Monsanto Company MON is scheduled to report its first-quarter fiscal 2017 (ended Nov 2016) results before the opening bell on Jan 5, 2017.

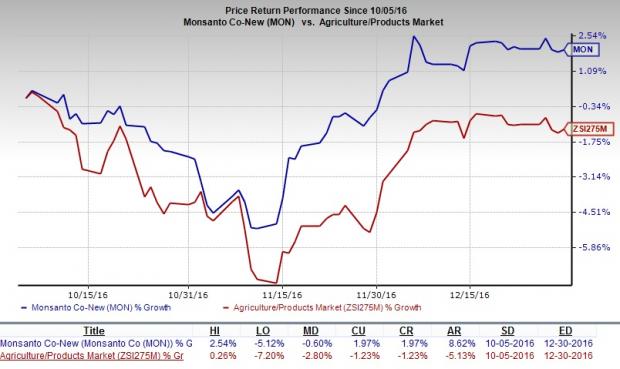

Post fourth-quarter fiscal 2016 earnings release (Oct 5, 2016), Monsanto’s shares recorded a return of 1.97%, as against the negative return of 1.23% provided by the Zacks categorized Agriculture/Products industry. However, this Zacks Rank #3 (Hold) has witnessed a positive average earnings surprise of 124.52% for the trailing four quarters.

Let’s see how things are shaping up prior to this announcement.

Factors to Play

Higher demand for pioneering biotechnology, breeding, digital agriculture, crop-protection and next-generation agricultural solutions are expected to boost Monsanto’s revenues in the fiscal first quarter. Also, new agreements with Broad Institute (Sep, 2016) and Dow AgroSciences (Oct, 2016) are likely to enhance the company’s technological expertise. In addition, Monsanto anticipates generating higher gross margin in the quarter on the back of increased penetration of Intacta, higher corn volumes and sales of some non-core assets.

However, we believe that the above mentioned bullish aspects would be partially shadowed by major headwinds such as sluggish global economy, lower investments in agricultural inputs, volatile weather patterns or sturdy competition within the industry.

Over the last 60 days, the Zacks Consensus Estimate for the stock remained unchanged for both fiscal 2017 and 2018.

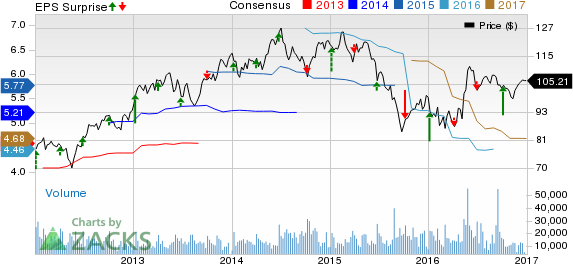

MONSANTO CO-NEW Price, Consensus and EPS Surprise

MONSANTO CO-NEW Price, Consensus and EPS Surprise | MONSANTO CO-NEW Quote

By the fall of calendar year 2017, Monsanto anticipates to successfully close its deal with Bayer AG BAYRY .

Earnings Whispers

Our proven model does not conclusively show that Monsanto is likely to beat earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as we will see below.

Zacks ESP: Monsanto currently has an Earnings ESP of 0.00%. This is because both the Zacks Consensus Estimate and the Most Accurate estimate both are valued at a loss of 4 cents.

Please check our Earnings ESP Filter that enables you to find stocks that are expected to come out with earnings surprises.

Zacks Rank: Monsanto carries a Zacks Rank #3. However, a 0.00% ESP makes surprise prediction difficult.

Note that we caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks that Warrant a Look

Here are some stocks within the industry that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

FMC Corporation FMC , with an Earnings ESP of +2.27%, and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here .

International Paper Company IP , with an Earnings ESP of +4.23%, and a Zacks Rank #2.

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest tickers for the entirety of 2017?

Who wouldn’t? These 10 are painstakingly hand-picked from 4,400 companies covered by the Zacks Rank. They are our primary picks to buy and hold. Be among the very first to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BAYER A G -ADR (BAYRY): Free Stock Analysis Report

FMC CORP (FMC): Free Stock Analysis Report

INTL PAPER (IP): Free Stock Analysis Report

MONSANTO CO-NEW (MON): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International