de Electricidad. The Company’s principal industrial and large customers operate in the steel production, copper, oil refining and defense industries (including Fort Bliss Army Base and White Sands Missile Range). El Paso Electric’s net dependable generating capability of 1,852 megawatts. Key events and catalysts – A substantial portion of the Company’s fossil fuel generation facilities are over 50 years old. Over the last five years, El Paso Electric has spent nearly $1 billion dollars for the replacement of plant and equipment and for additional generation, transmission and distribution. – El Paso Electric constructed its first new plan in nearly 30 years, a 288 MW Newman 5 natural gas-fired combined cycle plant – Additional cap-ex expected to top $1.5 billion in the next five years – Due to favorable location in high desert and reduction in cost of solar panels, El Paso Electric has introduced significant utility scale solar generation at costs competitive with fossil fuel alternatives – The Company’s Montana Power Station (a $372 million local generation facility) is expected to go on-line by summer of 2015 – El Paso Electric will not participate in extending the operation of the nearly five decade old coal-fired Four Corners Power Generating Station after its scheduled retirement in July 2016. – New Mexico rate case finalization in April 2015 and Texas rate case finalization in August 2015 will seek to recapture costs related to construction, load growth and facility retirement Service Area (Source Annual Report) (click to enlarge) While the population of the state of New Mexico grew a paltry 1.3% from April 2010 – July 2013 (compared the US as a whole – 2.4% – most recent data available from Census Bureau), the state of Texas grew 5.2%, more than double the national rate. Power Generation Station Primary Fuel Type Owned Net Dependable Generating Capacity (NYSE: MW ) Ownership Interest Location Palo Verde Station Nuclear 633 15.8% Wintersburg, Arizona Newman Power Station Natural Gas 732 100% El Paso, Texas Rio Grande Power Station Natural Gas 316 100% Sunland Park, New Mexico Four Corners Station (Units 4&5) Coal 108 7% Fruitland, New Mexico Copper Power Station Natural Gas 62 100% El Paso, Texas Renewables Wind/Solar 1 100% Hudspeth/El Paso Counties, Texas Total 1,852 (Source: Most recent annual report) Notes on power generation: – The Nuclear Regulatory Commission renewed the license of all operating units at Palo Verde which now expire between 2045 – 2047. – The estimated decommissioning costs related to the Palo Verde plant is $381 million. El Paso Electric’s trust fund had a $214 million at 12/31/13. – The 50-year participation agreement among the owners of the Four Corners Station expires in July 2016. El Paso Electric has informed the other owners that it has decided to cease it participation in the plant by July 2016 opting for more economical and cost effect energy alternatives. Customer growth Growth Rate Since 2009 Total growth: 29,335, 1.5% per year Residential growth : 25,482, 1.5% per year (click to enlarge) Customer growth has been positive since 2009, but at a very modest rate in total. Earnings per share EE Net Income (NYSE: TTM ) data by YCharts While earnings per share and net income are generally positive trending over the past decade, El Paso Electric has seen drop-offs in the last several years as decommissioning and other costs have outweighed rate and customer increases. El Paso Electric’s continued profitability hinges on its ability to successfully manage delivery and production costs in a rate-regulated environment. Last Friday, positive hiring news led to declines in “safe-haven” assets including gold, bonds and utilities stocks. El Paso Electric shares fell 4.34%, consistent with sector declines. The Company now trades at 17.72x TTM earnings , which is a lower multiple than the S&P 500 (20.03x) and the Dow Jones Utility Index (19.63x). Reliance on nuclear sourced power 2013 2012 2011 2010 2009 Nuclear 46% 46% 45% 45% 45% Natural Gas 34% 32% 30% 27% 22% Coal 6% 6% 6% 6% 7% Purchased Power 14% 16% 19% 22% 26% Nuclear power makes up a substantial portion of the Company’s sourced electricity. Despite the recoverability of fuel costs for nuclear power generation, it is still expensive and can result in additional regulatory costs associated with production, waste storage and disposal. The Company current sources less than 1% of its power from solar, wind and