Deere & CompanyDE is slated to announce third-quarter fiscal 2016 results on Aug 19, before the market opens. Last quarter, Deere’s earnings and sales both declined year over year, owing to downturn in the global farm economy and weakness in the construction equipment sector.

Let’s see how things are shaping up for this announcement.

Factors to Impact Q3 Results

Deere projected its sales in the third quarter of fiscal 2016 to deteriorate about 12% from the year-ago quarter. The projection includes a negative currency-translation effect of 1%. Low commodity prices and stagnant farm income coupled with soft conditions in the North American energy sector remain near term headwinds to Deere’s results.

Further, Deere’s results will continue to be affected by unfavorable foreign currency movements and sluggish economic growth. However, on a positive note, easing of political conditions in Brazil and a positive Indian agricultural outlook will drive growth.

Earnings Whispers

Our proven model does not conclusively show that Deere will beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) for this to happen. But that is not the case here, as you will see below.

Zacks ESP: The Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate stand at 95 cents.

Zacks Rank: Deere’s Zacks Rank #3 increases the predictive power of ESP, but a negative ESP leaves our surprise prediction inconclusive.

Surprise History

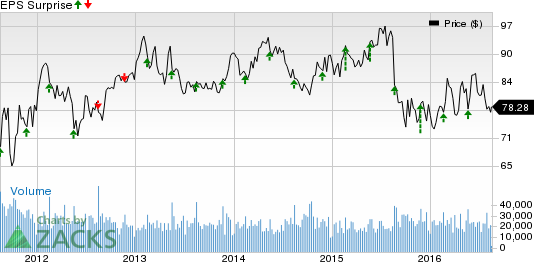

Deere has outpaced the Zacks consensus estimate in each of the trailing four quarters, with an average earnings beat of 17.39%.

DEERE & CO Price and EPS Surprise

DEERE & CO Price and EPS Surprise | DEERE & CO Quote

Stocks That Warrant a Look

Here are some stocks worth considering, as according to our model they have the right combination of elements to post an earnings beat this quarter.

Ascendis Pharma A/S ASND has an Earnings ESP of +7.46% and a Zacks Rank #2.

Alcobra Ltd. ADHD has an Earnings ESP of +18.18% and a Zacks Rank #3.

Best Buy Co., Inc. BBY has an Earnings ESP of +4.76% and a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days . Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DEERE & CO (DE): Free Stock Analysis Report

BEST BUY (BBY): Free Stock Analysis Report

ASCENDIS PHARMA (ASND): Free Stock Analysis Report

ALCOBRA LTD (ADHD): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International