CVR Partners, LPUAN is set to release fourth-quarter 2016 results, ahead of the bell on Feb 16.

Last quarter, the company posted a loss of 12 cents per share, narrower than a loss of 18 cents reported a year ago. However, the loss was wider than the Zacks Consensus Estimate of a loss of 9 cents.

On a year-over-year basis, the company’s net sales improved 59.2% to $ 78.5 million, up 59.2% in the third quarter. Revenues, however, missed the Zacks Consensus Estimate of $ 82 million.

Let’s take a look at how things are shaping up for this announcement.

Factors to Consider

CVR Partners is seeing increasing interest for nitrogen fertilizer in preparation for the corn planting season. The company expects a further surge in demand. However, pricing is likely to continue to be negatively impacted due to additional supply.

The company remains focused on ramping up its UAN production capacity and controlling costs. It also benefits from transportation cost advantage given the close proximity of its production facility to the U.S. Corn Belt.

CVR Partners is expected to gain from its strategic acquisitions and capacity expansion actions. With the buyout of Rentech Nitrogen Partners, the company has been able to create an entity with larger scale, enhance production capacity and increase operating reach. The combined company is now the second-biggest producer of UAN in North America. The merged entity is expected to realize synergies of at least $ 12 million, partly through savings in selling, general & administrative costs, and logistics and procurement improvements.

CVR Partners has outperformed the Zacks categorized Fertilizers industry over the past three months. The company’s shares have gained around 32.4% over this period, compared with roughly 13.3% gain recorded by the industry.

However, CVR Partners remains exposed to headwinds from lower nitrogen fertilizer prices. Its operations are also subject to the risks of production outages due to plant shutdowns. The company also faces intense price competition.

Earnings Whispers

Our proven model does not conclusively show that CVR Partners is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below:

Zacks ESP : Earnings ESP for CVR Partners is currently pegged at 0.00%. This is because the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at 3 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter .

Zacks Rank : CVR Partners carries a Zacks Rank #3. Though a Zacks Rank #3 increases the predictive power of ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

Concurrently, we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

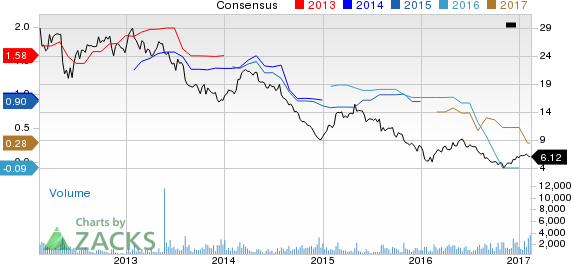

CVR Partners, LP Price and Consensus

CVR Partners, LP Price and Consensus | CVR Partners, LP Quote

Stocks to Consider

Here are some companies in the basic materials space you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Iamgold Corporation IAG has an Earnings ESP of +100% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rankstocks here.

Intrepid Potash Inc IPI has an Earnings ESP of +20% and carries a Zacks Rank #2.

VALE S.A. VALE has an Earnings ESP of +34.3% and a Zacks Rank #2.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks’ private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $ 10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks’ private trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intrepid Potash, Inc (IPI): Free Stock Analysis Report

Iamgold Corporation (IAG): Free Stock Analysis Report

VALE S.A. (VALE): Free Stock Analysis Report

CVR Partners, LP (UAN): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International