other renewable sources, but continued investment in these alternative energy sources can help El Paso Electric to remain profitable and competitive. Weather and energy (click to enlarge) (Source: Investor Presentation) Demand for energy is in part driven by climate and weather patterns. As show above, cooling degree days (CDD) dipped below their ten year average for the first time since 2008, while heating degree days (HDD) days are down to levels not seen since 2006. Assuming global warming is real , it is not unreasonable to expect larger and more frequent temperature swings which could drive demand for electricity. Selected Ratio and financial analysis (all information from morningstar.com unless otherwise noted) Ratios and metrics TTM 2013 2012 2011 2010 2009 Gross margin % 65.6% 67.5% 70.5% 67.5% 66.7% 64.4% Operating margin % 16.3% 18.6% 19.8% 20.8% 19.3% 16.1% Debt/equity 1.12 1.06 1.21 1.07 1.05 1.11 Book value per share 24.13 23.51 20.57 19.10 19.10 16.51 The Company’s gross and operating margins have been fairly consistent, while maintaining a health debt/equity ratio and increasing tangible book value per share. One risk facing the El Paso Electric is the continued availability of debt and equity financing for construction and other projects. Cash flow and dividends TTM 2013 2012 2011 2010 2009 Operating cash flow 237M 247M 273M 252M 239M 269M Capital expenditures 326M 289M 269M 236M 224M 252M Free cash flow -89M -42M 4M 16M 15M 17M Dividends 1.09 1.05 .97 .66 – – Operating cash flow has been on the decline since 2012, which is not what I look to see from a utility. The Company is investing in business, growing capital expenditures each year since 2010, which hopefully will result in more attractive power generation, distribution, and delivery mechanisms. As previously mentioned, prior to 2011, El Paso Electric had not paid dividends since 1989. Since the reinstitution its dividend policy, the company has grown the total payout each year since 2011. Understanding the Mexico opportunity While El Paso Electric serves a limited geographic (southwestern United States and northern Mexico), it has a fairly diversified customer base within this region. According to El Paso Electric’s most recent annual report, no customer makes up more than 4% of non-fuel base revenues. Most of the energy distributed to the Comision Federal de Electricidad is consumed in Juarez, a city of 1.5 million. While Juarez has a reputation for crime and violence, the city represnts a solid investment opportunity for El Paso Electric as it has nearly doubled in population since 1990. Continued growth and modernization of Juarez will be a long term benefit to El Paso Electric’s bottom line. Leadership El Paso Electric announced Thursday that Chairman of the Board Michael Parks resigned to accept a job with a global investment management firm. Parks served on the board since 1996. He was replaced by long-time board member Charles Yamarone as the new chairman. Bottom line If I was looking for a moderate risk/reward small cap utility play, I would be satisfied owning El Paso Electric at current prices. It has a reasonable 2.8% forward yield , conservative 50% payout ratio, and is taking steps to move away from dirty energy and to cleaner renewable sources. There are a substantial number of utilities that offer higher yield, a longer and more consistent dividend history, and more years of profitability. El Paso Electric may be the right stock for your portfolio, but not the right stock, right now, but if you are on the fence and need a sign, put it on your watch list, and consider scaling into a position when any of the following occur: – Alternative energy as a percentage of net dependable generating capacity exceeds 10% of total. This would mean El Paso Electric has entered a new era of largely clean (natural gas and alternative) energy generation that could be a competitive advantage when the freeze-period expires and competition is introduced into EEs Texas service area. – Yield rises to 5% (but payout stays same or increases). For this to occur, El Paso Electric would need to be trading at $22.40 per share, or a dirt cheap 10.2X earnings. – All Coal and Nuclear operations are ceased and all decommissioning costs settled and final. This would remove substantial uncertainty and potential earnings volatility for intermediate horizon investors (3 – 5 years). Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News